Why can RWA become a focus after stablecoins? Because blockchain can not only change the form of currency but also reshape the underlying architecture of traditional financial markets.

Written by: @100y_eth

Compiled by: Saoirse, Foresight News

Translator's Note: In the wave of Real-World Assets (RWA), U.S. government bonds are undoubtedly one of the most dazzling entities, with high activity in tokenization. This is driven by their high liquidity, stability, relatively high yields, expanding institutional participation, and ease of tokenization.

You might wonder if such tokenization involves complex legal mechanisms. In fact, it does not; its realization relies on transfer agents responsible for managing the official shareholder register, using blockchain to replace traditional internal databases.

To analyze the tokenization of major U.S. government bonds more clearly, this article constructs three analytical frameworks: an overview of tokens covering protocol introduction, issuance volume, etc.; regulatory framework and issuance structure; and on-chain application scenarios. It is worth noting that since U.S. government bond tokens are classified as digital securities, they must comply with securities laws and related regulations. This characteristic significantly impacts their issuance volume, number of holders, on-chain application scenarios, and other aspects, and there exists a dynamic relationship of interaction among these seemingly unrelated factors. Additionally, contrary to common perception, U.S. government bond tokens also have many limitations. Next, let us delve into the development and future of this field.

Tokenization of Everything

"Every stock, every bond, every fund, every asset can be tokenized." — Larry Fink, CEO of BlackRock

Since the passage of the U.S. "GENIUS Act," global attention on stablecoins has surged, and South Korea is no exception. But is stablecoin really the endpoint of blockchain finance?

Stablecoins, as the name suggests, are tokens pegged to fiat currencies on public blockchains. Essentially, they are still currency and must find application scenarios. As discussed in the "Hashed Open Research x 4Pillars Stablecoin Report," stablecoins can be used in various fields such as remittances, payments, and settlements. However, the area currently being hotly debated as the "ultimate release point of stablecoin potential" is Real-World Assets (RWA).

RWA (Real-World Assets) refers to tangible assets circulating on the blockchain in the form of digital tokens. In the blockchain industry, RWA typically refers to traditional financial assets such as commodities, stocks, bonds, and real estate.

Why can RWA become a focus after stablecoins? Because blockchain can not only change the form of currency but also reshape the underlying architecture of traditional financial markets.

Today's traditional financial markets still rely on extremely outdated infrastructure. Although fintech companies have optimized the front-end experience for retail users by enhancing the accessibility of financial products, the operational model of the trading back-end remains stuck in the practices of half a century ago.

