During the fierce competition among meme launch platforms like Pumpfun and Bonk, another market is starting to gain popularity among Degen traders, much like the Memecoin trend of 2023.

The prediction market has already tightened its grip on the Memecoins market.

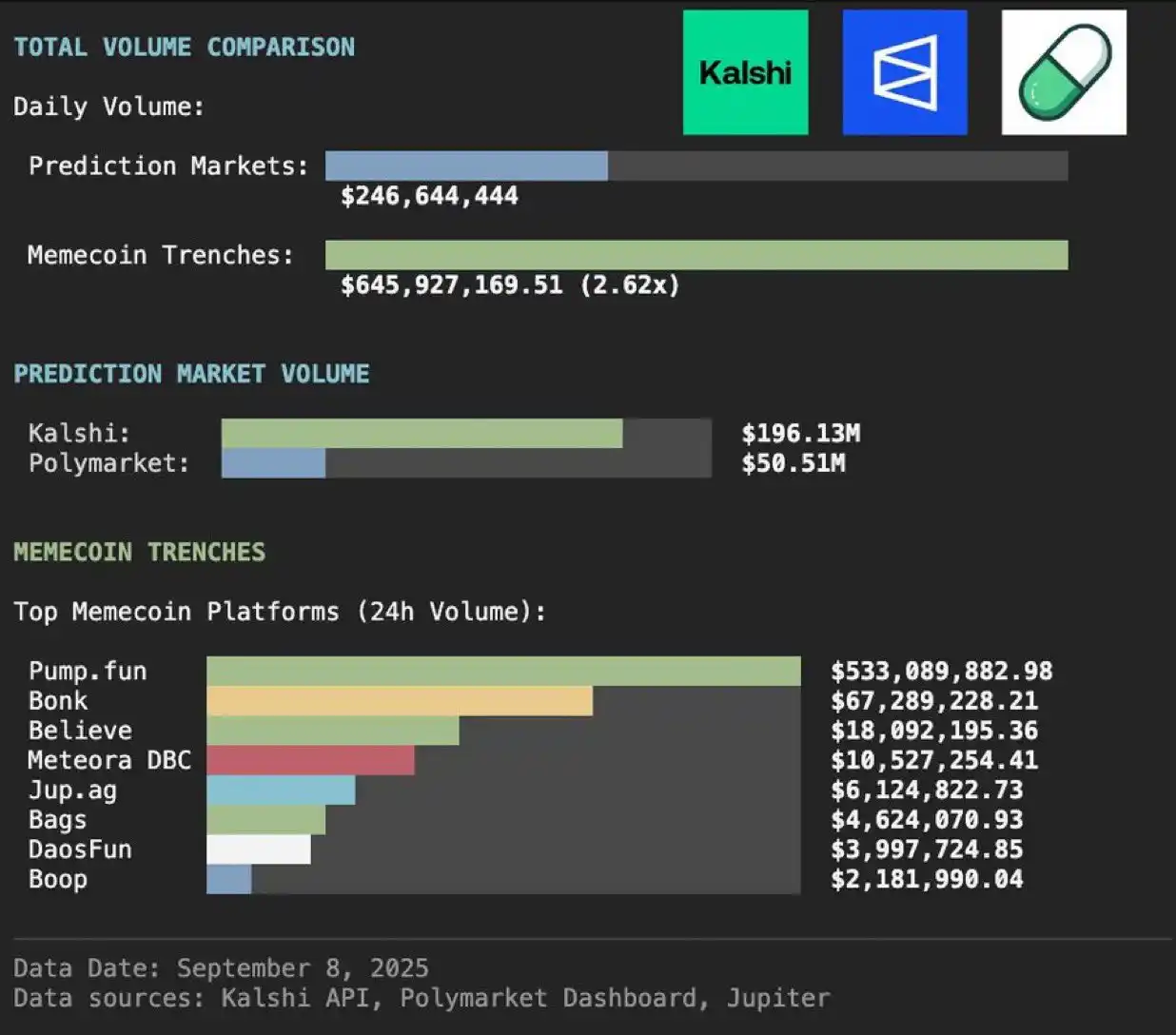

John Wang, who recently joined Kalshi as the head of cryptocurrency, recently released a set of data indicating that the current prediction market has reached 38% of the total trading volume of the Solana Memecoins market.

