Author: Octoshi.eth

Compiled by: Tim, PANews

By participating in points activities and investing in real yield protocols, I can earn about $500,000 a month, which sounds crazy.

The following article will introduce the sources of income.

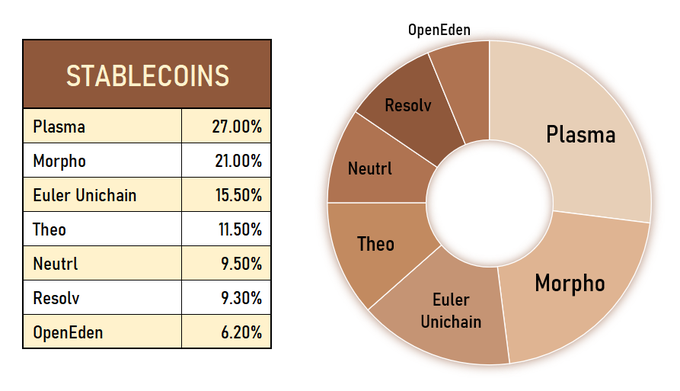

This is my current fund allocation, and my average annualized return rate is 78%. Although my estimates are relatively conservative, a large part is based on activity points, which makes it highly predictable.

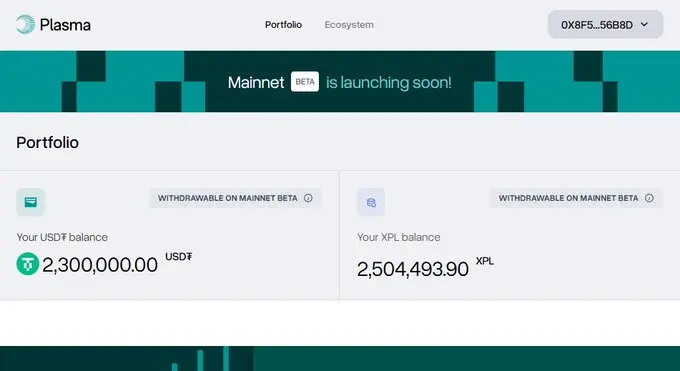

The first source of income is participating in Plasma. I deposited $2.3 million and purchased $125,000 worth of XPL tokens at a $500 million FDV.

Considering a 90-day investment cycle and calculating based on the current $5.7 billion valuation on Hyperliquid, my annualized return rate reached 217%. XPL aims for a $10 billion valuation!

The second source of income is passive holding for instant liquidity, so I can jump in whenever I discover new yield opportunities or interesting trades.

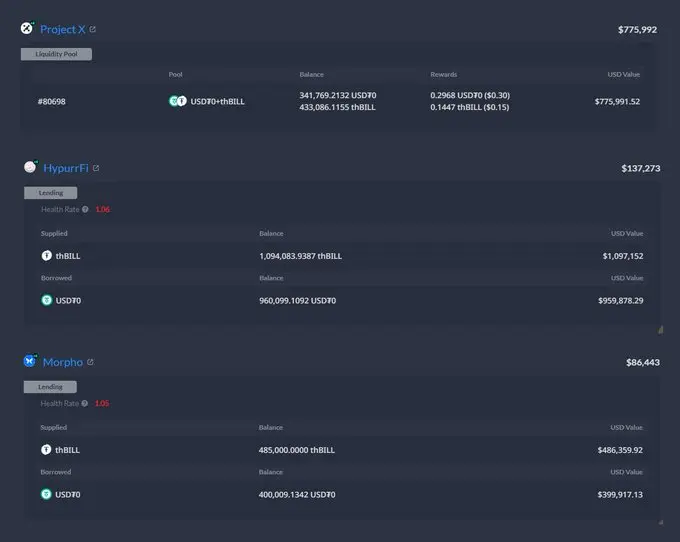

The operation is simple: I just need to deposit money into the Morpho treasury, which currently offers a 10% annualized return rate.

