Written by: Glendon, Techub News

In August, Bitcoin and Ethereum both broke their historical highs one after another. Although SOL has surpassed the $200 mark and has increased by over 110% compared to the previous cycle's low of $95.26, it is still far from its historical high of $295.83. Once, Solana was in the spotlight during the "Memecoin Season," even outperforming Bitcoin, but now, what "catalysts" can Solana rely on to take off again? Is its on-chain ecosystem active enough to support a price increase, and is it possible for it to break new highs in this cycle?

Solana Ecosystem: The Road to Recovery is Still Long

Before discussing external driving factors, let’s first understand the current development status of the Solana ecosystem.

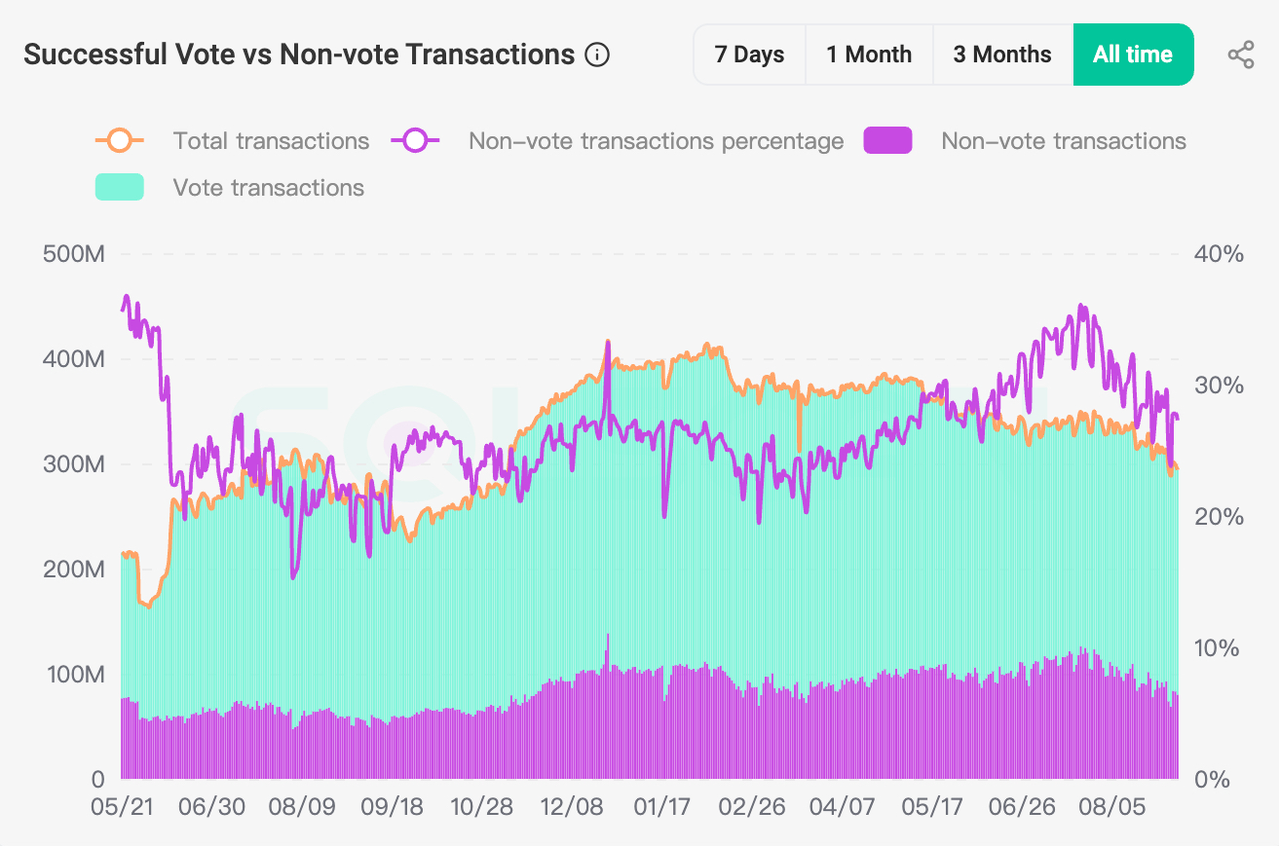

According to Solscan data, as of September 3, the daily transaction volume on Solana has remained relatively stable over the past week, with an average of about 300 million transactions per day, of which voting transactions account for over 70%. However, when we extend the timeline to the entire month of August, we can see a downward trend in daily transaction volume, and further breaking it down to Solana's transactions per second (TPS), we also find a slight decline.

