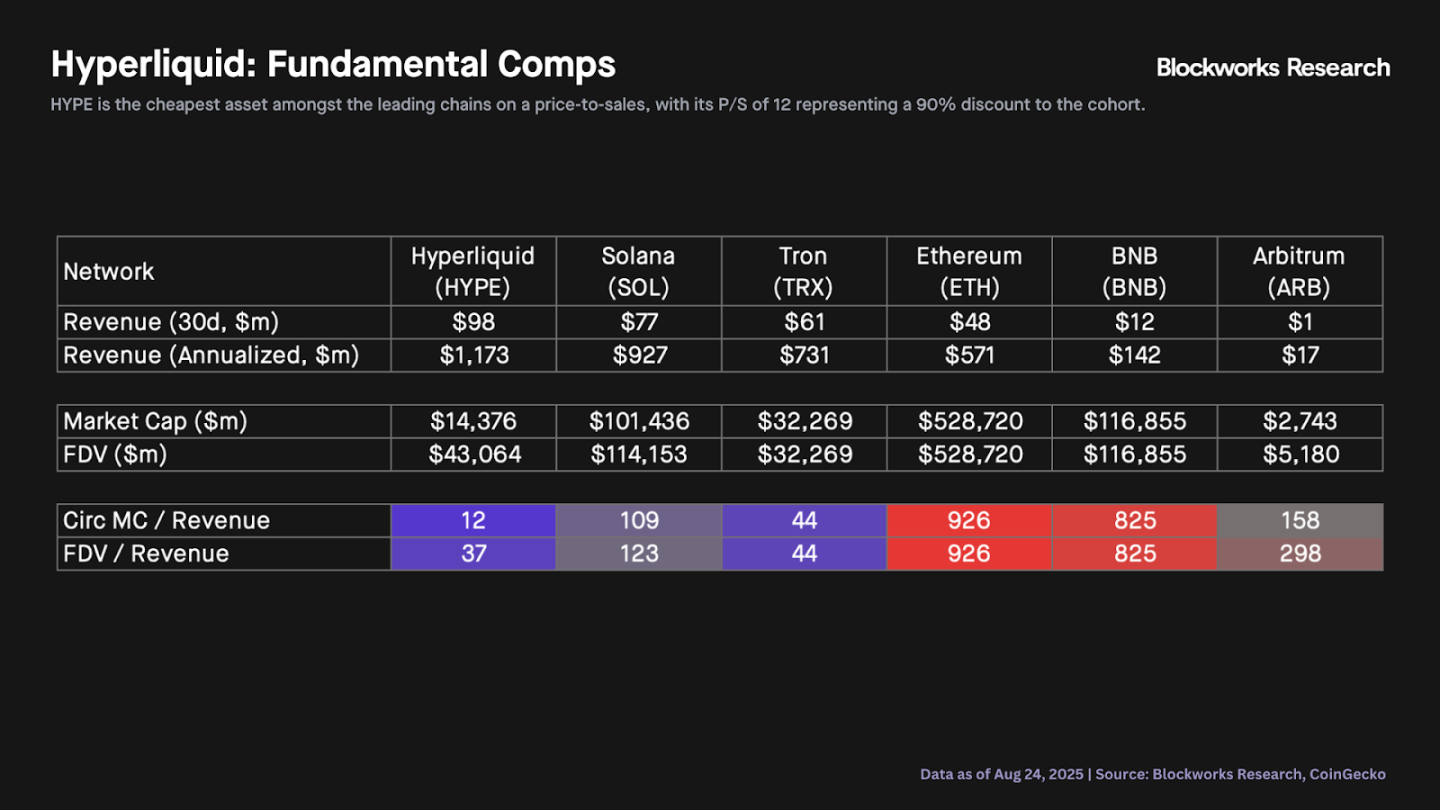

According to the price-to-sales ratio (P/S), HYPE is the cheapest asset among mainstream public chains, with a 12 times P/S that is 90% lower than similar assets.

Written by: Carlos

Translated by: AididiaoJP, Foresight News

The fundamentals of Hyperliquid continue to improve, but its valuation remains undervalued compared to other L1s.