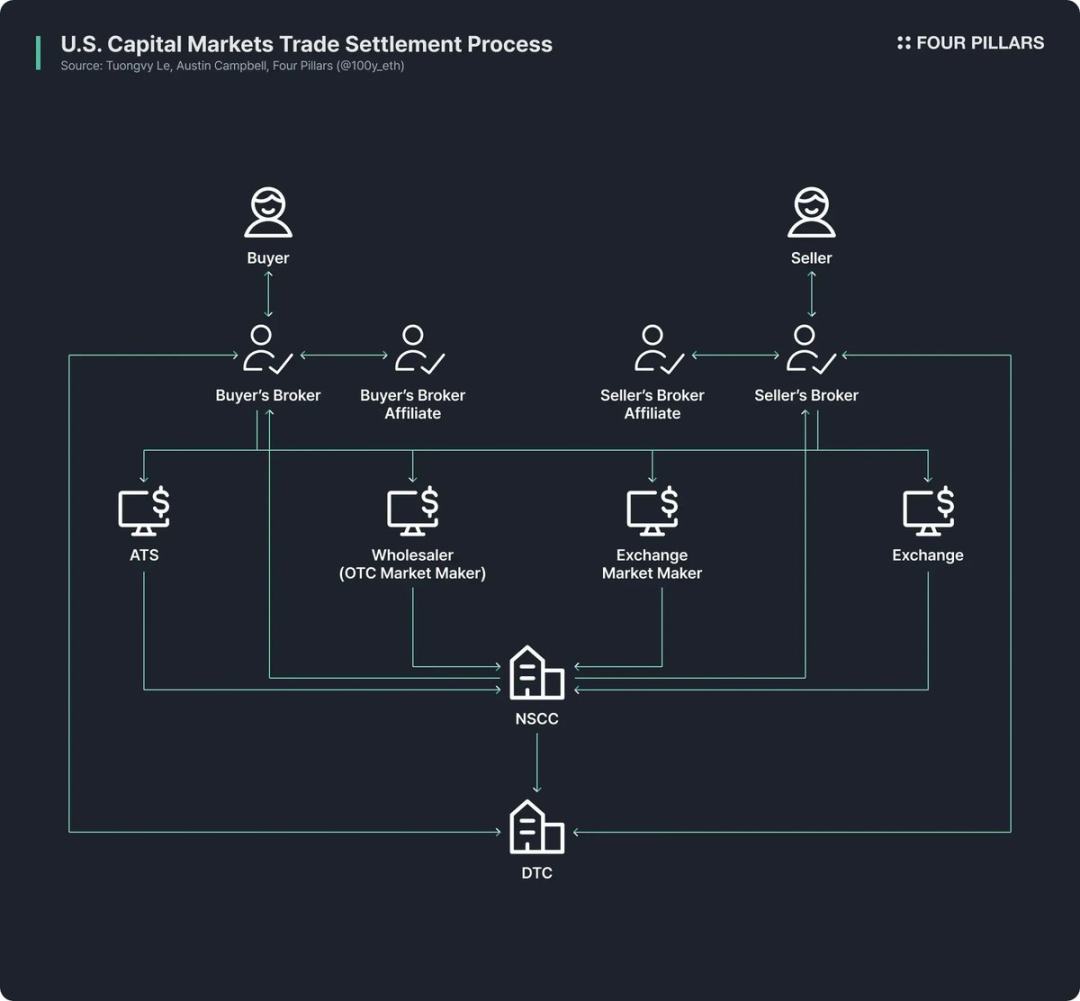

Taking the U.S. stock and bond trading market as an example, its current structure originates from the reforms of the 1970s following the "paperwork crisis" of the late 1960s: the Securities Investor Protection Act and amendments to securities laws were introduced, leading to the establishment of institutions such as the Depository Trust Company (DTC) and the National Securities Clearing Corporation (NSCC). This complex system has been in operation for over 50 years, consistently facing issues such as intermediary redundancy, settlement delays, lack of transparency, and high regulatory costs.

Blockchain is expected to fundamentally revolutionize this situation, creating a more efficient and transparent market system: by upgrading the financial market back-end through blockchain, it can achieve instant settlement, smart contract-driven programmable finance, direct ownership without intermediaries, higher transparency, lower costs, and fragmented investment.

For this reason, many public institutions, financial institutions, and enterprises are actively promoting the blockchain tokenization of financial assets. For example:

Robinhood plans to support stock trading through its own blockchain network and has submitted a proposal to the U.S. SEC calling for the establishment of a federal regulatory framework for RWA tokenization;

