Original | Odaily Planet Daily (@OdailyChina)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Management Guide | Katana, Agora Double Benefits; Huma 2.0 Reopens (July 16);

New Opportunities

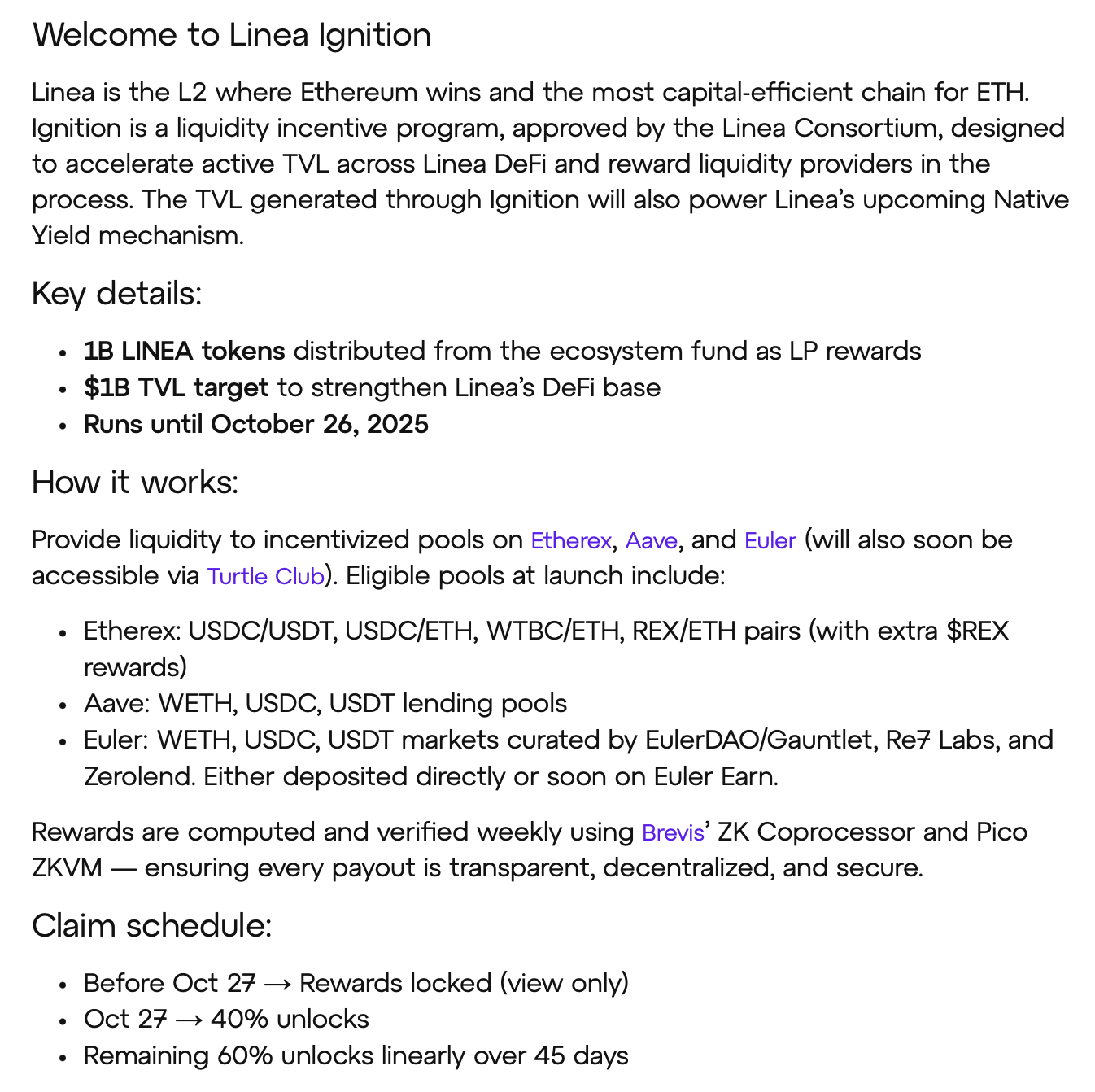

Linea Launches Liquidity Incentive Program

Last night, Linea officially announced the launch of the liquidity incentive program Linea Ignition, planning to distribute 1 billion LINEA tokens as incentives to attract an additional $1 billion TVL to Linea.

