Author: Aylo

Compiled by: Bernard, ChainCatcher

01 Seven Reasons to Be Bullish on Hyperliquid

1. Hyperliquid embodies the true spirit of crypto

Hyperliquid started with a top-tier DEX that requires no KYC, has zero gas fees, and offers an excellent user experience, gradually building its own L1 ecosystem. Its success stems from a series of "combination punches":

- Self-funding: No extractive private rounds, TGE was just a start without cashing out.

- Successful airdrop: 30% of the total supply was allocated in the genesis airdrop, and the HYPE token has increased over 10 times since its launch.

- Product-first approach: Build products based on user needs → Attract long-term users → Airdrop rewards to users → Continue to expand through building an on-chain ecosystem.

- Future incentives: 40% of the HYPE supply (worth billions of dollars) is reserved for future incentives, potentially including another airdrop.

- Strong token economics: 99% of protocol fees are used to buy back HYPE.

- Efficient and streamlined team: The Hyperliquid team consists of only 11 people, but the average revenue exceeds $100 million.

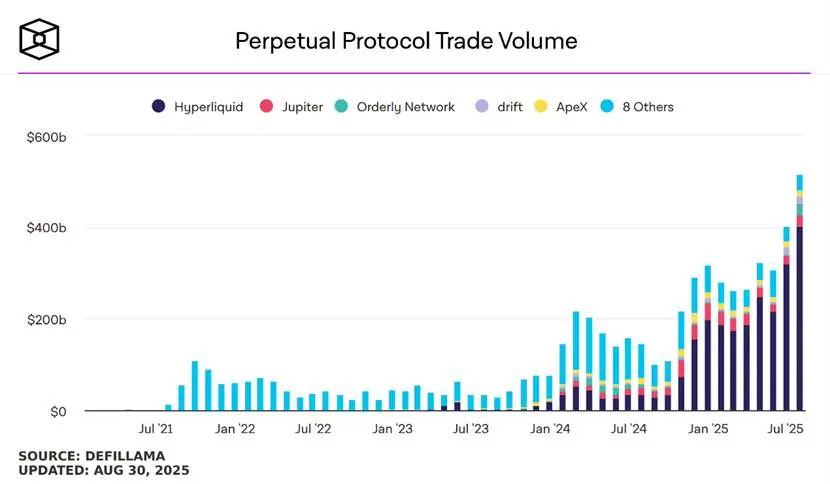

Unlike most projects that disappear after "mercenary mining," Hyperliquid has become even stronger after the airdrop. All metrics are soaring, and it is becoming the first DEX that can truly compete with giants like Binance.

2. Hyperliquid is a cash cow, HYPE is severely undervalued

With approximately $114 million in monthly fees, Hyperliquid currently has an annualized revenue of about $1.37 billion. Since 99% of the revenue is used for HYPE buybacks, theoretically, all circulating HYPE could be completely bought back in less than 9 years—no other protocol in the crypto space has such a strong economic model.

3. The ecosystem is growing rapidly

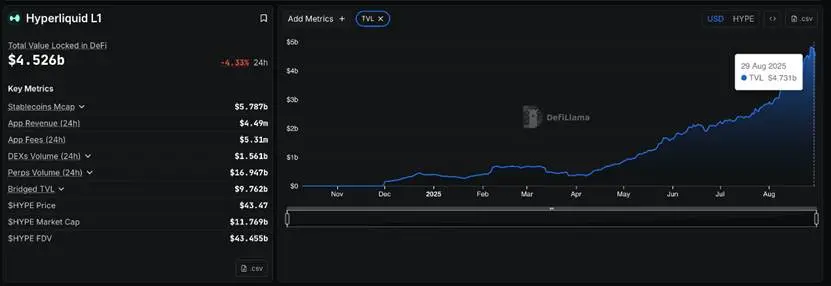

The TVL chart of Hyperliquid says it all—growth is accelerating.