Additionally, Nansen data shows that in the past 30 days, the total number of active addresses on the Solana chain was approximately 77.74 million, a decrease of about 22% compared to last month. Meanwhile, the "non-voting" transaction situation on Solana is also not optimistic, with about 2.069 billion transactions, a drop of over 105%. From this data, it is not difficult to see that the recent activity level of the Solana network has shown a significant decline.

However, despite the decrease in monthly transaction volume and active addresses, as of the time of writing, the total monthly user transaction fees on Solana have still increased. Excluding MEV rewards and validator tips (such as Jito on Solana), the total transaction fees reached $35.98 million, an increase of nearly 4%. A deeper analysis reveals that part of the decline in active addresses may stem from the cleaning of zombie accounts. Real users (especially institutional users) tend to have higher transaction values, which may be a significant factor driving the increase in total transaction fees.

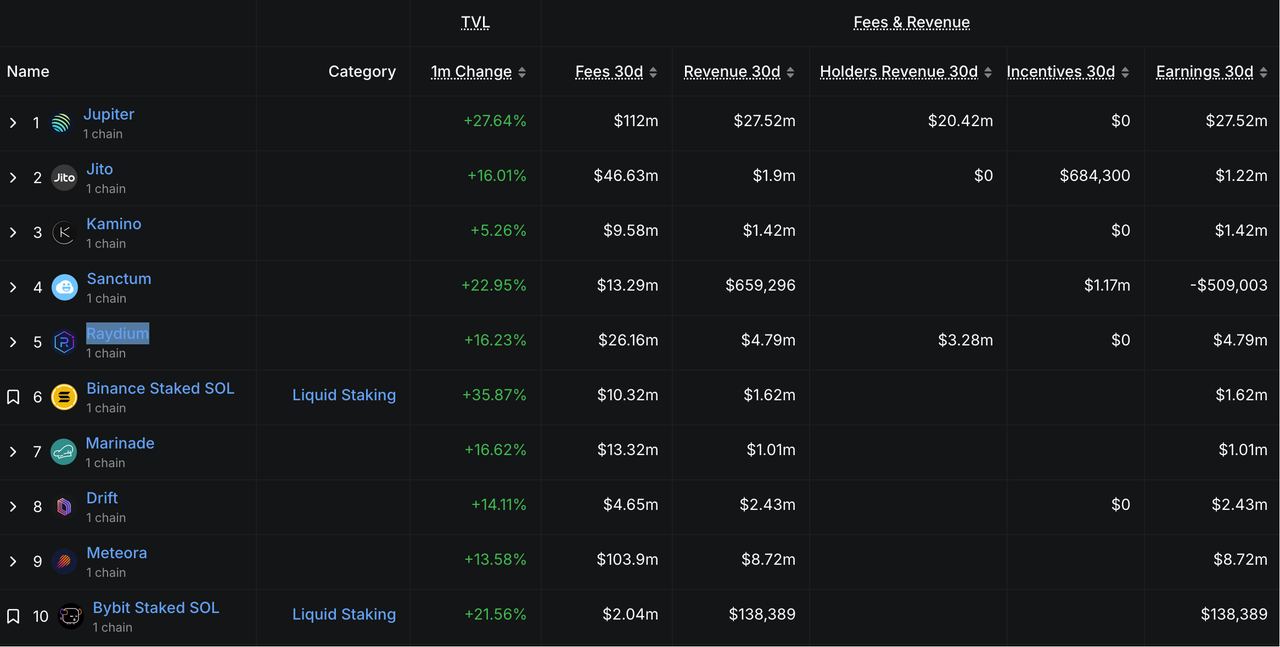

In the DeFi sector, DeFi protocols on Solana have recently shown a brief trend of value outflow. According to DefiLlama data, as of September 3, the total locked value (TVL) in the DeFi market reached $154.2 billion, nearing the peak of DeFi TVL in 2021 (approximately $178.7 billion). Among them, the DeFi TVL on Solana is about $11.688 billion, which is not far from its TVL peak of $11.989 billion in June 2025. However, in the past 7 days, among the top ten DeFi projects on Solana, all except Jupiter and Raydium have seen a decline in TVL.

