Growing Corporate Adoption of KindlyMD Bitcoin Treasury Trend

The NASDAQ listed healthcare firm, KindlyMD, Inc. (NAKA) revealed a $5 billion stock sale aimed at boosting its Bitcoin accumulation strategy. The move follows the firm’s recent collaboration with Nakamoto Holdings and its first large BTC Purchase weeks before.

CEO David Bailey said the new stock sale plan for KindlyMD Bitcoin hoard will help the company keep its accounts strong and slowly grow its holdings in the future.

KindlyMD Bitcoin Treasury Details

The KindlyMD Bitcoin journey started on May 27, 2025, when it had around 21 coins. The company first bought 5,744 BTC for $679 million on August 19 and later added a little more to its holdings.

Now, the company holds 5,765 coins, which is worth around $642 million, at an average price of $118,171 for each coin. At current prices, the value of its holdings is down about 5.7%, meaning a short term loss on this investment for now.

Source: BitcoinTreasury.Net

Stock & Financials

Investors responded cautiously to the KindlyMD Bitcoin investment decision. NAKA stock dropped 12% on Tuesday and fell another 2.7% in after hours trading to $7.85, though it has since recovered little to $8.07 (current). Even after the recent drop, the company’s shares are still up 330% since May and 550% this year because of excitement about its golden asset plan.

Source: Investing.com

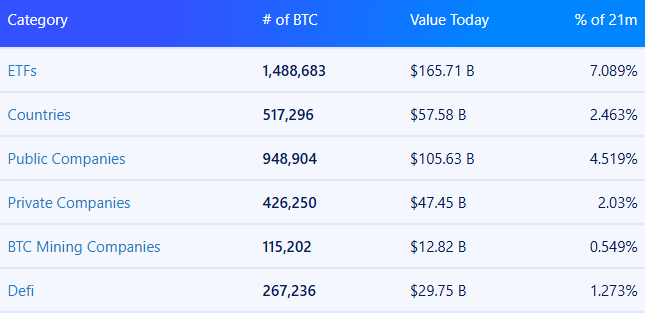

Growing Corporate Adoption

The firm's recent move made it join the growing list of public companies holding BTC. The largest is MicroStrategy with 632,457 BTC worth $60 billion, followed by MARA Holdings, Inc. with 50,639 BTC valued near $1.3 billion. Companies that share an nearing figure are Next Technology, Semler Scientific, ProCap.

The choice of golden asset is not limited to the corporate but every possible field is now exploring the currency.

Source: BitBo

Advantage from Dip

As the currency is now facing the lows from some weeks (currently trading at $111.2K) after enjoying the highest ranges, some traders are reacting warily. On the other side companies like Blackrock, Bitwise, ANAP holdings, including KindlyMD Bitcoin plan, harnessed the situation on the basis of the currencies firm beliefs.

Source: CoinMarketCap

Millions in Crypto Market: Perspective Changed

Public - Private organisations, national governments, entities, everyone is now openly engaging with the digital assets spaces. Whether it is DeFi, Crypto tokens, or Stablecoins, the rapid adoption shows the new phase in the world economy.

Although BTC is on top priority, following Ethereum, other altcoins are also experiencing the new trend. It can be seen from the recent activities when Soalna (SOL) received back to back billion dollar plans from top companies.

The upcoming time will tell more than the digital asset’s storing of value status. So, let’s see where this trend takes our traditional monetization systems.

Also read: WLFI Token Story: How Trump Family Bank Issues Inspire Stablecoin免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。