Some leading players in the DeFi space (Ethena, EtherFi, Pendle, Morpho) are expanding to HyperEVM. These "savvy" teams are investing resources here, undoubtedly a strong signal that something is happening.

Meanwhile, native projects like Kinetiq and Liminal are also thriving, and the recent integration of native USDC into Hyperliquid has further cleared obstacles for ecosystem development.

4. HYPE is a powerful collateral asset

Just like Ethereum's ETH, Solana's SOL, and BNB Chain's BNB, any L1 that wants to thrive needs a strong collateral token. Most Layer 1s lack such strong assets, limiting their DeFi growth. HyperEVM, however, has HYPE, which is considered "one of the strongest assets in the crypto space."

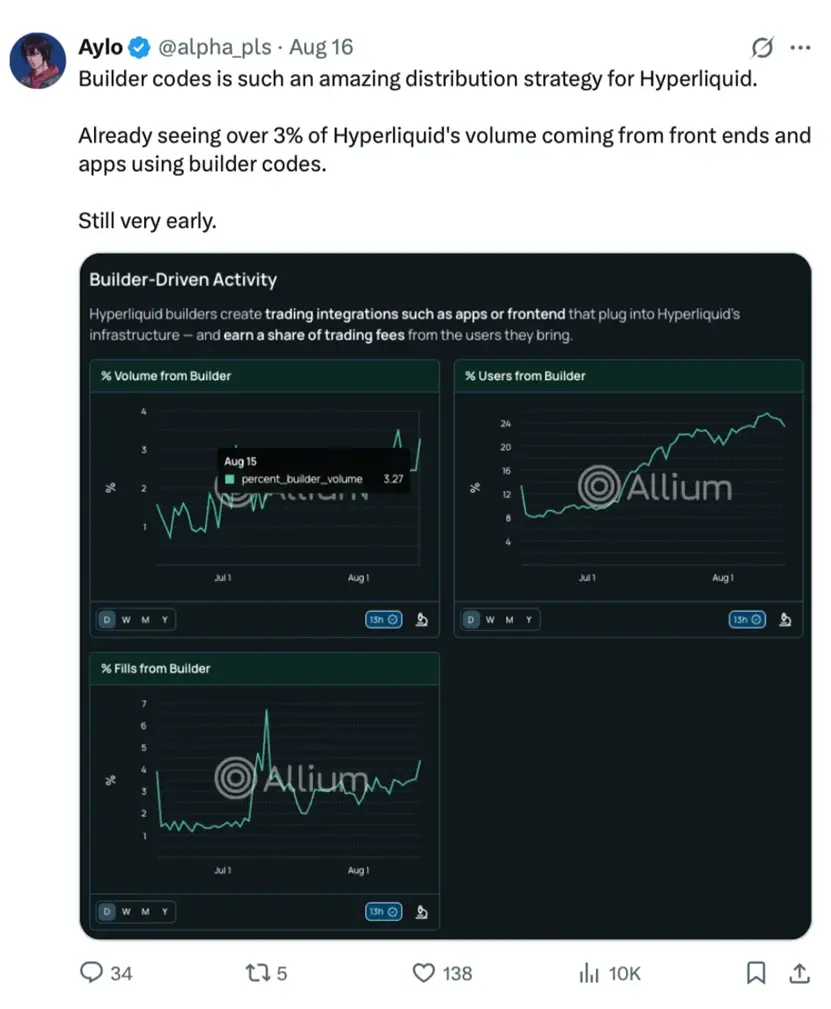

5. Builder Codes: A brilliant distribution strategy

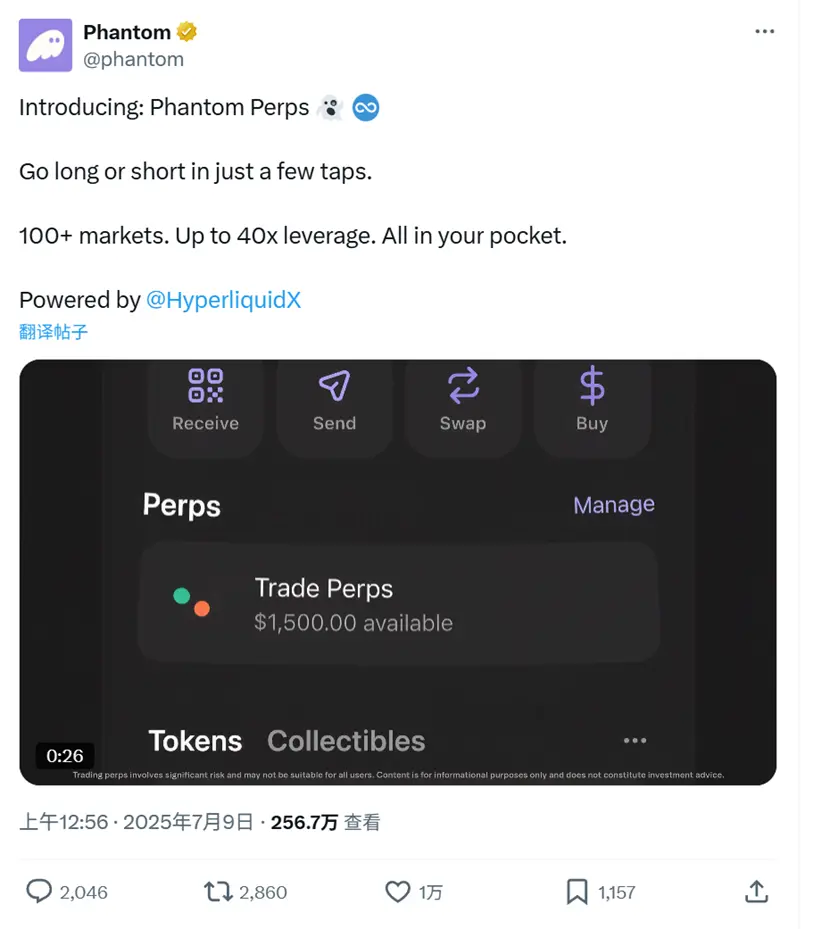

This mechanism allows developers to build trading applications using Hyperliquid's infrastructure and earn a share of the fees from the trades they guide, transforming DeFi builders into distribution partners for Hyperliquid, creating a true win-win model.

For example, Phantom has launched perpetual contract trading through Hyperliquid, and Rabby Wallet has hinted at similar initiatives, while protocols like Ranger Finance and Mass have also begun to leverage this mechanism.

6. HIP-3 is rewriting the rules of the game

Anyone can create a perpetual contract market by staking 1 million HYPE (approximately $42 million). Deployers can set parameters and earn up to 50% of the fees.

Unlike Builder Codes distribution, HIP-3 involves product expansion. More markets → more users → more fees → more buybacks → stronger appeal, creating a positive feedback loop.