When we expand the observation period to 30 days, the situation changes. We can see that the TVL of all top ten projects on Solana has increased, with Jupiter and Binance Staked SOL leading the way, rising over 27% and 35%, respectively. This indicates that the value outflow from projects in the past 7 days may just be a short-term trend in line with the overall structural adjustment of the cryptocurrency market and does not mean that Solana DeFi is in a downturn. However, it is worth noting that this data also indicates that investor interest in DeFi has not shown a significant rebound.

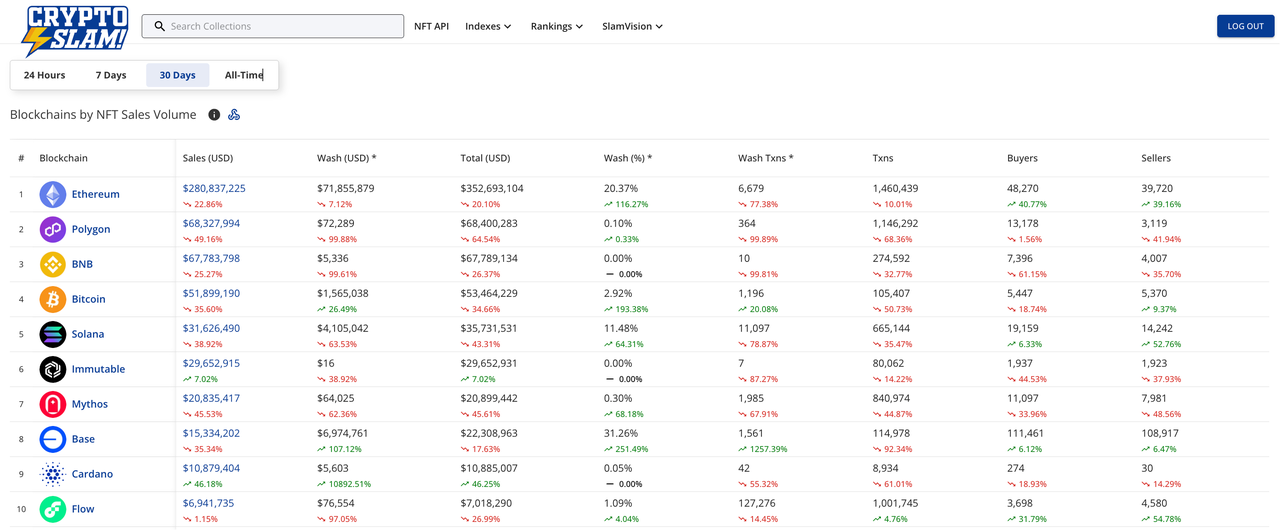

In contrast to the DeFi market, the NFT market, which had briefly warmed up a month ago, has recently shown a significant decline in sales volume. According to CryptoSlam data, in the past 30 days, all top five blockchains have seen a drop in sales, with Ethereum leading at approximately $281 million in NFT sales, but with a decline of nearly 23%. Solana's performance in this field is also lackluster, ranking fifth with sales of about $31.63 million, a drop of as much as 39%.

It is evident that the DeFi and NFT markets on Solana are currently insufficient to become the key driving forces for Solana's recovery.

On the other hand, Solana's true "trump card" may still be its large Memecoin market. Although the Memecoin craze has gradually faded, this market still has significant development potential and has not completely declined.

