Author: Ponyo

Translation: Saoirse, Foresight News

Key Points

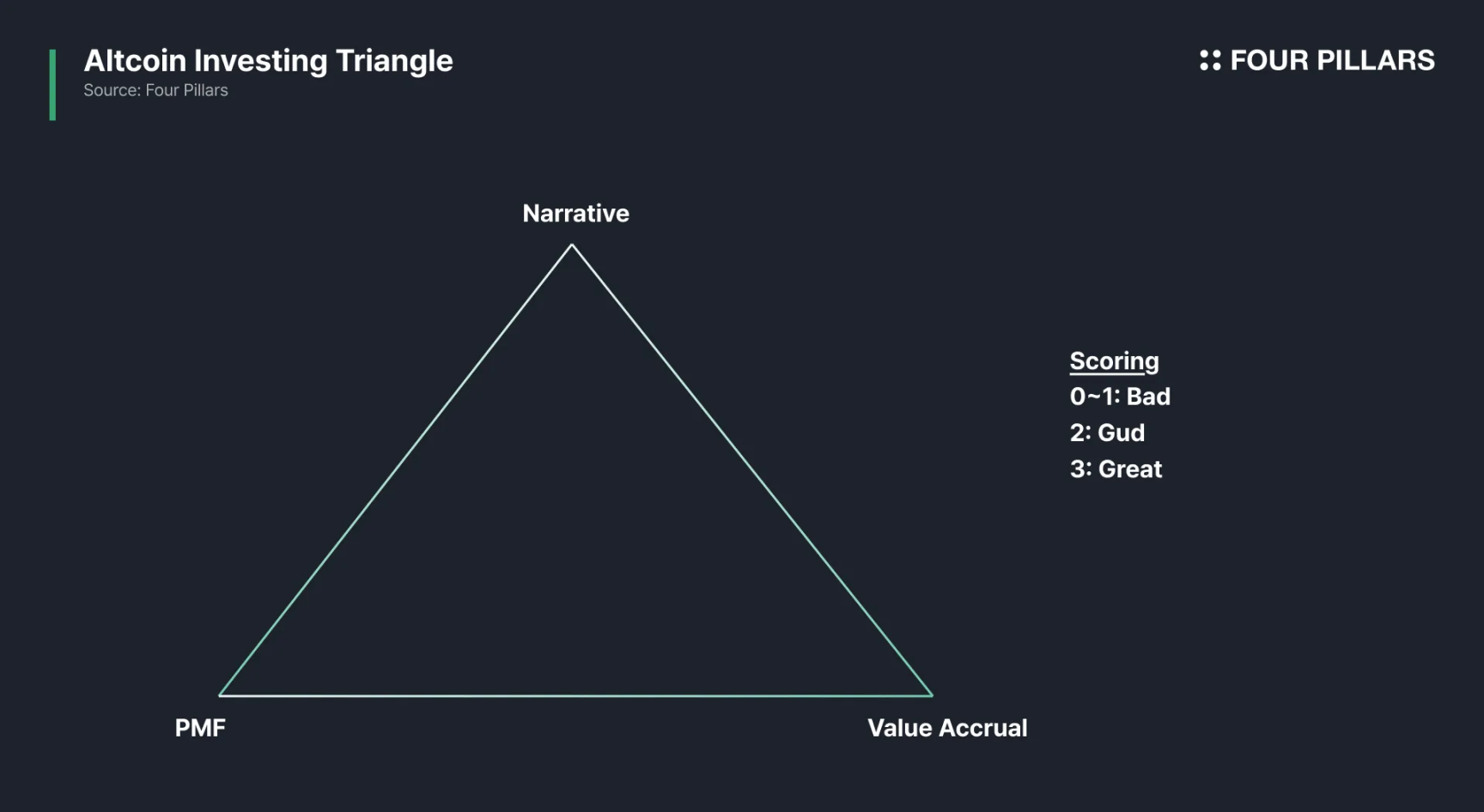

- The success of a token depends on three main factors: narrative, product-market fit (PMF), and value capture.

