Author: Pima, Co-founder of ContinueCapital

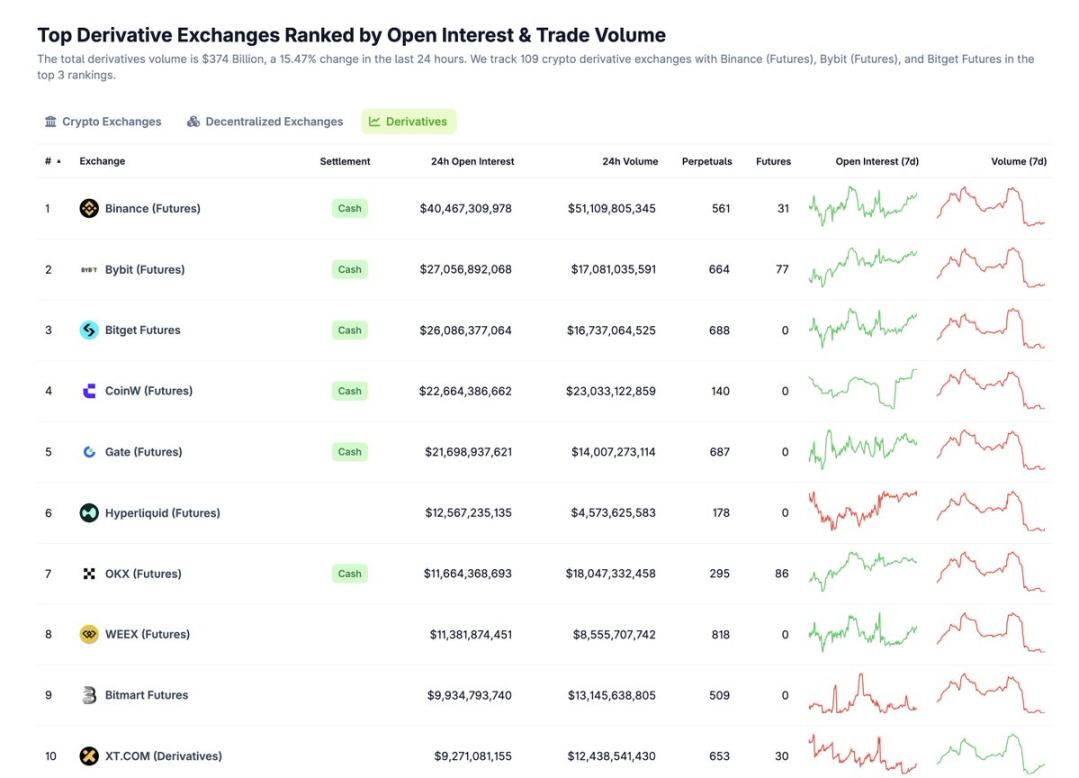

The most profitable business in the crypto field is the contract market, which currently generates approximately $20-30 billion in profits annually across the entire market. This has rapidly developed at an annual growth rate of about 100% over the past two years, while the spot market has been crushed, with profit distribution approximately at contract: spot = 3:1.

Based on a 25x PE ratio in the US stock market, we can roughly estimate that the contract market can support companies with a market value of $500-750 billion. If Binance takes 40% of the market share, it would correspond to a market value of about $200-300 billion. If Hyperliquid captures 30% of the market, it would correspond to a market value of about $150-220 billion. Why can't Binance achieve such a high PE? I believe one reason is the issue of financial transparency (the impact of Enron's fraud on the capital market was catastrophic). Another reason is the pipeline issue, which requires reaching more channels to involve the capital market (such as DAT/ETF/Robinhood, etc.). Thirdly, there is the issue of revenue diversification (subscription models enjoy higher valuations than commission models). Over time, the aforementioned obstacles are improving.

How long can $HYPE maintain a 30% market share? Analyzing the future requires a clear understanding of the present; your future performance is dynamically estimated based on current and past performance.

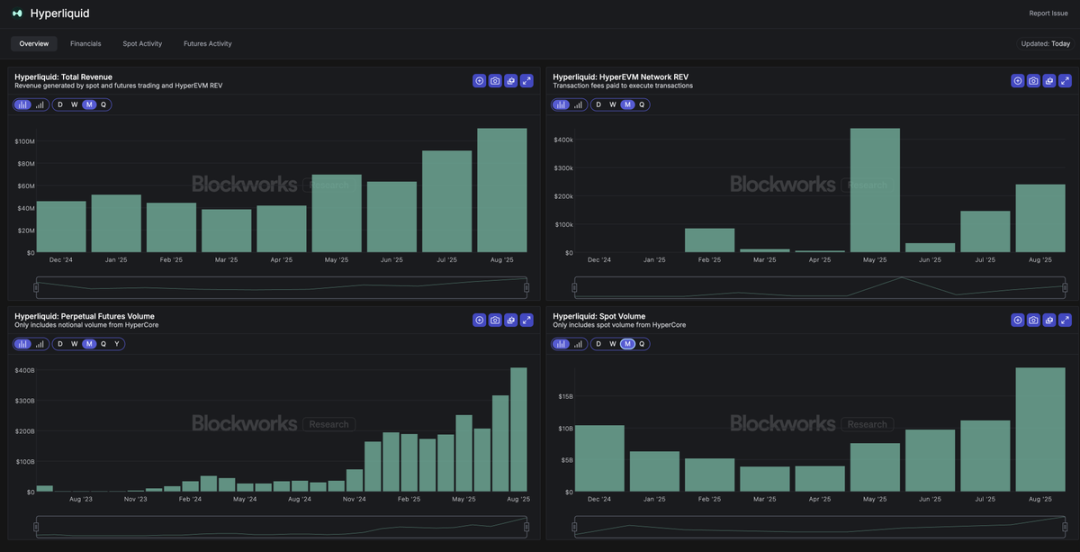

In December 2024, HYPE's monthly revenue is projected to be $45 million, and by August 2025, it is expected to reach $110 million, with a compound monthly revenue growth rate of 11.8%. At this growth rate, to achieve a monthly revenue of $1 billion, it would take approximately 19 months, resulting in an annual revenue of $12 billion. A PE of 25 corresponds to a fair market value of $300 billion. Assuming a decrease in marginal growth (due to increased scale/competition), if the monthly revenue growth rate drops to 5%, it would take a total of 64 months to grow from $0.45 billion to $1 billion, meaning it would still require 55 months, with an annualized growth rate of 80%. Thus, achieving an annualized revenue of $12 billion would take approximately 4.5 years.

Under the trend of compliance and the on-chain financialization of everything, the contract market continues to maintain rapid growth. Assuming an annualized growth rate of 30%, the profits in the contract market in five years could reach $74-111 billion. A profit of $100 billion can fully support a market value of $2 trillion. If you can capture 30% of the market share, a market value of $600 billion is a completely fair valuation. It is important to understand that the MEGA 7 in the US stock market (excluding TSLA) is not driven by PE; the majority is driven by EPS. Behind every company with a market value over $2 trillion is an annual profit of $100 billion.

This does not predict HYPE's stablecoin market revenue, spot market revenue, or future ecosystem revenue brought by HIP-3, etc. It merely focuses on the main contradictions and optimal solutions (of course, the payment market is also very large and needs to be addressed separately). The overall logic and thought process have built a framework, and those interested can extend it further.

The power of transparency and the power of permissionless systems are infinite. Instead of lamenting why projects are stagnating, it is better to study how companies can earn more cash flow in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。