"Your bank account ending in XXXX has been placed under judicial investigation, and some funds have been frozen." Ah Wei had just withdrawn 10,000 USDT last night, planning to pay his mortgage today and cover his daughter's tuition fees, but this "frozen card" text message left him confused, causing all his established plans to come to a standstill. He believed he was merely following the platform's procedures for receiving payments and releasing funds, with no other violations.

Ah Wei immediately called the bank's customer service, only to receive the response: "The bank is only responsible for executing the freeze; for specific reasons for the frozen card and the unfreezing time, please consult the investigating unit." Following this, Ah Wei embarked on a long "checkpoint" journey, from printing thick transaction records to queuing at the bank for explanations, and then cooperating with the police station to complete nearly a year’s worth of transaction history. A series of tedious processes left him exhausted from taking leave, waiting in line, traveling back and forth, and getting stamps.

"Frozen cards" are not an isolated case; many innocent users like Ah Wei are affected. These issues often stem from the lack of transparency in the capital chain under C2C/P2P deposit and withdrawal models: upstream transactions trigger risk control, and innocent downstream users are "jointly punished" with freezes. Once a bank card is frozen, funds are often "locked" for months or even longer, severely impacting normal life. Mortgage and credit card repayments may be overdue, and daily expenses like grocery shopping, taxi rides, and tolls may also be hindered. Worse still, some users are placed on the bank's risk list due to frequent frozen cards, leading to long-term restrictions on their account functions. Moreover, the time-consuming and labor-intensive unfreezing process only adds to the burden. Difficulties in deposits and withdrawals, along with a lack of security for funds, have become common concerns for cryptocurrency users.

OKX C2C "Frozen Compensation" Merchants Launched: Compensation for Frozen Cards, Up to 100% Compensation Rate

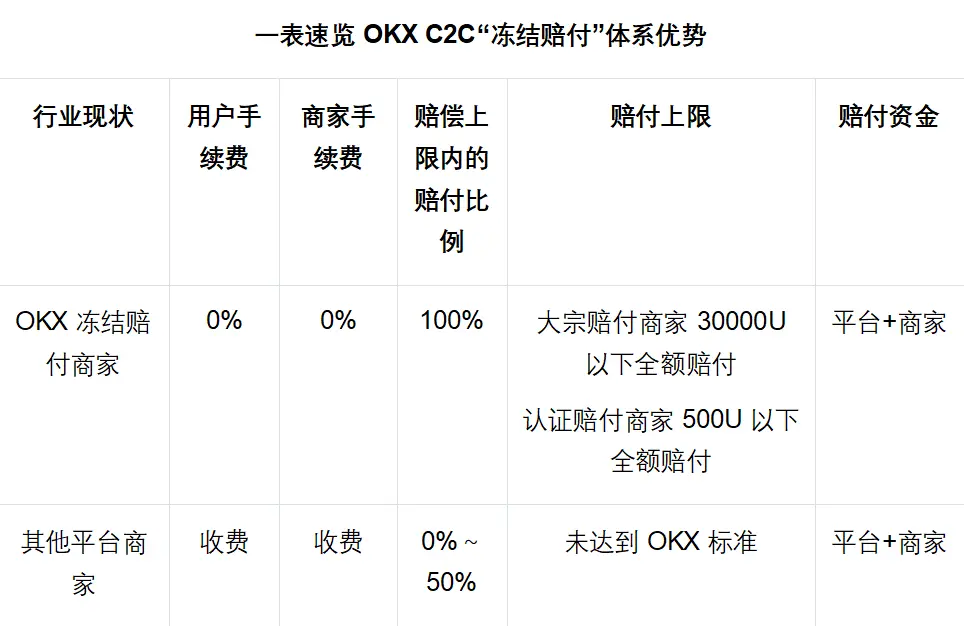

In response to this industry pain point, major trading platforms are also trying to provide solutions, focusing on the freeze rate and compensation rate to offer users a secure C2C deposit and withdrawal experience. However, there are significant differences in specific measures across different platforms.

OKX C2C has officially launched a new "Frozen Compensation" system. In simple terms, from now on, when users trade in the OKX C2C trading area with merchants marked with "Frozen Compensation," not only are there no transaction fees, but if their receiving account is frozen due to the other party's payment, eligible users can receive corresponding fund compensation according to platform rules: up to 100% compensation rate, with a single compensation cap of up to 30,000 USDT. This compensation amount is significantly higher than the guarantees previously offered by other platforms, fully reflecting OKX's determination and capability to ensure user fund safety.

The compensation funds from OKX are jointly supported by the platform and merchants, rather than relying solely on the merchants' deposits. This means that even in the event of large compensations, the platform has sufficient funds to back it up, and users need not worry about merchants being unable to compensate. OKX aims to "create the most trustworthy trading environment, ensuring every transaction is safe and worry-free." For traders troubled by frozen cards, OKX C2C is currently one of the safer and more reliable deposit and withdrawal platforms.

Another pleasant surprise for users is that OKX promises not to charge any transaction fees for all C2C trading orders. Regardless of the order size, users can buy and sell cryptocurrencies through "Frozen Compensation" merchants without incurring any fees. This significantly reduces users' trading costs, especially in a market where most platforms charge OTC transaction fees, demonstrating OKX's sincerity in giving back to users.

The "Frozen Compensation" rules announced by OKX are very detailed, striving for fairness and transparency. According to official explanations, the compensation amount will be calculated based on order size and merchant type (see table below). In simple terms:

Small Orders (≤500 USDT): Regardless of whether it is a regular certified compensation merchant or a bulk compensation merchant, all will compensate 100% of the order amount, with no minimum compensation amount. For example, if a transaction of 300 USDT triggers compensation, the user can receive the full 300 USDT.