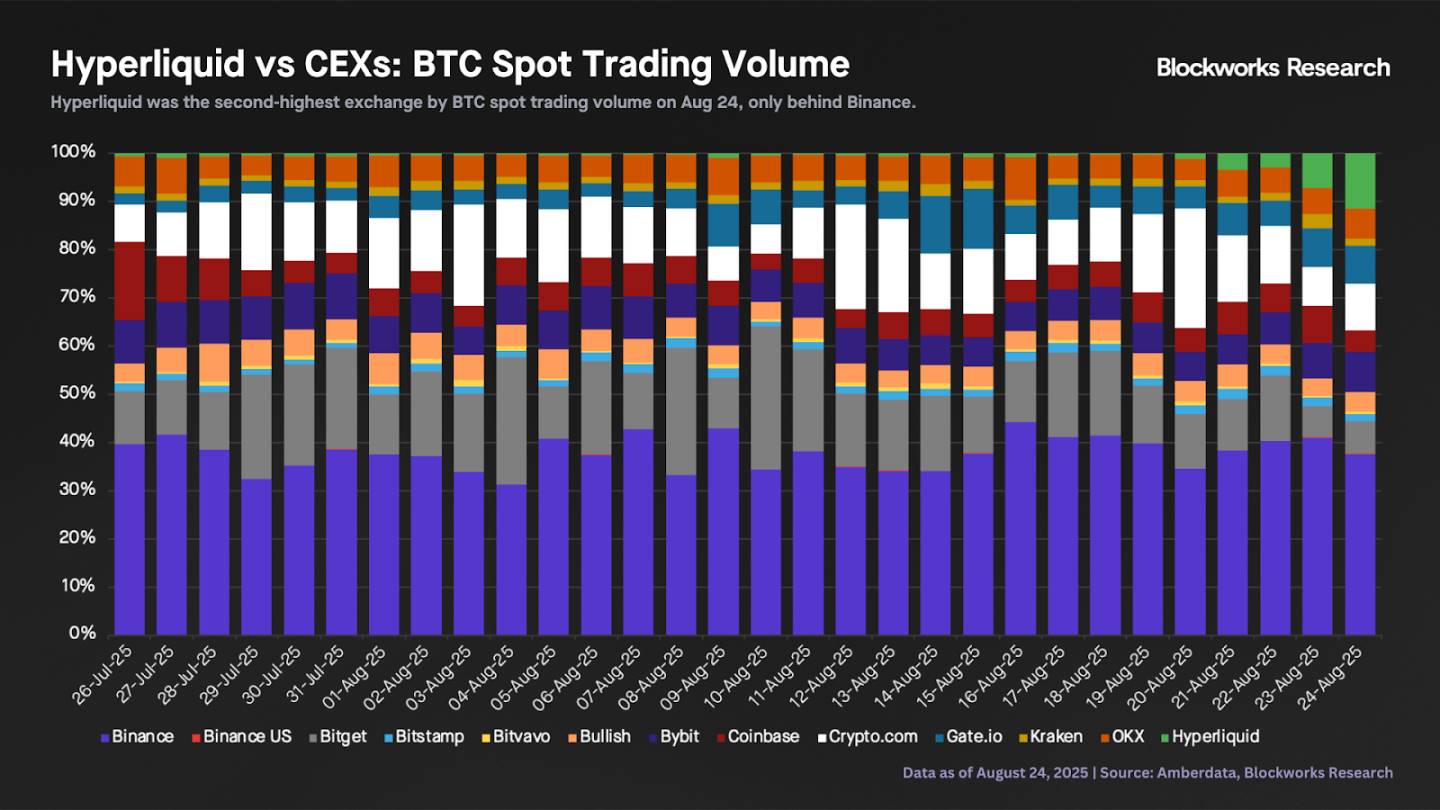

Hyperliquid has seen a significant increase in spot trading volume, especially compared to centralized exchanges. Last weekend, an unknown entity deposited and sold approximately 22,100 BTC on Hyperliquid, then bought about 555,000 ETH, worth over $2.4 billion. This surge in spot trading volume made Hyperliquid the second highest exchange for BTC spot trading volume on August 24, with a market share of 12%, second only to Binance (38%). This is a substantial increase compared to Hyperliquid's average daily market share of about 1% over the past 30 days.

