Author: David

In the summer of 2025, "Digital Asset Treasury" (DAT) is undoubtedly the hottest topic in the capital markets. From the continuous accumulation of Bitcoin (BTC) by the leading treasury player Strategy to various small and medium-sized listed companies directly purchasing crypto assets through financing, the DAT model has been endowed with the narrative of "crypto version of reserve assets," with stock prices often soaring following announcements.

However, with the apparent slowdown in Bitcoin treasury expansion and news of increased scrutiny from U.S. regulatory agencies (Extended Reading: Nasdaq Takes Action! Strict Regulation of "Coin Speculation" Listed Companies), the heat of this market is facing scrutiny. How long can the DAT market remain hot under the cold water of regulation?

The "Wealth Flywheel" of the DAT Model

The core logic of the DAT (Digital Asset Treasury) model is: listed companies raise funds through stocks, bonds, convertible bonds, etc., and then use the raised funds directly to purchase Bitcoin, Ethereum, and other crypto assets. As the price of these coins rises, the book value increases, the company's stock price benefits in tandem, and the ability to refinance also strengthens, forming a typical "wealth flywheel":

Financing: Using the "crypto asset strategy" as a story to attract secondary market funds.

Coin Purchase: Directly converting financing funds into mainstream assets like BTC/ETH.

Valuation Increase: The book value rises, and stock prices see significant premiums.

Refinancing: Higher market capitalization and attention lead to lower-cost financing.

The initial success case of this model is MicroStrategy (now renamed Strategy), which has become the world's largest Bitcoin treasury through continuous financing and coin purchases over the past few years. Its stock price movement is highly correlated with Bitcoin, and the company raised $42 billion through stock and bond issuance for Bitcoin purchases, with its stock price premium relative to Bitcoin holdings once reaching as high as 20%.

The Japanese company Metaplanet also followed suit, attracting capital through Bitcoin holdings and increasing its stake. This model not only enhanced the company's valuation but also stimulated the rise in Bitcoin prices, pushing the entire market into a high-growth phase. By the first half of 2025, the average Bitcoin purchase amount per transaction reached 1,200 coins (Strategy) and 343 coins (other companies).

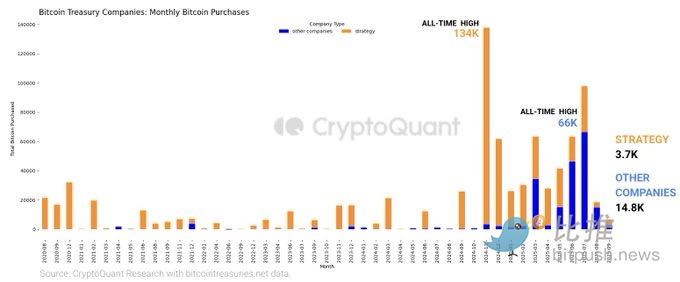

Data Perspective: Significant Slowdown in Bitcoin Treasury Growth

Entering August 2025, the expansion rate of BTC treasuries has seen a significant decline. Bitbo's report shows that corporate Bitcoin purchases dropped by 86% from the peak in the first half of the year, with the average transaction amount of Bitcoin sharply decreasing. In the past month, BTC treasury holdings grew by only about 16%, far below the monthly growth rate of over 90% at the beginning of the year. Aside from leading companies continuing to steadily increase their holdings, more listed companies have chosen to wait and even pause new coin purchases.

CryptoQuant data indicates that Strategy's monthly purchase volume plummeted from 134,000 coins in November 2024 to 3,700 coins in August 2025.

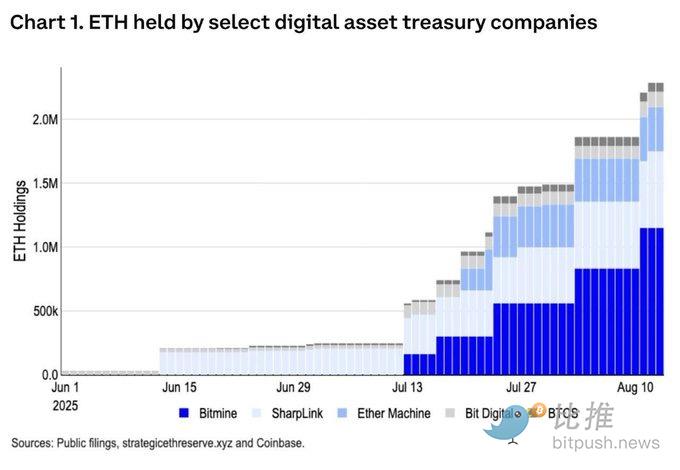

In stark contrast, ETH treasuries are showing a rapid upward trend.