The event will last until October 26, 2025, and the eligible cooperative agreements during the launch phase include Etherex, Aave, and Euler (with Turtle Club expected to be added later). The liquidity pools available for participation include:

- Etherex: USDC/USDT, USDC/ETH, WTBC/ETH, REX/ETH trading pairs (including additional REX rewards)

- Aave: WETH, USDC, USDT lending pools;

- Euler: WETH, USDC, USDT pools managed by EulerDAO/Gauntlet, Re7 Labs, and Zerolend, which can be directly deposited or participated in through Euler Earn (opening soon).

In terms of rewards, 40% of the incentive tokens will be unlocked on October 27, and the remaining 60% will be unlocked linearly over 45 days.

As of the time of writing, LINEA is quoted at $0.033 in the pre-market on Binance. At this price, 1 billion tokens correspond to a total prize pool of about $33 million. Considering that the entire event period is not long, although the tokens have certain lock-up restrictions, the unlocking period is also very short, so it is quite cost-effective to participate — it is recommended to deposit in Aave without much thought, and consider some circular loans appropriately.

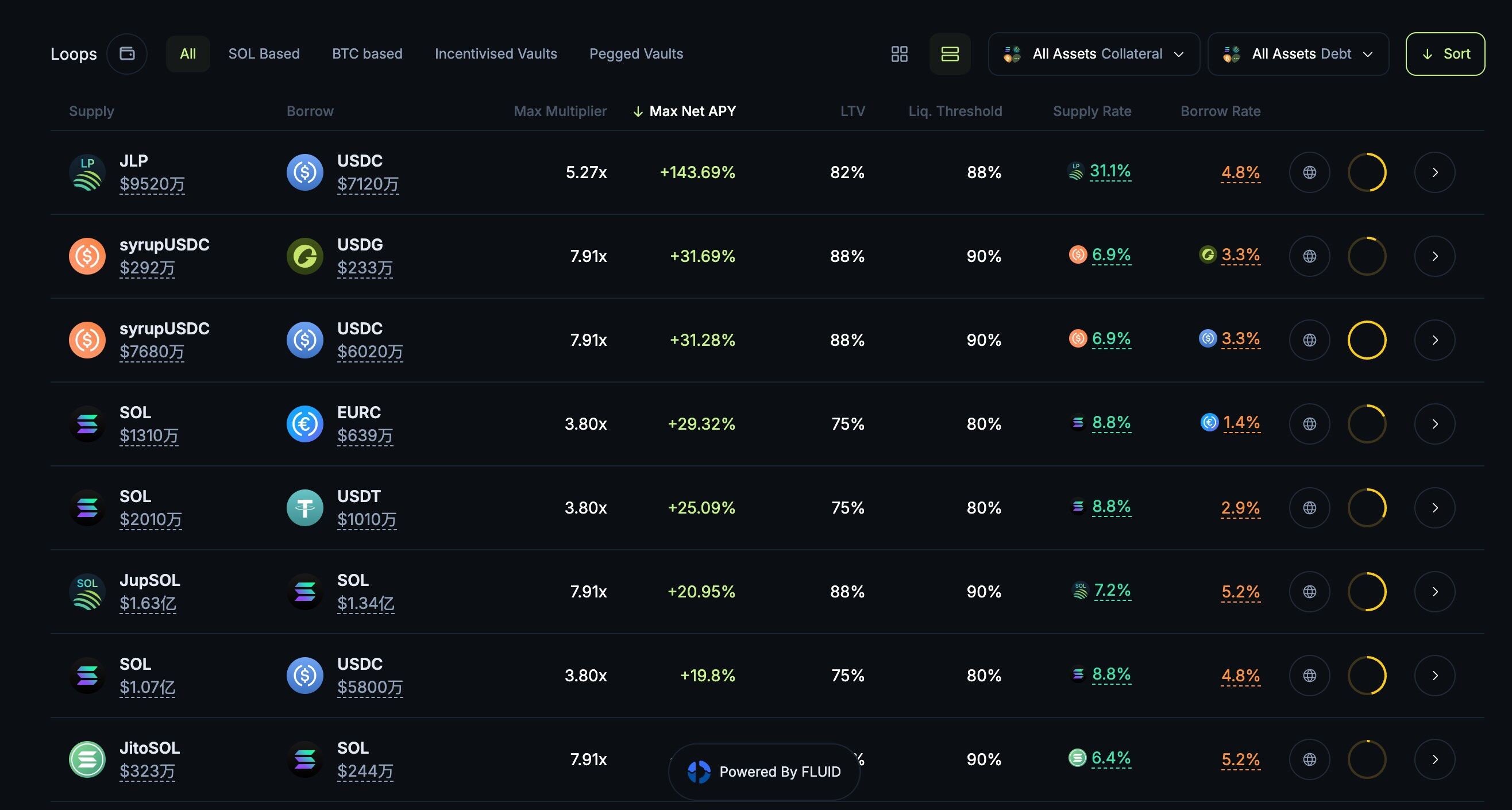

Jupiter Lend Officially Launched

The lending product Jupiter Lend, launched in collaboration with Fluid, officially went live last week and quickly became one of the fastest-growing lending protocols in the Solana ecosystem.

Currently, depositing USDC, USDT, USDS, and other stablecoins directly into Jupiter yields an annualized return of just under 10%. Although this is not high, it benefits from the security backing of Jupiter and Fluid, and rewards will be distributed in the form of the corresponding stablecoins (some earnings from Kamino, which has relatively high returns, will be distributed in the form of KMNO).