- Most tokens stop at the "two-thirds" stage: narratives are easy to build, product-market fit is challenging but not a binary outcome; however, value capture is more complex — the interplay between stakeholders, legal compliance requirements, and considerations at the listing level can make the design and timing of value capture mechanisms tricky.

- Only a few tokens (like HYPE) can satisfy all three factors simultaneously. Many protocols that perform strongly in other areas still encounter bottlenecks in value capture, which can limit the token's upside even if the fundamentals are solid; in some cases, there may even be a phenomenon where the fundamentals are weak but the token performs contrary to expectations.

- The investment triangle model is easy to understand but difficult to implement in practice. Metrics can be manipulated, protocol documents often obscure key details, and token economic mechanisms may change unexpectedly during project development; market narratives iterate rapidly, and tokens that are either completely underperforming or fully meeting the three factors may have drastically different future trajectories.

In the early days of cryptocurrency, a token's price could soar based solely on narrative, but that era has long passed. Today, a token's success depends on three dimensions: 1) a strong narrative; 2) product-market fit; 3) a robust token value capture mechanism.

Projects that excel in all three dimensions can be considered "excellent," those that meet two can be deemed "good," while those that meet only one or none are classified as "poor."

This is my core framework for evaluating tokens.

Analysis of the Three Dimensions

1. Narrative

This refers to the "story" that market participants agree upon. Without a narrative, a project struggles to gain attention.

2. Product-Market Fit (PMF)

The core is real users, real fee income, and real demand. While the metrics for different products may vary, the key lies in "paying users" — revenue and user retention are paramount. It is important to note that metrics like total locked value (TVL), wallet numbers, transaction counts, and original trading volume can be easily manipulated, so multiple data dimensions must be cross-verified. For example, in a decentralized perpetual contract exchange, both trading volume and open interest should be monitored: if open interest is low while trading volume is high, it usually indicates the presence of wash trading.

3. Token Value Accumulation

If a token cannot actually capture the value of the protocol, it is worthless. Common value accumulation mechanisms include fee sharing, token buybacks, buyback and burn, and mandatory usage scenarios. Personally, I believe buybacks are the optimal choice (for reasons detailed in "Revenue Sharing is Dead, Long Live Buyback and Burns"). However, value accumulation is closely tied to protocol revenue: even with a well-designed accumulation mechanism, if the protocol itself has weak revenue, the token cannot validate its value.

These principles may seem obvious, and most people believe they have already mastered them, yet they still fall into the trap of "narrative + user adoption rate = token price increase."