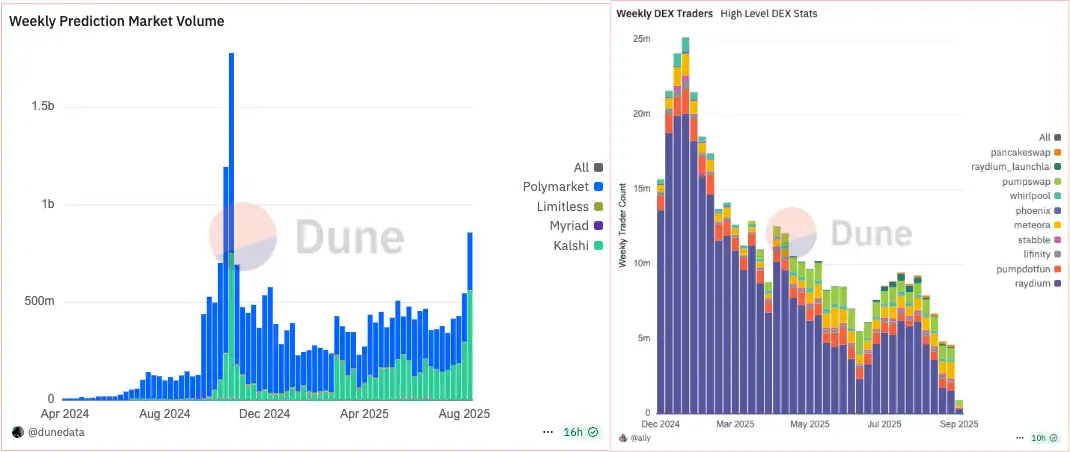

In less than a month since John joined Kalshi and doubled its trading volume, the overall trading volume of the prediction market has also reached levels seen just before the October elections last year. However, another set of data is quite striking: the number of unique addresses for Memecoins has dropped from a peak in December last year to now, with the number of traders falling to less than 5% of its peak.

Left: Weekly trading volume of the prediction market, Right: Number of traders on Solana DEX, Source: DUNE

Is the era of Memecoins really coming to an end? Will the size of the prediction market, as John mentioned, exceed that of the Memecoins market by more than ten times?

The Decline of the Memecoins Craze

It must be said that Memecoins in the crypto market have created many wealth myths in recent years, attracting many newcomers to the industry, but this frenzy is clearly cooling down now.

Looking back at 2021, established Memecoins like Dogecoin (DOGE) and Shiba Inu (SHIB) saw their prices soar, driven by topics like Elon Musk, with market capitalizations reaching as high as $80 billion and $39 billion, respectively. The market cap of Memecoins peaked at 12% of the entire altcoin market that year.

Subsequently, meme culture surged again in 2023-2024, especially with the emergence of the Pump.fun platform on the Solana chain in early 2024, which sparked a new wave of "Meme minting" with zero-barrier token issuance, leading to an unprecedented explosion of Memecoins trading in the crypto space, as a large number of retail investors flocked to Solana in pursuit of the next opportunity for wealth.

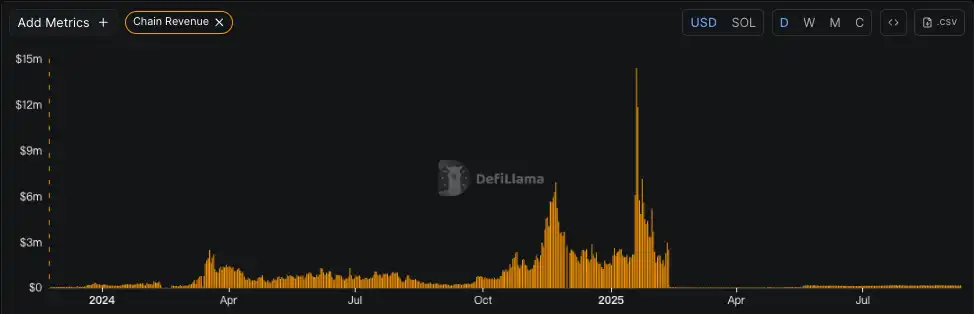

However, signs of decline have begun to appear. Although platforms like Pump.fun have created legendary cases of turning a few dollars into millions, the vast majority of speculators cannot escape the fate of losses. Statistics show that nearly 99% of newly issued Memecoins ultimately go to zero, and Solana's transaction fee revenue has also dropped by over 90%.

Solana transaction fee revenue, Source: Defillama

The decline of Memecoins can be attributed to multiple factors. The uncertainty of the macro environment has made speculative funds more cautious, the lack of regulatory constraints has led to rampant harvesting by manipulators and insider trading scandals, and social media influencers and celebrities have repeatedly engaged in schemes to hype and sell at high points (even presidents have done so). The prevalence of insider trading, lack of liquidity, and thousands of scams and rug pulls have left even the most risk-loving Degens feeling fatigued.