Large Orders (>500 USDT): Regular certified compensation merchants will compensate 20% of the amount exceeding 500 USDT, but the minimum compensation amount is 500 USDT, and the maximum compensation does not exceed 2,000 USDT. For example, if a transaction of 600 USDT triggers compensation, the user can receive a total of 520 USDT (500 + (600 - 500) * 20%).

In contrast, bulk compensation merchants provide 100% compensation within the compensation cap for large orders, with a minimum of 500 USDT and a maximum compensation of 30,000 USDT. This means that if a user trades 10,000 USDT with a bulk compensation merchant and encounters a freeze, they can receive up to 10,000 USDT; even if the transaction amount is higher (e.g., 50,000 USDT), the maximum compensation remains capped at 30,000 USDT. This amount essentially covers the common scale of a single withdrawal for ordinary traders, sufficient to handle most risk situations.

Merchant Admission and Review: Selecting the Best, Strictly Controlling Risks

Of course, "Frozen Compensation" is not applicable unconditionally. Only transactions with OKX officially certified "Frozen Compensation" merchants can enjoy this protection. These merchants have undergone strict multi-dimensional screening by the platform; they are either bulk compensation merchants with outstanding overall performance and high deposits or high-quality compensation merchants who have been certified and promised to provide compensation according to the rules. They will have a prominent "Frozen Compensation" label on their accounts, making it clear to users when placing orders.

Additionally, to facilitate user selection, OKX has added a dedicated filtering function in the C2C trading interface. Users can also directly choose to trade with "Frozen Compensation" merchants through the filtering function, making it quicker and more reassuring.

Once a merchant becomes a compensation merchant, OKX will also conduct ongoing supervision. For example, merchants are required to comply with the "Frozen Compensation" service guidelines and must not induce transactions with false promises. If a user complaint arises and is verified to be the merchant's responsibility, the platform has the right to take measures against the merchant, including point deductions, fines, account freezes, or even cancellation of compensation qualifications, depending on the circumstances. For merchants who actively fulfill their compensation obligations and perform excellently, OKX will provide incentives such as traffic preference and exclusive ranking rewards to encourage them to offer better services.

Through this strict admission and management mechanism, OKX aims to establish "Frozen Compensation" merchants as the "benchmark merchants" for C2C trading on the platform. They not only provide a good trading experience and quick transactions but, more importantly, offer users a form of insurance for their funds. For merchants, obtaining compensation qualifications also means higher credibility and platform support, helping to attract more users to trade with them.

At the same time, OKX reminds users: during the trading process, they still need to comply with the platform's risk control rules, such as verifying receiving account information and confirming payments in a timely manner, to avoid unnecessary disputes. If suspected fraud or abnormal funds occur, users should immediately request customer service intervention, and the platform will assist in handling the situation and take strict measures against violating merchants, including compensation.

In summary, OKX's compensation rules cater to the different needs of small high-frequency trades and large trades: small trades are fully compensated, allowing retail investors to experiment with zero risk; large trades are backed by strong bulk compensation merchants providing high compensation, ensuring the safety of large funds. Coupled with the zero-fee benefit, OKX aims to attract more users to choose officially certified compensation merchants for trading, thereby reducing the occurrence of frozen card incidents from the source and creating a healthier C2C trading ecosystem.

User Peace of Mind for Deposits: OKX C2C Becomes an Important Safe and Reliable Channel

The launch of the OKX C2C "Frozen Compensation" system is undoubtedly a boon for ordinary users. For a long time, difficulties in deposits and withdrawals, along with a lack of security for funds, have been significant barriers preventing newcomers from entering the cryptocurrency space. Many users outside the industry have concerns about OTC trading: "What if the other party doesn't release the funds after I make the payment?" "Who is responsible if my bank card is frozen after receiving the funds?" Now, OKX has provided a solution, allowing users to trade cryptocurrencies through the C2C channel with greater peace of mind.

For cryptocurrency industry users, this means they have a safer channel for their funds. Whether cashing out in a bull market or buying in a bear market, trading with "Frozen Compensation" merchants adds an extra layer of security for their funds. This will reduce users' anxiety about frozen cards, allowing them to focus more on the trading itself. Some users who previously reduced their trading due to concerns about frozen cards may increase their trading volume again.

For newcomers from outside the industry, OKX's compensation mechanism lowers their psychological barrier to entry. In the past, newcomers often hesitated due to fears of being scammed or having their cards frozen; now, with safe merchants available, they can more confidently try purchasing assets like Bitcoin and Ethereum, truly achieving "one-click deposits" without worries.

Additionally, OKX's compensation mechanism may also bring about a "catalyst effect," driving an overall improvement in service levels across the industry. When users find that OKX's C2C is both safe and inexpensive, they will naturally be more willing to use OKX for fiat transactions. This will prompt other platforms to follow suit and improve, such as lowering fees, strengthening merchant reviews, or providing similar compensation guarantees. Ultimately, the beneficiaries will be the vast number of investors, making the channels for funds entering and exiting the entire cryptocurrency market smoother and safer.

Of course, OKX also reminds users: while the compensation mechanism is beneficial, they still need to pay attention to transaction compliance and safety. Users should comply with applicable laws and regulations when using C2C services and should not engage in illegal activities such as money laundering or fund diversion. While choosing to trade with officially certified merchants, users should also take precautions against risks; only through the joint efforts of the platform and users can the risk of frozen cards be minimized. In the event of a risk occurrence, OKX's compensation system serves as a solid backing for users.

From "fear of freezing" to "compensation for freezing," OKX's initiative marks the entry of cryptocurrency C2C trading into a new era of secure transactions.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. Past performance does not guarantee future results, and historical returns do not represent future outcomes. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。