Author: Luo Luo

Recently, many users who contributed trading volume on Binance Alpha to earn airdrops have been shouting "I quit." The reason is that at the end of August, the point thresholds for the two rounds of new asset airdrops reached new highs, raising the "priority claim" and "first come, first served" airdrop thresholds to 260 and 230 points, respectively.

The high points and users calling for a "withdrawal" are reminiscent of the Alpha market atmosphere in May and June of this year. It was only after the implementation of the "point consumption" and "point tier" rules that the enthusiastic users of Alpha in July were able to navigate smoothly, pushing Binance Alpha's trading volume to the $10 billion level.

Now, the scenario of high trading volume and high claim thresholds has reappeared, and Alpha is increasingly becoming a platform that tests user loyalty. After low-point users consider giving up, where will Alpha go next?

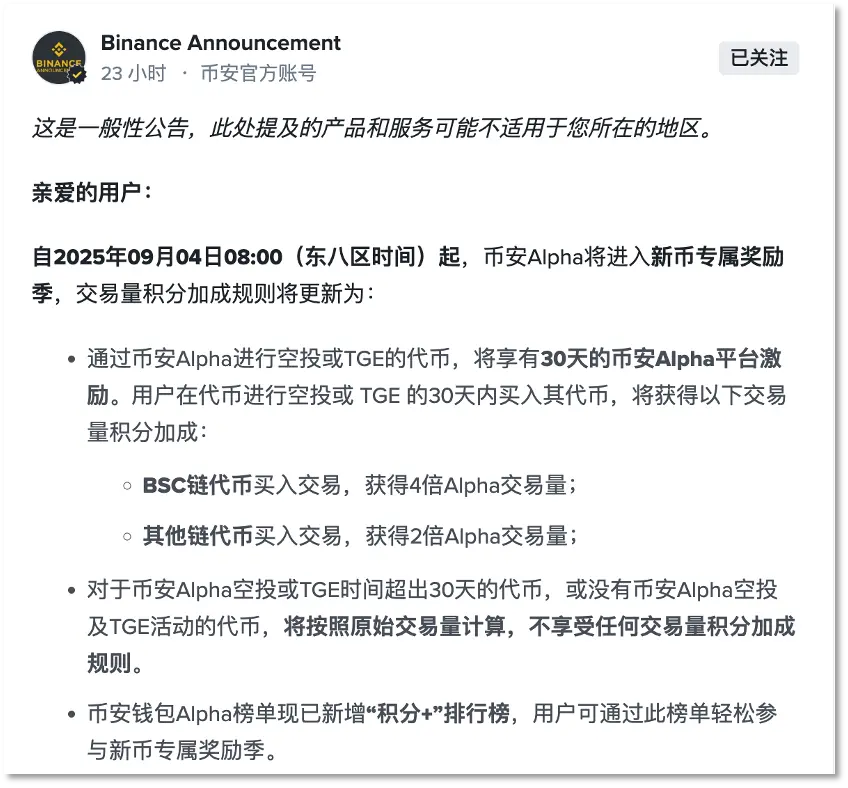

On September 4, the Alpha point rules were upgraded again, and new projects for airdrops/TGE will receive a 30-day "new user support period," during which users who buy these new tokens will earn points based on "super doubled" trading volume. Tokens on the BSC chain will receive a 4x trading volume bonus, while other chains will receive a 2x bonus. This rule will increase users' trading volume point returns, but users also need to be aware of the volatility risks of new tokens.

The "differentiated treatment" of BSC chain and other chains in this rule once again signals Binance's intention to support Alpha in the Web3 market.

In just over half a year, Binance Alpha has launched over a hundred airdrop events, and the trading volume and liquidity growth driven by incentives have made this platform seem even more attractive than the main Binance site, resembling a small clone market.