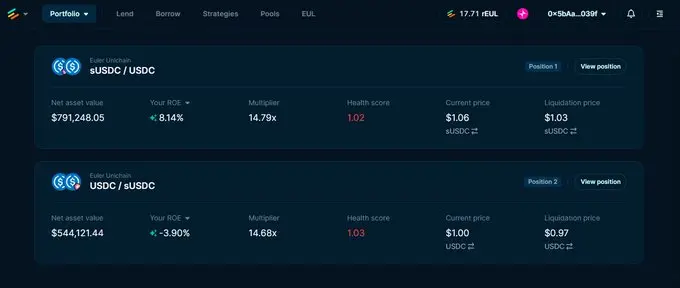

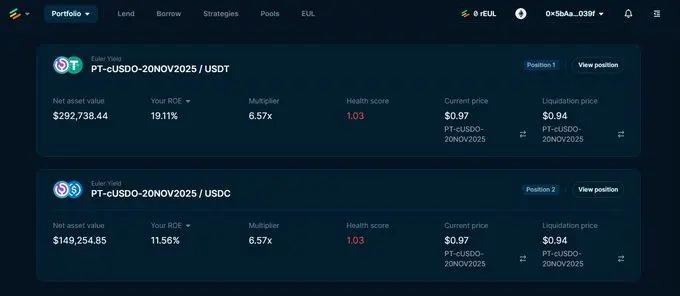

The next source of income is the Spark mining activity conducted by Euler Finance on Unichain, which provides OP token incentives.

In the current situation, the annualized return rate is 27% (Euler does not display OP rewards), and considering the relatively low risk, this return is quite high.

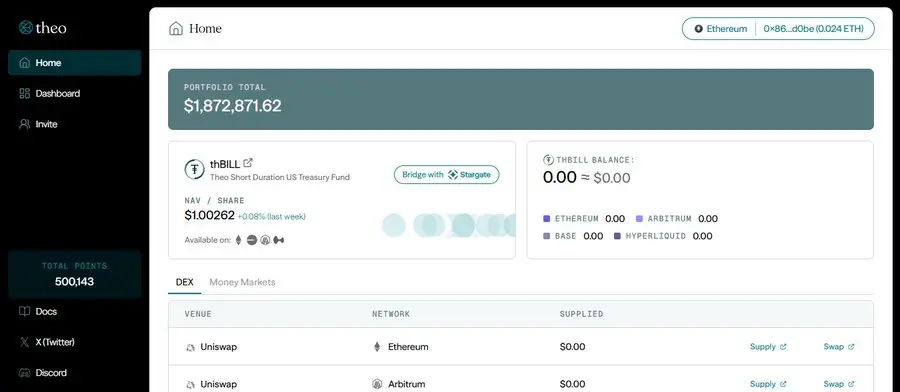

Next is Theo Network, a new player that just launched.

They have introduced a points system, which I am very optimistic about.

There are no private PY trades, so everyone can participate with peace of mind, without feeling scammed.

Praying for an annualized return rate of 30%

Next is Neutrl, a project that has not officially launched yet, but it offers a private trade with different options. I chose to lock my funds for 12 months to obtain a fixed annualized return rate of 30%.

Maybe it will launch soon?

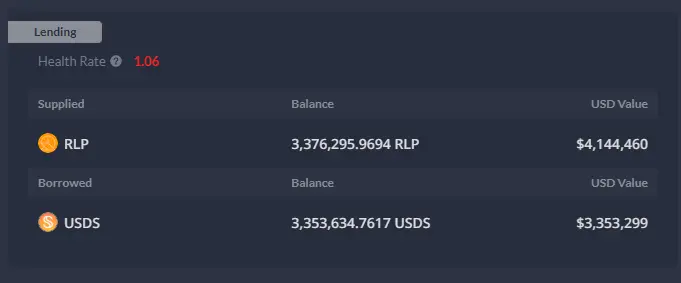

The next source of income is the RLP circular arbitrage from MorphoLabs, which currently has an actual annualized return rate of 33% (with high volatility) and does not yet account for Resolv point rewards, which are expected to add an additional 10% annualized return rate.

The last one is Open Eden. Although I am optimistic about this project, the profitability of the circular lending strategy has decreased due to rising interest rates, so I had to reduce my holdings (but I will soon increase my position again).

With an FDV of $300 million, I estimate the annualized return rate to be about 50%.

$500,000 a month and a 78% average annualized return rate—these two numbers are estimated and largely influenced by Plasma. It has proven to be a very wise investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。