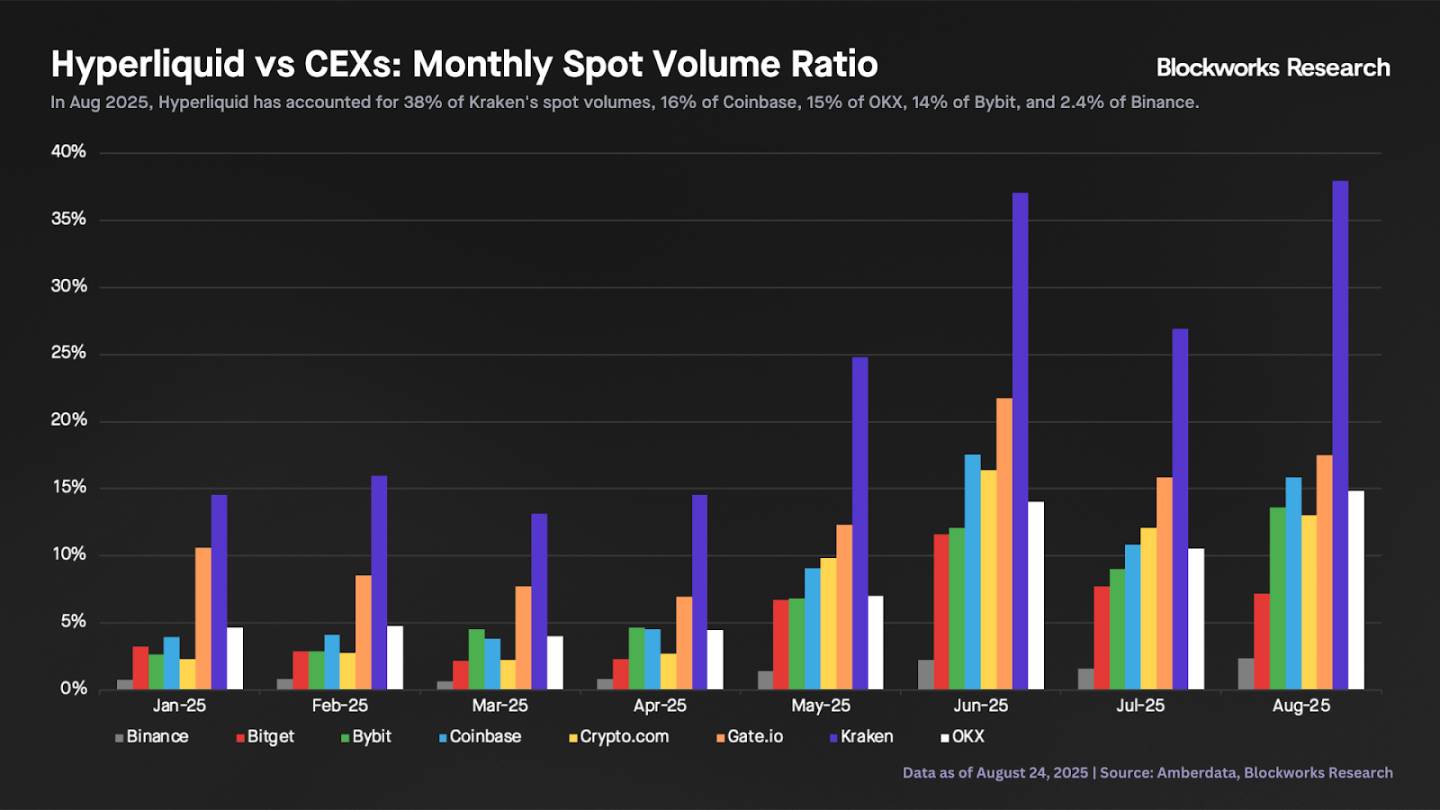

We can compare Hyperliquid's monthly spot trading volume with several CEXs (including all assets, not just BTC). We observe that Hyperliquid's share of spot trading volume has been steadily increasing this year. This month, Hyperliquid's spot trading volume accounted for 38% of Kraken, 16% of Coinbase, 15% of OKX, 14% of Bybit, and 2.4% of Binance. Although all data has significantly increased since the beginning of the year, it also indicates that Hyperliquid still has a long way to go to surpass some of the larger CEXs.