The structure of participants in the meme sector has changed. On one hand, under compliance pressure, many early large players acting as manipulators are withdrawing from this gray area; on the other hand, aside from the insider trading by whales, the market is now mostly filled with small and medium retail investors competing against each other, and meme trading is increasingly evolving into a naked zero-sum PVP.

Small players are eager to chase the thrill of short-term bets, while long-term holding to build a consensus culture has become less common. This lack of a solid PVP speculation model has made it difficult for Memecoins to form a true community consensus, leading to price fluctuations without fundamental support, resulting in a rush when prices rise and a scatter when they fall. No solid funds are willing to participate in long-term construction, and large funds are even less likely to step in, creating a vicious cycle.

The ratio of profits to losses among players participating in pumpfun, previously fluctuating around 7:3 (losses: profits), has now reached 6:4, but the range of profits and losses is almost concentrated around ±$500. The wealth effect of Memecoins is fading, Source: DUNE

Consensus leads to price instability, causing funds to shy away, which in turn makes it difficult for market capitalization to grow. This "pass-the-parcel" type of speculative game is becoming increasingly desolate as the wealth effect fades.

Old memes have turned into swing trading tools, new memes have become the domain of small players, and cultural consensus has become an impractical existence. Various signs indicate that the myth of Memecoins is gradually fading, and the market is beginning to shift its focus to new hot areas.

The New Arena for Degens

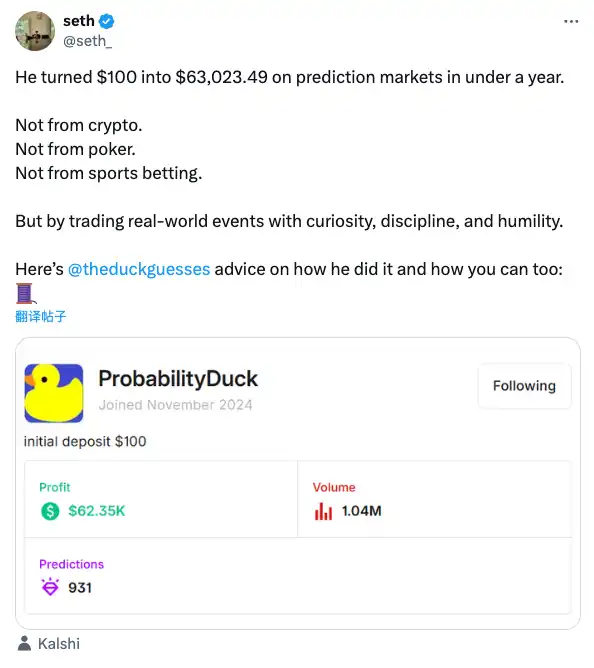

As the meme craze gradually recedes, Degens have not pulled back; instead, they have shifted their enthusiasm to the prediction market. If you frequently browse X, you may often see some so-called "personality stories," which typically narrate how someone turned a small amount of money into a high multiple. The backdrop of these stories used to be Memecoins or DeFi arbitrage, but now it has changed to the prediction market.

Dopamine

David Sklansky, the founder of poker mathematics theory, once said in "Theory of Poker," "The essence of gambling is betting under information asymmetry." In other words, what gamblers need is a perception of odds and information advantage, rather than an absolute guarantee of winning.

From this perspective, the prediction market provides a dopamine rush similar to that of speculating on Memecoins, but with a mechanism that is more transparent and fair. When you buy a betting contract on "Trump winning the election" or "the Federal Reserve cutting interest rates," the outcome ultimately depends on the objective results of events. There is no risk of project teams suddenly running away, nor is there the risk of a "carpet pull" that artificially drives prices to zero; the worst outcome is simply betting in the wrong direction and losing your stake, rather than suffering unwarranted losses under insider manipulation like some air coins.

This psychological shift from "Will the development team run away with the funds?" to "Will the event itself happen?" represents an "upgrade" in the mode of speculative behavior. Gamblers are still betting and competing, but the bets are anchored to real-world outcomes, providing a basic level of authenticity.

