How Important is the Right Corporate Structure?

Written by: Crypto Miao

“Choosing the right corporate structure is crucial for Web3 companies going global. It not only optimizes tax burdens but also reduces risks and enhances global operational flexibility.

Whether leveraging a single entity structure to enjoy low tax rates or establishing a multi-entity structure based on business needs, a well-designed framework can significantly enhance a company's international competitiveness, helping it thrive in the Web3 ecosystem.”

Web3 companies face unique legal, tax, and operational challenges in international expansion due to their decentralized nature.

Choosing the appropriate corporate structure can help companies operate in compliance, optimize tax burdens, reduce risks, and enhance market flexibility to adapt to different regional legal frameworks, technological infrastructures, and market demands.

I. What is an Offshore Structure

An offshore structure refers to the organizational structure and management model that companies build during the globalization process, aimed at coordinating global resources, adapting to the characteristics of different markets, and achieving efficient multinational operations.

The design of an offshore structure directly impacts a company's global competitiveness and operational efficiency. It is essential to consider not only the equity structure but also future structural adjustments, tax costs, intellectual property management, financing activities, and overall maintenance costs.

II. Types of Offshore Structures

Tax optimization is a significant consideration in the choice of corporate structure for Web3 companies, as the global tax framework increasingly affects digital assets. When establishing a holding company for international expansion, Hong Kong, Singapore, and the BVI are popular choices.

(1) Single Entity Structure

1. Hong Kong

Hong Kong implements a low tax rate system, primarily including profits tax, salaries tax, and property tax, with no value-added tax or business tax. The corporate income tax rate is 8.25% for profits not exceeding HKD 2 million, and 16.5% for profits exceeding HKD 2 million. Dividends from overseas companies with a shareholding ratio of over 5% are exempt from tax.

Hong Kong has signed double taxation avoidance agreements (DTA) with approximately 45 countries and regions worldwide, covering key markets such as mainland China, ASEAN, and Europe. This extensive network of agreements creates significant tax planning opportunities for companies, particularly in reducing withholding tax on cross-border dividends and interest.

2. Singapore

Singapore's corporate income tax rate is 17%, slightly higher than Hong Kong. However, Singapore's tax system is relatively friendly to technology and research companies, allowing them to enjoy various tax exemptions and deduction policies. Additionally, Singapore exempts overseas dividends and capital gains from tax (subject to relevant conditions).

Moreover, Singapore offers a range of tax incentive policies, such as Regional Headquarters (RHQ) and Global Trader Programme (GTP), providing companies with more tax planning possibilities.

Singapore has signed DTAs with over 90 countries internationally, covering major global economies, including China, India, and the EU. This network provides companies with extensive operational space for tax planning, especially beneficial in reducing withholding tax on cross-border dividends and interest.

3. BVI (British Virgin Islands)

The BVI, with its zero tax regime, strong privacy, and flexible structure, has become the preferred offshore jurisdiction for global cross-border investment, asset protection, and tax optimization, particularly suitable for holding companies and the crypto industry.

The BVI does not impose corporate income tax, capital gains tax, dividend tax, or inheritance tax, resulting in very low tax burdens.

BVI companies do not publicly disclose shareholder and director information and can further conceal actual controllers through Nominee services, ensuring business privacy and asset security.

As an internationally recognized offshore entity, BVI companies are widely accepted in major financial centers (such as Hong Kong, Singapore, London, etc.), facilitating the opening of accounts in multinational banks and efficiently conducting international payments, trade settlements, and capital operations.

Main Tax Rate Comparison:

(2) Multi-Entity Structure

Using a multi-entity structure allows for more effective tax planning. Domestic companies can establish one or more intermediate holding companies in low-tax countries or regions (usually Hong Kong, Singapore, BVI, or Cayman) to invest in target countries. By leveraging the low tax rates and confidentiality of offshore companies, overall tax burdens can be reduced while protecting company information, diversifying parent company risks, and facilitating future equity restructuring, sales, or financing.

Case 1 Intermediate Layer Control: China → Singapore → Southeast Asian Subsidiary (e.g., Vietnam)

The Chinese parent company invests in Vietnam through a Singapore holding company. Singapore has signed bilateral tax agreements (DTA) with both China and Vietnam, allowing the withholding tax rate on corporate dividends to be reduced to a minimum of 5%, which can lower the tax rate by 50% compared to direct control of the Vietnamese subsidiary (the China-Vietnam DTA agreement is 10%).

The Singapore company, as an intermediate layer, typically does not incur capital gains tax when transferring shares of the Singapore company; however, directly transferring shares of the Vietnamese subsidiary may face Vietnam's capital gains tax (20%). The Singapore structure aligns better with the transaction habits of European and American investors, enhancing asset sale liquidity.

Additionally, the Singapore company can serve as a regional headquarters, managing multiple subsidiaries in different countries, facilitating the introduction of international investors or spin-off listings. The developed financial market in Singapore allows holding companies to issue bonds or obtain international bank loans, reducing financing costs.

Case 2 VIE Agreement Control: BVI → Hong Kong → Operating Company

Due to strict regulations in some regions regarding the Web3 industry and high operational risks, a "VIE" agreement control framework (Variable Interest Entities) can be employed, where a BVI company holds a Hong Kong company that reinvests in the operating company (e.g., Alibaba, Tencent Music, New Oriental, etc.). The offshore holding company achieves control over the operating company through a layered structure using the VIE agreement.

The BVI company, as the top holding entity, is exempt from capital gains tax on future equity transfers, protecting the privacy of the founders.

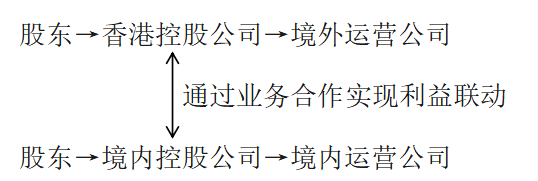

Case 3 Parallel Structure of Domestic and Foreign Companies:

A parallel structure of domestic and foreign companies can be applicable due to market and regulatory uncertainties, or due to financing, geopolitical, qualification, licensing, data security, and other reasons, where different domestic and foreign companies need to collaborate on different business functions. For example: Mankun Research | Web3 Entrepreneurship, Can the "Front Store and Back Factory" Model of Hong Kong + Shenzhen Comply? (hyperlink https://mp.weixin.qq.com/s/PEdL5ArnCXOnqHov3HT4vA)

Overall lower tax rates. Foreign companies can choose to register in tax-advantaged regions (such as Hong Kong, Singapore, Cayman Islands, etc.), which typically have lower corporate income tax rates or exemptions from capital gains tax compared to domestic rates. By reasonably distributing profits through business cooperation, they can enjoy tax deductions in various locations, reducing overall tax burdens.

Independent operations of domestic and foreign entities. Under a parallel structure, domestic and foreign companies operate as independent legal entities, each subject to the tax jurisdiction of their respective locations. This means that the two companies can pay taxes according to the tax laws of their locations, avoiding global income consolidation tax issues due to equity relationships.

III. Conclusion

Choosing the right corporate structure is crucial for Web3 companies going global. It not only optimizes tax burdens but also reduces risks and enhances global operational flexibility. Whether leveraging a single entity structure to enjoy low tax rates or establishing a multi-entity structure based on business needs, a well-designed framework can significantly enhance a company's international competitiveness, helping it thrive in the Web3 ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。