SolanaFloor tweeted that on September 3, the number of new token issuances on Solana reached 48,081, setting a new single-day issuance record since August 13. On September 4, SolanaFloor further disclosed that pump.fun generated $2.55 million in revenue in the past 24 hours, surpassing Hyperliquid's $2.23 million during the same period, making it the highest-grossing application in the cryptocurrency field, with its revenue level only second to stablecoin issuers like Tether and Circle.

Pump.fun is undoubtedly one of the key driving forces that once propelled Solana to its peak. Recently, it has regained its leading position in the Solana Memecoin market, but the daily revenue of $2.55 million, while considerable in the current market environment, still shows a significant gap compared to its historical peak single-day fee income of $15.5 million on January 24, 2025.

At the same time, the Memecoin market seems unable to assist Solana in taking off again. According to defioasis monitoring, in August, pump.fun created a total of 595,034 new tokens, attracting 1,349,616 addresses to participate in trading. However, the overall trading situation is not optimistic, with total losses for all traders reaching as high as $66 million, and no "millionaire" was created. Specifically, over 60% of addresses have accumulated losses exceeding $169 million, and the only address with losses exceeding $1.32 million still failed to become a "millionaire." In terms of profits, 416,413 addresses made profits of $0-1,000, totaling about $41.17 million; 18,179 addresses made profits of $1,000-10,000, totaling $47.5 million; and there are 1,665 addresses with profits exceeding $10,000. These addresses collectively made profits exceeding $100 million, but no "millionaire" addresses emerged.

This indicates that the once "Memecoin Season" has completely passed, ironically aligning with Solana's nickname as a "casino." Crypto trader James Wynn also pointed out that the Solana ecosystem has become a "saturated market," filled with short-term speculators and "farming behavior," making it difficult to support Meme coins in achieving long-term value. He believes that even the AI Meme coin FartCoin, once seen as successful, is just another Ponzi scheme that may ultimately go to zero.

In his view, the only projects in the current crypto market with real blue-chip potential are DOGE, SHIB (not entirely "Meme"), and PEPE. Other projects have almost no chance of becoming blue-chip. He also mentioned that the crypto community used to remain active and successful amid market fluctuations, but this characteristic is gradually fading.

Therefore, unless there are future scenarios such as interest rate cuts, the market reaching new highs in Q4, and a strong return of retail investors, the entire Memecoin market will continue to remain sluggish, and Solana will find it hard to stand out.

In summary, the Memecoin market may have become a thing of the past, and we can see that relying solely on the internal development of the Solana ecosystem, it is currently difficult to support the rise of Solana and its tokens, and the participation level in its ecosystem is far from its most fervent period. So, what else can Solana rely on for its revival?

The key point lies in institutions. As mentioned earlier, the increase in Solana's transaction fee revenue over the past month may stem from institutional trading. In fact, institutional demand is becoming a major driving force for Solana's development.

Can Solana Share in the "Institutional Era"?

With the arrival of the "Institutional Era" in the cryptocurrency market, major listed companies are launching a "cryptocurrency reserve war," and the digital asset treasury (DAT) has become a hot topic, while Solana's development is also inseparable from institutional buying.

In fact, Solana gained the favor of traditional financial companies earlier than its competitor Ethereum. As early as the end of October 2024, Canadian listed company Sol Strategies purchased 130,125 SOL, initiating a Solana reserve strategy and becoming a pioneer in this field. As of August 31 this year, the company's SOL holdings had reached 402,623, valued at approximately $81.93 million at current prices.

Subsequently, the U.S. listed company DeFi Development (formerly Janover) entered this field in mid-April this year. On August 28, DeFi Development further increased its holdings by 407,247 SOL, bringing its total holdings to 1,831,011 SOL, valued at approximately $373 million. During the same period, Nasdaq-listed company Upexi also began to formulate a Solana treasury strategy, subsequently increasing its SOL holdings through several large-scale financings and steadily advancing its treasury strategy. As of August 5, Upexi publicly disclosed that its SOL holdings had surpassed 2 million.

