Key Points

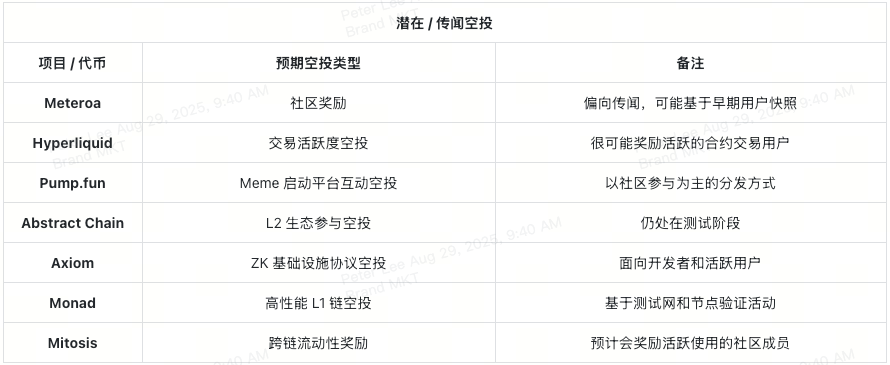

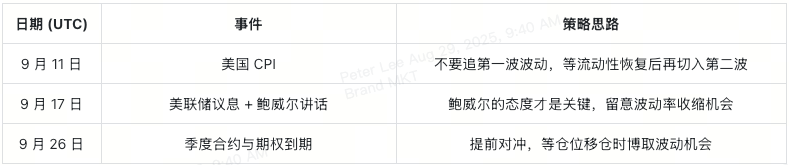

- – Macro Events Set the Tone for the Cryptocurrency Calendar in September 2025: Non-farm employment (September 5), US CPI (September 11), and the Federal Reserve's interest rate decision (September 17) are the core anchors determining market expectations. Powell's speech and interest rate cut expectations directly impact the US dollar, stock market, and crypto assets.

- – Geopolitical and Policy Risks Cannot Be Ignored: The US government shutdown deadline, tariff disputes, and energy shocks could disrupt market rhythms at any time, becoming hidden disturbance factors in September.

- – Exclusive Catalysts for the Crypto Market Are Coming: Bitcoin ETFs continue to attract capital inflows, expectations for Ethereum ETF approvals are heating up, WLFI completed a token issuance of over $2.2 billion on September 1, along with over $1 billion in token unlocks, making the September 2025 cryptocurrency calendar full of volatility highlights.

- – Multiple Scenario Paths: The baseline scenario leans towards a soft landing (BTC around $130,000, ETH over $5,000), but if interest rate cuts accelerate or WLFI ignites liquidity, a bull market may emerge; if inflation rebounds or policies falter, risk assets could face comprehensive pressure.

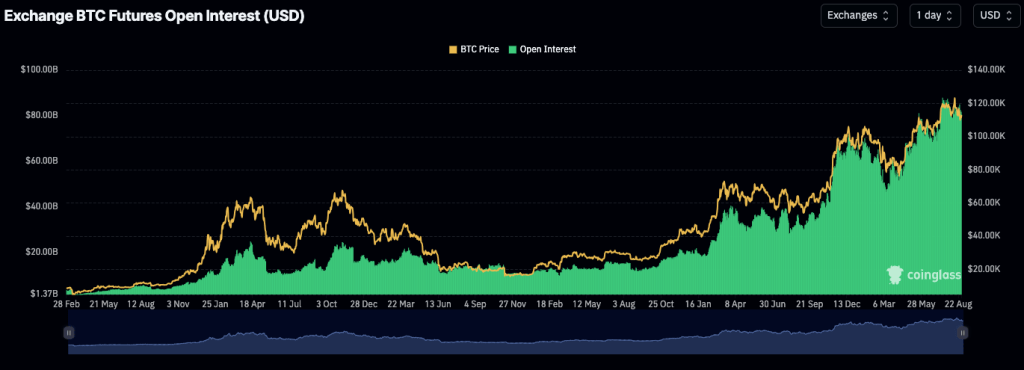

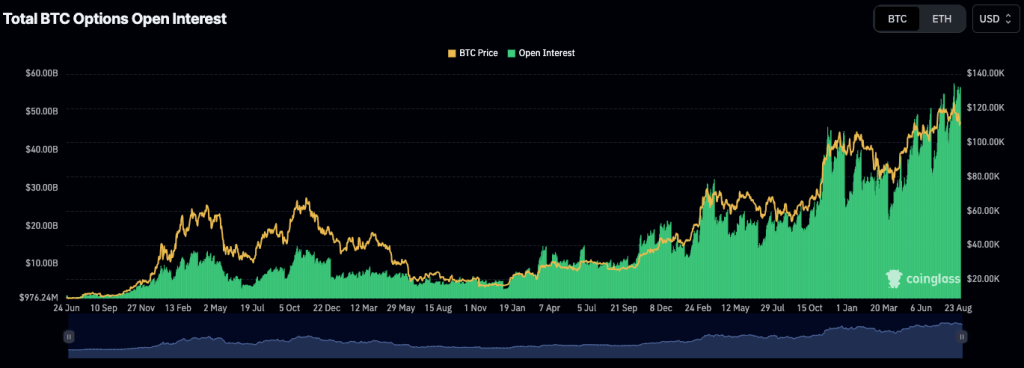

- – Optimistic Yet Fragile Capital and Positioning: ETF inflows, increased open interest in contracts, concentrated call options, and record stablecoin supply all provide tactical opportunities for the cryptocurrency market in September 2025, but changes in market expectations for interest rate cuts and WLFI demand could also trigger reversals.

All fluctuations in September revolve around Powell.

The Federal Reserve will make its interest rate decision on September 17, which will be the most critical moment of the month. There is significant market divergence: will it be the first rate cut, or will high rates be maintained to combat inflation? If the tone is dovish, it could ignite a comprehensive rebound; if hawkish, risk assets may face pressure.

The prelude is equally important:

- – Non-farm employment data on September 5

- – CPI data on September 11

These two pieces of data can reset market expectations in real-time, affecting the stock market, bond market, and even directly driving Bitcoin fluctuations.

Besides macro factors, the cryptocurrency market is also experiencing undercurrents in September:

- 1. Bitcoin** ETF**: Record capital inflows steadily boost market liquidity.

- 2. Ethereum ETF Expectations: Market rumors suggest that regulators may approve a new round of ETH ETFs, potentially involving staking and custody mechanisms.

- 3. WLFI Token Issuance: Officially launched on September 1, issued on the Ethereum chain, raising over $2.2 billion, making it one of the most anticipated TGEs of the year.

- 4. Token Unlocking Wave: Projects like Arbitrum, SUI, and Jupiter will release over $1 billion in tokens in September, which may bring selling pressure in the short term.