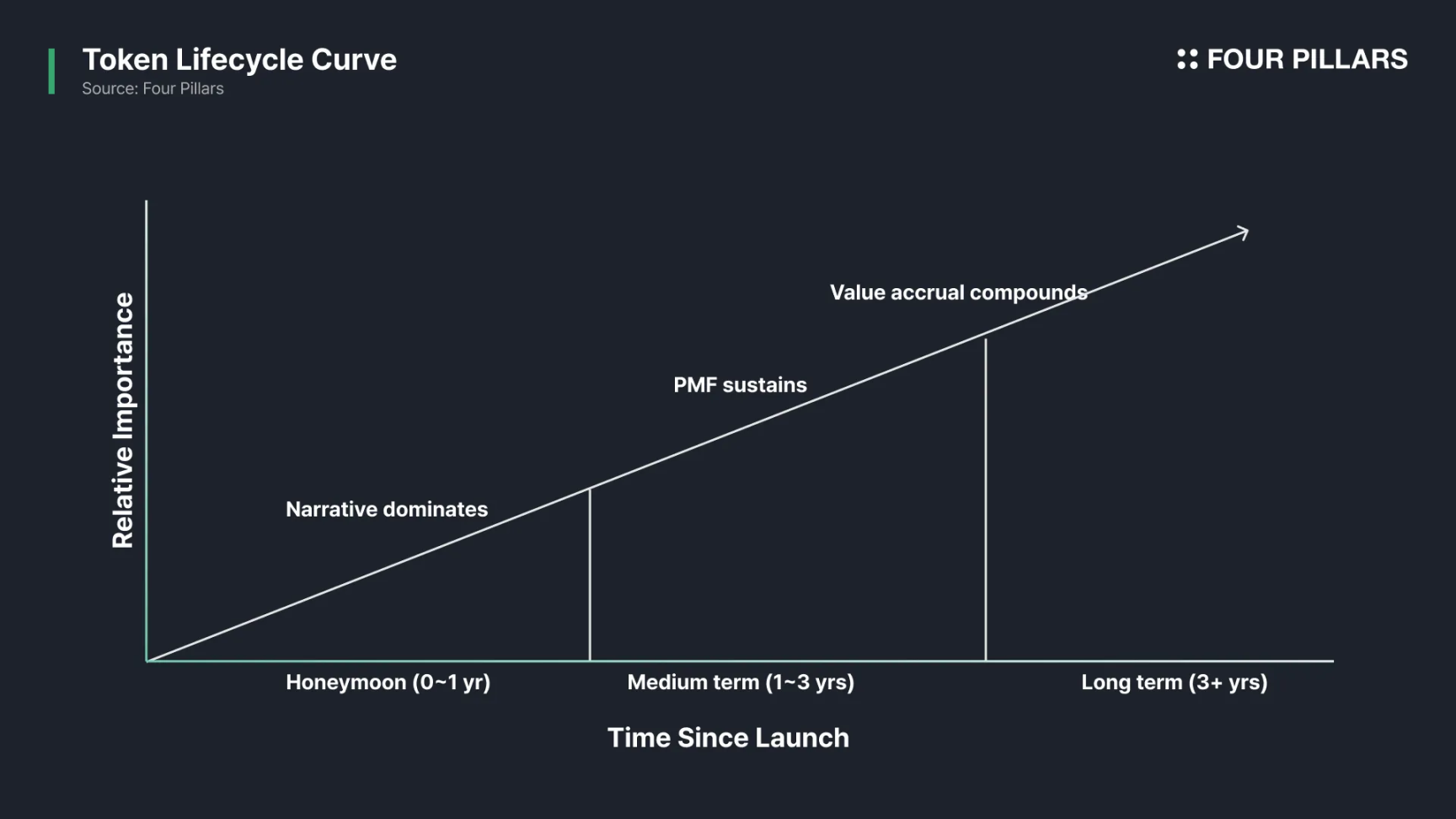

Lifecycle Characteristics

The investment triangle is not a static model; the influence of the three dimensions varies at different stages of a token's lifecycle:

- Narrative (short-term): In the early stages of a project launch, the team must rely on narrative to attract liquidity, attention, and user base.

- Product-Market Fit (mid to long-term): While narrative can buy time and funding for the project, it cannot ensure user retention — only products that truly meet market demand can achieve long-term development.

- Value Capture (mid to long-term): If the token is unrelated to the protocol's cash flow, even if the number of product users continues to grow, internal personnel may still sell off tokens, leading to losses for holders.

Why is "Excellence in All Three" So Difficult?

Most tokens can satisfy at most two of the three dimensions. Among them, building a narrative is relatively simple; achieving product-market fit is challenging but has clear standards — either it addresses a market pain point or it does not. Value capture is the easiest aspect to underestimate, as it quickly evolves into a "game" among all stakeholders:

- Project founders: seek capital reserves and liquidity;

- Users: want lower fees, more incentives;

- Token holders: only care about the token price increase;

- Market makers: need more capital support for market making;

- Exchanges: pursue low risk and a good compliance image;

- Lawyers: want to reduce legal disputes.