The top three companies collectively purchased over 1.7 million ETH in August, far exceeding the increase in BTC treasuries during the same period. The reason lies in the ETH ecosystem itself, which can generate additional returns through staking, aligning the narrative more with the logic of "capital efficiency," leading to a noticeable structural shift in market funds.

In other words, the heat of Bitcoin treasuries is cooling, while ETH treasuries are in an acceleration phase. The overall story of DAT continues, but the distribution of funds has shifted from "widespread frenzy" to "structural differentiation."

This slowdown is not sudden but rather the result of multiple factors overlapping.

First, market maturation has led to decreased volatility. The annualized volatility of Bitcoin has dropped from nearly 200% in the early days to about 50%, shifting from speculation-driven to mature allocation. The early "flywheel effect" has weakened, and companies can no longer easily achieve skyrocketing stock prices through Bitcoin holdings. Second, macro liquidity recovery is slow. Despite the Federal Reserve cutting interest rates, there has been no significant FOMO sentiment in the off-market funds. Finally, regulatory factors have become the biggest obstacle, especially with Nasdaq's intervention.

Regulatory Perspective: Nasdaq Strengthens Scrutiny

According to foreign media The Information, the Nasdaq exchange is strengthening its regulation of listed companies under the DAT model, (Nasdaq Takes Action! Strict Regulation of "Coin Speculation" Listed Companies) focusing on those "raising stock prices through financing to purchase coins." The regulatory measures mainly include:

Mandatory Disclosure of Financing Use: Companies must clearly state whether the raised funds are directly used for coin purchases.

Shareholder Voting Requirements: A significant proportion of crypto asset allocation must be approved by shareholder meetings.

Enhanced Risk Disclosure: Listed companies need to detail the financial risks that may arise from crypto asset volatility in their financial reports and announcements.

Increased Refinancing Thresholds: Companies that frequently conduct private placements and quickly convert to coin purchases will face stricter reviews.

This series of measures essentially serves as a "brake" on the market. In the short term, this has led to a collective correction in the stock prices of DAT concept stocks, with some previously small-cap stocks that relied on "announcement-driven surges" experiencing significant declines. The cold water of regulation is directly extinguishing the enthusiasm of speculators.

Despite the tightening regulations, there are still extreme cases of "announcement-driven surges" in the market. For example, Eightco's stock price soared nearly 5,000% after announcing in September that it would raise $270 million to purchase Worldcoin tokens, with trading volume reaching tens of thousands of times its usual level. Such cases indicate that short-term funds remain highly sensitive to "crypto + treasury."

However, the more extreme the surge, the more it becomes a target for regulators and short-sellers. It reminds us that the market is not entirely cooling but has entered a phase of "long-tail frenzy, head stabilization." Leading companies continue to advance steadily, while long-tail thematic stocks oscillate under the pressure of speculation and regulation.

Is It Overheated?

To determine whether the DAT market is overheated, we can analyze it from three dimensions:

- Valuation and Pricing

NAV Premium Rate: The premium of stock prices relative to the net asset value of holdings. Some companies have premiums exceeding 80%, indicating clear speculation.

Cost of Equity Dilution: The dilution required to raise $1 in new assets. If dilution is increasing, it suggests the model is unsustainable.

- Funds and Rhythm

Holding Growth Rate: BTC treasuries have downgraded, while ETH treasuries are still running fast. There is a divergence in market heat.

New Funding Channels: For example, the $500 million DAT fund launched in Hong Kong indicates that institutional backup funds are still entering the market.

- Regulation and Governance

Listing and Financing Thresholds: After regulatory tightening, the path for rapid private placements to purchase coins is restricted.

Extreme Behavior Samples: Cases like Eightco's surge serve as a magnifying glass for market overheating.

In summary, the heat of the DAT market has not completely dissipated but is in a state of "localized overheating + mainline cooling."

Outlook: Three Possible Paths

In the future, the DAT market may evolve along three paths:

Regulated Development: Leading companies continue to expand within a compliance framework, gradually being valued by the market as alternative asset management firms.

Long-Tail Cleanup: Small and medium-sized companies that overly rely on speculation may be eliminated due to financing obstacles and regulatory pressure.

Capital Diversion: More capital may shift from BTC treasuries to ETH treasuries or enter new products supported by compliant funds.

In other words, the cold water does not completely extinguish the fervor but rather returns the market to differentiation: truly governed, transparent, and capital-efficient DAT models will remain, while speculative "shell companies trading coins" will be the first to exit.

Therefore, the DAT market has not reached a comprehensive peak, but how long it remains hot will no longer depend on speculative stories, but rather on: the further clarification of regulatory rules, the governance and transparency of leading companies, and the allocation choices of funds between BTC and ETH. After the cold water, the DAT market may have less frenzy and more stability. This could represent a new opportunity for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。