The program, KindlyMD (Nasdaq: NAKA) detailed in a filing with the U.S. Securities and Exchange Commission (SEC), allows the company to issue and sell shares from time to time through various sales agents. The company stated it intends to use the net proceeds for general corporate purposes, which include working capital, funding acquisitions, capital expenditures, and, of course, pursuing its bitcoin (BTC) treasury strategy.

“This initiative is the natural next phase of our growth plan,” David Bailey, chief executive officer and chairman of KindlyMD remarked on Tuesday. He noted the program will be a flexible tool to strengthen the company’s balance sheet and seize market opportunities following its recent merger with Nakamoto Holdings Inc. and an initial purchase of 5,744 bitcoin valued at $643 million at press time.

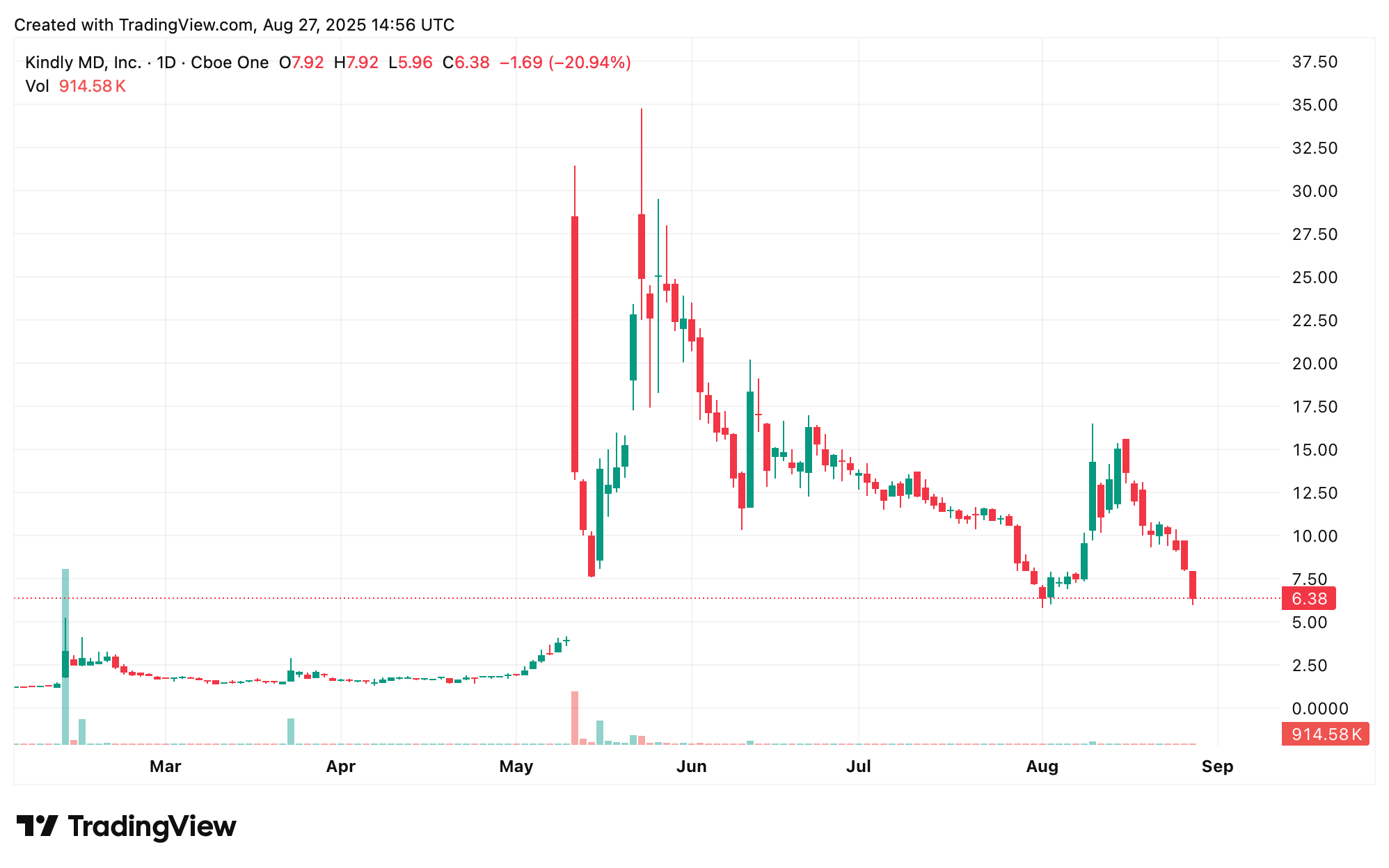

Nasdaq: NAKA on Aug. 27, 2025.

Sales of the stock will be made at prevailing market prices directly on the Nasdaq exchange or through other existing trading markets. The timing and amount of sales will be determined by the company based on a variety of factors, meaning sale prices may vary.

The offering is being made pursuant to a prospectus supplement filed as part of an effective shelf registration statement. The sales agents for the offering include TD Securities, Cantor Fitzgerald, B. Riley Securities, Benchmark, and several other well known firms.

As of Wednesday, Aug. 27, Nakamoto Holdings secures the 16th position out of the top 20 bitcoin treasury companies measured by BTC held. NAKA has not had the best success on the Nasdaq, and shares are down 43% in the last month and 39% over the last five trading sessions. Still, six-month stats show a 250% gain since Feb. 27.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。