As a "frontline" for Binance to improve new offerings, Alpha is testing various Web3 projects in the real trading market. Looking at the performance of Alpha airdrop tokens over the past three months, there have been 3-4 projects each month that have entered the main Binance site and emerged as "blockbusters," changing the earlier predicament of project tokens "peaking upon listing on Binance."

The recently launched Alpha 2.0 market maker program indicates that this segment, which has evolved from the Web3 Wallet, is trying to make Alpha a larger "cake."

Why the "Super Size" Alpha Points?

On August 28, the two projects that raised the Alpha airdrop point thresholds were DOLO and BLUM.

First, DOLO, which adopted a phased point claim system, had a point exposure of 260 points for the "priority claim" phase, the highest since the launch of Alpha airdrops; the second phase's "first come, first served" threshold also rose from the unchanged 200 points over 11 consecutive rounds to 230 points.

Users waiting for high-point players to finish claiming DOLO and then lower their points for the next BLUM airdrop were surprised to find that the "first come, first served" threshold for that airdrop was also pushed to 230 points.

While some were shouting on social media that "it's unplayable" and "I quit," others were converting the DOLO and BLUM airdrops into $48 and $28, respectively.

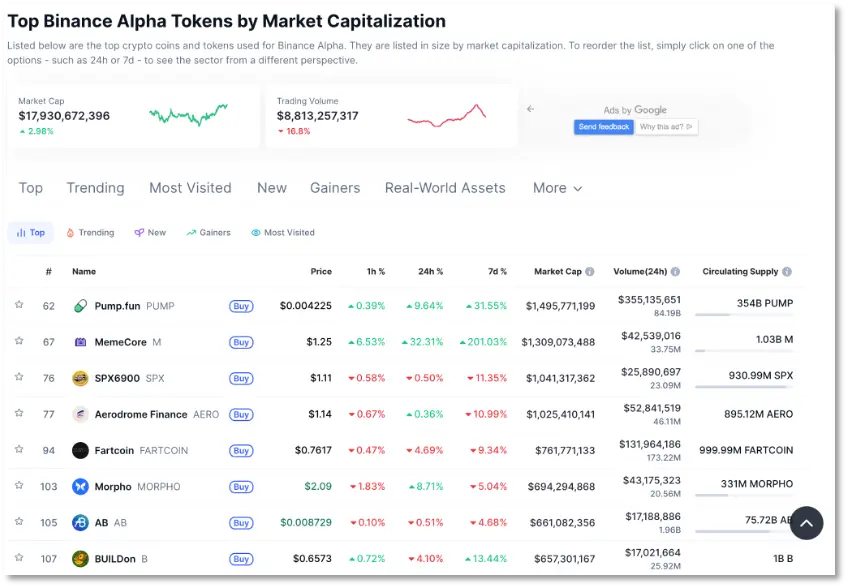

The high airdrop thresholds suggest that Alpha's trading activity is on the rise. According to CoinMarketCap data, two weeks ago, the overall market cap of Binance Alpha tokens was $17.4 billion, with a trading volume of $8.83 billion. With the launch of new tokens, the trading volume in the following week rose to $10.015 billion, maintaining a market cap level of $17.1 billion. As of September 4, the trading volume was $8.813 billion, and the market cap was $17.93 billion.

As of September 4, Binance Alpha's trading volume was $8.813 billion.

With high points, traders and point farmers are still present, a scene reminiscent of the Alpha operation in May and June, accompanied by Binance's dynamic adjustment measures over two consecutive months.

Essentially, Alpha Points is an initiative aimed at rewarding users for actively participating in the Binance ecosystem, officially launched on April 25 of this year, allowing users to accumulate points based on both balance and trading volume, and meet the point standards to claim new airdrop tokens. Before this, some users had keenly captured early opportunities, accumulating a significant amount of token airdrops with only a small amount of trading, quietly amassing over ten thousand dollars in earnings within a month, with a "daily salary" of nearly a thousand dollars.

On the very day the point system was launched, the number of active users on the Binance wallet surged by over 58%—from 44,967 to 71,228, and trading volume doubled within 24 hours—from $48.46 million to $118 million.