September is also marked by political and policy uncertainties:

- – Risk of US Government Shutdown: Funding deadline on September 30

- – Tariff Negotiations: US-EU and US-China tariff disputes may reignite

- – Energy and Conflict: The Russia-Ukraine situation, Middle East risks, and hurricane season energy shocks

Overall, September will become a convergence point for central banks, cryptocurrencies, and geopolitical risks. Expectations for interest rate cuts, ETF capital flows, unlocking waves, and political storms intertwine, and this month may determine the market direction from the second half of 2025 to early 2026.

Table of Contents

Global Macro Trends: How the Federal Reserve's Rate Cuts, CPI, and Employment Data Set the Tone

Geopolitical and Policy Risks: Shutdowns, Tariffs, and Energy Shocks

Crypto Catalysts: Bitcoin ETF, Ethereum ETF, WLFI, and Unlocking Waves

Market Path Simulation for September 2025: Baseline, Optimistic, and Pessimistic Scenarios

Positioning and Capital: September Trading Manual

Global Macro Trends: How the Federal Reserve's Rate Cuts, CPI, and Employment Data Set the Tone

Before discussing the driving factors of the cryptocurrency market or geopolitical risks, we must first look at the macro calendar. The market direction in September is primarily determined by employment, inflation, and central bank policies.

All this data will ultimately converge on the Federal Reserve's interest rate decision on September 17, and this meeting will set the tone for global assets. Every piece of data released in early September is part of Powell's "script," determining whether the Federal Reserve shifts to easing or remains on hold.

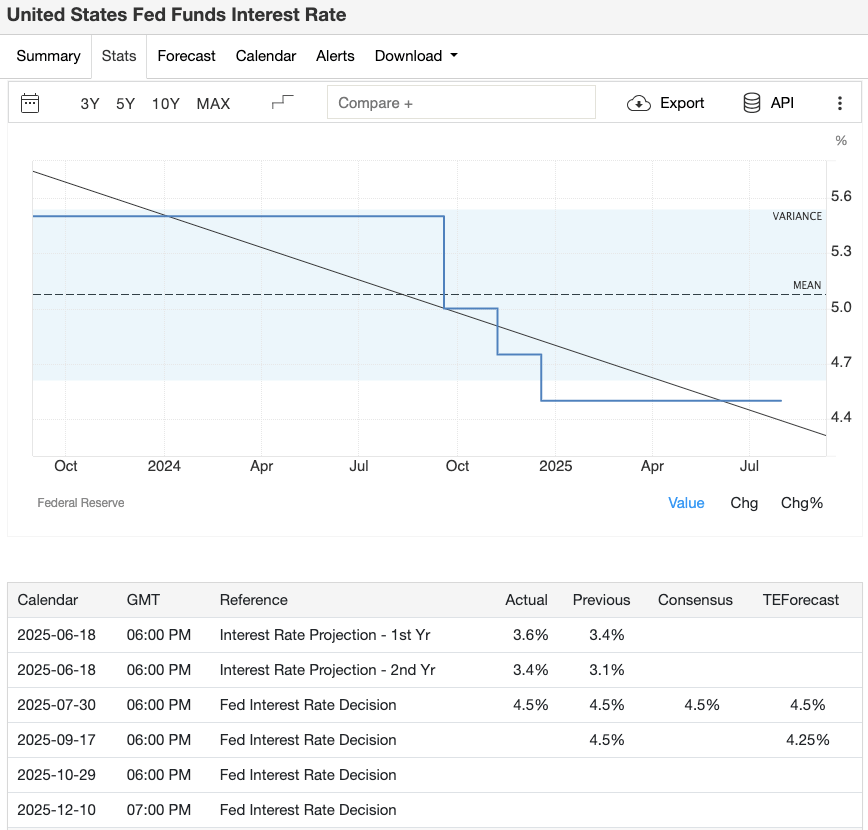

Federal Reserve's September Decision: Rate Cut or Continued Tightening?

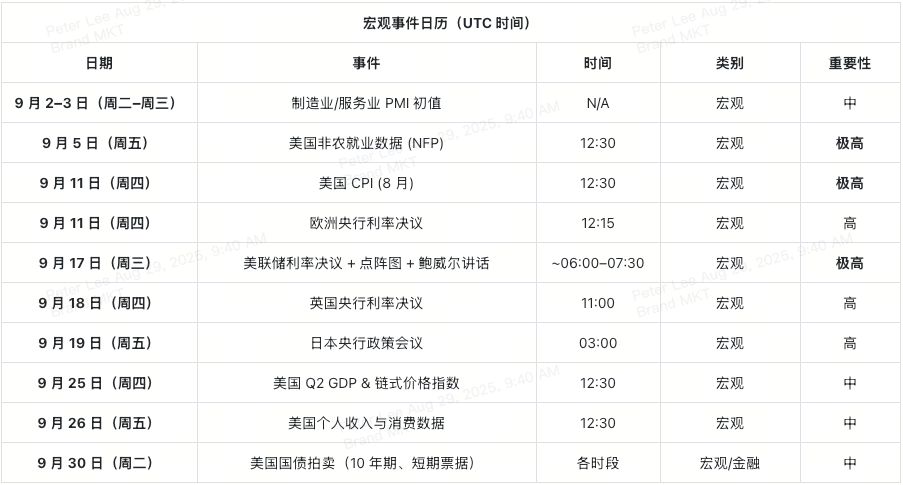

The FOMC meeting on September 16-17 may bring about the first rate cut in years. The market currently expects an 85-90% probability of a 25 basis point cut, as Powell has already emphasized the risks in the job market at the Jackson Hole meeting. A Reuters economist survey also shows that most believe there will be at least one more rate cut before the end of the year.

Traders may glance at the dot plot, but the real determinant of market sentiment will be Powell's press conference:

- – If the tone is dovish, the dollar is likely to weaken, US Treasury yields will decline, and Bitcoin and Ethereum are expected to continue rising.

- – If the tone is hawkish, even with a rate cut, if inflation pressures are still emphasized, the dollar will strengthen, and the gains in the stock and crypto markets may be limited.