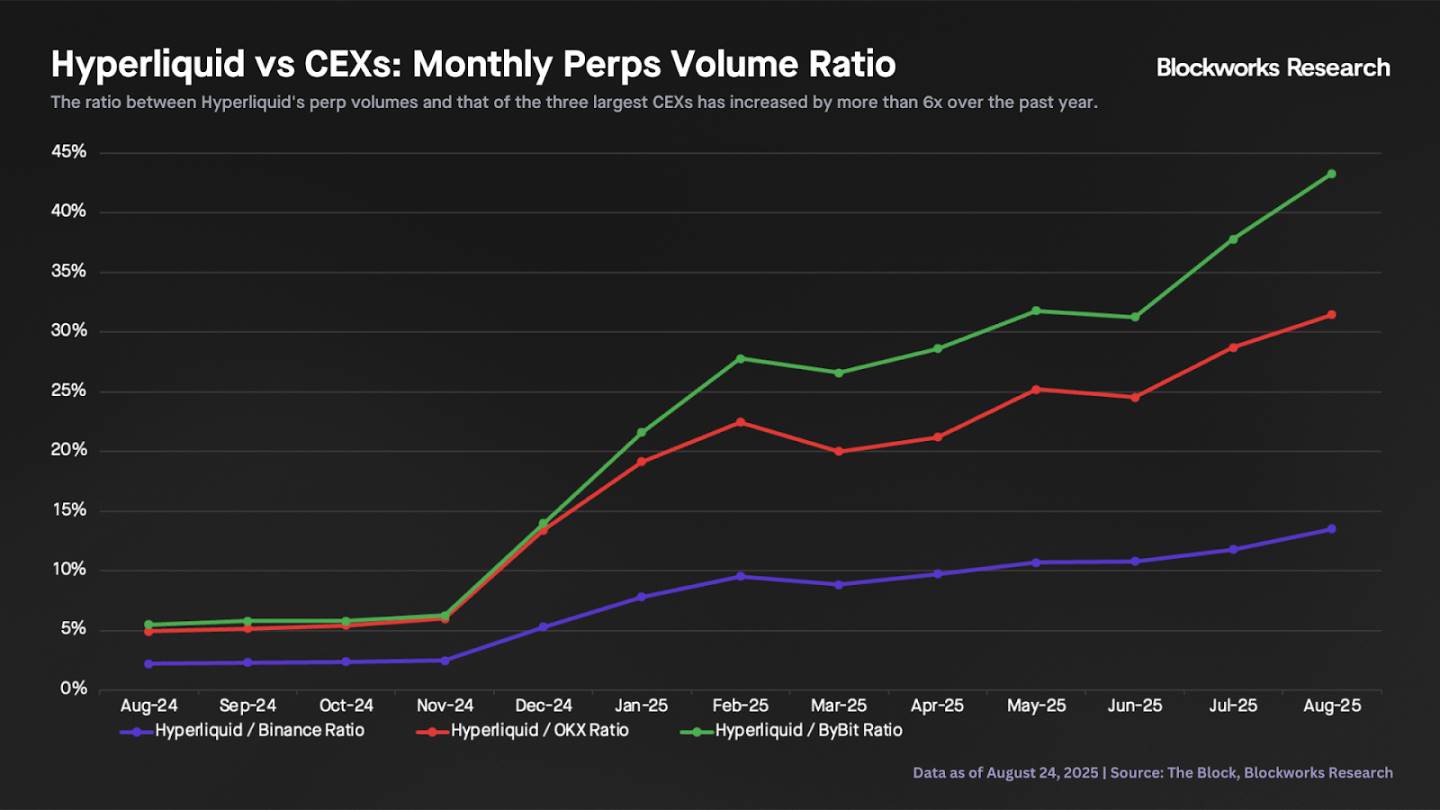

In terms of perpetual contract trading volume, Hyperliquid's growth rate far exceeds that of its centralized competitors. The chart below shows that over the past year, Hyperliquid's perpetual contract trading volume has increased more than six times compared to the three major CEXs. Hyperliquid's monthly perpetual contract trading volume now accounts for nearly 14% of Binance's futures trading volume, up from just 2.2% a year ago.