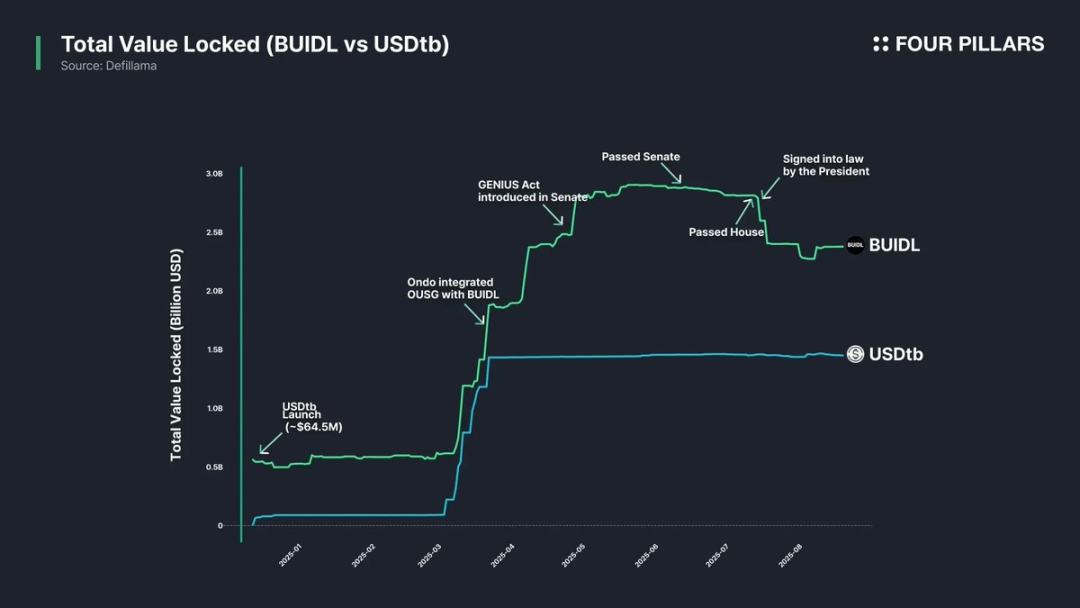

BlackRock has partnered with Securitize to issue a tokenized money market fund worth $2.4 billion, BUIDL;

SEC Chairman Paul Atkins has publicly supported stock tokens, and the SEC's internal cryptocurrency working group has formalized regular meetings and roundtable discussions related to RWA.

(Source: rwa.xyz)

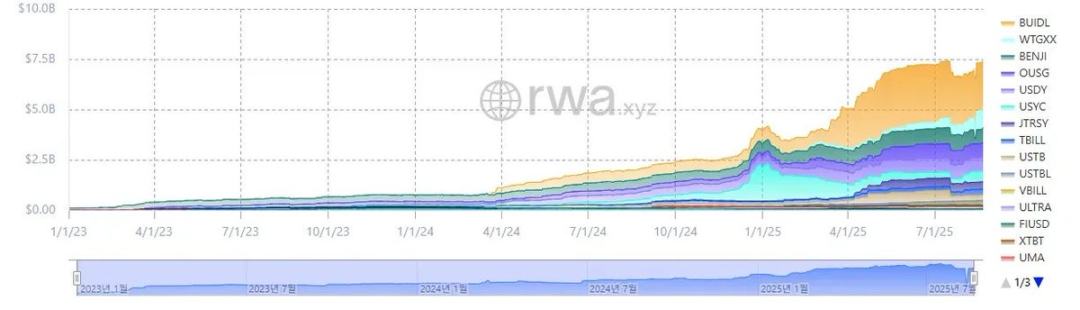

Setting aside the hype, the growth of the RWA market is indeed rapid. As of August 23, 2025, the total issued RWA has reached $26.5 billion, an increase of 112% compared to one year ago, 253% compared to two years ago, and 783% compared to three years ago. The types of tokenized financial assets are diverse, among which U.S. government bonds and private credit are growing the fastest, followed by commodities, institutional funds, and stocks.

U.S. Government Bonds

(Source: rwa.xyz)

In the RWA market, the tokenization of U.S. government bonds is the most active. As of August 23, 2025, the market size of U.S. bond RWA is approximately $7.4 billion, a 370% increase from last year, showing explosive growth.

It is noteworthy that both global traditional financial institutions and decentralized finance (DeFi) platforms are actively laying out in this field. For example, BlackRock's BUIDL fund leads with an asset size of $2.4 billion; DeFi protocols like Ondo have launched funds such as OUSG based on bond-backed RWA tokens like BUIDL and WTGXX, maintaining a scale of about $700 million.