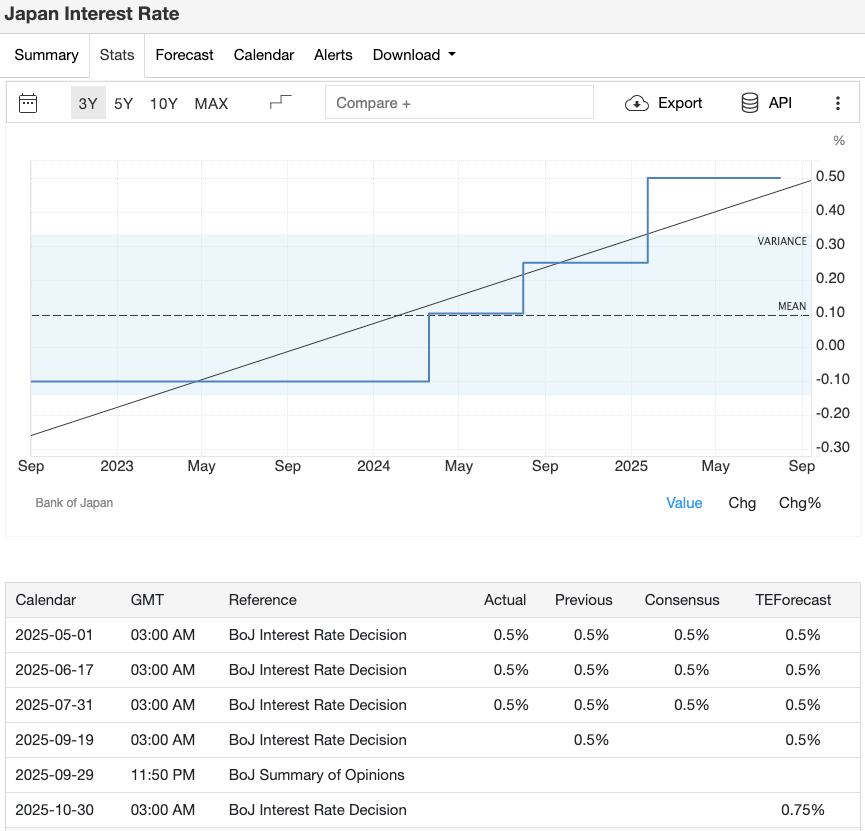

Image Credit:Trading Economics – Fed Interest Rate Decision

CPI and Non-Farm: Leading Indicators of Market Sentiment

Before the Federal Reserve meeting, two key data points will first test the market:

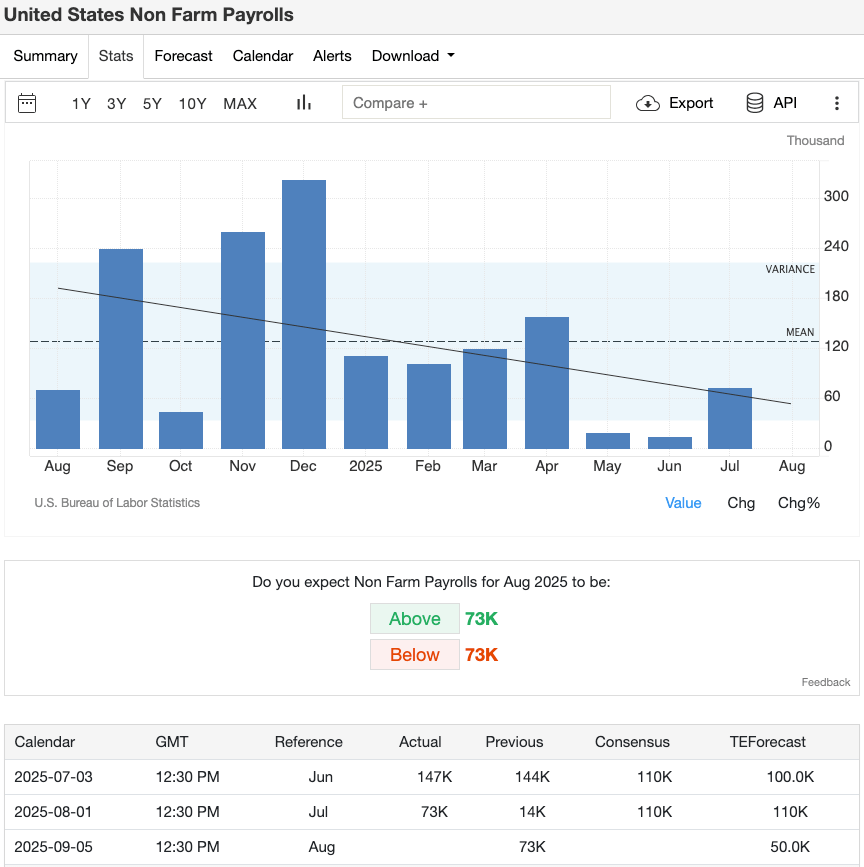

- – Non-farm Employment (September 5): Weak employment data will reinforce rate cut expectations, but if employment is strong, market judgments may diverge.

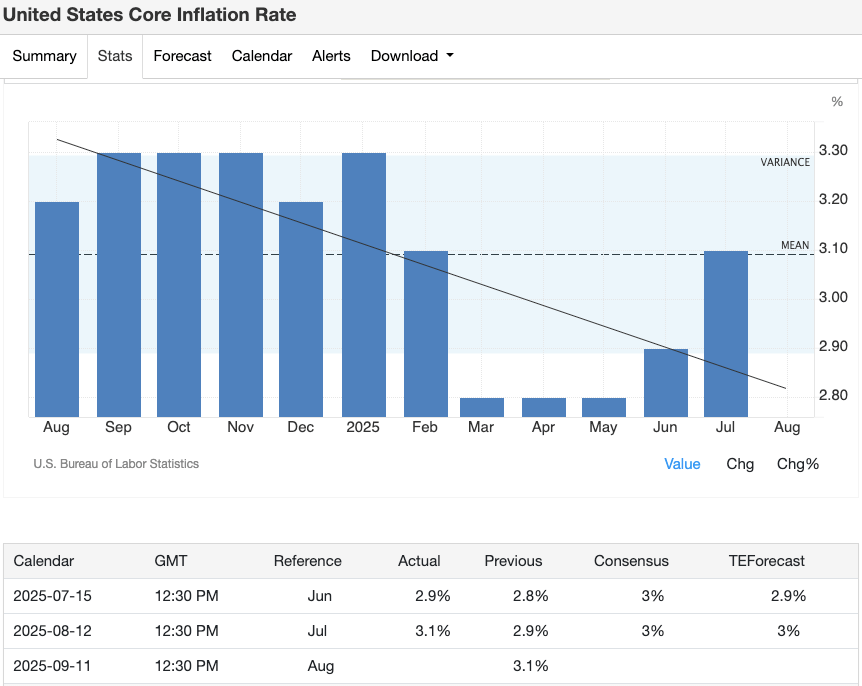

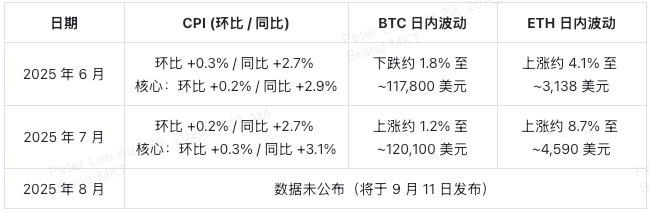

- – CPI (September 11): Although core inflation is declining, base effects may lead to unexpected rebounds. Historically, on CPI release days, BTC often experiences 2-5% intraday fluctuations, and ETH may react even more significantly.

Traders need to pay attention not only to the headline data but also to revisions, medians, and market "whisper expectations."

