Core Indicators (Hong Kong Time September 1, 16:00 to September 8, 16:00)

- BTC/USD rose 1.6% (from $109,600 to $111,300), ETH/USD fell 4.0% (from $4,470 to $4,290)

The BTC spot market has shown unclear trends over the past two months: although it touched the lower end of the long-term target range ($125,000–$135,000) in August, the pattern is not favorable, requiring cautious assessment of subsequent price behavior. The current technical structure shows a double top pattern, with two rebounds after hitting the key level of $125,000, indicating that the market may enter a sideways adjustment mode. If it fails to break the previous high again, it may trigger a deeper correction.

Short-term resistance levels are $112,000, $117,000, and $125,000–$126,000; downward support/breakout is at $109,000 and $100,000–$101,000. Based on the price trend, the actual volatility is expected to continue rising in the next two months.

Market Theme

After the summer, the market entered a tug-of-war between bulls and bears in the first week: macro risk assets are still supported (this week’s U.S. economic data slowdown confirms the rationale for a 25 basis point rate cut at the September 17 FOMC meeting, driving continued ETF inflows); however, there is strong selling pressure from the crypto-native community, and retail buying is weak (exchange deposits have sharply decreased from their peak). The asynchronous hedging of bullish and bearish forces has caused BTC to be temporarily trapped in the $109,000–$114,000 range, but with significant volatility within that range. If one side dominates and breaks the range, it may trigger a surge in volatility — if selling pressure eases or is absorbed by strong buying, the market is expected to continue its upward trend (the skew of BTC indicates that current local bullish positions are insufficient); if the macro environment worsens or ETF inflows decline (or even turn into outflows), selling pressure may quickly suppress spot prices below $100,000.

BTC Implied Volatility

- The actual volatility has remained in the 35–38 vol range over the past two weeks, especially evident in hourly fluctuations. The chaotic technical situation, combined with macro positives (ETF inflows) and native selling pressure, has made it difficult for the market to form a balance.

- Option demand remains weak, with the only significant buying coming from short-term put hedges around non-farm payroll data (positions closed after the event). Due to a lack of volatility buying, the market is unwilling to raise the pricing of long-term volatility, with implied volatility for September and October contracts approaching recent actual volatility levels (35–36 vol).

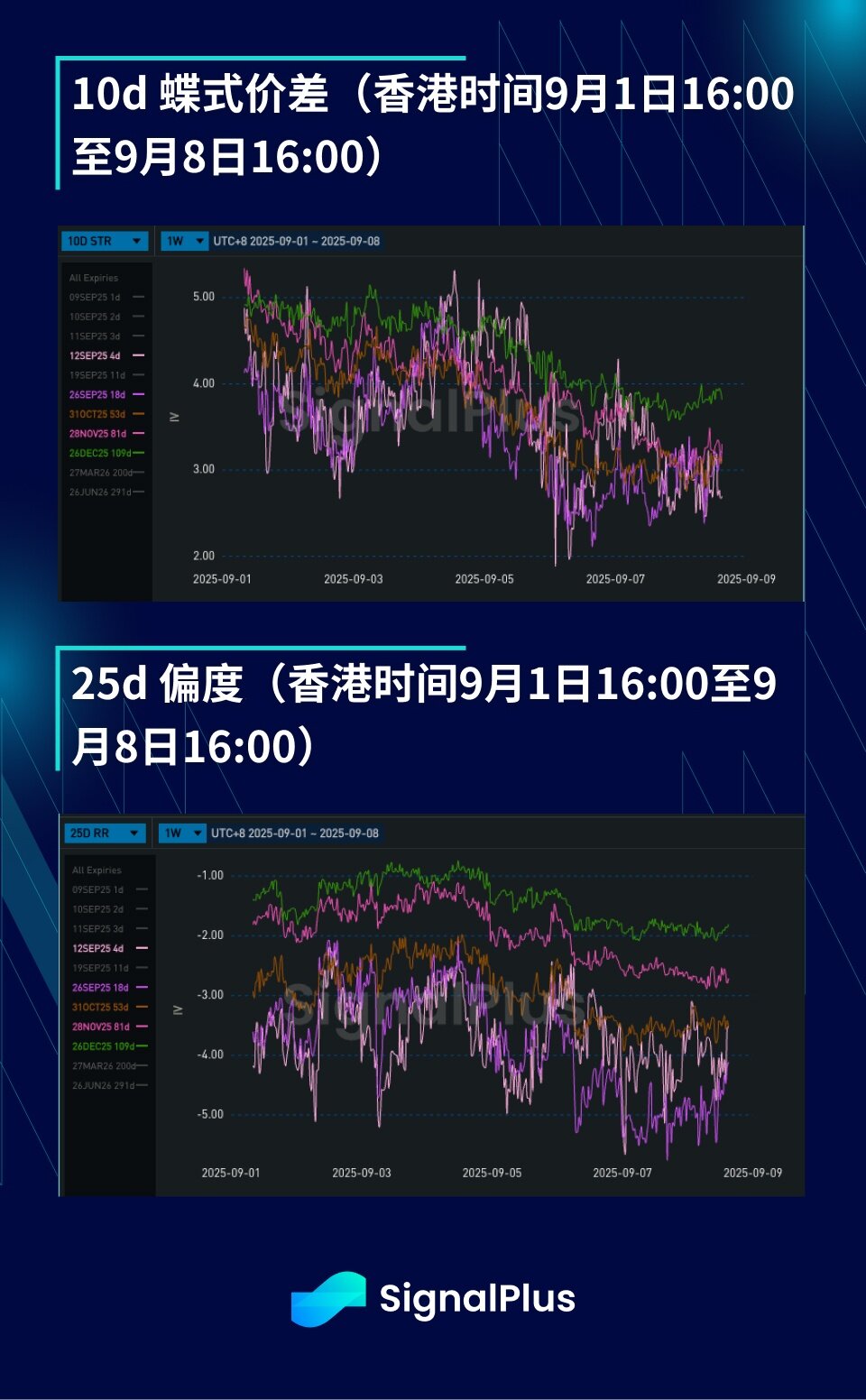

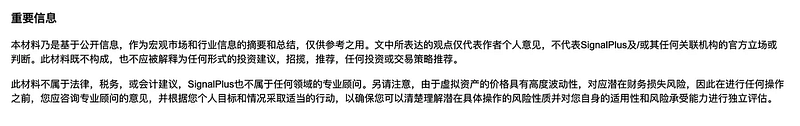

BTC USD Skew/Kurtosis

The skew continues to lean downward: despite favorable non-farm payroll data, price movements remain weak, and the rapid pullback from $113,000 to $110,000 raises concerns about a deeper correction. Structural bullish participation is low, with only data-driven tactical bullish spreads; at the same time, there is a lack of interest in volatility for strike prices below $100,000, leading to long-term skew approaching parity.

Kurtosis prices are generally declining: the market continues to suppress kurtosis, reducing pricing for extreme tail risks. Although the volatility of volatility has been relatively stable in recent weeks, historical experience shows that BTC's ecosystem can change rapidly — any significant volatility could lead to instantaneous evaporation of liquidity in both spot and options, making holding long kurtosis a good choice in the current market.

Wishing you a successful trading week ahead!

You can use the SignalPlus trading indicator feature for free t.signalplus.com/crypto-news/all, integrating market information through AI, making market sentiment clear at a glance.

You can use the SignalPlus trading indicator feature for free t.signalplus.com/crypto-news/all, integrating market information through AI, making market sentiment clear at a glance.

If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between English and numbers: SignalPlus 888), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。