Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $440 Million

Last week, the U.S. Bitcoin spot ETF saw a net inflow for four consecutive days, totaling $440 million, with a total net asset value reaching $13.995 billion.

Last week, 9 ETFs were in a net inflow state, with inflows mainly from IBIT, ARKB, and BITB, which saw inflows of $247 million, $78.6 million, and $46.2 million, respectively.

Data Source: Farside Investors

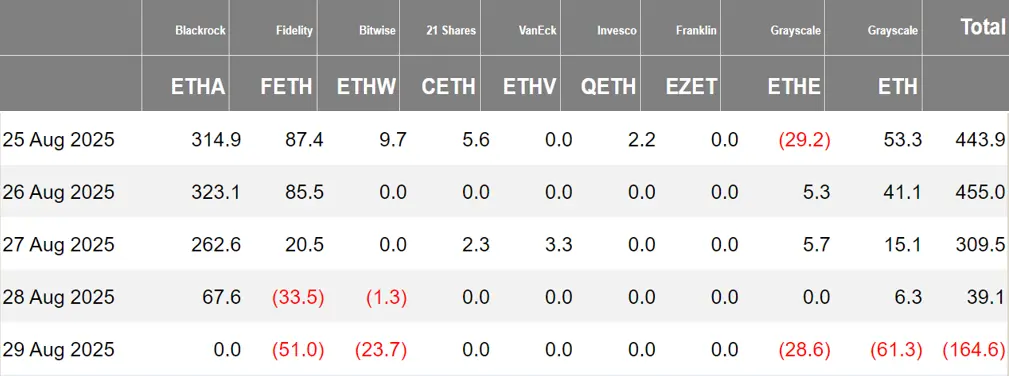

U.S. Ethereum Spot ETF Net Inflow of $1.082 Billion

Last week, the U.S. Ethereum spot ETF experienced a net inflow for four consecutive days, totaling $1.082 billion, with a total net asset value reaching $2.858 billion.

The inflow last week mainly came from BlackRock's ETHA, with a net inflow of $968 million. Six Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 55.08 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 55.08 Bitcoins, with a net asset value of $48 million. The holdings of the issuer, Harvest Bitcoin, decreased to 292.66 Bitcoins, while Huaxia increased to 2390 Bitcoins.

The Hong Kong Ethereum spot ETF saw a net inflow of 1395.69 Ethereum, with a net asset value of $12.9 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of August 28, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.13 billion, with a nominal total long-short ratio of 3.61.

As of August 27, the nominal total open interest of U.S. Bitcoin spot ETF options reached $24.9 billion, with a nominal total open interest long-short ratio of 1.88.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 40.86%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

REX Shares Solana Staking ETF Surpasses $200 Million AUM for the First Time

According to SolanaFloor, the first Solana staking ETF (SSK) launched by REX Shares has continued to attract capital inflows, with an additional inflow of $11 million, bringing its total assets under management (AUM) to over $200 million for the first time.

21Shares Submits Application to SEC for SEI Spot ETF

According to official news, 21Shares has submitted an S-1 registration statement for the SEI ETF to the U.S. Securities and Exchange Commission (SEC), indicating in the prospectus a desire to explore staking for SEI.

Rex is Applying to Launch an ETF Supporting BNB Staking

According to Bloomberg senior ETF analyst Eric Balchunas, Rex is applying for a BNB staking ETF under the Investment Company Act of 1940, similar to the "REX-Osprey SOL Spot ETF (SSK)."

21Shares Renames Its Spot Ethereum ETF Product to 21Shares Ethereum ETF (TETH)

According to Globenewswire, 21Shares US announced that it will rename its spot Ethereum exchange-traded fund product from 21Shares Ethereum Core ETF (CETH) to "21Shares Ethereum ETF (TETH)," effective August 28, 2025, without affecting investment objectives, primary investment strategies, or any other operational aspects. Customer holdings will not be affected by the name change.