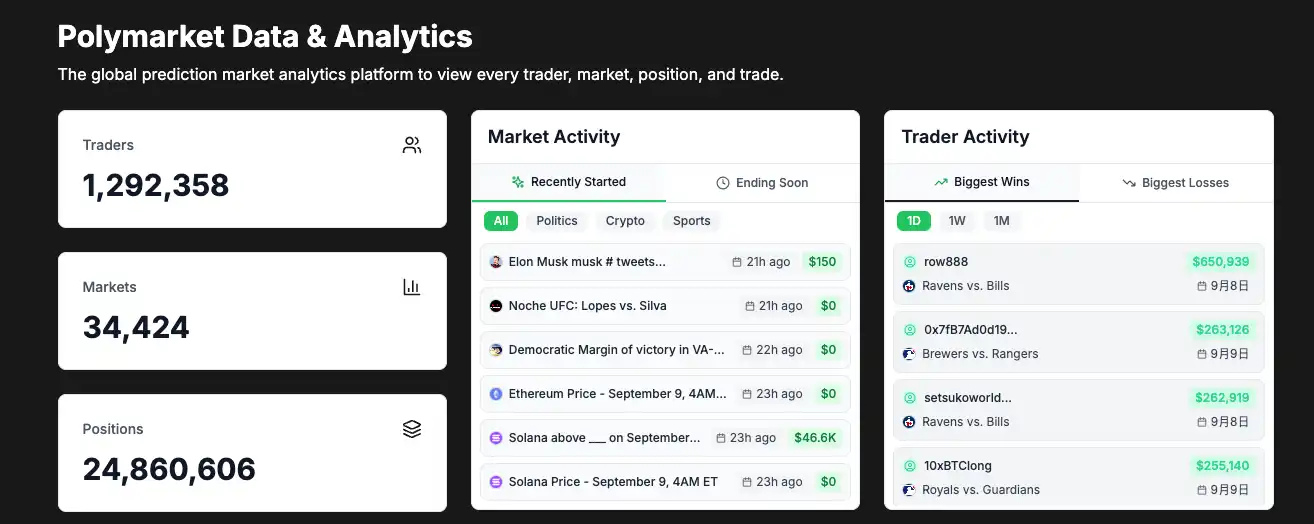

The number of traders on Polymarket has reached 1.3 million, while Kalshi has not disclosed user data, but its market share has already surpassed Polymarket. The number of participants in the prediction market may have reached millions, Source: polymarketanalytics

Regulation

More importantly, regulatory trends have added a halo of legitimacy to the prediction market. Many decentralized prediction platforms previously closed their doors to users in markets like the U.S. due to policy risks, but the situation is changing.

In the second half of 2024, a lawsuit between the Kalshi platform and the U.S. Commodity Futures Trading Commission (CFTC) became a turning point. This prediction market exchange, headquartered in the U.S. and fully compliant, had previously been blocked by the CFTC for attempting to launch contracts on congressional election results. However, reports indicate that in September of that year, a federal court ruled in favor of Kalshi, stating that the regulatory agency had no authority to prohibit such political event contracts.

This ruling cleared the way for Kalshi to operate nationwide in the U.S., making it the first truly licensed prediction market platform in the country. Kalshi quickly seized the opportunity to expand its operations during the 2024 U.S. elections. According to reports from Reuters and others, on the night of the presidential election alone, the platform generated approximately $1 billion in trading volume, with the total annual trading volume surging tenfold to $1.97 billion. With its compliance advantage, Kalshi was able to rapidly expand its reach, attracting users to participate without geographical restrictions, which also helped it achieve a valuation of up to $1 billion in a new round of financing in early 2025.

Meanwhile, the established decentralized prediction market Polymarket is also seeking a path to compliance. The platform was fined $1.4 million by the CFTC in 2022 for failing to comply with U.S. regulations and temporarily closed to U.S. users. However, after the Trump administration took office, the regulatory environment in the U.S. loosened, and Polymarket re-entered the U.S. market in 2025 by acquiring a licensed entity.

Wealth Effect

For profit-seeking speculative funds, the reason the prediction market can absorb the heat after the decline of Memecoins lies in its similar wealth effect and more diverse gameplay.

First, in terms of potential returns, betting on black swan events can yield returns comparable to those from speculating on altcoins. In the prediction market, if you bet on a low-probability event at very low odds early on, and it actually happens later, you can achieve returns of several times or even tens of times. For example, before the 2024 U.S. elections, many people purchased contracts for Trump's victory as a hedge or speculation. Reports indicate that one large player bet $30 million on a "Trump elected" call option, resulting in a profit of up to $85 million after Trump successfully won the election.

Of course, small capital players can also choose long-tail event contracts with odds of dozens of times to take a shot at "small bets winning big money." It is worth mentioning that decentralized prediction markets centered around binary options have also begun to introduce contract leverage tools to further amplify returns. Platforms like Azuro, D8X, and Drift have either provided or continue to provide contract leverage.

