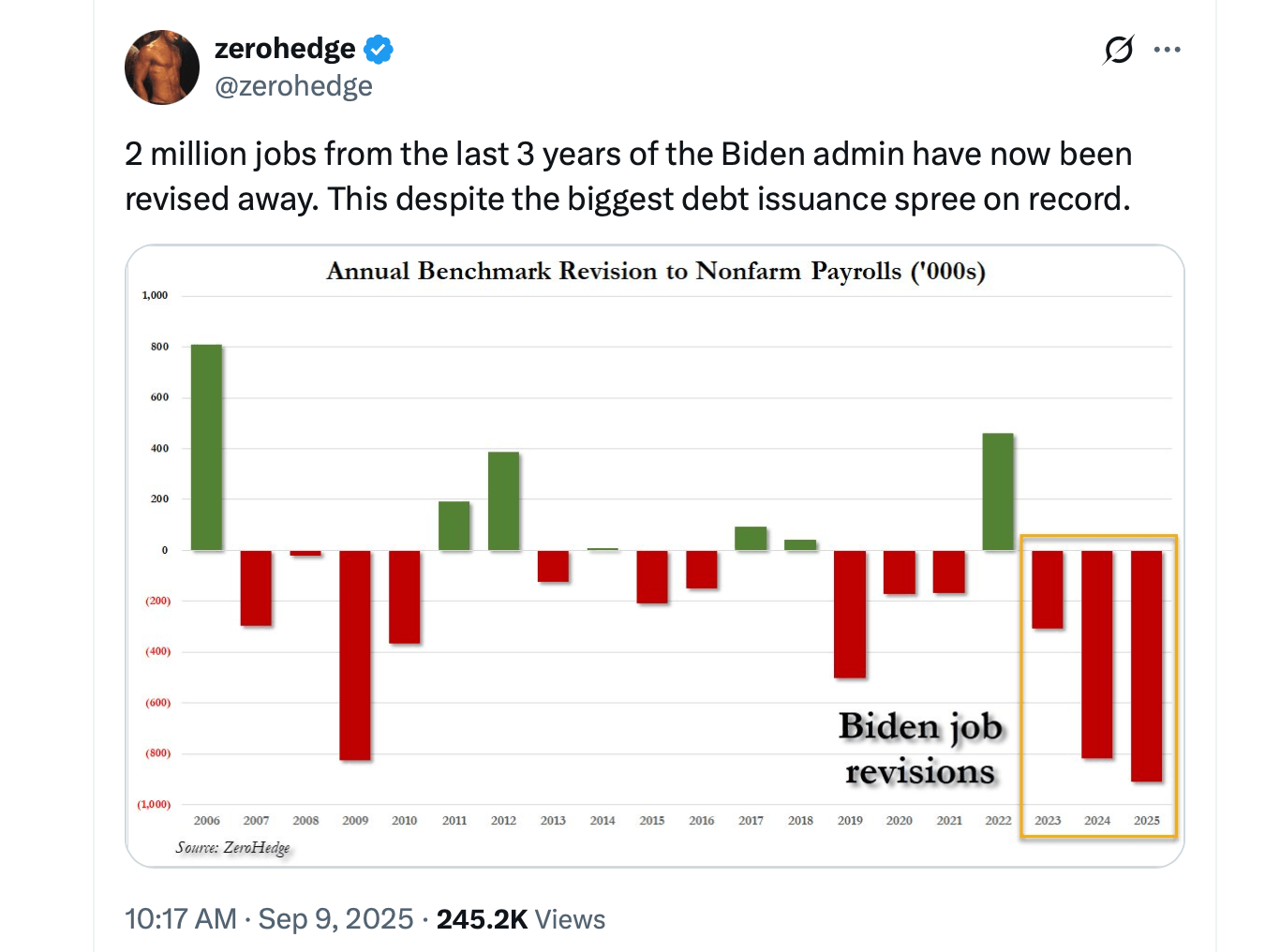

Zerohedge, which has long heckled the sausage-making in Washington’s data kitchen, put it bluntly: “2 million jobs from the last 3 years of the Biden admin have now been revised away. This despite the biggest debt issuance spree on record.” It added, “This is another BLS scandal, and Trump was absolutely right to fire the BLS commissioner,” concluding there was “virtually no job creation in the last year of the Biden admin.”

From an economic vantage, that indictment tracks with basic incentives: when the scorekeeper is also the promoter, you get glossy press releases up front and quiet corrections later. The numbers aren’t quibbles around the edges. On Sept. 9, BLS’s final benchmark revision showed employers added 911,000 fewer jobs than previously estimated for April 2024–March 2025, chopping the period’s gains by roughly a third.

The downshift follows earlier cuts, including the 818,000 preliminary haircut to March 2024 that Zerohedge highlighted several times last year. Conservative political strategist Scott Jennings called the saga what many outside the beltway already suspected: “Trump inherited a mess. What an absolute scandal across the board.” Even the Fed chair signaled caution on headline payrolls, saying he would “mentally tend to adjust them based on the QCEW adjustment.”

Yes, revisions happen: monthly updates and annual “benchmarking” reconcile survey guesses with administrative tax data. But the scale and one-directional nature of these changes are the story. Under Biden, the pattern bent heavily toward downward revisions, a trend rarely seen outside major shocks.

Add them up and you get more than 2 million jobs vaporized over 2023–2025, a tally that pairs nicely with Washington’s record borrowing binge—a political tableau where spending swells while measured results quietly shrink. In a market, bad counters go bankrupt; in government, they get revised. Critics like Zerohedge point to the “birth-death” model—BLS’s imputation of net jobs from business births and deaths—as a chronic optimism machine.

Goldman’s work suggests it overstated payroll gains by about 45,000 a month in late 2024, while Standard Chartered estimates the data overstates true job growth by roughly 70,000 a month, with continuing firms adding a meager 25,000 jobs monthly since early 2024. Seasonals that “learn” too slowly, ADP/BLS gaps in health care, and immigration/population misestimates compound the fog, all pushing initial prints higher and revisions lower when reality intrudes.

Strip away the drama and you confront a banal truth with ethical bite: monopolies on measurement are monopolies on narrative. A government that compels payment and then grades its own homework will always be tempted to tell heroic stories today and schedule the humility for tomorrow.

So many will certainly celebrate the revision, not as transparency achieved, but as the latest proof that centralized scorekeeping is a political good, not an economic one. Want confidence? Don’t launder facts through a monopoly. Want clarity? Count first, spin later—or better, not at all. The rest is just another news cycle waiting for its correction.

Following the latest adjustment, U.S. Treasury Secretary Scott Bessent argued that the truth is “President Trump inherited a far worse economy than reported, and he’s right to say the Fed is choking off growth with high rates.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。