Why can U.S. government bonds become the most active and largest area of tokenization in the RWA market? The reasons are as follows:

Liquidity and Stability: U.S. Treasuries have the deepest liquidity globally and are regarded as "safe assets" with no default risk, possessing strong credibility;

Increased Global Accessibility: Tokenization lowers the investment threshold, allowing overseas investors to participate in U.S. Treasury investments more conveniently;

Expanded Institutional Participation: Leading institutions such as BlackRock, Franklin Templeton, and WisdomTree are guiding the market by issuing tokenized money market funds and Treasury products, providing trust backing for investors;

Stable and Attractive Yields: U.S. Treasury yields are stable and relatively high, averaging around 4%;

Low Tokenization Difficulty: Although there is currently no specific regulatory framework for RWA, the basic tokenization operations for U.S. Treasuries are feasible within the existing regulatory framework.

Tokenization Process of U.S. Government Bonds

How exactly are U.S. Treasuries tokenized on-chain? It may seem to involve complex legal and regulatory mechanisms, but in fact, it is quite simple under the premise of complying with existing securities laws (the issuance structures of different tokens may vary, and only representative methods are introduced here).

It is important to clarify: The currently issued "RWA tokens based on U.S. Treasuries" do not directly tokenize the bonds themselves but rather tokenize funds or money market funds based on U.S. Treasuries.

In the traditional model, public asset management funds such as U.S. Treasury funds must designate a "transfer agent" registered with the SEC—these financial institutions or service companies are entrusted by the securities issuer to manage the ownership records of investors' funds. From a legal perspective, transfer agents are central to the management of securities records and ownership, bearing the official responsibility of maintaining the shares of fund investors.

The tokenization process of U.S. Treasury funds is very straightforward: tokens representing fund shares are issued on-chain, and the transfer agent conducts internal operations through the blockchain system to manage the official shareholder register. In simple terms, it is just migrating the database that maintains shareholder records from a private system to the blockchain.

Of course, since the U.S. has not yet established a clear regulatory framework for RWA, holding tokens currently does not guarantee 100% legally protected ownership of fund shares. However, in practice, transfer agents manage fund shares based on on-chain token ownership records, so in the absence of hacking or unforeseen events, token ownership typically can indirectly safeguard fund share rights.