Image Credit:Trading Economics – US Non-Farm Payroll

Image Credit:Trading Economics – US Core Inflation Rate YoY

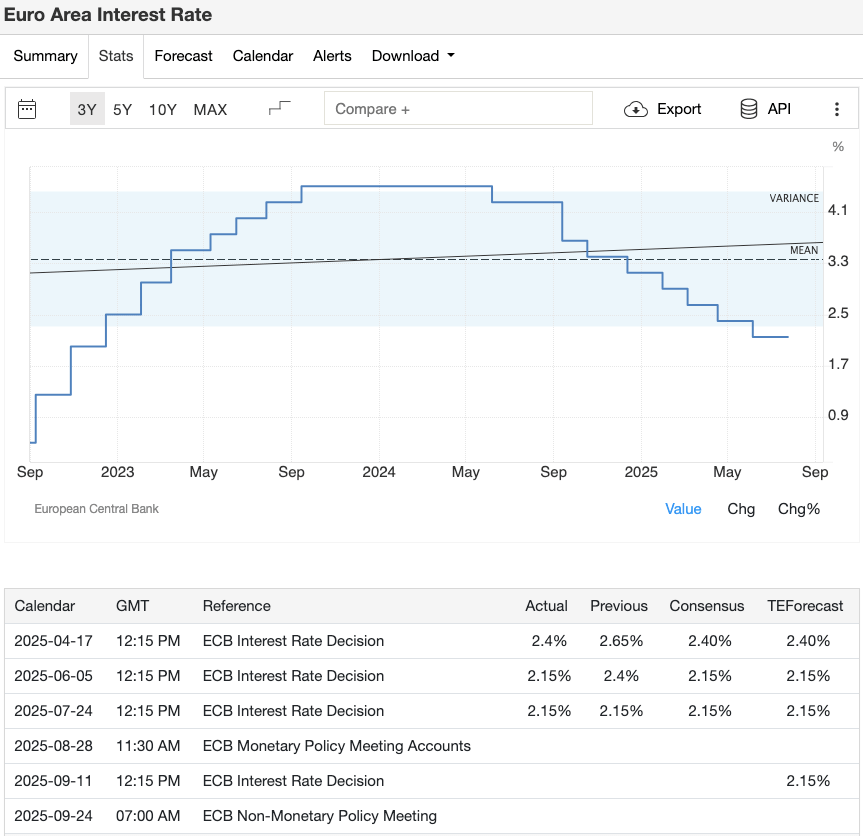

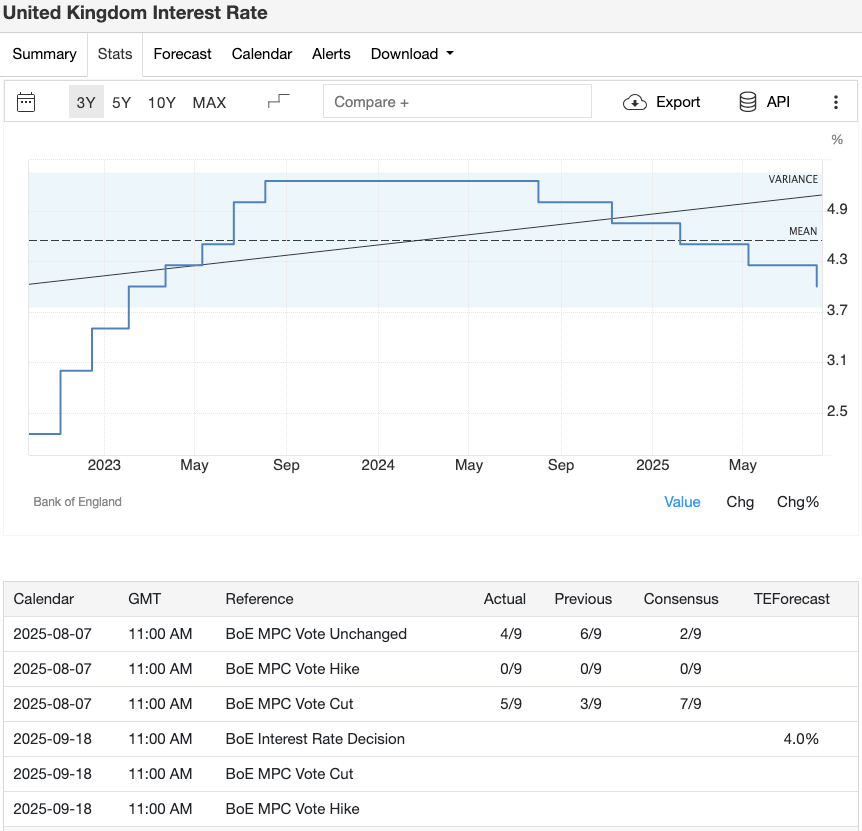

European and Japanese Central Banks: How Peripheral Policies Affect Global Liquidity

The European Central Bank (September 11) and the Bank of England (September 18) are likely to remain on hold, but their statements on inflation and growth will influence the euro and pound, subsequently affecting global bond markets. The Bank of Japan (September 19) may unexpectedly take action, such as adjusting yield curve control, which will directly impact the yen's movement.

Image Credit:Trading Economics – European Central Bank Interest Rate Decision

Image Credit:Trading Economics – Bank of England Interest Rate Decision

Image Credit:Trading Economics – Bank of Japan Interest Rate Decision

CPI and Cross-Market Effects Linked to the Federal Reserve

The linkage between macro data and various assets is crucial:

- – If CPI data weakens, the dollar is likely to weaken, and Bitcoin may gain new upward momentum.

- – If Powell sends hawkish signals at the press conference, the stock market may come under pressure, and Ethereum may perform poorly due to decreased risk appetite.

- – If non-farm data is strong, US Treasury yields will rise, and market expectations for rate cuts will be delayed.

Historical Comparison: CPI and Cryptocurrency Market Reactions

Geopolitical and Policy Risks: Shutdowns, Tariffs, and Energy Shocks

Macro factors never act in isolation. Even the clearest CPI data or Federal Reserve signals can be overshadowed by sudden political and geopolitical events. September is no different. In addition to employment, inflation, and interest rates, investors must also pay attention to fiscal deadlines, tariff disputes, and potential global risks that could erupt at any moment. These factors collectively form the second layer of risk mapping for the September market.

