Upbit's Chain Initiative: More a Response to Circumstances than a Proactive Strategy

Written by: David, Deep Tide TechFlow

The arms race in public chains has gained another participant.

On September 9, South Korea's largest cryptocurrency exchange, Upbit, officially launched Giwa, an Ethereum Layer 2 network built on the Optimism OP Stack, at the UDC 2025 conference in Seoul.

Before its official launch, there was only a mysterious countdown website stirring market sentiment.

The name Giwa is also quite interesting; in Korean, "기와" refers to the traditional roof tiles used in Korean architecture. These tiles interlock through a clever structure, forming a fully functional roof.

Upbit's choice of this name is clearly not arbitrary; the concepts of modularity and interoperability, which are core to blockchain, are beautifully encapsulated in the meaning of interlocking tiles.

However, reality may not be as beautiful as the name suggests.

For exchanges to create their own chains, Upbit is not particularly early to the game. Coinbase's Base has been operational for a year, with a TVL exceeding $8 billion, becoming a hub for social and consumer applications. Binance's BNB Chain is an even older player, with a plethora of ecological projects and CEX-bound gameplay emerging. Recently, even Kraken launched Ink, and Robinhood has entered the fray with stock tokenization on Arbitrum.

Everyone understands one principle: relying solely on trading fees has its limits.

(Source: Tiger Research)

However, as a latecomer, Giwa is built on an open-source tech stack. Where might its advantages and opportunities lie?

Giwa's Outlook: Same Source as Base but Different Paths

In choosing the OP Stack, Upbit didn't seem to have much hesitation.

There are only a few technical routes for Layer 2: Optimistic Rollup, ZK Rollup, and some hybrid solutions. While ZK technology is appealing, its maturity is a concern; Arbitrum's tech stack is also solid, but its ecosystem is relatively closed. The OP Stack is open-source, modular, and has Coinbase's Base as a successful precedent—this is a validated path.

The core of the OP Stack is optimistic rollup, which assumes all transactions are honest and challenges them only if issues arise.

This brings two benefits: transactions are executed before verification, leading to faster speeds; and the verification logic is simple, resulting in lower costs. This is particularly suitable for Upbit, which has a massive daily trading volume.

Interestingly, a comparison between Base and Giwa reveals that, despite using the same OP Stack, the two chains are taking completely different paths.

Base, backed by Coinbase's U.S. user base, emphasizes "Onchain is the new Online," targeting consumer scenarios like social, gaming, and NFTs. Although these narratives are lukewarm in the current cycle, the previous success of social products like Friend.tech on Base is closely related to its positioning. Low gas fees, smooth user experience, and comprehensive developer tools are Base's three main strengths.

Giwa's positioning is different. Upbit's users are primarily Korean, with different trading habits and regulatory environments. Korean users are more accustomed to centralized exchange experiences and are less accepting of DeFi. This necessitates that Giwa provide a user experience closer to CEX while maintaining decentralization.

Based on the information revealed so far, Giwa may focus on several directions:

First, native support for a Korean won stablecoin should be a top priority. If users can pay gas fees directly with a Korean won stablecoin, it would significantly lower the barrier for Korean users. This requires modifications at the protocol level and cooperation at the regulatory level, not just a simple contract deployment.

In July, it was reported that Upbit's parent company, Dunamu, confirmed it would collaborate with Naver Pay to promote Korean won stablecoin payment services, which appears to be part of the groundwork for Giwa.

Second, compliance features may be built into the chain. South Korea has strict regulatory requirements, and KYC and AML cannot be avoided. Instead of having each project handle this independently, it would be better to provide standardized solutions like an on-chain identity system and transaction monitoring mechanisms at the chain level.

Finally, performance optimization may focus on different aspects than Base. Base optimizes for high-frequency small transactions, suitable for social scenarios. Giwa may prioritize the efficiency and security of large transactions, as transactions worth hundreds of thousands of dollars are common on Upbit.

Additionally, cross-chain bridges are a key issue. Users' assets are primarily on Upbit's centralized ledger; how can they be safely and conveniently migrated to Giwa? If this experience is not well executed, everything else is moot. Upbit may develop a dedicated bridging solution, potentially integrating it directly into the exchange interface, similar to Binance's approach.

Of course, these are speculations based on existing information.

However, the choice of technology reflects strategic intent; choosing the OP Stack indicates that Upbit aims for rapid deployment and risk reduction while leveraging the existing ecosystem integrated with its CEX.

Transformation, or Transformation

Upbit's chain initiative is more a response to circumstances than a proactive strategy.