Main Protocols and RWA Analysis Framework

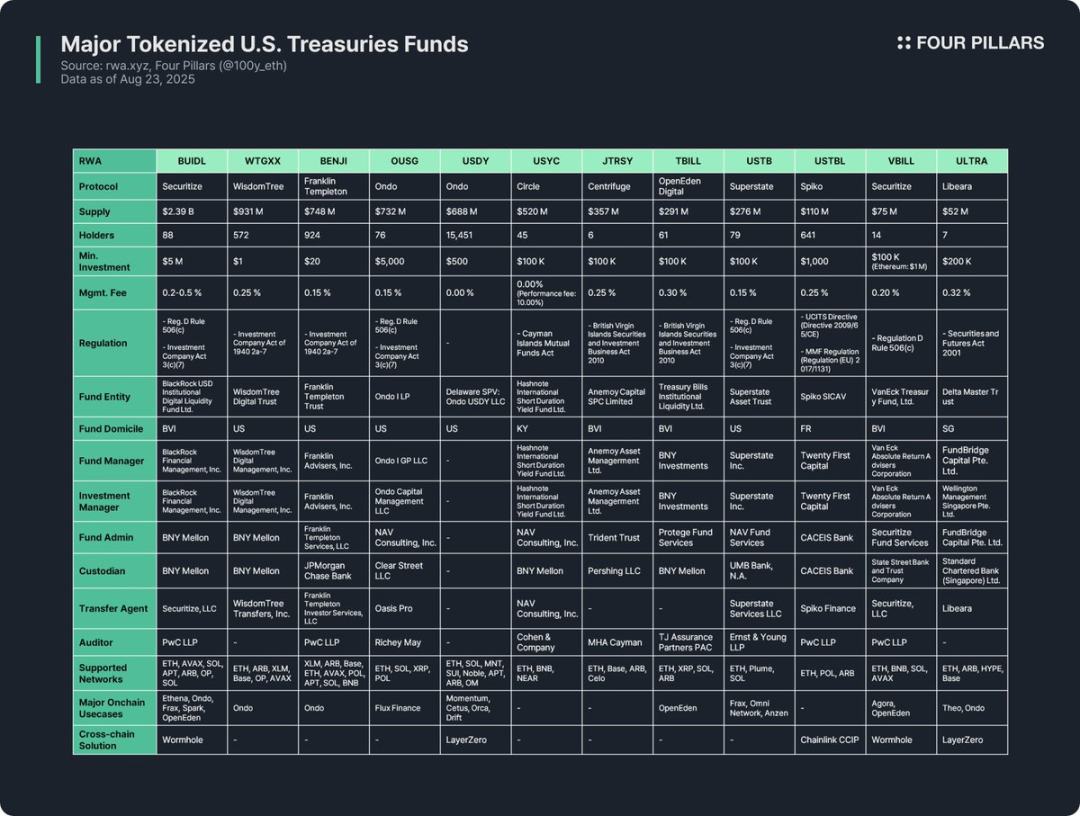

The tokenization of U.S. Treasury funds is the most active area in the RWA industry, so many protocols have issued related RWA tokens. This article analyzes 12 major tokens from three dimensions:

(1) Token Overview

Including the introduction of the issuing protocol, issuance volume, number of holders, minimum investment amount, and management fees. Due to differences in fund structures, tokenization methods, and on-chain usability among various protocols, analyzing the issuing protocols can quickly grasp the core characteristics of the tokens.

Issuance Volume: Reflects the scale of the fund and market acceptance;

Number of Holders: Suggests the legal structure of the fund and on-chain application scenarios. If the number of holders is small, it may be due to securities laws requiring investors to be high-net-worth accredited investors or qualified purchasers; such tokens are usually limited to whitelist wallets for holding, transferring, or trading, making it difficult to be widely used in DeFi protocols.

(2) Regulatory Framework and Issuance Structure

Clarifying the national regulatory rules that the fund follows and sorting out the various entities involved in fund management.

After analyzing the 12 types of RWA tokens based on U.S. Treasury funds, their regulatory frameworks can be categorized by the fund's registration location and fundraising scope as follows:

- Regulation D Rule 506(c) + Investment Company Act Section 3(c)(7)

The most widely used framework. Regulation D Rule 506(c) allows public fundraising from an unspecified number of investors but requires all investors to be "accredited investors," and issuers must strictly verify identities through tax records, asset proofs, and other documents; Investment Company Act Section 3(c)(7) exempts private funds from SEC registration requirements but requires all investors to be "qualified purchasers" and the fund to maintain a private structure. The combination of the two can expand the investor base while avoiding regulatory burdens such as registration and disclosure, applicable to eligible U.S. and foreign funds. Representatives include BUIDL, OUSG, USTB, VBILL, etc.

- Investment Company Act of 1940, Rule 2a-7

This framework for SEC-registered money market funds requires funds to maintain stable value, invest only in short-term high-credit instruments, and ensure high liquidity. Unlike the aforementioned framework, it allows public offerings to ordinary investors, resulting in lower minimum investment amounts and more accessible thresholds. Representatives include WTGXX and BENJI.

- Cayman Islands Mutual Funds Law

Applicable to open-ended mutual funds registered in the Cayman Islands (with flexible issuance and redemption), it requires a minimum initial investment of no less than $100,000. A representative is USYC.

- British Virgin Islands Securities and Investment Business Act of 2010 (Professional Funds)

This is the core law governing investment funds registered in the British Virgin Islands, with "professional funds" targeting professional investors (non-public) and a minimum initial investment of $100,000. It should be noted that if fundraising from U.S. investors, additional compliance with Regulation D Rule 506(c) is required. Representatives include JTRSY and TBILL.