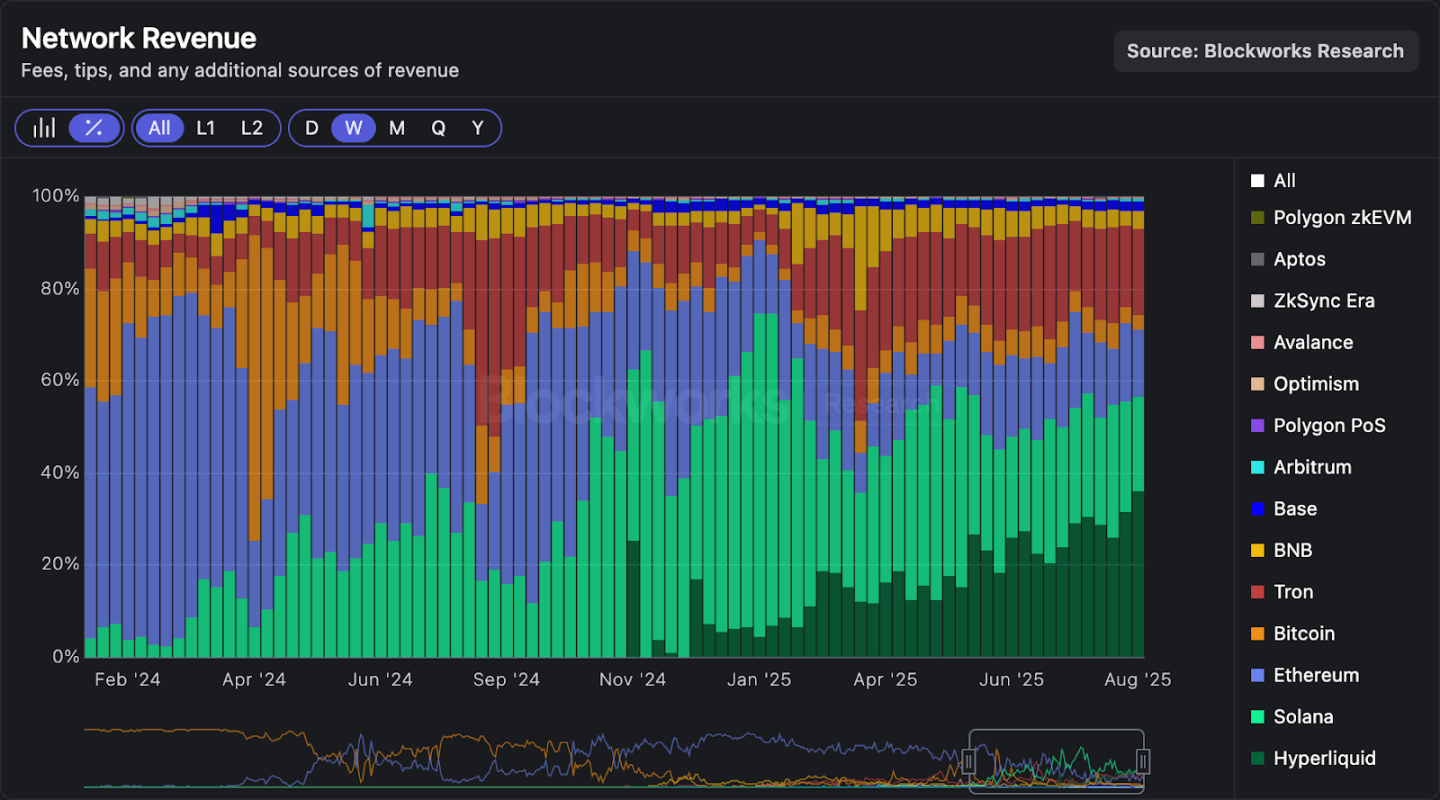

The growth in trading volume is impressive. But how does the revenue compare to other chains? Hyperliquid (HyperCore + HyperEVM) has maintained a weekly revenue of about $28 million for two consecutive weeks, with total revenue over the past 30 days reaching $98 million. These figures correspond to an annualized revenue between $1.2 billion and $1.4 billion. The chart below shows that Hyperliquid has been the highest revenue-generating chain for the past two weeks, with a market share reaching a historic high of 36%.

The chart below shows that according to the price-to-sales ratio (P/S), HYPE is the cheapest asset among mainstream public chains, with a 12 times P/S that is 90% lower than similar assets. Even when calculated based on fully diluted valuation/sales (FDV/sales), HYPE is still the cheapest L1. While we often debate whether L1s should enjoy a premium or whether they should be valued based on revenue, the fact is that from this metric alone, HYPE's current price seems more attractive than all other L1s.

What would happen if the so-called "L1 premium" disappeared? What if the buying pressure from DATCOs (referring to unknown entities or institutions) weakened? Is HYPE undervalued, or are other L1 valuations incredibly high? We cannot be certain, but these are definitely questions worth pondering.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。