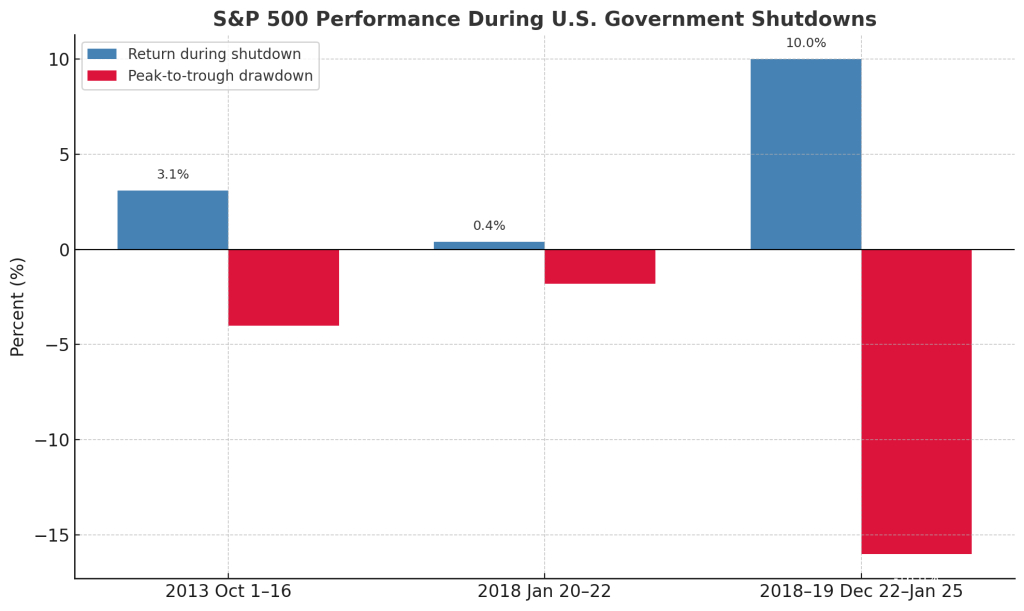

Risk of US Government Shutdown: The Big Test at the End of September

The most prominent policy risk in September is the US government shutdown deadline on the 30th. Historically, similar events often lead to:

- – A stronger dollar, with inflows into safe-haven assets

- – Short-term US Treasury yields rising before the deadline

- – US stocks facing short-term pressure but often rebounding quickly after an agreement is reached

In recent years, Bitcoin has also shown certain safe-haven characteristics amid shutdown concerns, making this time point a common volatility node for both traditional and crypto markets. A historical review clearly shows the pattern of short-term pressure followed by subsequent recovery in the S&P 500.

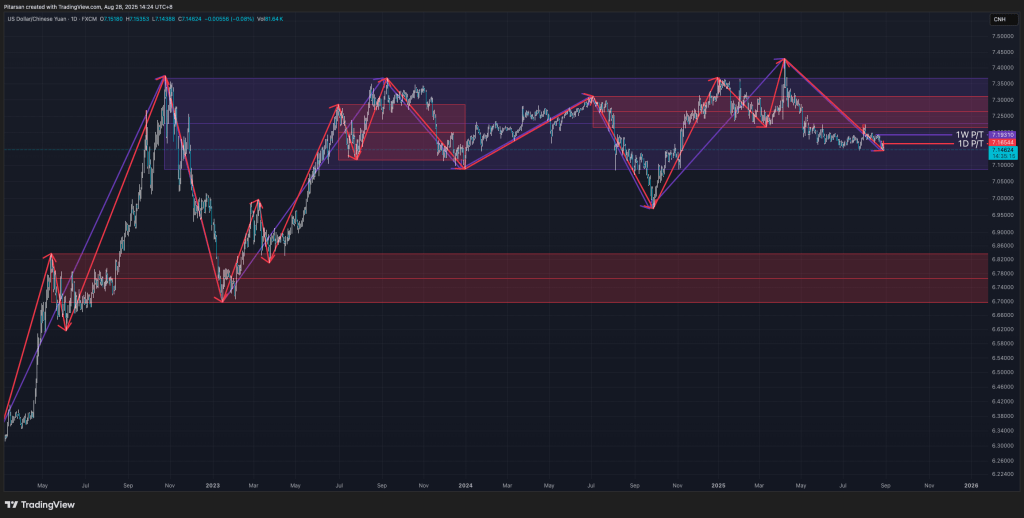

US-EU and US-China Trade Frictions: Tariff Negotiations Affecting Market Nerves

Trade is also a pressure point. Before the end of August, the US and EU face a final negotiation window on tariffs for automobiles and agricultural products; whether they can successfully reach an agreement will determine if a new round of disputes can be avoided. Meanwhile, the US and China are in a fragile 90-day tariff truce, lasting until early November. This truce is the result of previous rounds of tax increases and the cancellation of tax exemptions for small packages.

- – If the US and EU reach an agreement, the automotive and cyclical sectors may benefit.

- – If negative news emerges from US-China negotiations, the yuan may weaken, and the yuan is often viewed by the market as a barometer of global risk sentiment; its decline could impact the stock market, commodities, and even the crypto market.

Image Credit: TradingView – USDCNH Performance Daily Timeframe

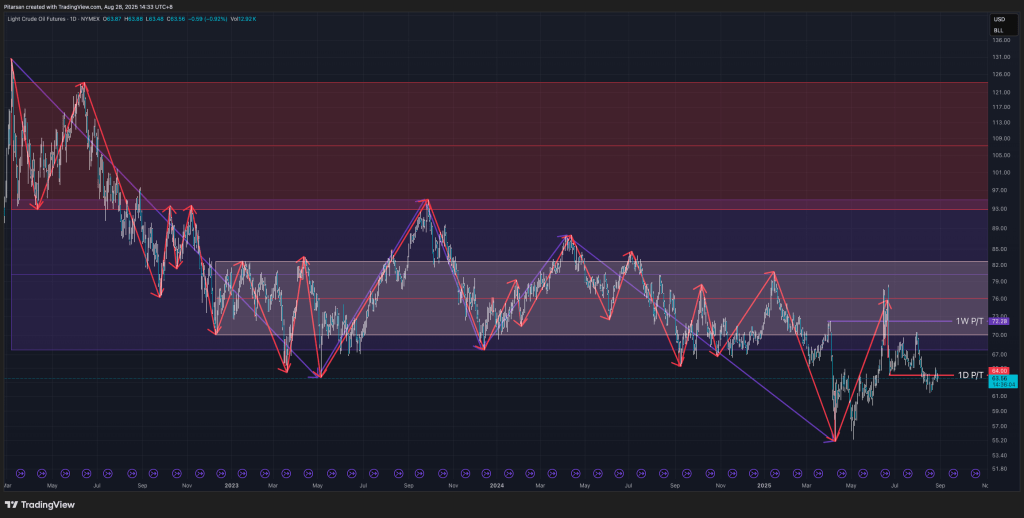

Energy and Conflict: The Black Swan of Soaring Oil Prices

Beyond fiscal and trade issues, geopolitical situations also harbor uncertainties:

- – The direction of Russia-Ukraine negotiations remains a mystery.

- – The situation in the Middle East could escalate at any moment.

- – Hurricane season brings risks of energy supply disruptions.

If oil prices suddenly soar, it will quickly raise inflation expectations and US Treasury yields. This shock will not be limited to commodities but will also transmit to Bitcoin and Ethereum, as they are increasingly viewed as macro hedging assets.