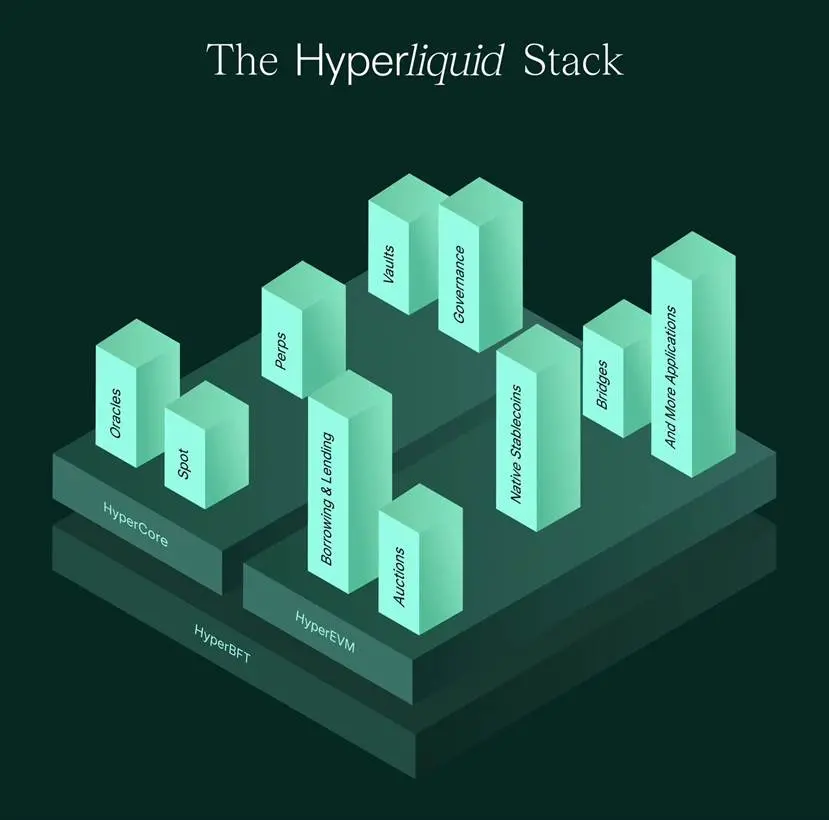

7. The synergy between Hyperliquid and HyperEVM

Hyperliquid and HyperEVM are not two different concepts but two sides of the same coin—HyperEVM makes Hyperliquid programmable and combinable with the rest of DeFi, while Hyperliquid provides liquidity and cash flow, bringing instant trading volume, credibility, and revenue to the exchange.

This creates a unique feedback loop: DeFi protocols on HyperEVM can directly access Hyperliquid's deep liquidity and order book while using EVM smart contracts.

02 Airdrop Opportunity Tier Assessment

S Tier: Unit, Kinetiq

- Functionality: Asset tokenization and cross-chain bridging layer for Hyperliquid spot trading, allowing users to directly deposit, withdraw, and trade major crypto assets (such as BTC, ETH, and SOL) on Hyperliquid.

- Key data: TVL exceeds $1 billion, annual trading volume exceeds $115 billion. So far, over 98% of this revenue has been directly used for HYPE buybacks.

- Participation method: Deposit and trade assets like BTC, ETH, SOL through the app.hyperunit.xyz or Hyperliquid interface, and further engage in two-way bridging operations with Hyperliquid, or interact with HyperEVM using Unit assets.