At that time, institutional interest in Ethereum was just beginning to emerge. Unfortunately, the subsequent development of the Solana DAT market has not been satisfactory, as it not only failed to keep pace with Bitcoin but was also far behind the fervent Ethereum DAT market. It was only last week that Solana finally welcomed institutional "recognition."

On August 25, U.S. listed company Sharps Technology made a strong entry, completing over $400 million in PIPE private financing, and announced plans to establish the world's largest Solana digital asset treasury. On August 29, the company further stated its intention to expand the fundraising scale to $1 billion to advance its SOL-focused digital asset treasury strategy. From the current situation, Sharps Technology has somewhat realized its ambitious claims. As of September 2, within just a week, its SOL token holdings exceeded 2 million, with a market value of over $400 million.

Almost simultaneously with Sharps Technology's entry, two major financial institutions announced the launch of their Solana treasury strategy.

According to Bloomberg, on August 25, three giants in the cryptocurrency investment field—Galaxy Digital, Multicoin Capital, and Jump Crypto—are actively negotiating with potential supporters to raise about $1 billion to purchase SOL. Insiders revealed that these three companies have hired Wall Street investment bank Cantor Fitzgerald LP as the lead underwriter for this transaction and plan to acquire a yet-to-be-disclosed public entity to create a digital asset financial company focused on Solana, with the deal expected to be completed in early September.

On the other hand, cryptocurrency fund Pantera Capital announced on August 26 its plan to raise up to $1.25 billion to acquire a Nasdaq-listed company and rename it "Solana Co." This new company will focus on accumulating SOL as its core business and further develop the Solana ecosystem.

From the above developments, it is clear that Solana treasury companies are gradually becoming a key force driving the development of the Solana ecosystem. As more and more listed companies buy SOL and leverage staking operations for returns, this will undoubtedly bring high-intensity capital support to the Solana network.

So, why are institutions inclined to choose Solana?

The reason is not complicated. The rise of the DAT model has opened up a new path for institutional investors to capture value. With this model, institutions can hold cryptocurrencies, waiting for price increases to realize asset appreciation, while also participating in various DeFi protocols to obtain stable returns, thus achieving diversification and multiple forms of asset appreciation.

In fact, traditional financial institutions are not only focused on Solana; leading tokens such as XRP, BNB, and LINK have also garnered attention and investment from listed companies to varying degrees. This phenomenon indicates that institutions are implementing a mature strategy to layout the entire cryptocurrency field. However, compared to other tokens, Solana's significant technical advantages have made it enter the institutional spotlight earlier and more easily gain institutional favor.

As mentioned earlier, Solana stands out in balancing the three major challenges of blockchain: decentralization, security, and scalability, thanks to its high-speed transaction processing capabilities and low gas fees. Additionally, Solana has a relatively mature network and ecosystem.

In addition to the aforementioned advantages, similar to Bitcoin and Ethereum, SOL treasury companies typically use common fundraising methods such as issuance and private placements. However, according to information disclosed by some listed companies, they can acquire SOL at a discount below the spot price with a lock-up period. This operational approach helps reduce accounting risks while minimizing the impact of secondary market volatility. For example, Upexi's SOL holding structure shows that about 57% of its SOL was purchased through a locking agreement at a discount to the spot price; Sharps Technology signed a letter of intent with the Solana Foundation to purchase $50 million in SOL at a 15% discount to the 30-day average price.

Such purchasing models have, to some extent, reduced the cost for listed companies to buy SOL, increasing their enthusiasm for entry. Moreover, currently, the proportion of SOL held by listed companies in the circulating supply is extremely low, far less than that of Bitcoin and Ethereum, which also means that SOL still has significant upside potential in terms of institutional holdings.

Subsequently, with the large-scale influx of institutional capital, the liquidity structure of SOL is bound to undergo fundamental changes, potentially forming a more stable yet relatively concentrated holding pattern. At the same time, this will provide strong support for SOL's price. From Ethereum's development experience, its price successfully broke historical highs last month due to institutional buying. If a similar trend occurs with SOL, its price is also expected to enter a relatively stable upward channel.