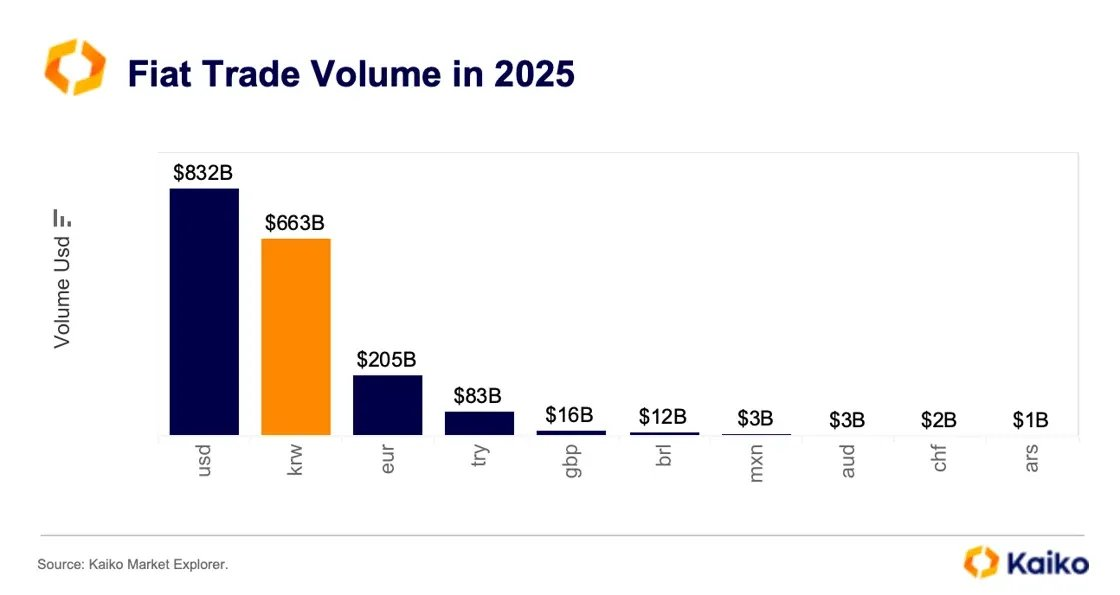

On the surface, Upbit in 2025 seems to be doing well. With an 80% market share in South Korea, its daily trading volume often ranks among the top three globally. However, the growth curve has begun to flatten. South Korea is relatively small, and those who can trade cryptocurrencies are already doing so; where will new users come from?

This anxiety seems to have spread throughout the cryptocurrency industry in the past year or two. Global exchanges are searching for a second growth curve, and the answer is remarkably consistent: create a chain.

Coinbase's Base has proven this path is viable: not only can it collect gas fees, but more importantly, it gains control over ecological pricing. When breakout applications like Friend.tech take off on Base, Coinbase benefits not just from transaction fees but also from the spillover effects across the entire value chain.

More importantly, beyond exchange operations, Coinbase has extended its value chain through ecosystem development. The transformation from a "trading platform" to an "infrastructure provider" essentially diversifies its revenue model.

The uniqueness of the South Korean market makes this transformation even more urgent. The "kimchi premium" seems to be a moat for Korean exchanges, allowing them to sell the same Bitcoin at a higher price, but it actually reflects market isolation and inefficiency.

International arbitrageurs cannot enter, and Korean capital cannot exit; this isolation will eventually be broken. Once international exchanges find compliant ways to enter South Korea, Upbit's monopoly position will be at risk.

Here, the Korean won stablecoin actually presents an opportunity window. After the collapse of Terra, the vacuum for stablecoins in the Korean market has yet to be filled. There is a genuine demand for local currency stablecoins among Koreans: for cross-border remittances, hedging, and daily payments. Public data also shows that South Korea has a $15 billion annual transaction volume in the cross-border remittance market.

(Source: Tiger Research)

However, the problem lies precisely here: South Korea's "Virtual Asset User Protection Act" stipulates that exchanges cannot trade tokens issued by themselves or related parties.

Building a Giwa chain to allow partner Naver Pay to issue a Korean won stablecoin on-chain, with Upbit providing the infrastructure, would circumvent regulatory issues while maintaining control over the ecosystem.

Additionally, seeking positioning in the capital market and facing increasing competition from rivals are also significant reasons for Upbit to accelerate its transformation.

Another local exchange, Bithumb, is preparing for an IPO in the second half of 2025, and Dunamu (Upbit's parent company) likely has similar plans. As multiple global cryptocurrency exchanges go public, the capital market may be tired of the exchange narrative; however, "Web3 infrastructure" sounds much more appealing.

Of course, creating a chain also carries risks. The failure of Klaytn is still fresh in memory. Even with the support of a large conglomerate like Kakao, it ultimately did not succeed. Technology is not the issue; the ecosystem is. Without applications and users, a chain may just be an empty shell.

But for Upbit, the risk of not attempting this may be greater than the risk of proceeding.

Looking ahead from the point of view in September 2025, exchanges creating chains have transitioned from "innovation" to "standard practice." Coinbase has Base, Binance has BNB Chain, and now Upbit has Giwa.

The outcome of this arms race may not be about whose chain is better, but rather who can find a new business model first. In this sense, the launch of Giwa is merely the first step in Upbit's transformation. The real test is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。