Image Credit: TradingView – Light Crude Oil Futures Performance Daily Timeframe

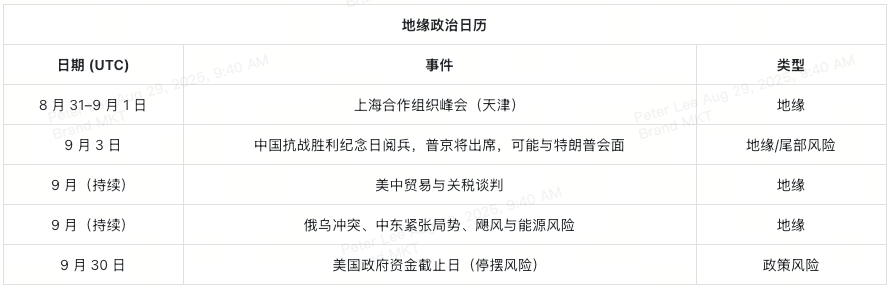

Crypto Catalysts: Bitcoin ETF, Ethereum ETF, WLFI, and Unlocking Waves

Macro and geopolitical risks provide the broader context, but the crypto market in September also has its own "explosive points." These factors are sufficient to sway market sentiment and even amplify or offset macro signals. For crypto traders, the importance of ETF capital flows, token launches, and changes in contract positions is on par with Powell's speeches or the next CPI data.

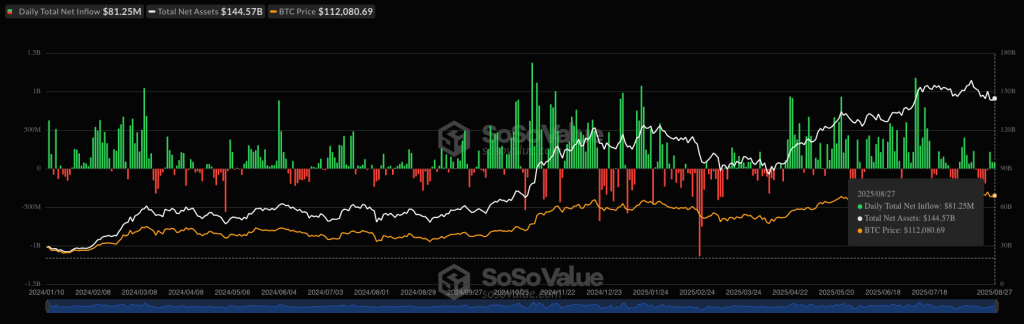

Bitcoin ETF: Capital Flows Determine Market Temperature

Bitcoin ETFs remain the strongest driving force at present. US spot products continue to attract record capital inflows, providing depth to the market and somewhat cushioning downward volatility. Now, traders are monitoring ETF capital flows almost daily, as seriously as they watch non-farm or inflation data.

Image Credit:SoSoValue – Total BTC Spot ETF Net Inflow

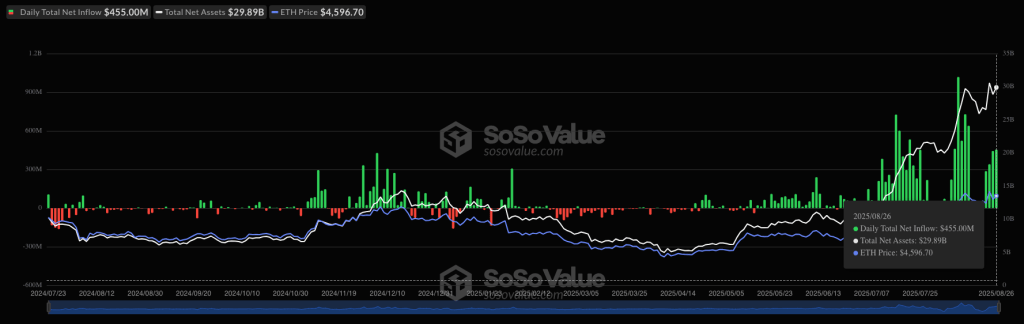

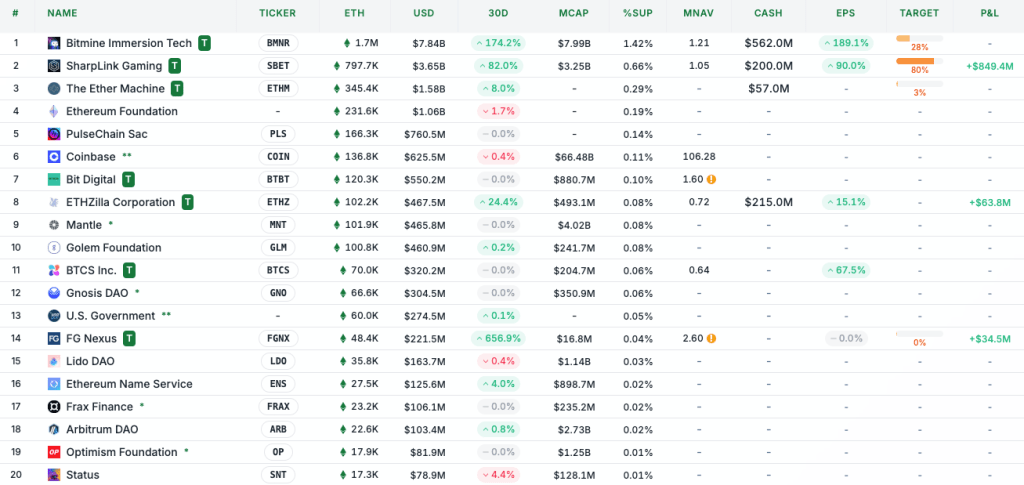

Ethereum ETF: Approval Rumors and Staking Expectations Heat Up

Ethereum has also become a focal point. The market speculates that regulators may soon approve new ETH ETFs, potentially even introducing staking mechanisms and institutional custody. Even if it's just a rumor, it is enough to keep ETH strong. Once the news is confirmed, new capital flows will immediately push ETH higher, especially before entering the fourth quarter.

Image Credit:SoSoValue – Total ETH Spot ETF Net Inflow

Image Credit:Strategic ETH Reserve

WLFI Token Launch: Can $2.2 Billion in Financing Translate to Demand?

On September 1, World Liberty Financial (WLFI) officially launched. WLFI raised over $2.2 billion, making it one of the most significant TGEs of the year. Its debut will test whether substantial financing can truly convert into sustained market demand.

Image Credit:World Liberty Financial Official X (Formerly Twitter)

Moreover, just weeks before the Federal Reserve's decision, WLFI's launch adds another layer of liquidity variable to the market.

