Why Strategy Miss S&P 500 Race Even With the Passed Requirements?

Michael Sayloy’s Strategy miss S&P 500, shocking everyone where it was expected by many to be added this week . The hopes towards it were so high as the bitcoin admirer meets every possible qualification whether it is market capital or profits. The decision leaves investors in a perplexity that why BTC- based company missed the race where another crypto involved firm, Robindhood, made it?

Let’s dive a little deeper to understand the judgment anomaly and possible factors behind "Strategy Miss S&P 500".

Source: X

Committee’s Secretive Role, Is Criteria not a Major Base?

The S&P 500 index is not purely automatic. Surely, companies must meet criteria such as profitability, trading activity, and market capitalization, where Strategy is standing firmly with its market value above $92 billion, strong trading volumes, and more than $5.3 billion in profits over last year.

But the final decision depends on the index committee. This is a group of 10 members to vote on which companies are admitted. Analysts often called it a “secretive committee,” since its decisions are not always explained in detail.

Why Bitcoin Giant, MSRT Was Left Out

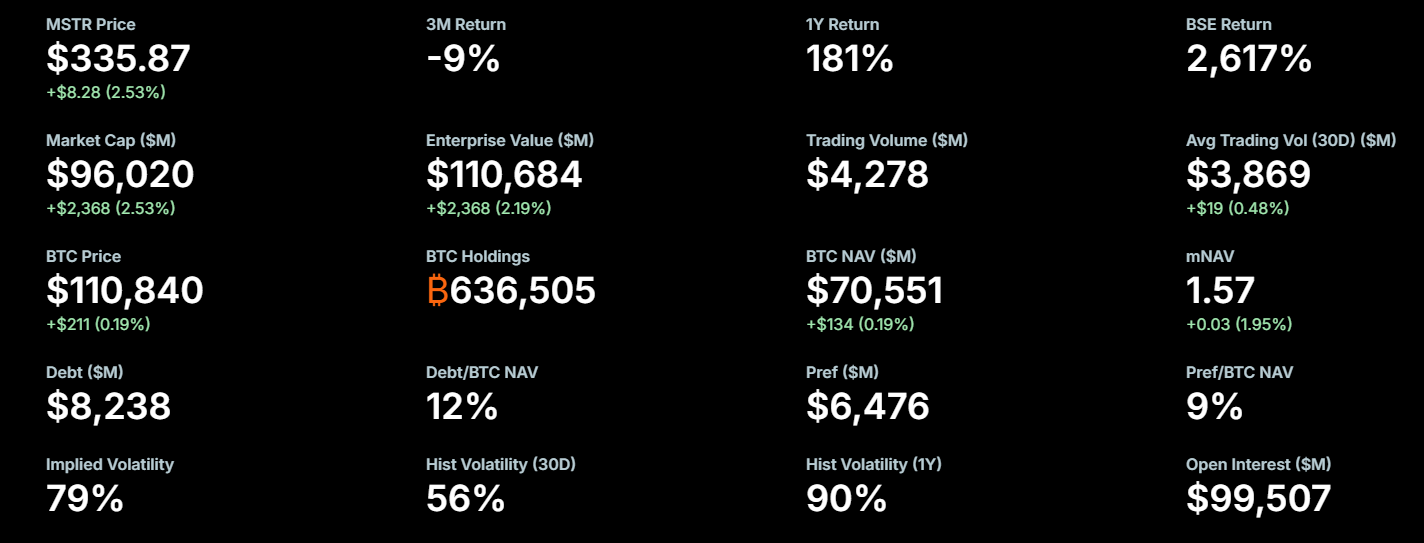

Bloomberg reported that the committee may have concerns about companies’s unique business model, which involves holding massive amounts of bitcoin . The company currently owns more than 636,000 BTC, making it the largest corporate Bitcoin holder in the world.

However, its stock is also highly volatile, with average 30 day price swings of 95%, which may have influenced the decision.

Robinhood Gets the Nod Instead

Instead of Strategy, the committee added Robinhood Markets (HOOD), a trading platform with growing crypto services. Robinhood’s stock jumped more than 7% in after hours trading after the announcement. Other new entrants included Applovin Corp (APP) and EMCOR Group (EME), while companies like MarketAxess and Caesars Entertainment were removed.

Source: MarketWatch

Crypto in the S&P 500

Until this only two crypto linked organisations had made it into the index. Coinbase (COIN), major cryptocurrency exchange, became the first to be added in May, and later on Block (SQ), added in July. Robinhood’s entry m,eans there are now three digital assets involving firms in the index, but Strategy has to wait.

Impacts of the Unexpected Judgement

Inclusion in the S&P 500 often boosts a company’s stock as we see in Robinhood's case because it attracts investment from large funds that follow the index. For Strategy miss S&P 500, facing a nearly 3% drop where it enjoyed the up before the news.

Still after all this, experts strongly believe that the company has a high chance in the future if the committee becomes more comfortable with its crypto balance sheet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。