The "meme launchpad battle" between pump.fun and Letsbonk.fun can now be pre-ordered as one of the most exciting crypto stories of the year. In the blink of an eye, we have arrived at early September, and pump.fun has regained the upper hand in this back-and-forth competition.

When thinking about how the "meme launchpad battle" began, my first reaction is that pump.fun's brilliant performance throughout 2024 and into this year has stirred the desire of many projects to "slice the cake."

In fact, this "meme launchpad battle" is not merely a war between asset issuance platforms. The moment pump.fun launched PumpSwap, transforming into an asset issuance + trading platform, this competition became inevitable. The opposing sides are pump.fun and Raydium.

Honeymoon Period

pump.fun and Raydium had always maintained a symbiotic relationship. Before the birth of PumpSwap, pump.fun served as a meme coin issuance platform, and when the market cap of new meme coins on it reached $69,000, they would migrate to Raydium for trading.

New meme players entering the market often found the concepts of "internal market" and "external market" confusing, as the same coin had two different contract addresses, which was caused by this process.

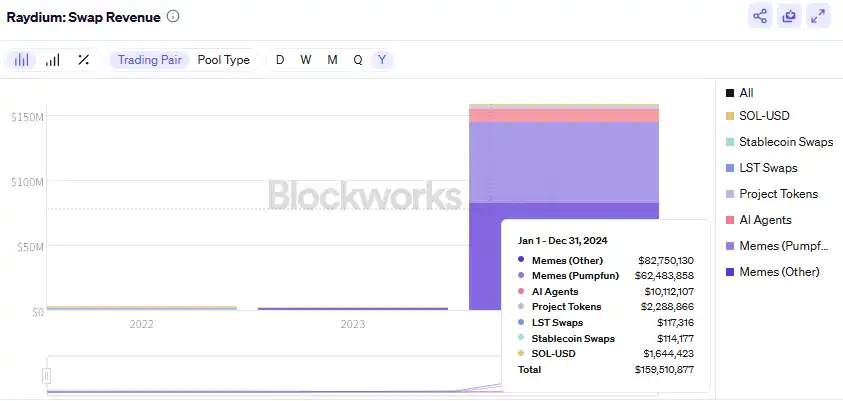

In 2024, not only was it the golden age for pump.fun, but it was also the golden age for Raydium. According to data from Blockworks, Raydium's trading fee revenue in 2024 was approximately $160 million, more than five times that of 2023. Among this, revenue from meme coin trading reached about $145 million, accounting for over 90% of the total annual revenue. Of this, meme coins from pump.fun contributed approximately $62.5 million in revenue, making up about 43% of meme coin revenue and about 39% of total revenue.

For Raydium, pump.fun was like a rapidly developing "printing machine," standing at the upstream of liquidity, while it sat steadily at the downstream of liquidity. You eat on one side, I eat on the other.

Divergence

The honeymoon period between the two lasted until late February of this year.

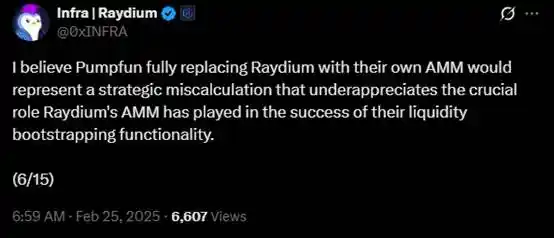

On February 24, someone on Twitter discovered that pump.fun was testing its own AMM liquidity pool. The next day, Raydium core contributor @0xINFRA published a lengthy tweet sharply criticizing this move. This long tweet was already filled with a strong sense of hostility, essentially emphasizing that Raydium played a significant role in pump.fun's success and that recent data showed Raydium was not so dependent on pump.fun. His sharpest words were in the following excerpt:

"pump.fun replacing Raydium with its own AMM is a strategic misjudgment."

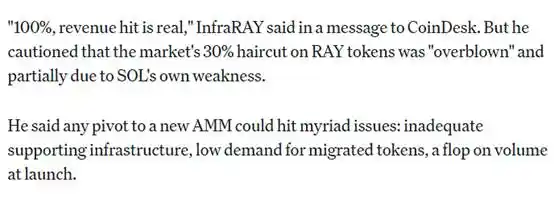

In response to CoinDesk, @0xINFRA continued to express that the breakup was not so bad for Raydium and voiced his concerns about pump.fun, stating, "Any new AMM could encounter countless problems: inadequate infrastructure, low demand for migrating tokens, declining trading volume."

This news indeed dealt a blow to Raydium's token price, with $RAY experiencing a nearly 30% drop, falling from $4.2 to below $3. The decline continued until mid-April, with the lowest point dropping to around $1.5.