The competition began. Binance has been dynamically balancing the reward distribution for participants by iterating the point rules; at the same time, it has strengthened risk control to maintain the fairness of the activities.

In May, as the point claim threshold for Alpha airdrops was about to rise from double digits in April to triple digits nearing 200 points, on May 13, Binance Alpha's point system was upgraded, introducing a "consumption mechanism," meaning users need to actually consume 15 points when confirming participation in Alpha or TGE.

Point consumption and lowering thresholds, Binance attempted to adjust the rules towards benefiting contributors and suppressing excessively high points to allow newcomers to "get on board." However, it took nearly half a month for the "point consumption" to truly lower the threshold to around 200 points, roughly corresponding to the 15-day accumulation cycle.

User @Mingo shared his earnings on social media, stating that the 24th round of Alpha and TGE airdrops earned him $1,795 that month, after deducting $133.5 in trading costs, resulting in a "monthly salary" exceeding $10,000, with the minimum earnings per round valued at $70. Among them, the blockbuster project NXPC (Adventure Island) had a threshold of 187 points, directly pushing many users' single round earnings to $600 or even over a thousand, setting a historical record for Alpha airdrop earnings and undoubtedly becoming @Mingo's highest "daily salary" that month.

Image from Binance user @Mingo Ming Ge's social media post.

Undoubtedly, the high earnings from early Alpha airdrops have been a continuous attraction for users to participate. However, studio teams working together have long been viewed by ordinary users as a major threat to the fairness of Alpha airdrops. Photos of multiple phones competing for Alpha and recruitment ads for studios seeking dedicated airdrop grabbers have circulated widely on social networks.

In response, Binance initiated a crackdown. In early June, certain teams using bots to participate in Alpha activities were detected by Binance, which made it clear that any behavior using bots (including but not limited to scripts, automated tools, or other non-manual methods) would be considered "violations." The company has upgraded its risk control system to enhance the detection and handling of violations, and accounts triggering risk control will have their eligibility for Alpha points revoked.

In the Binance internal social section "Square," many reported being popped with violation reminders, with some successfully appealing and others failing.

However, the weekly active users still pushed the threshold for directly claiming airdrops based on points to between 210 and 251 in June.

Starting June 19, Binance iterated the point rules again, and Alpha airdrops began to adopt a two-phase distribution mechanism. The first phase set a high point threshold for priority claims within a limited time, while the second phase lowered the points to a certain level and distributed them to qualifying users on a first-come, first-served basis.

After the phased point rules were introduced, many users found that claiming/grabbing airdrops required "machine testing," with face recognition and slider verification to prove they were human.

Binance once again strengthened its ability to identify bot cheating, and the Alpha points remained relatively stable in July. In the 31st round of Alpha airdrops (excluding TGE), the highest point for "priority claim" was 234, appearing only in the first round of PEAQ airdrop, with single round earnings around $45; the lowest point was 210, from the BGSC at the beginning of the month and RCADE on July 10, with single round earnings around $40; while the "first come, first served" threshold fluctuated between 120-190 points and basically stabilized at 200 points.

According to a user feedback, after accumulating to a high threshold of 240 points, he claimed 5 rounds of airdrops in July, with net earnings around $240 after costs, averaging about $48 per round, "which is obviously much lower than the previous two months."

In August, the "first come, first served" threshold, which was almost primarily around 200 points, was broken by the 230 points at the end of the month, and the internal competition for Alpha airdrops continued. A Dune report indicated that the weekly active users of Binance Wallet transactions had climbed from over 120,000 at the beginning of the month to over 180,000 by the end of the month.

On September 4, Alpha updated the trading volume rules for points.

Finally, on September 4, Alpha adjusted the point rules again, introducing the "Points Plus" feature, which allows for "super doubled" trading volume points for new tokens in airdrops/TGE, providing an "accelerator" for users keen on accumulating points and obtaining airdrops, thereby increasing point returns.

