On August 26, the market finally welcomed the latest collaboration project from Four.meme - the on-chain credit scoring platform Creditlink. This article will comprehensively analyze Creditlink from the market and product perspectives, helping everyone better understand the important application scenario of on-chain credit and the value and potential of Creditlink.

In the past decade, the development path of the blockchain industry has been clear:

Bitcoin initiated the experiment of decentralized currency;

Ethereum brought smart contracts and asset prosperity;

DeFi, NFT, GameFi, and DAO gradually built a diverse ecosystem.

However, behind all this prosperity, a long-standing issue that has not been fully resolved is: on-chain credit.

Wallets can be created at will, identities can be repeatedly forged, and witch attacks are not uncommon. For project parties, airdrops are often "harvested" by opportunists; for investors, the authenticity of tokens is hard to discern, and contract risks frequently arise; for the entire industry, the lack of a verifiable credit system is becoming a significant bottleneck hindering the large-scale entry of capital and users.

Research institutions estimate that once on-chain credit is widely applied, it will directly leverage a trillion-dollar market—covering multiple fields such as DeFi lending, decentralized identity, compliance review, and on-chain investment and financing.

Exploration of Existing Tools

Currently, there are some representative tools on the market that have made good progress:

DeBank: Known for wallet asset display and multi-chain visualization, suitable for individual users to view assets, but lacks in-depth credit analysis capabilities, especially in batch address recognition.

Trusta: Has made certain breakthroughs in community sentiment analysis and contract monitoring, but the depth and coverage of data are limited, unable to support systematic credit assessments in complex scenarios.

It can be seen that these tools focus more on data presentation and basic analysis, while Creditlink's market entry point is how to achieve a truly meaningful "on-chain credit infrastructure."

Creditlink's Entry and Advantages

As the latest project launched by the Fourmeme platform, Creditlink has a very clear positioning: to build a complete closed-loop system centered on "on-chain credit analysis," from data collection, intelligent analysis to user incentives.