Market News: Canary Capital Submits Application for Canary American-Made Crypto ETF to SEC

According to market news, digital asset management company Canary Capital has submitted an application for the Canary American-Made Crypto ETF to the SEC, intending to list on the Cboe BZX exchange under the ticker MRCA.

This fund will only invest in crypto assets invented, mined, or dominated in the U.S., classified as a high-risk speculative product, and is currently awaiting approval.

Canary has also applied for the Canary Trump Coin ETF and the Canary Staked Injective ETF.

Grayscale Submits S-1 Filings for Polkadot and Cardano ETFs to SEC

SEC Delays Decision on Grayscale's Spot Ethereum ETF Adding Staking Feature

Canary Has Submitted S-1 Application for TRUMP ETF to SEC

SEC Delays Decision on Canary Spot PENGU ETF and Grayscale Spot Cardano ETF Applications

Market News: SEC Confirms Receipt of Canary Staked INJ ETF Application

Grayscale Has Submitted S-1 Application for Avalanche ETF to SEC

Views and Analysis on Crypto ETFs

Bitwise Chief Investment Officer Matt Hougan stated on social media, "The formula is simple: ETF capital flows + fund companies + simple stories = historical highs. It applies to Bitcoin, it applies to Ethereum, it applies to Solana."

CryptoQuant: U.S. ETFs Have Become the Main Source of Bitcoin Spot Trading Volume

CryptoQuant's research director Julio Moreno stated that U.S. ETFs have become the main source of Bitcoin spot trading volume. Currently, U.S. spot Bitcoin ETFs typically see daily trading volumes of $5 billion to $10 billion on active days, sometimes exceeding most cryptocurrency exchanges, reflecting the growing institutional demand. However, Binance remains the primary trading venue for BTC and ETH.

Binance continues to lead in spot trading volume, with BTC trading volume peaking at $18 billion and ETH trading volume reaching $8.8 billion to $11.1 billion, surpassing ETFs and all other exchanges. On key trading days like August 13 and August 22, Binance's ETH trading volume was 54% and 96% higher than ETF ETH trading volume, respectively. Ethereum trading is concentrated on cryptocurrency exchanges. Since the 2024 U.S. presidential election, ETH spot trading has primarily concentrated on Binance (35%), followed by Crypto.com (20%), with ETFs ranking sixth (4%), indicating limited participation of ETFs in ETH spot trading. This suggests that institutional investors are adopting Ethereum at a slower pace compared to Bitcoin.

Bloomberg Analyst: There Are Currently 92 Cryptocurrency ETF Applications Filed in the U.S.

Bloomberg ETF analyst James Seyffart stated on the X platform that there are currently 92 records of all cryptocurrency ETP products filed and/or applied for in the U.S.

According to Zhitong Finance, Chan Haolian, Deputy Secretary for Financial Services and the Treasury of the Hong Kong Special Administrative Region, stated that in terms of the variety of tokenized products, three years ago, the Hong Kong SAR government was actively issuing green bonds every year. In the future, it plans to regularize the issuance of such bonds and will also explore the application of tokenization in various fields, including renewable energy.

In addition, the Hong Kong SAR government will take measures to explore tokenization methods for ETFs that are already listed on the Hong Kong Stock Exchange, further attracting investor participation.

KPMG Executive: Japan's Bitcoin ETF May Launch in Spring 2027

According to CryptoNews, KPMG Japan executive Kenji Hoki stated at the Tokyo WebX2025 summit that Japan's Bitcoin ETF may launch in the spring of 2027.

Hoki mentioned that Japanese policymakers might propose lifting the domestic Bitcoin ETF ban in the next tax reform, which is typically submitted at the beginning of each year. This means that the request for a Bitcoin ETF could be made in early 2026, and if approved, the National Diet may legislate it in March or April 2026, with the relevant law taking effect in the spring of 2027.

However, Hoki also noted that if the issue is resolved through a government ordinance amendment rather than a legal amendment, the ban on Bitcoin ETFs could potentially be lifted as early as next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。