Cathie Wood's Ark 21Shares Boosts Crypto Positioning with BTC Buy

Cathie Wood's Ark 21Shares has recently bought 658.5 Bitcoins which is worth 472.9 million. This move highlights the firm’s growing confidence in Bitcoin as a long-term asset.

The purchase adds to Ark 21Shares expanding ETF portfolio and showing strong institutional demand and aligning with the broader trend of companies accumulating digital gold for treasury diversification, recently shared by Whale insider on its X post.

Source: X

BTC Acquisition Strengthens ETF’s Crypto Positioning

Apart from Ark 21Shares, Strategy, company of Michael Saylor also purchased 4,048 BTC which is worth $449 million. The rise in BTC ETFs has been seen after the heavy purchase.

As per the data of SoSo value , the daily total net inflow recorded is $332.76 million with a total volume traded at $3.93 billion whereas the total net asset is recorded at $143.21 billion. Lastly on August 29, Bitcoin ETF showed an outflow of $126.64 million and after the purchase, it surged to an inflow of $332.76 million on September 2, 2025.

Source: Soso value

Whereas the firm's Bitcoin ETFs as of September 2, a day inflow recorded at $71.87M with a cumulative net inflow of $2.17 billion.

Source: soso value

Previously, Cathie Wood’s ARK Invest bought 339,113 shares of BitMine Immersion Technologies (OTC: BMNR) across three ETFs— ARKF (40,553), ARKK (227,569), and ARKW (70,991)

Market Impact: BTC Price Outlook After Latest Buy

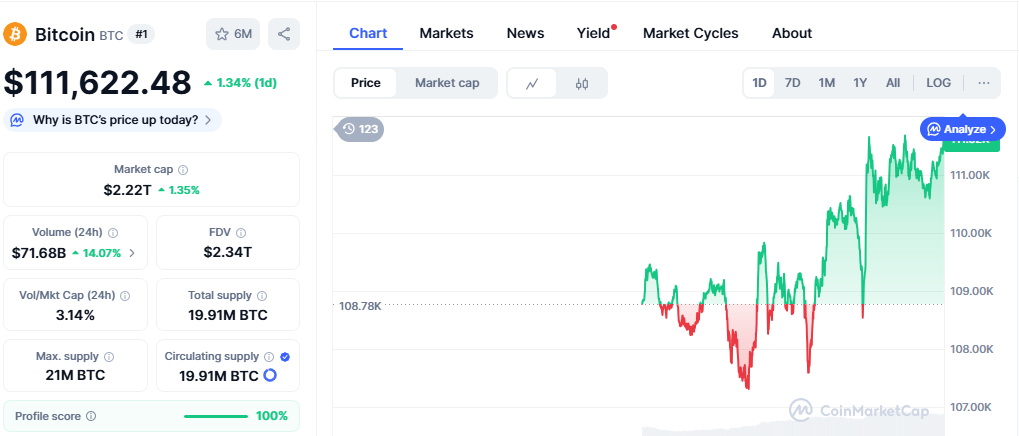

After the purchasing of Ark 21Shares and Strategy’s new purchase there has been a surge in BTC price. As per the data from CoinMarketCap, a few days before, the coin suffered through a regular dip, trading around $107k to $108k and now with a rise of 1.39% observed in 24 hours the coin prices are trading at $111,636, at the time of writing.

Source: CMC

Big firms like Cathie's firm and Strategy are buying dips as opportunities, showing strong confidence. If this trend continues, Bitcoin may recover soon and push back toward its all-time high.

Conclusion

Institutional buying of BTC shows growing trust in crypto as a long-term asset. With ETFs seeing strong inflows, market stability is improving, and the digital gold is likely to rebound steadily, attracting more investors and driving future growth.

Also read: Beetz Daily Combo 03 September 2025: Earn Tokens Easily免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。