USDT is a "gray giant" that has grown organically in the market, while compliant stablecoins are the biggest source of Alpha for TradFi this year.

Written by: imToken

From a macro perspective, stablecoins are entering an unprecedented reshuffling phase.

In July, U.S. President Trump officially signed the "GENIUS Act," marking the long-awaited arrival of stablecoin legislation; in August, Hong Kong's "Stablecoin Regulation" also came into effect, becoming the world's first regional regulatory framework; at the same time, major economies like Japan and South Korea are accelerating the follow-up of regulatory details, planning to allow compliant entities to issue stablecoins.

In other words, the stablecoin sector has ushered in a true "regulatory window"—evolving from a liquidity tool that grew in the gray area to a financial infrastructure that balances compliance and experimentation.

Why pay attention to "compliant stablecoins"?

In the classification system of stablecoins, compliant stablecoins (Regulated Stables) occupy a unique and critical position.

First, from the perspective of market demand, stablecoins are no longer just a "general equivalent" for on-chain transactions. For crypto-native users, they are core assets for hedging and liquidity; for traditional institutions, they may represent a new tool for cross-border settlement, treasury management, and payment clearing.

However, in the past, stablecoins like USDT expanded naturally due to market demand, and although they are large in scale, they have long operated in a regulatory gray area, facing scrutiny due to insufficient transparency and compliance risks. Compliant stablecoins, on the other hand, have aimed for "compliance and usability" from their inception, issued by regulated entities, meeting the licensing requirements of their respective jurisdictions, and backed by clear asset reserves and legal responsibilities.

In simple terms, the biggest feature of compliant stablecoins is regulated issuers + compliance with local licensing requirements. Each token has clear asset reserves and legal responsibilities behind it, allowing users and institutions to trace back to the regulatory entities and asset custody arrangements when using them.

This enables them not only to circulate on-chain but also to be included in corporate financial reports and compliance documents, becoming the "official channel" between traditional finance and the crypto world.

Source: imToken Web (web.token.im) compliant stablecoins

From imToken's perspective, stablecoins are no longer a tool that can be summarized by a single narrative, but rather a multidimensional "asset collective"—different users and different needs correspond to different stablecoin choices (Further reading: "Stablecoin Worldview: How to Build a Classification Framework for Stablecoins from the User Perspective?").

In this classification, compliant stablecoins (USDC, FDUSD, PYUSD, GUSD, USD1, etc.) are not meant to replace USDT, but to serve as a parallel track, providing legal and safe options for cross-border payments, institutional applications, and financial compliance.

If USDT's significance lies in "driving global liquidity in the crypto market," then the significance of compliant stablecoins is "to truly integrate stablecoins into the daily financial and life activities."

Overview of Major Compliant Stablecoins

From this perspective, the global paths of compliant stablecoins are not uniform, but their directions converge—transitioning from gray liquidity to compliant financial interfaces, with future application scenarios likely extending beyond exchange matching and arbitrage to cross-border payments, corporate treasury management, and even personal daily payments.

Globally, compliant stablecoins have formed several different development paths.

In the United States, USDC is the most representative compliant stablecoin, issued by Circle, backed by cash and highly liquid short-term U.S. Treasury bonds, and subject to regular audits to ensure the safety of 1:1 redemption for U.S. dollars, making it the most widely adopted dollar stablecoin among institutions and one of the few stablecoins that can be "written into financial reports."

Alongside it is USDP, issued by Paxos Trust Company, which holds a trust license from the New York Department of Financial Services. Although it is not as widely circulated as USDC, its compliance attributes are clear, primarily targeting institutional payment and clearing scenarios.

At the same time, PayPal's PYUSD is more symbolic; it is not designed for the trading market but directly enters the retail payment segment, attempting to bring stablecoins into everyday consumption and cross-border transfers.

In Hong Kong, the "Stablecoin Regulation," which officially took effect in August 2025, has made it the first region in the world to propose a complete regulatory framework for the issuance, reserves, and custody of stablecoins. This means that stablecoins issued in Hong Kong are no longer tokens in a gray area but are truly recognized as tools by financial regulators. FDUSD, issued by First Digital, is a representative in this context.

In Japan, JPYC has become the first approved yen stablecoin, issued by JPYC Inc. and regulated under a money transfer service provider license, supported by liquid assets such as government bonds. The Financial Services Agency (FSA) plans to approve it as early as this fall, having completed the registration of remittance business operators, and plans to deploy its yen stablecoin on Ethereum, Avalanche, and Polygon networks.

Similarly, South Korea is exploring the application of a won stablecoin through a "regulatory sandbox," focusing on cross-border payments and B2B settlement.

These attempts point to a trend: compliant stablecoins are not meant to challenge the market positions of USDT or USDC but to carve out a new track that serves real scenarios requiring compliance and transparency. Their emergence signifies that the narrative of stablecoins is shifting from "gray liquidity in the trading market" to "legitimate interfaces in global finance."

While the paths of the three differ, their directions are highly consistent: compliant stablecoins are becoming a parallel track to USDT, with significance not in competing for liquidity dominance but in providing legal, transparent, and regulatory options for financial institutions, cross-border payments, and daily applications.