On March 21, pump.fun officially announced PumpSwap, meaning that the coins pumped would no longer have an internal and external market distinction. However, just two days before the announcement of PumpSwap, on March 19, Cointelegraph revealed that Raydium was about to launch its own launchpad, named "LaunchLab."

Raydium's official announcement did not come until nearly a month later. On April 16, Raydium officially announced LaunchLab.

The sweet days of "Brother, you stand at the bow, and sister, I sit at the stern" were no more. These two biggest winners in the 2024 Solana meme coin frenzy were now going downstream and upstream, respectively, each brandishing their swords at the territory held by the other.

The Great Battle

You might wonder why Raydium's LaunchLab hasn't made much noise; isn't the main event of the meme launchpad battle between pump.fun and Letsbonk.fun?

Letsbonk.fun was indeed created using Raydium's "Plug & Play SDK." Simply put, it can be understood that Letsbonk.fun is just a customized version of Raydium LaunchLab.

According to data from defillama, in April, May, and June, PumpSwap's total fee revenue and net fee revenue both exceeded Raydium's. By July, when Letsbonk.fun suppressed pump.fun, Raydium's total monthly fee revenue was about 2.76 times that of the previous month, and net fee revenue was about 4.66 times that of the previous month. Meanwhile, in July, PumpSwap's monthly total fee revenue was only about 30% of Raydium's, and monthly net fee revenue was only about 18% of Raydium's.

From this perspective, pump.fun's recent continuous support for its own ecosystem's "new coins" on Twitter, even establishing the Glass Full Foundation to directly purchase its own ecosystem's meme coins, can be rationally explained—PumpSwap's performance as an asset trading platform is strongly correlated with pump.fun as the upstream asset issuance platform, because PumpSwap's foundation is still shallow, relying solely on the meme coins it produces.

While many on-chain players feel despair over the meme coin market, stating that the current meme coin market is "hellishly difficult," the coins supported by pump.fun have maintained relative strength amid the overall volatility of the cryptocurrency market. Whether it's $USDUC, $NEET, or $TOKABU, these meme targets on pump.fun have provided ample "boarding" time in the $1 million to $3 million market cap stage, steadily rising to nearly $30 million market cap or even more.