These demands often contradict each other. When the team attempts to balance the interests of all parties, the token ultimately becomes "mediocre" — this is not due to a lack of team capability, but rather an inevitable result of the incentive mechanisms at play.

Case Studies

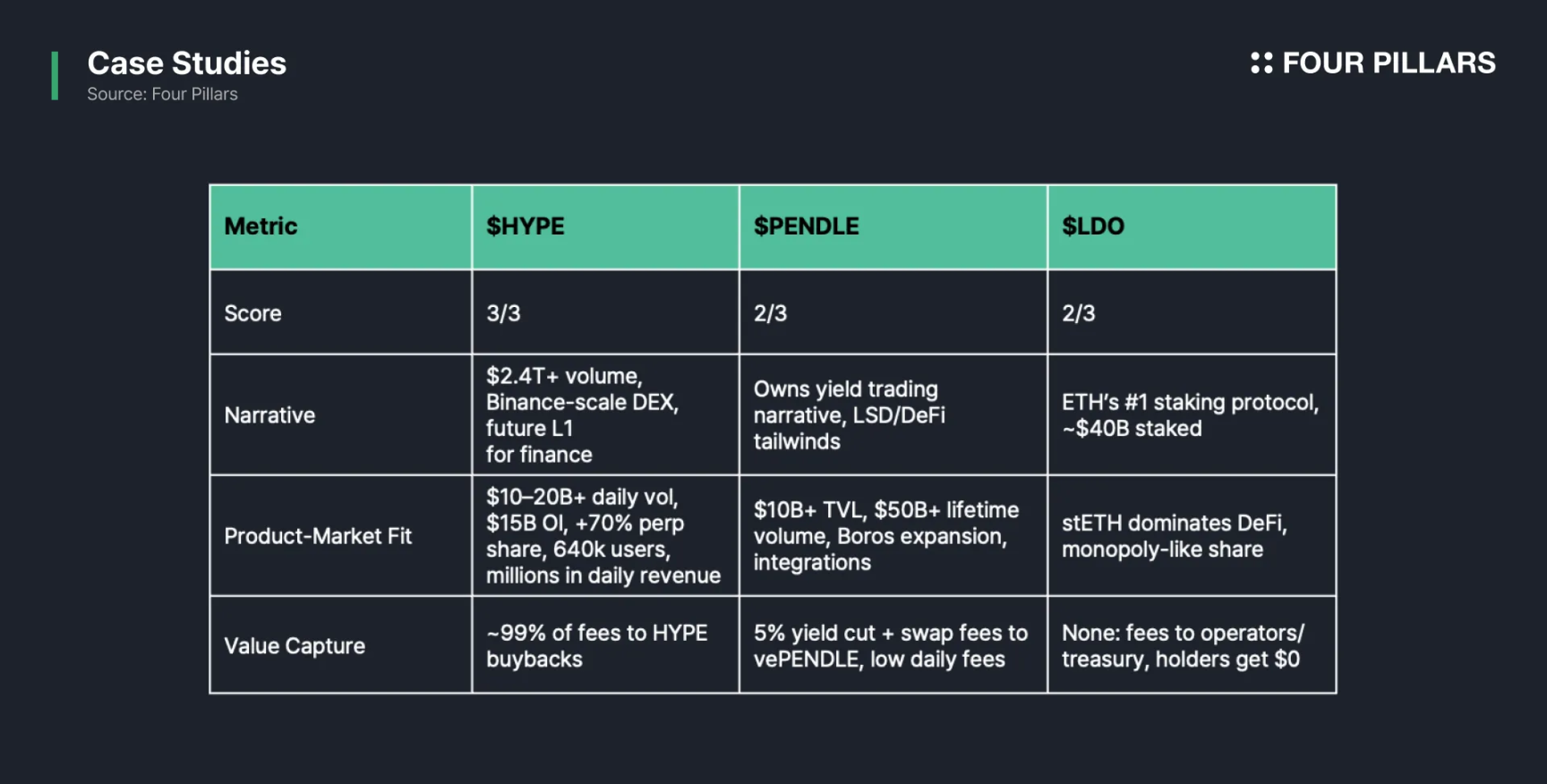