What’s the next step?

Overall, the biggest structural change in TradFi by 2025 is the full emergence of compliant stablecoins, and the focus of competition is shifting from scale and flow to compliance capabilities and scenario penetration.

Whether it is Hong Kong's pioneering "Stablecoin Regulation" or the U.S. market's strengthened regulation of USDC, PYUSD, etc., they convey the same message: the stablecoins that can truly serve global users and traditional capital must move towards a deep integration of off-chain compliance and on-chain structure.

This also means that the logic of competition among stablecoins has shifted from "who has more dollar reserves" to "who can enter the most authentic user scenarios faster," including cross-border settlement, corporate treasury, as well as retail payments and daily consumption. In this trend, new compliant attempts are continuously emerging.

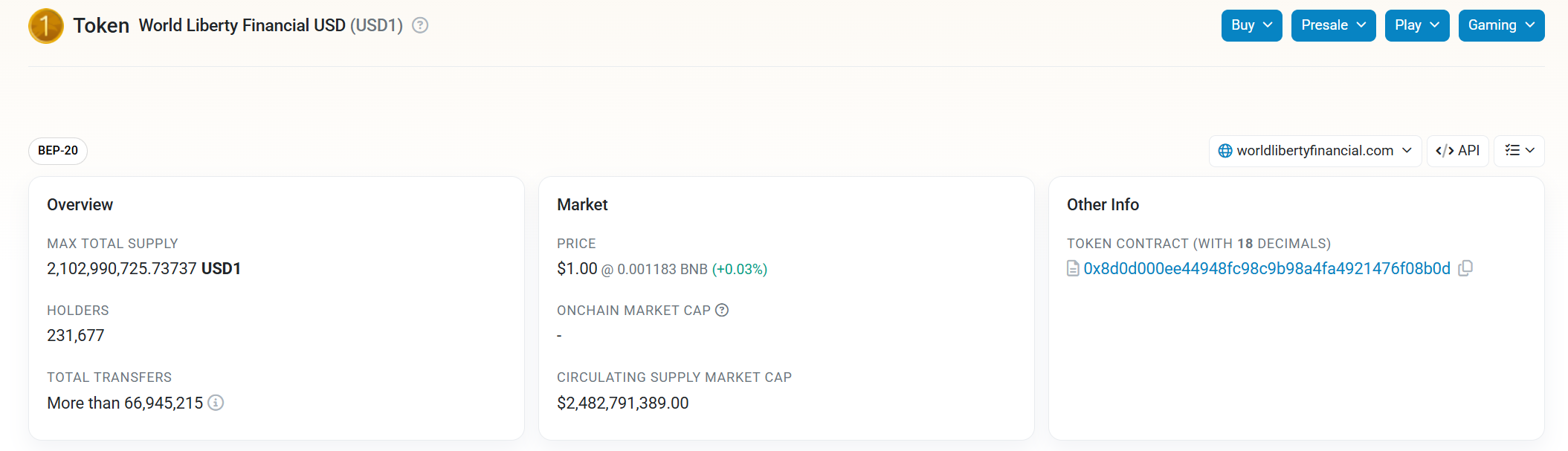

For example, emerging stablecoin projects like USD1, relying on strong traditional capital and policy resources, emphasize compliance pathways and global usage scenarios from the very beginning—backed by the political endorsement of the Trump family, USD1 achieved a phenomenal "from 0 to 1" growth and top exchange coverage within just six months:

Since March, its issuance has skyrocketed to $2.1 billion, surpassing FDUSD and PYUSD to become the fifth largest stablecoin globally (CoinMarketCap data), and sweeping through leading CEXs like HTX, Bitget, and Binance. In contrast, PYUSD, backed by PayPal for two years, is still struggling to gain traction.

At the same time, infrastructure around Liquidity-as-a-Service is also emerging, aiming to make stablecoins not just a token symbol on-chain but directly callable as settlement APIs globally.

This gives rise to a foreseeable future scenario where cross-border payments, corporate treasury, and even personal daily payments may gradually find a new balance between the gray liquidity of USDT and the whitelist system of compliant stablecoins.

From a more macro perspective, stablecoins are experiencing a "fork," and the future landscape is destined to be diverse and parallel:

USDT continues to serve as the liquidity engine for the global crypto market;

Yield-bearing stablecoins meet the demand for capital appreciation;

Non-dollar stablecoins open up a multipolar narrative;

Compliant stablecoins gradually embed themselves into the real financial world;

Over the past decade, USDT has represented the "organically grown" gray power, driving global liquidity in the crypto market; semi-compliant products like USDC have built a transitional bridge between gray and white, and now, with the implementation of the U.S. "GENIUS Act," the effectiveness of Hong Kong's "Stablecoin Regulation," and the successive pilot releases in Japan and South Korea, compliant stablecoins are truly entering a window period.

This time, stablecoins are no longer just tools for on-chain users but will become financial carriers that are ubiquitous in cross-border settlements, corporate treasuries, and even daily consumption.

This is the significance of compliant stablecoins: to truly bring stablecoins out of the crypto world and into the daily financial and life activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。