Additionally, Jupiter Lend's built-in one-click circular loan feature (Multiply) is quite useful, and users with relevant operational experience can appropriately use some leverage to amplify their yields — the most recommended here is for SOL holders, as the JupSOL/SOL circular loan risk is more controllable, and the returns are relatively considerable among all SOL earning products.

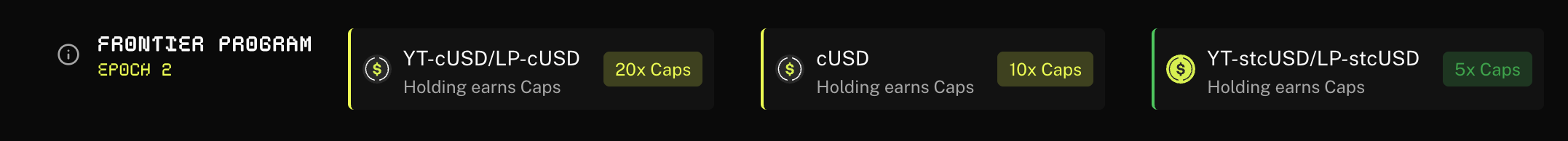

Cap Further Integrates Pendle

The yield-generating stablecoin Cap, mentioned last week, has completed further integration with Pendle — previously only supporting yield-bearing assets stcUSD, it now also supports the points asset cUSD.

When recommended last week, Cap was still in Epoch 1, where static holding of cUSD could earn a 20x points multiplier, but there would be no annualized yield. This week, Epoch 2 officially starts, and the points multiplier for static holding of cUSD is reduced to 10x, while still having no annualized yield. However, choosing to invest cUSD in Pendle's LP can continue to earn a 20x points increase, while also enjoying an 8.3% APY, making it a reasonable choice.

Other Observing Protocols: USD.AI, Reflect

USD.AI was also recommended last week, but it was unexpected that the project's progress would be so rapid, first raising $13 million, then securing funding from Binance (YZi Labs), and subsequently partnering with the popular stablecoin public chain Plasma, leading to the initial deposit limit being quickly filled. USD.AI has previously announced that it will open more deposit limits for USDT, so it is recommended to keep an eye on it and seize opportunities early.

Reflect announced this morning that it has completed a $3.75 million seed round of financing, led by a16z crypto's CSX accelerator, with participation from Solana Ventures, Equilibrium, BigBrain Holdings, and Colosseum. Reflect plans to build "software as a stablecoin" infrastructure, allowing applications to issue yield-bearing dollar stablecoins without locking funds. The project is expected to launch on the mainnet in early September, initially supporting USDC on Solana, at which point we can check the yield situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。