HYPE: Excellence in All Three

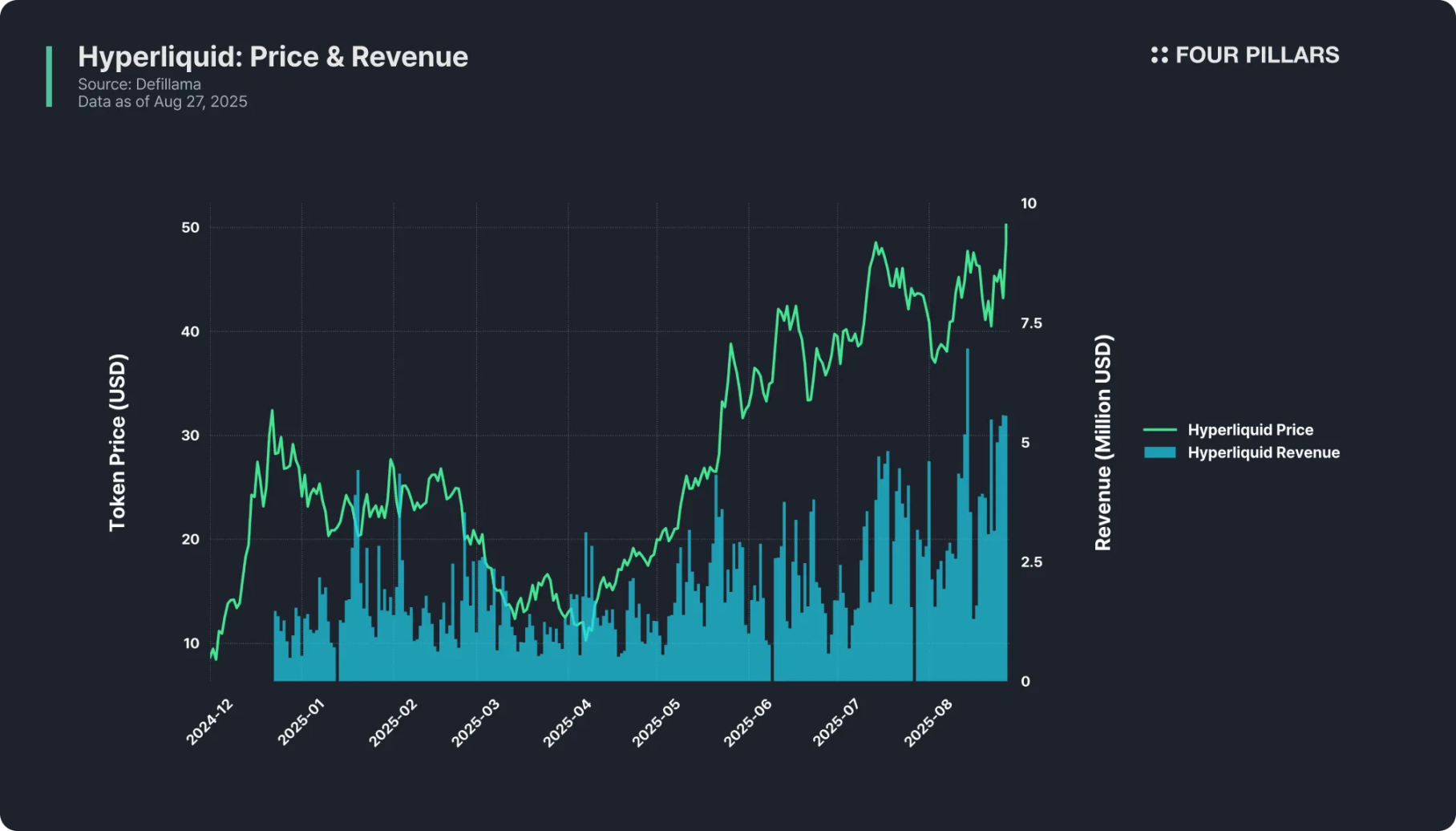

- Narrative: As a unique "Binance-level" decentralized exchange, its cumulative trading volume has surpassed $2.4 trillion, positioning itself as a "Layer 1 (underlying blockchain) capable of supporting all types of financial services in the future."

