Abstract: $MNT Integration with Bybit's Core Business May Ignite Billions in Demand.

Author: MooMs

Translation: Deep Tide TechFlow

This week, Mantle announced one of the most significant updates of the year. Its token will be integrated into Bybit's core business. Bybit is the second-largest centralized exchange (CEX) in the world. I present a model predicting that $MNT will experience an average nine-figure annual buying pressure.

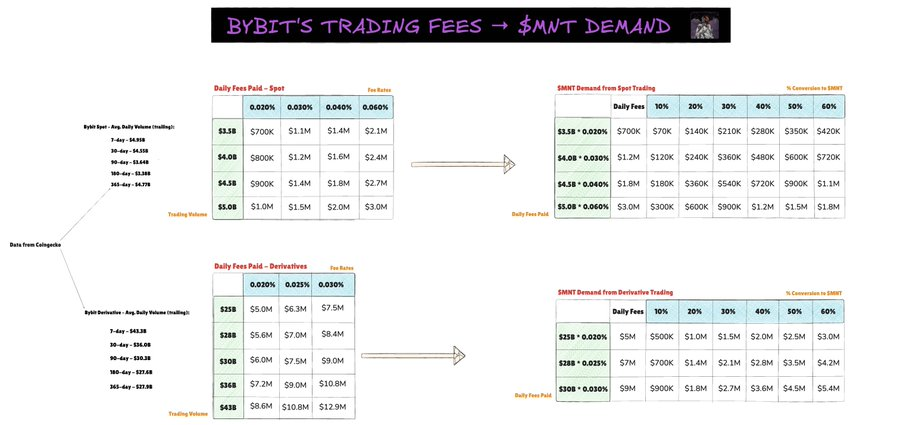

(Please enlarge the image to view all calculation results)

Background

By trading volume, Bybit is the second-largest CEX and ranks third in derivatives trading volume (according to @coingecko). Recently, Bybit's co-CEO and Head of Spot joined Mantle as a core contributor, further strengthening the connection between centralized exchanges (CEX) and the Mantle ecosystem. This aligns with Mantle's efforts to bridge DeFi and TradFi, as evidenced by the launch of @URNeobank and its increasing focus on RWA. In addition to this strategy, Mantle outlined a plan to directly integrate $MNT into Bybit's core products.

However, with the new team joining, the announced significant news is the plan to integrate $MNT into Bybit's core business.

Currently, $MNT has been integrated into:

Bybit's Launchpool project

Bybit's structured products

Bybit's over-the-counter trading portal

Upcoming integrations announced by the team include:

Discount trading fees paid in $MNT

VIP level qualification through $MNT

Trading pairs priced in MNT

Others

Using MNT to pay fees and for VIP levels is a huge application scenario for this token. Indeed, this is the best outcome that the token has longed for.

We are talking about an exchange that has had an average daily trading volume of over $30 billion in the past year.

BYBIT Fees → MNT Demand Model

Below, I present a simple model to estimate how Bybit trading fees translate into daily $MNT buying pressure under realistic assumptions, applicable to both spot and derivatives.

Trading Volume

Spot trading volume: The scenario forecast is based on Bybit's historical average from last year, approximately $3.5 billion to $5 billion per day.

Derivatives trading volume: The scenario forecast is based on $25 billion to $43 billion per day, consistently aligned with last year's historical average.

Effective Fee Rate (Basis Points)

Bybit fees vary by trading pair group, level, and maker/taker. I did not calculate each tier but used a weighted average:

Derivatives: 0.020% / 0.025% / 0.030%

Spot: 0.020% / 0.030% / 0.040% / 0.060%

How the Table is Calculated

Daily Fees: For each [Volume x Fee] pair, daily dollar fees were calculated.

MNT Buying Pressure: Then, I used the medium volume/medium fee results as a baseline and applied a 10-60% conversion scenario to estimate the daily demand for $MNT.

Results

1. Conservative Scenario

Daily Demand: $570,000

Annual Demand: $208,000,000

Even in a conservative case, with only 10% of spot and derivatives fees flowing to $MNT, the token should see an additional demand of $500,000 daily, translating to over $200 million annually.

2. Basic Scenario

Daily Demand: $2,460,000

Annual Demand: $898,000,000

In my view, in the basic case, about 30% of spot and derivatives trading fees are converted to $MNT. In this scenario, we are talking about nearly $2.5 million daily, equivalent to nearly $1 billion annually.

3. Optimistic Scenario

Daily Demand: $7,200,000

Annual Demand: $2,600,000,000

In a very optimistic case, about 60% of trading fees are converted to $MNT, creating enormous demand for the token. More specifically, $7.2 million daily, or $2.6 billion annually.

Of course, these are all assumptions and rough estimates, but the outlook should be clear. The addition of Bybit executives to Mantle, the launch of new banks, and the integration of $MNT into the world's second-largest centralized exchange all serve as significant catalysts for the ecosystem and its token. The fundamentals and data are bullish.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。