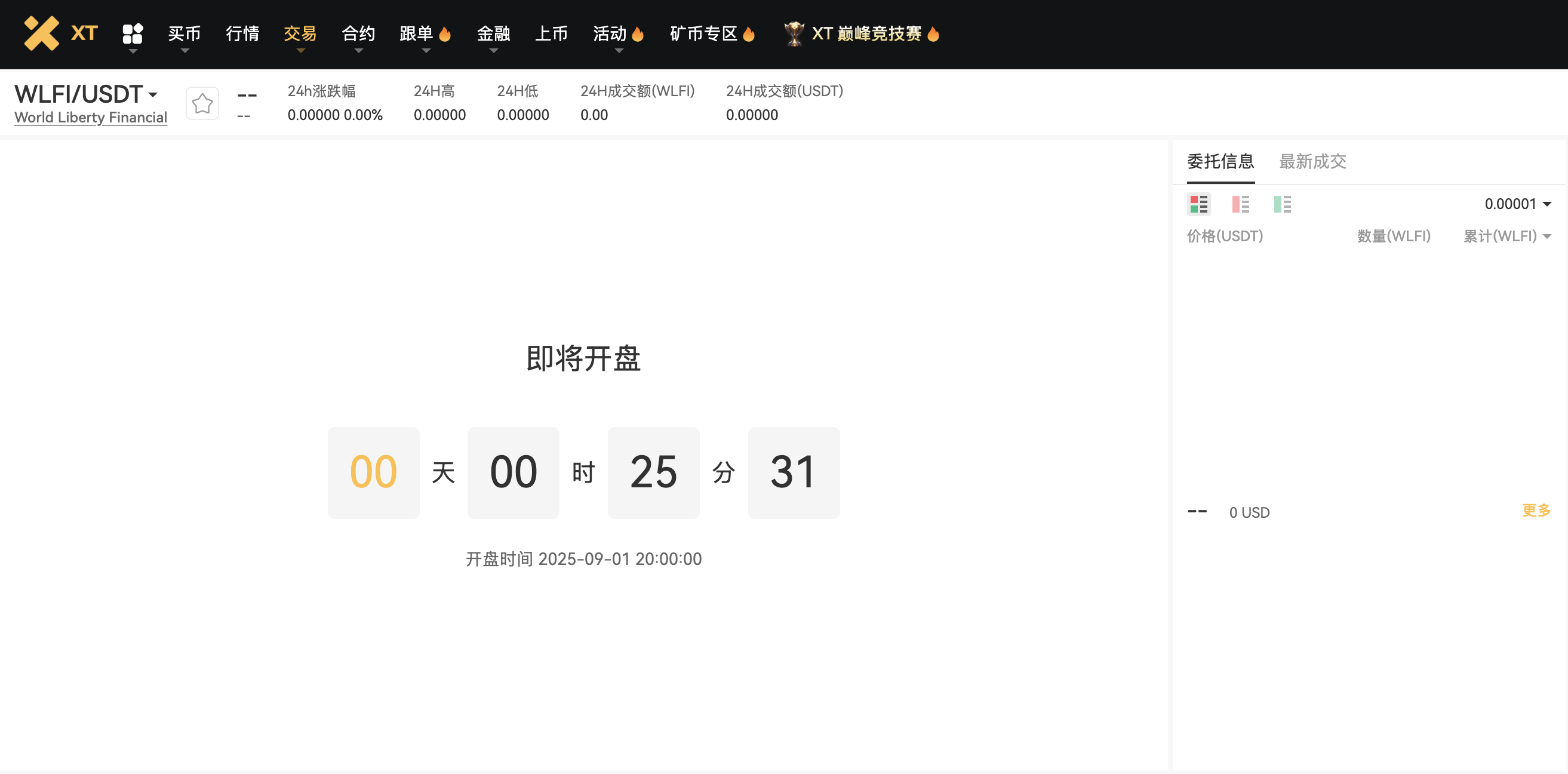

Note: XT will launch the WLFI/USDT spot trading pair at the earliest opportunity, and traders should prepare for high volatility at the opening.

XT.com WLFI/USDT spot trading pair

September Unlocking Wave: Over $1 Billion in Tokens Impacting the Market

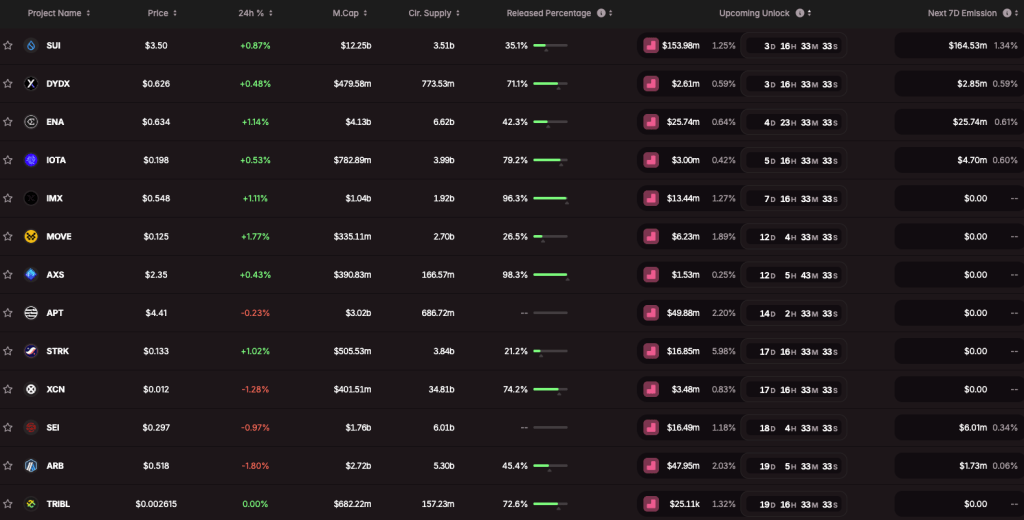

From early to mid-September, multiple projects will experience unlocking, with a total scale exceeding $1 billion:

- –Arbitrum(ARB): Approximately 92.65 million tokens will unlock on September 16, accounting for about 2% of the circulating supply.

- –SUI** and Jupiter(JUP)**: The total unlocking scale exceeds $620 million, with SUI unlocking about 44 million tokens ($159 million) and JUP unlocking about 53.5 million tokens ($27 million).

These unlocks are the most noteworthy, but they are not the only ones. Various projects in DeFi, infrastructure, and gaming will also unlock in September, bringing continuous supply pressure to the market. Historically, unlocks often lead to short-term selling pressure, but if the market's absorption capacity is strong, it may become an opportunity for a mid-term rebound. Many traders will wait for the oversold range after the unlocks as a good time to re-enter.