- Product-Market Fit: Daily clearing volume of $10-20 billion, open interest of about $15 billion, holding over 60% market share in the decentralized perpetual contract market, with over 640,000 users and daily revenue reaching millions of dollars.

- Value Capture: 99% of fees (1% goes to the HLP fund) are used to buy back HYPE, with every transaction's revenue flowing back into the token value system.

Hyperliquid (HYPE) is a model of "trinity," perfectly covering all three dimensions.

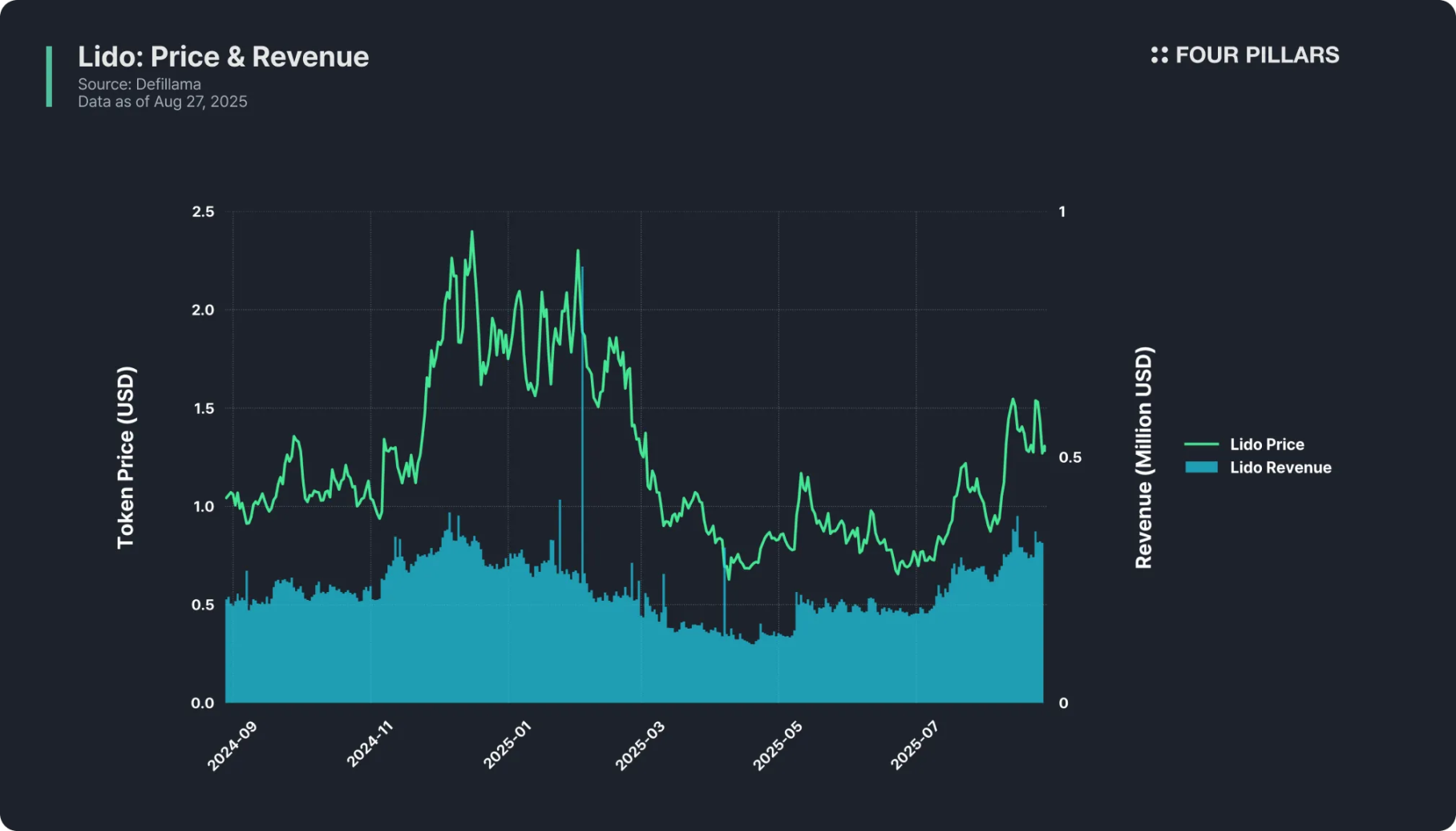

LDO: Two Factors Met

- Narrative: As the largest staking protocol on Ethereum, with a staking scale of about $40 billion, it is synonymous with "liquid staking." Ethereum staking is one of the strongest narratives in the current crypto space, and Lido is a core participant in this narrative.

- Product-Market Fit: Significant advantages — stETH (the liquid staking token issued by Lido) has penetrated the entire DeFi ecosystem, Lido holds nearly monopolistic market share, and the product experience is mature with high user trust.

- Value Capture: Completely lacking. While Lido charges a 10% fee on staking rewards, all of it goes to node operators and the protocol treasury, leaving LDO holders with no earnings — the token only has governance functions. For example, Lido generated over $100 million in revenue last year, but LDO holders received nothing.

Although Lido is a leading protocol in the industry, its token has become a "bystander," a typical case of "two factors met."

PENDLE: Two Factors Met

- Narrative: Occupying a core position in the "yield trading" sector — users can split yield-bearing assets into PT (principal token) and YT (yield token) and trade yield rights on the Pendle platform. As a pioneer and leading project in the sector, Pendle deeply benefits from the market boom of "DeFi + liquid staking."

- Product-Market Fit: Total locked value exceeds $10 billion, cumulative trading volume exceeds $50 billion, supports multi-chain deployment, and its Boros product has opened up new markets, gaining recognition from yield traders and liquidity providers.