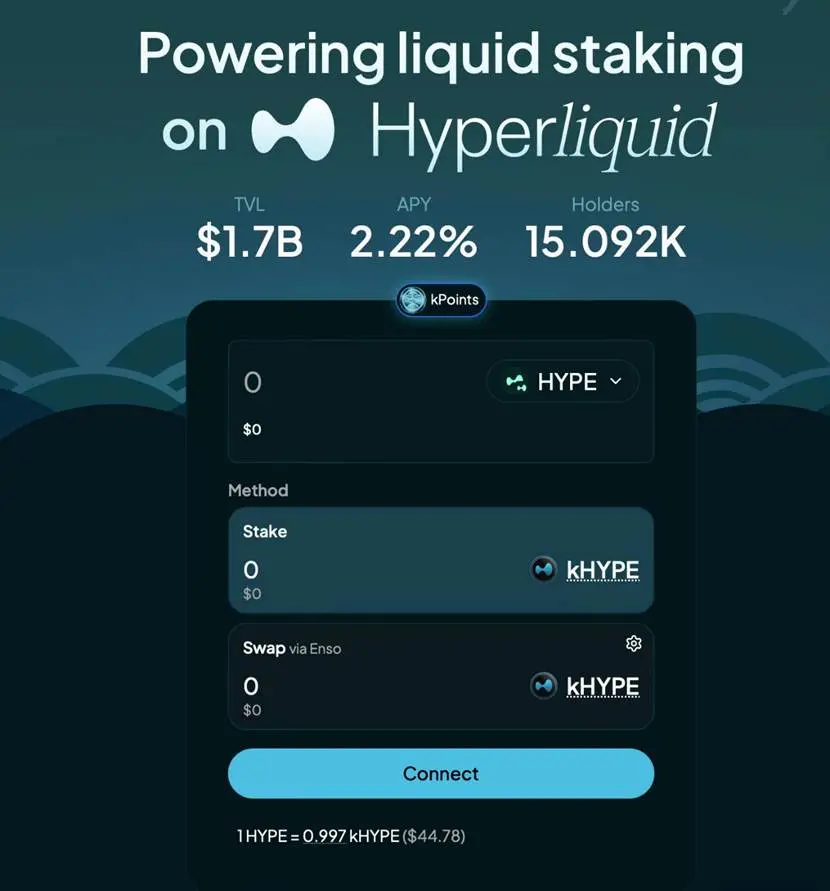

- Functionality: Hyperliquid's leading liquid staking protocol.

- Operation mechanism: Stake HYPE and receive Kinetiq Staked HYPE (kHYPE) as a reward. kHYPE is fully liquid, usable in DeFi, and automatically generates staking rewards.

- Key data: Kinetiq is the most anticipated LST on Hyperliquid to date. Since its launch on July 15, the protocol has accumulated over $1.7 billion in TVL across 15,000 wallets and has become a key protocol on HyperEVM.

- Participation method: Kinetiq also has a points program underway. Specific rules have not been fully disclosed, but the program combines holding kHYPE and using it in DeFi (currently, a large amount of points is flowing into YT-kHYPE on Pendle). To easily set up earning points, simply deposit kHYPE into Kinetiq's Earn vault (and you can also mine multiple protocols simultaneously).

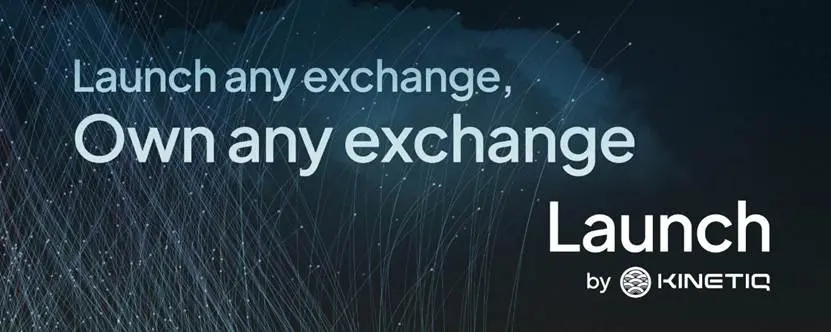

- Innovative product: Another factor that could bring significant FDV to Kinetiq in the future is its new product Launch. This is the first "Exchange as a Service" (EaaS) platform built on HIP-3, allowing anyone to deploy and operate their own perpetual contracts without the requirement of staking 1 million HYPE.

- Valuation reference: Comparable to Jito in the Solana ecosystem, with similar valuation potential. Importantly, Kinetiq is currently not over-mined: the total TVL across approximately 15,000 wallets has reached $1.7 billion, which remains a healthy ratio.