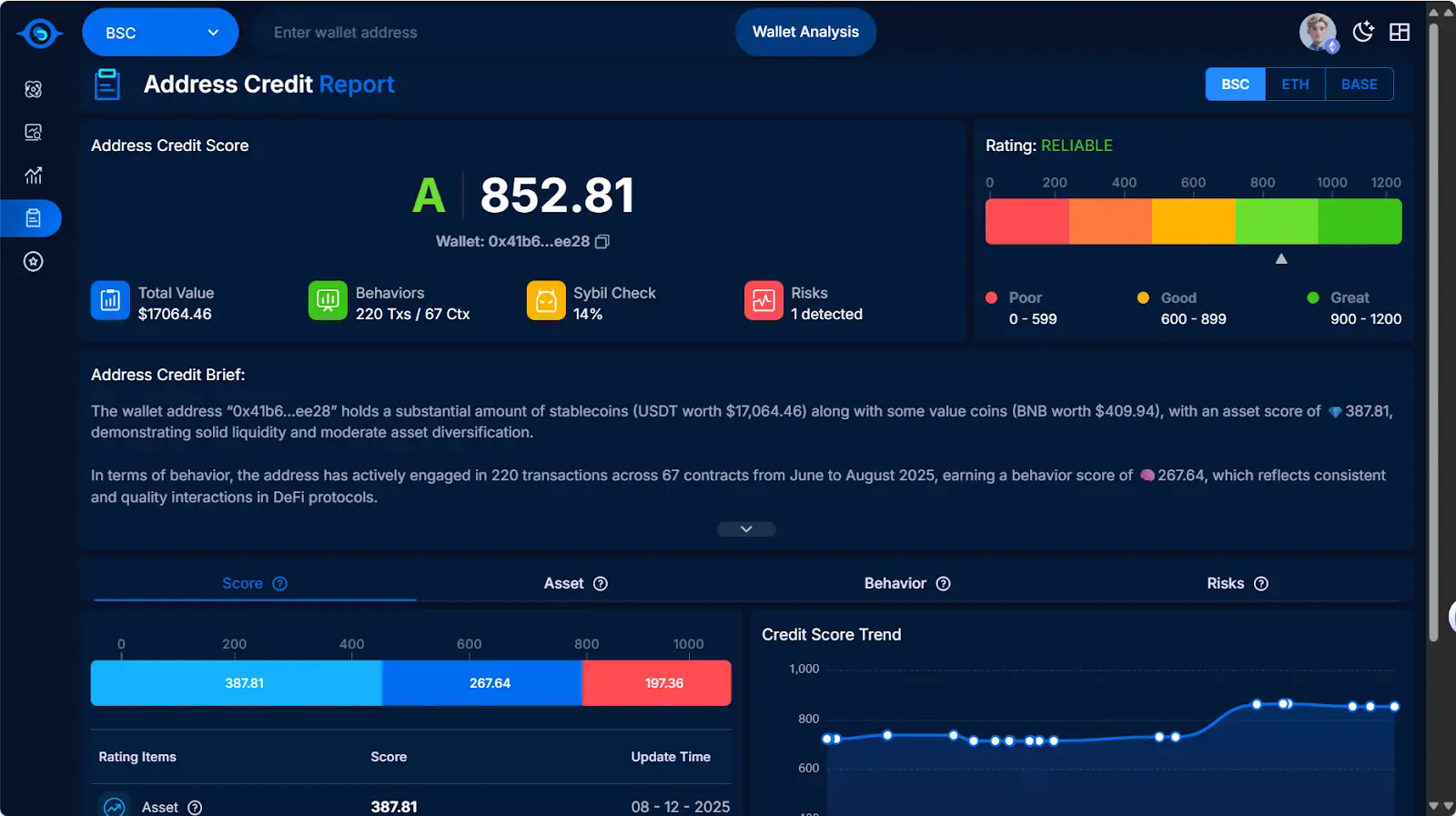

1. Intelligent Analysis: AI-Driven Credit Recognition Engine

Creditlink introduces intelligent algorithm models that can:

Automatically identify potential witch networks and suspicious trading patterns;

Generate comprehensive health scores for addresses and tokens;

Predict future risk trends based on historical behavior.

This shifts credit analysis from "post-event statistics" to "real-time warnings."