- Value Capture: There are shortcomings. Pendle charges a 5% share on yields and allocates part of the trading fees to vePENDLE stakers, but the nature of yield trading results in low user activity — most users only "set strategies and hold long-term," leading to daily fees of only tens of thousands of dollars, which is highly mismatched with the large locked value and market cap.

Pendle relies on narrative and product fit for support, but its revenue shortfall limits its value capture ability. Additionally, its product has a high barrier to entry for ordinary users — the logic of yield trading is complex, making it difficult for non-crypto veterans to understand, which also limits its growth ceiling in the short term.

0-1 Factor Met: 99% of Tokens

The vast majority of tokens fall into this category: either they have only a narrative with no actual users, or they have launched a product but lack a value capture mechanism, or they are merely governance tokens that no one pays attention to. Aside from a few projects like XRP and Cardano that have broken market rules through "community belief," almost all altcoins follow the "greater fool theory" — price increases rely solely on "greater fools" rather than real value support.

VI. Future Outlook

The investment triangle model is easy to understand but difficult to implement. Metrics can be manipulated, protocol documents often hide key details, and token economic mechanisms may change unexpectedly; market narratives iterate rapidly, and tokens that are either completely underperforming or fully meeting the three factors may have their future trajectories completely reversed.

Moreover, the difficulty of investing in altcoins lies in the "huge case differences": the performance of most tokens is hard to surpass BTC, ETH, or SOL. However, once a truly "excellent in all three" rare token is found, the returns can be life-changing — a successful investment can help investors escape the loss trap and even completely alter their wealth trajectory. This is the allure of crypto investment and the reason why, despite the challenges, people continue to participate. Good luck.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。