Original: that1618guy, Delphi Digital Market Researcher

Translated by: Yuliya, PANews

The market generally expects the Federal Reserve to make its first rate cut of this cycle in September. Historically, Bitcoin tends to rise before the implementation of easing policies but falls back after the rate cut is realized. However, this pattern does not always hold true. This article will review the situations in 2019, 2020, and 2024 to predict the potential trends that may emerge in September 2025.

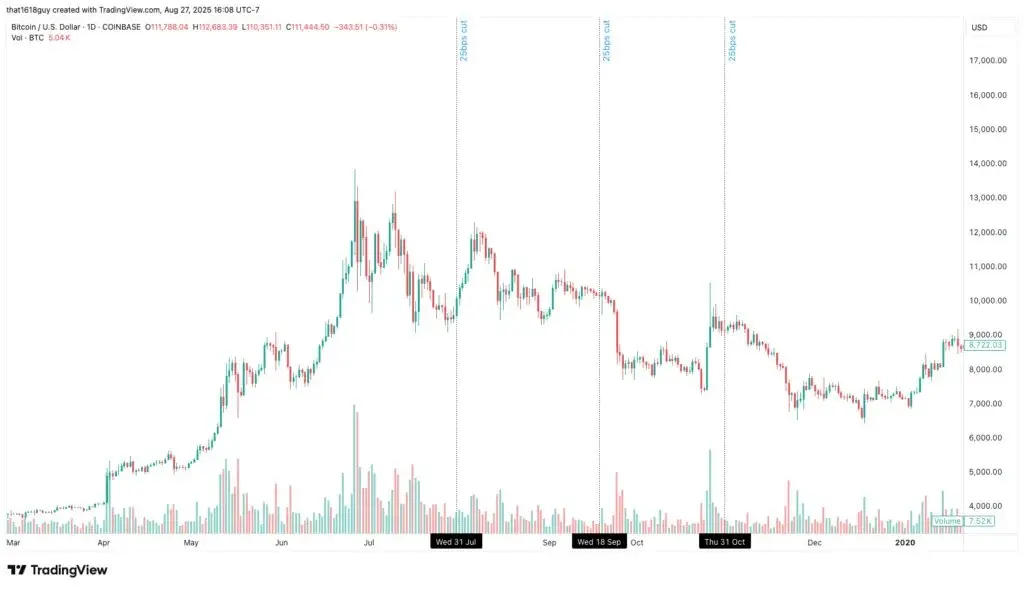

2019: Rise as Expected, Fall After Realization

In 2019, Bitcoin rebounded from $3,000 at the end of 2018 to $13,000 in June. The Federal Reserve announced rate cuts on July 31, September 18, and October 30.

Each rate cut decision marked the nearing exhaustion of Bitcoin's upward momentum. BTC surged significantly before the meetings but faced sell-offs afterward as the reality of sluggish economic growth re-emerged. This indicates that the positive effects of the rate cuts had been priced in by the market in advance, while the reality of slowing economic growth dominated subsequent trends.

2020: An Exception Amid Emergency Rate Cuts

The situation in March 2020 was not a typical cycle. At that time, in response to the panic caused by the COVID-19 pandemic, the Federal Reserve drastically cut interest rates to zero.

During this liquidity crisis, BTC plummeted alongside stocks but then rebounded strongly due to massive fiscal and monetary policy support. Therefore, this was a crisis-driven exception and cannot be used as a template for predicting trends in 2025.

2024: Narrative Overwhelms Liquidity

The trend in 2024 changed. BTC did not fall back after the rate cuts; instead, it continued its upward momentum.

The reasons include:

- Trump's campaign turned cryptocurrency into an election issue.

- Spot ETFs were attracting record inflows of capital.

- MicroStrategy's demand for purchases at the balance sheet level remained strong.

In this context, the importance of liquidity decreased. Structural buying and favorable political factors overwhelmed the traditional economic cycle influences.

September 2025: Conditional Market Initiation

The current market backdrop is different from the uncontrolled surges seen in past cycles. Since late August, Bitcoin has been in a consolidation phase, ETF inflows have significantly slowed, and the once-continuous buying from corporate balance sheets has also begun to weaken.

This makes the rate cut in September a conditional trigger point for the market rather than a direct catalyst.

- If Bitcoin surges significantly before the meeting, the risk of history repeating itself increases—i.e., traders "selling the news" after the easing policy is implemented, leading to a "rise then fall" scenario.

- However, if the price remains stable or slightly declines before this decision, most excess positions may have been cleared, allowing the rate cut to stabilize the market rather than become the endpoint of upward momentum.

Core Viewpoints

The current Bitcoin trend may be influenced by the Federal Reserve's September meeting and related liquidity changes. Overall, Bitcoin may experience a wave of upward movement before the FOMC meeting, but the extent of the rise may struggle to break new highs.

- If the price surges significantly before the meeting, a "sell the news" type of pullback is likely;

- But if the price consolidates or declines from early September to the meeting, it may lead to an unexpected rise due to the rate adjustment.

However, even if a rebound occurs, the market should remain cautious. The next upward movement may form a lower high (around the $118,000 to $120,000 range).

Assuming this lower high occurs, it could create conditions for the latter half of Q4, when liquidity is expected to stabilize, demand may rebound, pushing Bitcoin towards new highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。