The "30-day trading volume doubling period" rule, in the view of KOL @BitHappyX, "is a redistribution of resources and benefits": while restricting the arbitrage model of studios, it shifts resources and traffic to real participating users and new projects.

He explained that since old tokens only retain 1x trading volume points, this will cut off the channel for studios to acquire points through large-scale purchases on stagnant old tokens, compressing their arbitrage space; while new tokens enjoy point bonuses, their prices often fluctuate significantly in the first month (within 30 days). Although ordinary users will also face risks, studios pursuing high points and heavily investing will clearly bear higher financial risks.

He predicts that under the circumstances of insufficient point advantages for old tokens and significantly increased risks for new tokens, some studios will be forced to abandon "fake activity" or even directly exit Alpha.

As Winson Liu, the global head of Binance Wallet, emphasized, "By rewarding participation, we provide a fairer way for truly loyal users of Alpha to engage, while also enabling Binance Alpha to support more quality Web3 projects."

Does the "Selection Pool" Work for Binance's Token Listings?

After running for over eight months, Binance Alpha has distributed over a hundred airdrops. When the trading volume of this segment broke $10 billion, the continuously surging trading volume indicated that this ecosystem strongly stimulated user interest, allowing Alpha to form a momentum cycle independent of the traditional altcoin market, continuously validating market projects for Binance through the hard metric of trading.

In fact, as early as December last year, when Binance announced the launch of Alpha, it intended to use this on-chain DEX within the Binance wallet as a new token selection pool for the main site. Although it does not guarantee that Alpha tokens will definitely be listed on the main site, the cases of certain projects conducting exclusive TGEs (Token Generation Events) on the Binance wallet being listed on the main site at the beginning of the year enhanced the external perception of Alpha as a "token candidate area."

At that time, Binance was troubled by public opinion issues such as "poor quality of listed tokens" and "friend tokens," prompting co-founder He Yi to respond to doubts multiple times, repeatedly publicly stating the listing standards and emphasizing "strict selection." Binance also initiated a "vote for listing/delisting" rule.

Although Binance later intended to slow down the pace of new listings, the downward trend of most new assets "peaking upon listing" was not effectively improved.

Against this backdrop, Binance Alpha officially "went live for testing," and the results proved that no promise is better than transforming user demands into effective products and experiences, which is what Binance excels at.

On March 18, Binance Alpha 2.0 was born by integrating into the main site, breaking the boundaries between centralized exchanges (CEX) and Web3 wallets, allowing CEX users to directly purchase various newly emerging early project tokens with assets like USDT and USDC within the platform.

Winson Liu clearly stated, "The Binance Alpha platform serves as a token selection pool before listing, aiming to enhance the transparency of the token listing process on Binance exchange. By publicly recommending selected early projects, the Alpha platform can strengthen community trust and provide users with insights into tokens with future development potential within the Binance ecosystem."

As the number of Alpha tokens increases, the number of projects in the selection pool grows. Will the new listings on the Binance main site explode due to the emergence of new tokens? Have these projects selected by Alpha brought improvements to Binance's token listings?