A Tier: Liminal, Hyperbeat

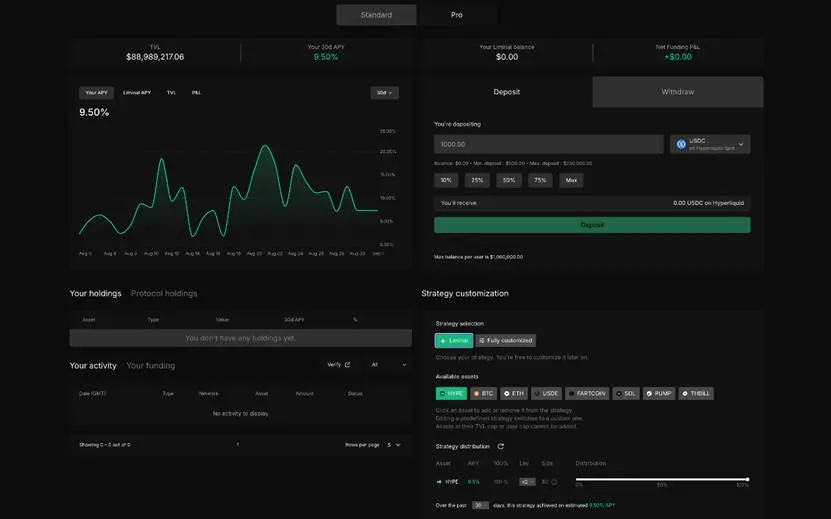

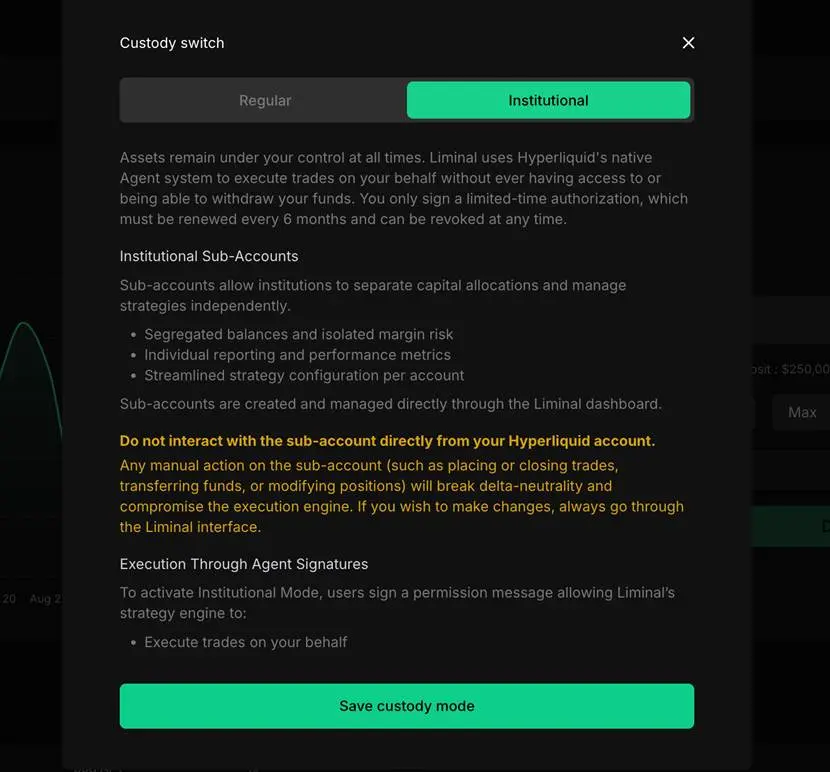

- Functionality: A delta-neutral yield platform similar to Ethena, but with Limina, users can flexibly decide their portfolio allocation for delta-neutral mining.

- Operation: Deposit USDC into Liminal, choose whether to allocate to Liminal's classic strategy, or build a custom delta-neutral trading portfolio to earn yields without worrying about market direction. It is important to note that by default, Liminal is set to "regular" mode. In this mode, Liminal manages asset custody and investment strategies, but spot and perpetual contract trading volumes may not count towards Hyperliquid or Unit account activities, meaning potential Unit airdrop opportunities may be missed.

