Arthur Hayes, Fed Rate Cuts, and the Trillion-Dollar DeFi Opportunity

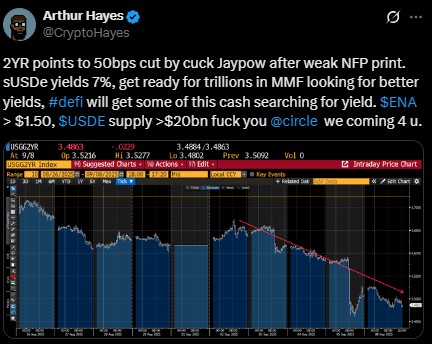

BitMEX co-founder Arthur Hayes has taken a bold call on the next FOMC meeting 2025, calling a Fed Rate Cut of 50 basis points. With disappointing U.S. jobs, Hayes utilized the two-year Treasury yield as an indicator that Federal Reserve Chairman Jerome Powell might deliver even more easing. Further, he added that the synthetic dollar stablecoin (sUSDe) is now providing 7% yields, and it's an improved choice compared to U.S. money market funds.

Source: X

Source: X

Arthur Hayes believes that once trillions of dollars in traditional finance start chasing better yields, a significant share will flow into DeFi. He went as far as predicting that ENA price could surpass $1.50 and USDE supply may cross $20 billion, directly competing with Circle’s USDC.

Why Arthur Hayes Is Confident on Fed Cuts: The DeFi Connection

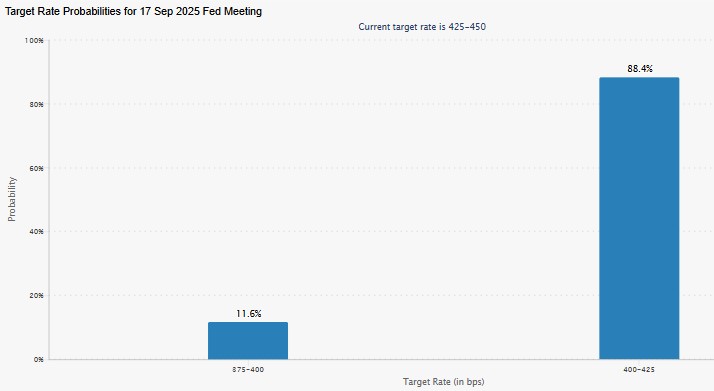

Beyond charts and bond yields, Hayes’ confidence also comes from CME’s FedWatch Tool data. On September 6, probabilities suggested an 89% chance of a modest 25 bps cut and only an 11% chance of a deeper 50 bps. But by September 9, numbers shifted—markets showed an 88.4% chance of a 25 bps and an 11.6% probability of 50 bps.

Source:FedWatch

Source:FedWatch

Even though the majority still favors a smaller move, the small uptick in 50 bps expectations indicates stronger confidence among some analysts. Hayes thinks that Powell, being politically pressured by Donald Trump, could be compelled to take a more extreme measure. This is in accordance with growing speculation regarding the Fed rate cut September 2025 as investors anticipate market transformation.

September 17 Fed Meeting: What Crypto Investors Should Expect

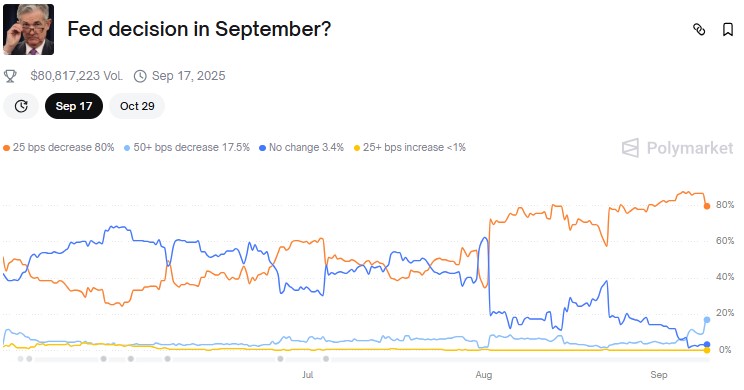

Attention is then directed at the date of the FOMC meeting 2025 : September 17. Based on Polymarket data, 80% support the likelihood of having a 25 bps drop. There is a 17.5% likelihood of a 50+ bps move and an extremely low 3.4% likelihood of no move.

Source: Polymarket

Source: Polymarket

This is how expectations have changed over time. In July, there were less than 40% chances of a 25 bps cut, but now they have skyrocketed to nearly 80% in early September. The market has settled on the view that easing is coming, though debate remains on how big the cut will be. Whether it is 25 or 50, a drop looks almost certain this September, which explains the recent confidence in the crypto market.

Is the Fed Rate Cut Good or Bad News for the Future of Crypto?

As the meeting approaches, global markets are turning bullish. At the time of writing, the total crypto market cap stood at $3.88 trillion, up by nearly 0.9%. Bitcoin was priced at $111,920.31, up 0.77%, while Ethereum was at $4,311 and XRP at $2.96.

Analysts explain how a Fed rate announcement would be relaxing financial conditions, and risk assets such as crypto would be more appealing. For the majority of traders, this is the primary reason why crypto has been trending upward in recent sessions. Powell makes a drop announcement, and it can be the catalyst for more gains across the board.

Conclusion

The next FOMC meeting 2025 is turning out to be a biggie on the global markets' agenda. Whereas everyone anticipates a steady 25 cut, Arthur Hayes' 50 Fed Rate prediction is catching steam. Big or small, the cut appears to be a done deal in September. For crypto investors, this policy move has the potential to pave the way for fresh inflows, to the benefit of both DeFi and mainstream digital assets.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。