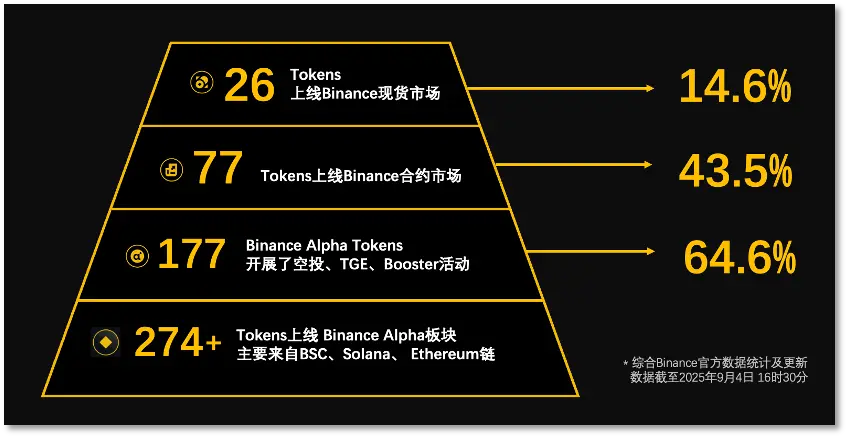

As of September 4, CoinMarketCap recorded a total of 274 token projects listed on Binance Alpha that generated trading activity. Combining Binance's official data from August 18 and subsequent updates, among the projects listed on Alpha, 177 tokens conducted TGE/airdrop/Booster activities, accounting for 64.6%; of these, 26 entered the spot market on the Binance main site, accounting for 14.6%, and 77 were listed on the contract market, accounting for 43.5%.

The conversion rate of Alpha airdrop tokens listed on the spot market is 14.6%.

According to data compiled by DWF Labs in June, at that time, among the more than 190 tokens in the Binance Alpha segment, 18 were listed on the spot market of the Binance main site, resulting in a conversion rate of 9.5%. Comparing this with the data two months later, only 26 out of 274 Alpha tokens were listed on the spot market, maintaining a conversion rate of 9.48%.

It is evident that even with Alpha as a pre-selection pool, Binance has maintained an almost unchanged conversion rate under the "strict selection" standard.

Looking at the Alpha tokens listed on the Binance main site, the vast majority have launched TGE/airdrop/Booster activities, with airdrops being the most frequent and the channel through which tokens are most often listed on the Binance spot or contract markets.

Hive Tech has compiled statistics on the 107 airdrop tokens launched by Binance Alpha from June to September, with a total of 13 tokens listed on the spot and contract markets of the Binance main site, and 19 tokens listed solely on the contract market.

Performance of Alpha airdrop tokens after being listed on Binance spot market.

From the performance of these 13 Alpha tokens listed on the Binance spot market, as of September 4, 8 tokens fluctuated with the overall decline in the current cryptocurrency market, but the current prices of PROVE, ERA, SAHARA, and SPK remained strong, showing increases of 1-5 times compared to their opening prices, with SPK having the highest increase at 501%. Only 3 tokens significantly (over 10% drop) fell below their opening prices, with RESOLV, which launched in June, performing the worst, down 51.8% from its issuance price.

Among the 13 projects, 9 tokens had ATH (All-Time High) prices that increased by over 100% compared to their opening prices on the first day, with the lowest increase still above 40%. The ATHs of PROVE, SAHARA, ERA, and SPK increased by 540%, 737%, 928%, and 1922%, respectively, compared to their opening prices on the Binance spot market.

If we take the closing price on the day of the Alpha airdrop as a reference, except for LA, which was listed earliest (-9.1%), the remaining tokens still achieved a minimum increase of 20% in their ATHs after being listed on the Binance spot market. The ATHs of TREE, SPK, and C soared by 123%, 476%, and 245%, respectively, compared to the closing price on the day of the Alpha airdrop, demonstrating Binance's ability to support project tokens.

The performance of these new tokens has greatly surpassed the new projects launched by Binance at the end of last year, breaking the "vicious cycle" of new projects frequently falling below their listing prices on Binance. This indicates that the combination of Alpha and the "airdrop" strategy for token listings is indeed playing a "selection" effect.

Accelerating Towards the Core Web3 Market

As the number of projects increases, the "peak upon listing" situation has now appeared in the Alpha trading area. This aligns with the market attributes of Alpha as an emerging Web3 on-chain platform: projects are relatively early, and on-chain liquidity is poor.

However, Binance plans to make changes.

First, the new Alpha point rules announced on September 4 focus more on newly launched projects, which are expected to bring real trading volume from the market, while also amplifying Binance's "one fish, multiple eats" effect.