- Others

Local rules apply depending on the fund's registration location. For example, the USTBL issued by France's Spiko follows the EU's Directive on Transferable Securities and the Money Market Fund Regulation; ULTRA issued by Singapore's Libeara follows the Securities and Futures Act of 2001.

The fund issuance structure involves seven core participants:

Fund Entity: The legal entity that pools investor funds, often using offshore structures such as U.S. trusts, British Virgin Islands, or Cayman Islands;

Fund Manager: The entity that establishes the fund and is responsible for overall operations;

Investment Manager: The entity that makes actual investment decisions and manages the portfolio, which may be the same as the fund manager or exist independently;

Fund Administrator: Responsible for accounting, net asset value calculation, investor reporting, and other back-office operations;

Custodian: Safely holds the fund's assets such as bonds and cash;

Transfer Agent: Manages the shareholder register, legally records and maintains ownership of the fund or shares;

Auditor: An independent accounting firm responsible for the external audit of the fund's accounts and financial statements, which is key to investor protection.

(3) On-Chain Application Scenarios

One of the greatest values of bond fund tokenization is its potential applications in the on-chain ecosystem. Although regulatory compliance and whitelist restrictions make it difficult for bond fund tokens to be directly used in DeFi, some protocols have explored indirect applications: for example, DeFi protocols like Ethena and Ondo issue stablecoins using BUIDL as collateral or include it in investment portfolios, providing retail users with indirect participation channels. In fact, BUIDL has rapidly expanded its issuance volume by integrating with mainstream DeFi protocols, becoming the largest bond-related token.

Cross-chain solutions are also crucial for enhancing on-chain usability. Most bond fund tokens are issued not only on a single network but also across multiple chains to increase investor choices—although their liquidity does not need to reach stablecoin levels, cross-chain functionality can enhance user experience and enable seamless transfer of tokens across multiple networks.

Insights

After studying 12 major U.S. Treasury fund RWA tokens, I found the following insights and limitations:

Limited On-Chain Usability: RWA tokens cannot be freely used just because they are tokenized; their essence remains digital securities that must comply with real-world regulatory frameworks. All bond fund tokens are limited to holding, transferring, or trading among whitelist wallets that have completed KYC, creating a barrier that makes direct application in permissionless DeFi difficult.

Low Number of Holders: Due to regulatory threshold limitations, the number of holders of bond fund tokens is generally low. Money market funds like WTGXX and BENJI, which target retail investors, have relatively more holders, but most funds require investors to be accredited investors, qualified purchasers, or professional investors, leading to a limited pool of eligible participants and making it difficult for the number of holders to even reach double digits.

Primarily B2B Applications On-Chain: For the reasons mentioned above, bond fund tokens currently have no direct DeFi applications targeting retail users and are more often adopted by large DeFi protocols. For example, Omni Network uses Superstate's USTB for treasury management, and Ethena issues USDtb stablecoins using BUIDL as collateral, allowing retail users to benefit indirectly.

Decentralized Regulation and Lack of Standards: The issuers of bond fund tokens are registered in different countries, following various regulatory frameworks. For instance, although BUIDL, BENJI, TBILL, and USTBL are all bond fund tokens, they belong to different regulatory systems, leading to significant differences in investor qualifications, minimum investment amounts, and application scenarios. This decentralization increases the difficulty for investors to understand, and the lack of unified standards makes it challenging for DeFi protocols to integrate universally, limiting on-chain usability.

Lack of a Dedicated RWA Regulatory Framework: There are currently no clear rules for RWA. Although transfer agents have recorded shareholder registers on the blockchain, on-chain token ownership has not yet been legally recognized as equivalent to ownership of real-world securities. Specific regulations need to be established to connect on-chain ownership with real legal ownership.

Insufficient Application of Cross-Chain Solutions: Although almost all bond fund tokens support multi-chain issuance, very few practical cross-chain solutions have been implemented. Further promotion of cross-chain technology is needed to avoid liquidity fragmentation and enhance user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。