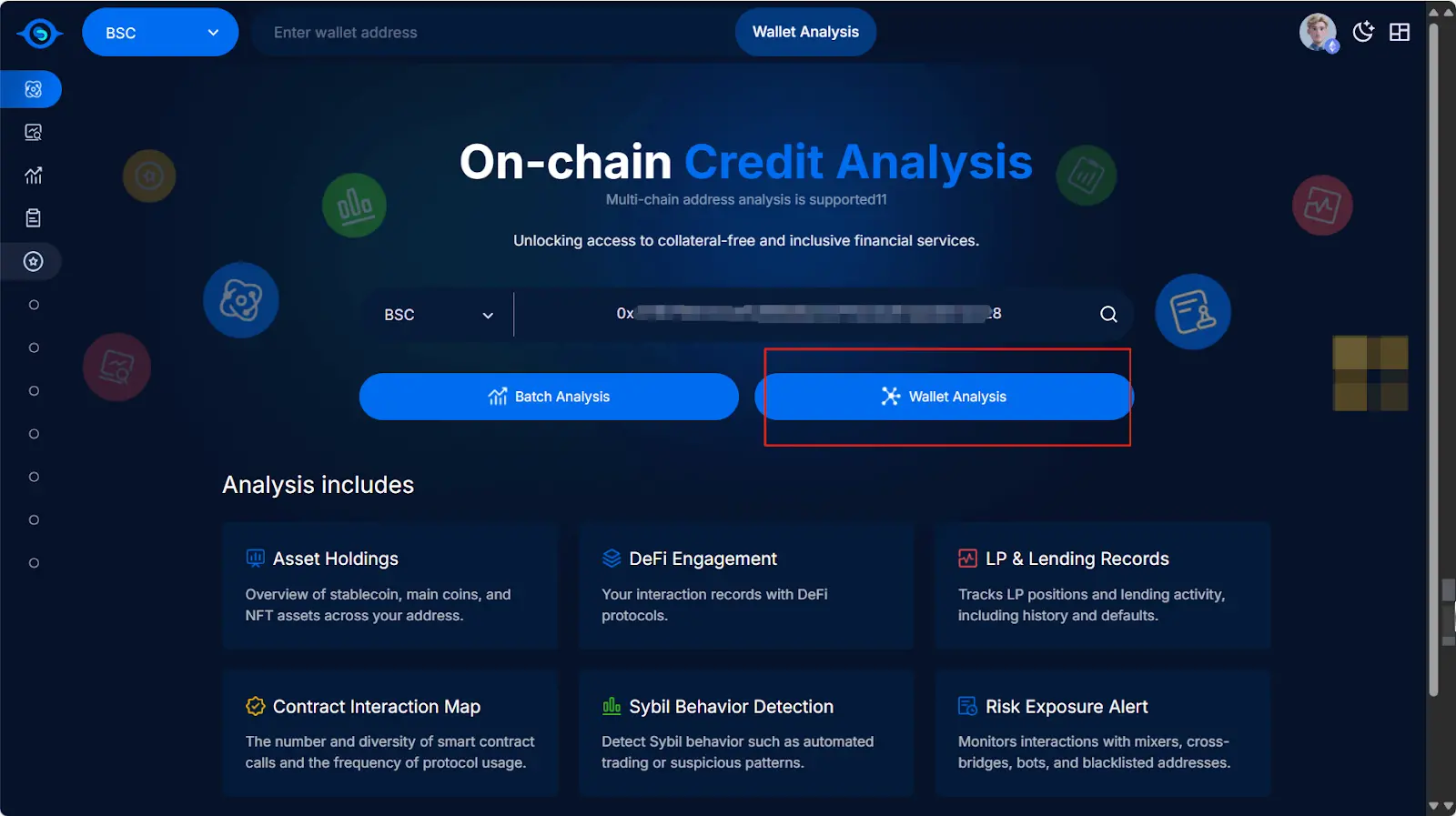

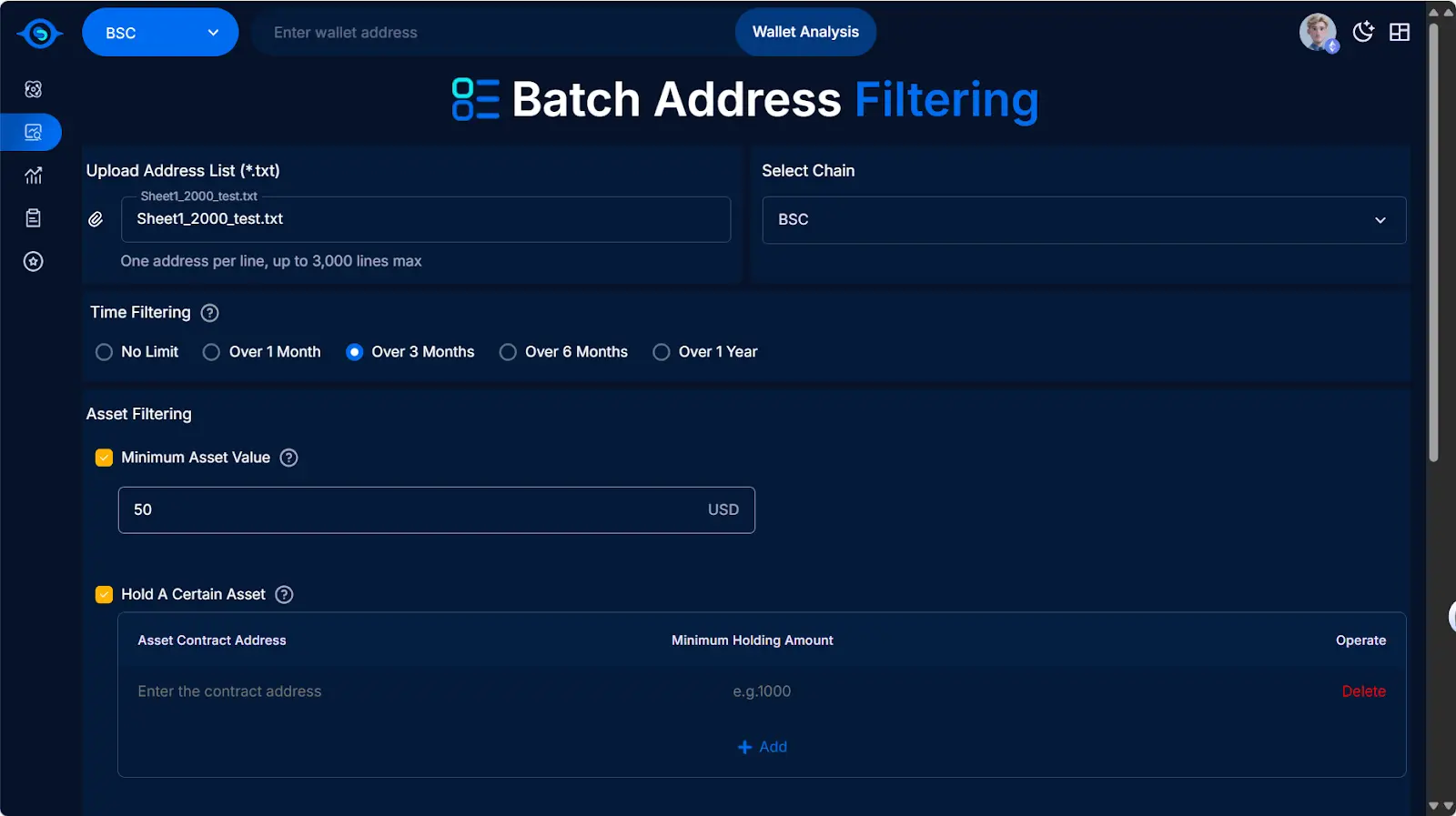

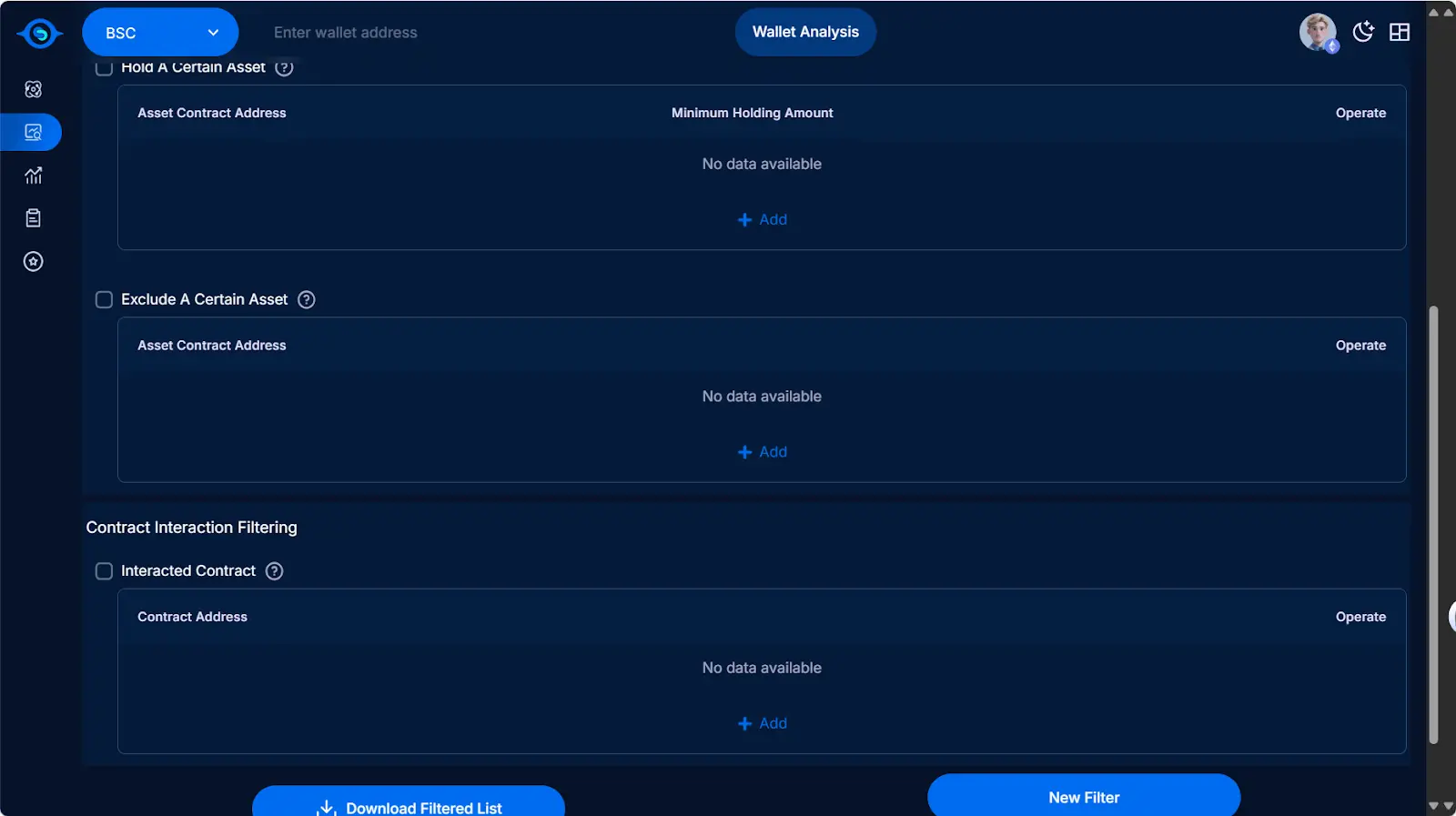

2. Batch Address Analysis: A Tool for Operations and Investments

Creditlink supports users to upload hundreds or thousands of addresses and filter them through custom conditions:

Wallet creation time, balance thresholds

Whether to interact with specific contracts

Whether to have received airdrops

Through this feature, project parties can accurately identify real users and reduce resource waste; investment institutions can also quickly assess the wallet profiles of target communities.