From the rules, BSC, which occupies the mainstream issuance chain among Alpha tokens, remains a key ecosystem supported by Binance, incentivizing BNBChain with "4x trading volume" (previously unlimited time, 2x). On-chain activity and fee income are expected to rise as a result; the trading efficiency and price performance of new project tokens in the Alpha trading area may also improve with increased user trading participation.

In addition to improving the trading performance of new tokens from a traffic perspective, on August 28, Binance officially announced the launch of the Alpha 2.0 limit order market maker program, inviting users with extensive trading experience in DEX to join, offering zero trading fees for limit buy/sell orders and exclusive API access to Alpha.

Binance is leveraging its strategic advantages cultivated over years in CEX to fill the "liquidity" gap for Alpha as a core Web3 market, while its long-standing advantages have gradually become apparent over the past six months.

Since Alpha has attracted a large number of users to participate in trading through airdrops and trading competition rewards, the number of active users on Binance Wallet has already ranked among the top in the global mainstream Web3 wallets. Additionally, most tokens listed on the Binance Alpha platform originate from the BNBChain, with 77% of the tokens from the airdrop between June and August coming from BNBChain.

The latest report from Messari on BNBChain for Q2 2025 shows that BNBChain maintained strong growth in the second quarter, with user activity and on-chain transactions reaching all-time highs. Daily active addresses and transaction volumes surged, DeFi activity remained robust, and DEX trading volume, as well as the number of stablecoin transactions and active users, ranked first across all chains, solidifying its leading position in the Web3 ecosystem.

Among them, in terms of market capitalization and investor confidence, BNB's market cap increased by 7.5% quarter-on-quarter, reaching $92.6 billion; in terms of on-chain transactions and activity, with fees dropping by 90% to 0.1 gwei, BNBChain's average daily transaction volume increased by 101.9% quarter-on-quarter to 9.9 million transactions, and the number of daily active addresses grew by 33.2% to 1.6 million; in May, 17 million new addresses were added; in terms of DEX performance, it ranked first in trading volume across all chains, with an average daily trading volume of $3.3 billion in Q2, with PancakeSwap, which undertook a large volume of Alpha trading, holding an 85.1% market share.

Active users, surging traffic, and DEX trading volume are attracting project teams to build on BNBChain. An OG in the cryptocurrency asset circle openly suggested in the community that innovative projects should deploy directly on BNBChain, stating, "Low transaction fees and high traffic are what early projects most want to achieve, and BNBChain can almost meet all of these needs. Project tokens also have the opportunity to enter Alpha and even receive support from Binance, so why not?"

Winson Liu, the global head of Binance Wallet, believes that the surge in trading volume represents a change in how users interact with Web3, stating, "Binance Alpha is redefining how users discover early projects and receive real rewards—we are setting a new standard for Web3 users to participate preferentially."

As the DEX functionality in the Binance Web3 wallet gradually becomes an important section of the main site, Alpha is developing towards the core product direction of Web3, which is evident from the richness of its interface.

Initially, Alpha was displayed alongside Binance's spot and contract trading functions on mobile; later, due to the introduction of the point system, it had a separate airdrop interface similar to Launchpool; subsequently, this interface not only featured airdrops but also allowed users to access trading competitions, financial management, TGE, and Booster tasks with one click, effectively integrating the user-favorite features of the Binance Web3 wallet into a single interface.

Now, users no longer need to enter their wallet addresses on third-party websites to calculate accumulated points based on trading volume; Alpha directly provides an estimated value for users' points reference.

Currently, projects landing on Alpha are achieving effects close to being listed on the Binance main site—gaining optimal exposure for projects, capturing strong traffic from top platforms, and obtaining effective market liquidity. Binance Alpha is increasingly taking on the shape of a core Web3 market. The new rule of doubling points for trading volume also means that new listings on Alpha will continue, and as this "cake" grows larger, "airdrops" will have the opportunity to become a continuous benefit for users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。