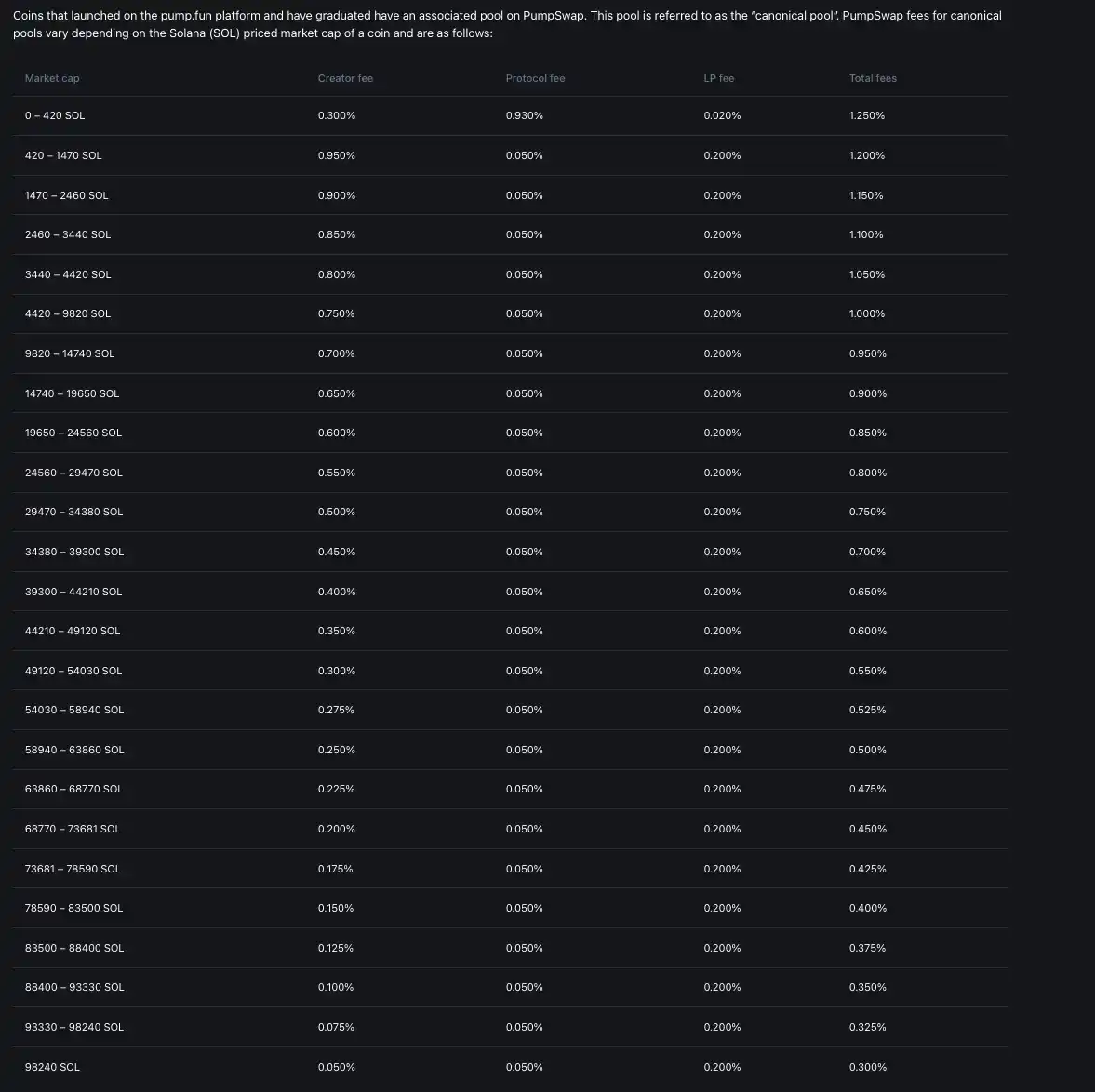

Last week, pump.fun released the "Project Ascend" update, with the most core change being the Dynamic Fees V1 system. This new tiered creator fee structure completely alters the previous fixed-rate model. In the past system, creators received the same proportion of trading fee sharing regardless of the token's market cap. Now, the system introduces a dynamic rate linked to market cap—tokens with higher market caps have lower creator fees, while smaller projects continue to contribute higher fees. The logic behind this design is to encourage creators to focus on the long-term growth of the token rather than short-term cashing out.

The fees and content creator earnings corresponding to different market cap tokens on PumpSwap

Dynamic Fees V1 applies to all PumpSwap tokens, including newly issued and existing tokens, while maintaining the same protocol and liquidity provider fee distribution. For those "abandoned" projects where creators have disappeared, the fees will flow to the community. CTO projects can apply to receive creator fees, and Pump.fun promises to significantly expedite the approval process.

pump.fun officially claims that this update will increase the potential earnings for creators by tenfold. For those creators who can successfully operate token ecosystems, this means they no longer need to profit by selling their holdings but can obtain stable income through continuous trading fee sharing. This shift in model is a key step for Pump.fun in addressing the prevalent "pump and dump" issue in the memecoin ecosystem.

The future path chosen by pump.fun is "CCM" (Creator Capital Markets). Whether it is introducing more live streamers or solving the sustainability issues of meme coins, essentially, pump.fun aims to attract more quality creators currently on social media platforms like Twitch and TikTok through "content monetization," launching a vampire attack on the creator economy from Web3 to Web2.

On the other hand, Letsbonk.fun has chosen to strive in a different direction. On September 1, WLFI's official Twitter announced that USD1 was launched on Solana, stating, "Solana needs a dollar that is as vibrant as its core: instant execution, permissionless, and globally accessible. USD1 is backed by reserve assets 1:1 and was integrated with Raydium, BONK.fun, and Kamino on the first day of its launch on Solana, bringing digital dollar stablecoins into the internet capital market." BONK.fun's official Twitter announced that it would become the official USD1 launchpad for WLFI on Solana.

Not long ago, Letsbonk.fun's leading token $USELESS was also listed on Coinbase. These two events reflect that Letsbonk.fun's advantages lean more towards resource integration capabilities. With years of development in the Solana ecosystem, Letsbonk.fun continues to play its cards.

It is impossible to compare the merits of these two development paths; it can only be said that pump.fun and Letsbonk.fun have already presented different development visions, and both are cleverly leveraging their strengths. As for what the future holds, only time will tell.

Conclusion

The "meme launchpad battle" was actually ignited by the shift from a cooperative symbiotic relationship between pump.fun and Raydium to competition. On the surface, it is pump.fun vs Letsbonk.fun, but in reality, it is pump.fun + PumpSwap vs Letsbonk.fun + Raydium.

In this intense commercial competition, we have indeed seen some better changes, such as the creator reward mechanism and incentives for CTOs or those who can sustainably operate meme coins. Only with sufficient competition can the market improve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。