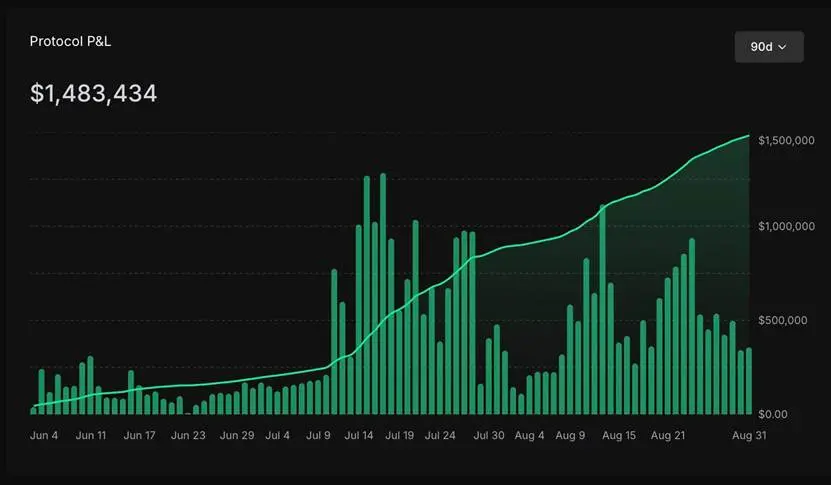

- User returns: Since its launch, over $1.4 million has been distributed to users.

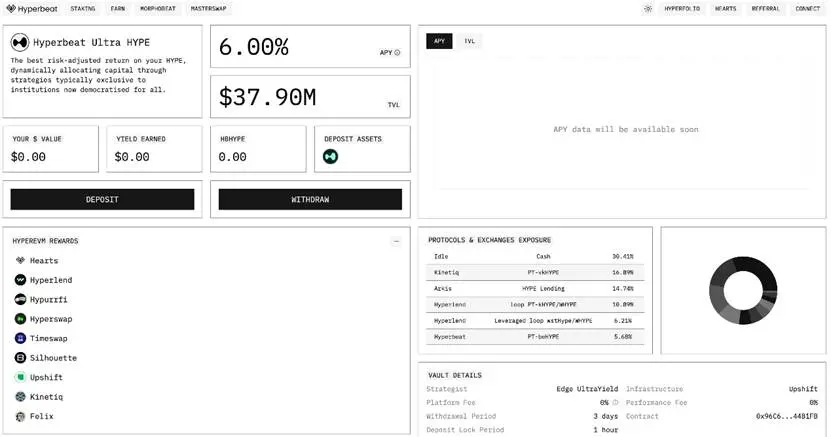

Functionality: A one-stop DeFi protocol for the HyperEVM ecosystem.

Products:

Staking: Stake HYPE as beHYPE, built in collaboration with EtherFi.

Yield: HyperBeat collaborates with top infrastructure providers and strategists to launch various vaults on HyperEVM, allowing users to earn points across all major HyperEVM protocols.

Morpho beat: A permissionless and independent lending market powered by Morpho, allowing borrowing and lending of all assets on HyperEVM.

Masterswap: Transfer any on-chain asset to HYPE on HyperEVM. Hyperbeat automatically selects the best path, such as one-click swapping SOL on Solana for HYPE on HyperEVM.

Points system: A total of 51 million Hearts points, with less than 12% remaining. The reward system is divided into six tiers, potentially indicating a tiered airdrop.

Participation method: Deposit into vaults and mine multiple HyperEVM protocols, with various options based on the assets you want to invest in (HYPE, BTC, stablecoins, or even gold). If you hold HYPE, you can directly stake it as beHYPE (earning 10 million Heart points). beHYPE will soon be listed as cash collateral for the EtherFi card.

Part Two: A Comprehensive Interpretation of Hyperliquid Airdrop Projects: Mining Golden Opportunities in the HyperEVM Ecosystem (2)

Click to learn about ChainCatcher's job openings

Recommended reading:

Pantera Capital In-Depth Analysis: The Value Creation Logic of Digital Asset Treasury DATs

Backroom: Tokenization of Information, Solutions to Data Redundancy in the AI Era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。