Image Credit:Tokenomist – Token Unlocks

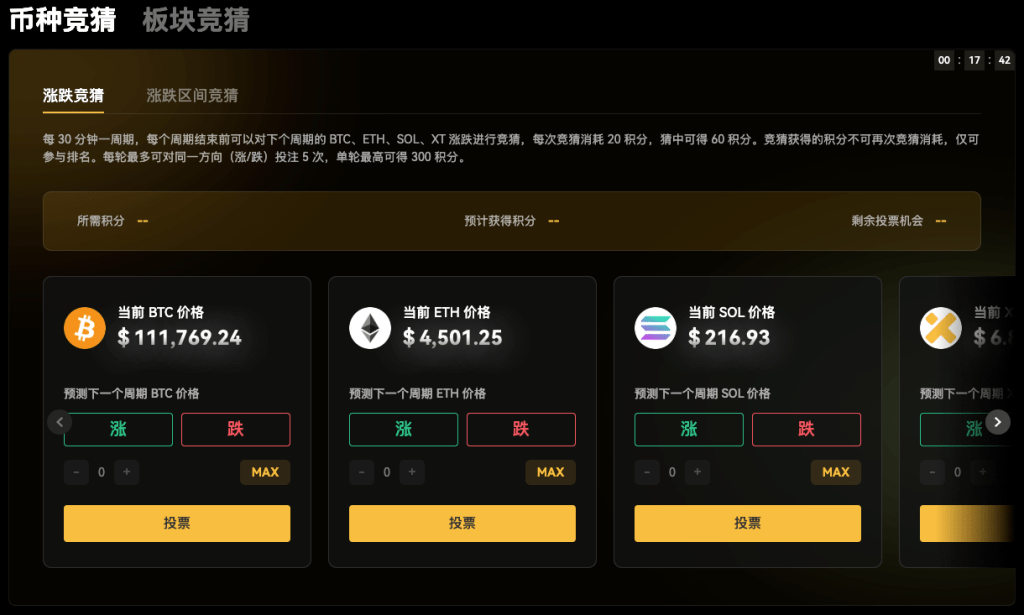

🚀 XT Peak Competition: Test Your Market Intuition and Win in the September Storm

The September market can be described as "hell mode": CPI, Federal Reserve meetings, massive token unlocks, ETF capital flows…

Each event could ignite significant market volatility. Instead of just watching, why not turn your judgment directly into rewards!

Participate in the XT Peak Competition, and you will:

✅Predict the price direction of BTC, ETH, SOL, and XT

⚔️Compete with global traders and see real-time rankings

💰Win rewards, turning correct predictions into tangible returns

This is a "battle of wits" across the entire market. In the most turbulent market of September, every judgment you make could bring glory and profit. 👉Join the XT Peak Competition now and see if your intuition can beat the market!

September 26: Volatility Window for Quarterly Contracts and Options Expiration

The final major catalyst is the quarterly expiration on September 26. Deribit, Binance, and OKX will complete quarterly contract settlements at 08:00 UTC, while CME's Bitcoin and Ethereum contracts will expire at 16:00 UTC on the same day.

These expirations often concentrate a large number of positions, making them prone to significant volatility. Traders need to pay attention to:

- – The spot and contract price spread (basis)

- – The funding rate of perpetual contracts (changes quickly during hedging)

- – Option skew and implied volatility (especially at key price levels)

Not every expiration week will see major market movements, but when market positions are overly one-sided, the settlement period often becomes a point of volatility. For active traders, this is a good time to capture tactical opportunities.

Image Credit: Coinglass –BTC Futures OI\u0026amp;BTC Options OI

September Market Path Simulation: Baseline, Optimistic, and Pessimistic Scenarios

By mid-September, the market will face Powell's interest rate decision, record ETF capital inflows, WLFI's launch, the token unlocking wave, and the risk of a US government shutdown. Any one of these factors could trigger market movements on its own, and their combination makes September the most unpredictable month of the year.

The clearest response method is to conduct scenario analysis, breaking down possible paths into baseline, optimistic, and pessimistic scenarios to help traders establish expectations and prepare for opportunities and risks in advance.

Baseline Scenario: 60% Probability, Rate Cut Materializes, Market Rises Moderately

The most likely situation is a gentle soft landing.

- – The Federal Reserve cuts rates by 25 basis points on September 17;

- – CPI remains stable or slightly declines, and the job market cools moderately;

- – Risks of a shutdown and tariffs have not yet materialized.

US stocks rise moderately, the dollar weakens, and risk appetite extends to the crypto market. BTC is expected to approach $130,000, and ETH will stand above $5,000.

Optimistic Scenario: 20% Probability, Liquidity Explodes, ETH ETF Ignites Market

If inflation cools more than expected, along with favorable policies and regulations:

- – The Federal Reserve hints at multiple future rate cuts;

- – Bitcoin spot ETFs continue to attract capital;

- – Approval of ETH staking ETFs, with WLFI's listing boosting liquidity.

In this case, BTC could break through $150,000, and ETH could surge to $7,000, driving a comprehensive rotation in altcoins.

Pessimistic Scenario: 20% Probability, Inflation Resurges, Market Falls Back into Risk-Averse Mode

If inflation unexpectedly rises, along with fiscal deadlock or shutdown risks:

- – Powell is forced to tighten, and market rate cut expectations are dashed;

- – Unlocking selling pressure and ETF capital outflows compound;

- – Investor risk appetite plummets.

BTC could drop to around $90,000, and ETH could fall to $3,500, with the market returning to a defensive mode.

Positioning and Capital Flow: September Trading Manual

Scenario analysis provides us with possible paths, but what truly determines how the market moves is the distribution of capital and positions. As we enter September, the overall atmosphere in the crypto market is optimistic but still fragile.

How to Interpret Capital Signals from ETFs, Options, and Stablecoins

Key Event Tactics: CPI, FOMC, and Expiration Week Trading Strategies

Five Major Strategies for September: Opportunities and Risks Coexist

🚀 Experience the XT Peak Competition Now

The storm in the September market is approaching. Can your judgment outperform other traders? 👉Join the XT Peak Competition now

Join the XT Peak Competition to predict the price direction of BTC, ETH, SOL, and XT. Compete with global players, and if your predictions are correct, you can win rewards.

Frequently Asked Questions: September 2025 Crypto Calendar

1. Why is the Federal Reserve meeting on September 17 so critical?

Because this could be the first rate cut in years, and if it happens, it will directly impact the dollar, stock markets, and the trends of Bitcoin and Ethereum. Powell's statements may even be more important than the rate cut itself.

2. How will the CPI data on September 11 affect the crypto market?

CPI data often brings significant volatility. Historically, BTC typically experiences a 2%–5% single-day fluctuation on announcement days, while ETH often sees even larger price swings.

3. What does the risk of a U.S. government shutdown mean for the market?

When the market is concerned about a shutdown, the dollar usually strengthens, the S&P 500 comes under pressure, and Bitcoin may sometimes be sought after as a "safe-haven asset."

4. Why is the token unlocking in September 2025 so important?

Because projects including Arbitrum, SUI, and Jupiter will see over $1 billion in unlocks, directly increasing circulating supply and potentially creating selling pressure in the short term.

5. Why is the contract expiration on September 26 so significant?

Quarterly contract expirations often concentrate a large number of positions, triggering significant rebalancing and repricing of Bitcoin and Ethereum. Typically, expiration weeks reset liquidity and market direction.

6. How should traders respond to the September 2025 market?

Stay flexible. Monitor ETF capital flows and key macro data, hedge before major events, avoid blindly following during extreme volatility, and look for opportunities in mainstream coins after contract expirations.

Quick Links

- –2025 Ethereum Price Prediction: How Much Room is There After ETH Breaks $4000?

- – Why Do Others Earn More Than You When Staking the Same ETH?

- – Will Ethereum Staking Enter Wall Street? The Evolution of ETH ETFs

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 1000 quality cryptocurrencies and 1300 trading pairs. The XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。