Additionally, a Solana spot ETF is expected to become a significant boost for its development.

Currently, many well-known asset management companies, including Franklin Templeton, Bitwise, Fidelity, Grayscale, 21 Shares, Invesco Galaxy, and VanEck, have submitted S-1 registration statement amendment documents for a spot Solana ETF to the U.S. Securities and Exchange Commission (SEC). Moreover, the number of institutions interested in joining this lineup continues to grow. Compared to other cryptocurrencies, the active layout of Solana spot ETFs by numerous institutions is undoubtedly a significant advantage for Solana. Furthermore, the promotion of Solana spot ETFs is closely linked to the development of the Solana DAT market and institutional-level narratives, with current market expectations even suggesting that Solana ETFs may be approved this year.

Once these Solana ETFs are approved for launch, they will unleash a new wave of institutional capital. On one hand, this will reduce the supply of SOL circulating in the market; on the other hand, it will provide structured investment exposure for those unwilling to hold digital assets directly, which could very likely change the price dynamics of SOL.

It is worth mentioning that the development trend of tokenization on the Solana chain is also noteworthy, as it is steadily transitioning from a "high-performance blockchain" to an "internet capital market." For example, Nasdaq-listed company Galaxy Digital has partnered with Superstate to successfully tokenize its SEC-registered stock GLXY on the Solana blockchain; Hong Kong's Fosun has also tokenized $328 million worth of medical company stock and issued it through platforms like Solana and Ethereum.

Conclusion

With the entry of institutional capital, is it possible for Solana to break historical highs in this cycle? I believe it is unlikely in the short term, but from a long-term perspective, it has ample room for growth.

Regardless of whether the Solana spot ETF can be successfully approved, the development of the Solana DAT market may not be smooth sailing. According to The Information, Nasdaq is strengthening its scrutiny of companies holding large amounts of cryptocurrency. Some companies have raised funds to purchase crypto assets to enhance their stock performance. Nasdaq has expressed concern over this behavior, believing it may mislead investors, and has decided to strengthen regulatory measures.

Although Nasdaq has not yet announced specific regulatory measures, it is expected to require relevant companies to disclose detailed information about their cryptocurrency asset investments, covering investment scale, strategies, and potential risks. While this move will help promote greater compliance and maturity in the field, it will undoubtedly hinder the process of some listed companies purchasing cryptocurrencies like Ethereum and Solana in the short term. From a broader regulatory perspective, the impact of U.S. government cryptocurrency regulatory policies on Solana's development will be more significant compared to Bitcoin and Ethereum. For example, in July 2024, the U.S. Commodity Futures Trading Commission (CFTC) ruled that Bitcoin and Ethereum are digital commodities under the Commodity Exchange Act, rather than securities, but Solana has not yet received such clear recognition from regulatory agencies.

Fortunately, at the end of August, the U.S. Department of Commerce synchronized core economic data such as GDP with public chains like Bitcoin, Ethereum, and Solana, which has somewhat strengthened Solana's position as infrastructure.

On the other hand, Solana also faces centralization risks, as the number of its validating nodes is only about 3,000, compared to over 800,000 nodes for Ethereum, creating a significant disparity that makes its systemic risk relatively high. The large-scale influx of institutional capital may further impact the decentralization of the Solana network.

Additionally, on the technical front, unlike Ethereum's recent network performance expansion, Solana has not rested on its laurels. On September 2, the Solana community governance process was completed, passing the SIMD-0326: Alpenglow proposal with 98.27% in favor, 1.05% against, and 0.69% abstaining. This upgrade will enhance the finalization time of the Solana network to 125 milliseconds, significantly improving its network performance.

In summary, although the Solana ecosystem and network activity are currently relatively flat, the growing institutional demand will drive the price of SOL upward in the short term. From a long-term development perspective, Solana is also expected to continue maintaining a rapid growth trajectory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。