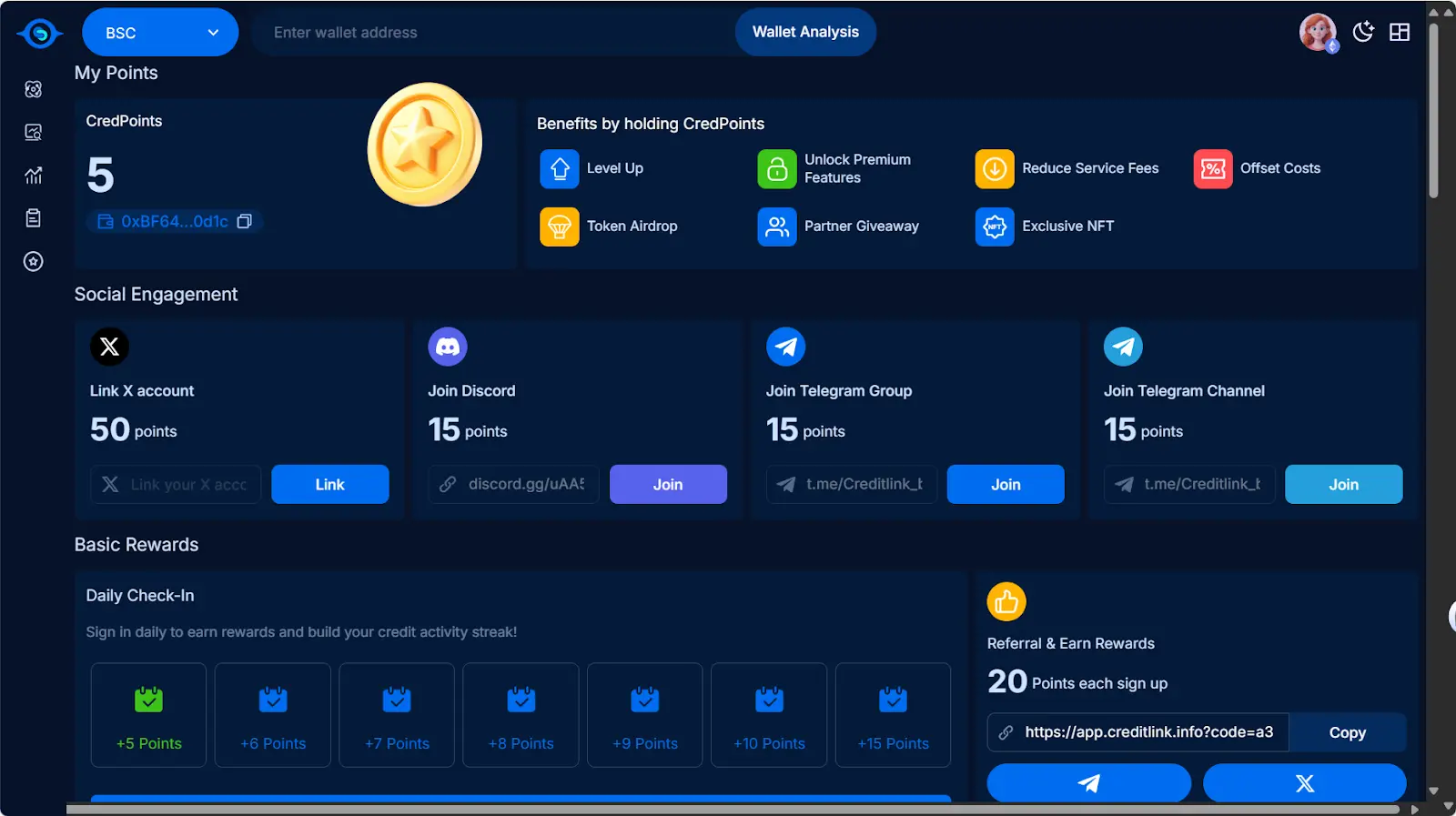

3. Credit Points System (CreditPoints): From Tool to Ecosystem

Creditlink has designed a CreditPoints system:

Users can earn points by binding wallets, completing analysis tasks, and participating in community interactions;

Points can be exchanged for rewards and can also serve as qualification certificates for future platform activities.

This means that Creditlink is not just a "tool," but is attempting to promote the ecological cycle of on-chain credit through an incentive mechanism.

Why Now? Why Creditlink?

The on-chain credit track is not a new concept, but there are not many projects that truly have landing scenarios and application closed loops.

From the perspective of Fourmeme, choosing to collaborate with Creditlink for a pre-sale at this time is based on three layers of logic:

Market demand is urgent: Projects like DeFi, Airdrop, and GameFi have a stronger need for "real user identification" than ever before.

Technical conditions are mature: The combination of AI and big data technology makes intelligent analysis possible.

Narrative and capital alignment: On-chain credit, as the underlying infrastructure of Web3, inherently possesses the imaginative space of a "trillion-dollar market."

Creditlink's advantage lies in that it does not only solve one point (such as wallet display or sentiment analysis), but forms a closed loop through data analysis + intelligent algorithms + point incentives, possessing the potential to evolve into a larger-scale credit ecosystem.

Conclusion: The Breakthrough Player in On-Chain Credit?

The construction of the on-chain credit system is moving from theoretical discussion to practical application. Whoever can find the solution for "real user identification" first will grasp the core entry point of Web3.

The emergence of Creditlink may be a signal worth paying attention to.

Beyond predecessors like DeBank and Trusta, will Creditlink become the breakthrough player in the new track of on-chain credit? The market will provide the answer.

About the Creditlink Pre-sale

According to information disclosed by both parties, the pre-sale will start at 4:00 PM Beijing time on August 28 and end at 4:00 PM on August 30. The pre-sale has not only received support from the Four.meme platform but also from the stablecoin USD1 issuer WLFI. Users can choose to invest using USD1 or Form. The pre-sale price, valuation, and share details have not yet been disclosed and will be revealed on the 28th.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。