This model that integrates DeFi derivatives has broadened the profit space and provided a platform for professional players skilled at capturing arbitrage opportunities, allowing some DeFi players to navigate the prediction market with ease. They can seek out arbitrage opportunities from odds discrepancies across different platforms or use derivatives to hedge risks. Coupled with increasingly sophisticated data dashboards and copy trading bots, the gameplay is much richer than merely speculating on Memecoins or engaging in straightforward contract trading.

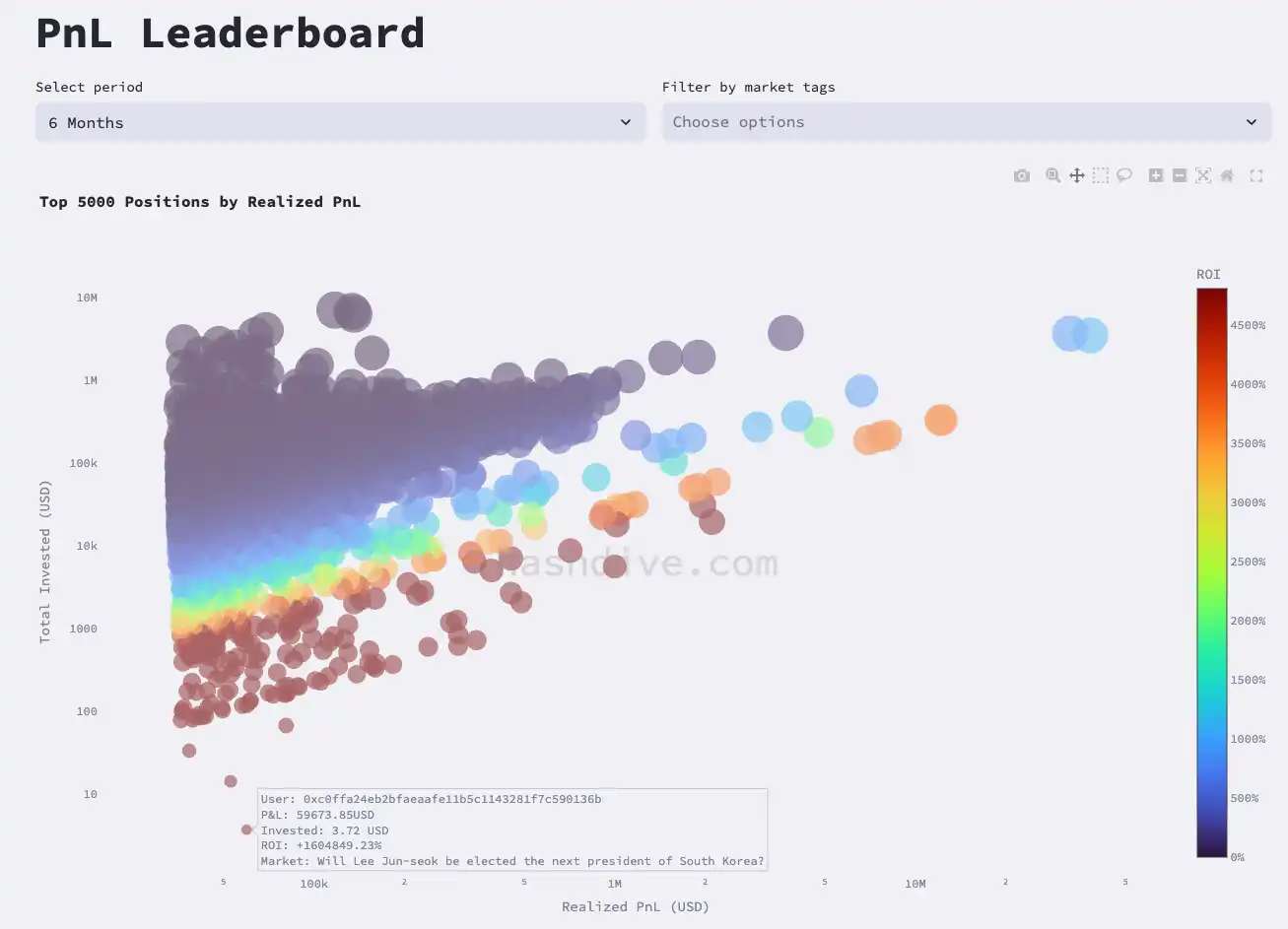

Distribution of profit players in the prediction market over the past six months; the redder the area, the higher the ROI. One player in the lower left corner turned $3.72 into nearly $60,000, Source: hashdive

Low Educational Cost

In addition to high return opportunities, "low educational cost" is also one of the important reasons why the prediction market attracts funds.

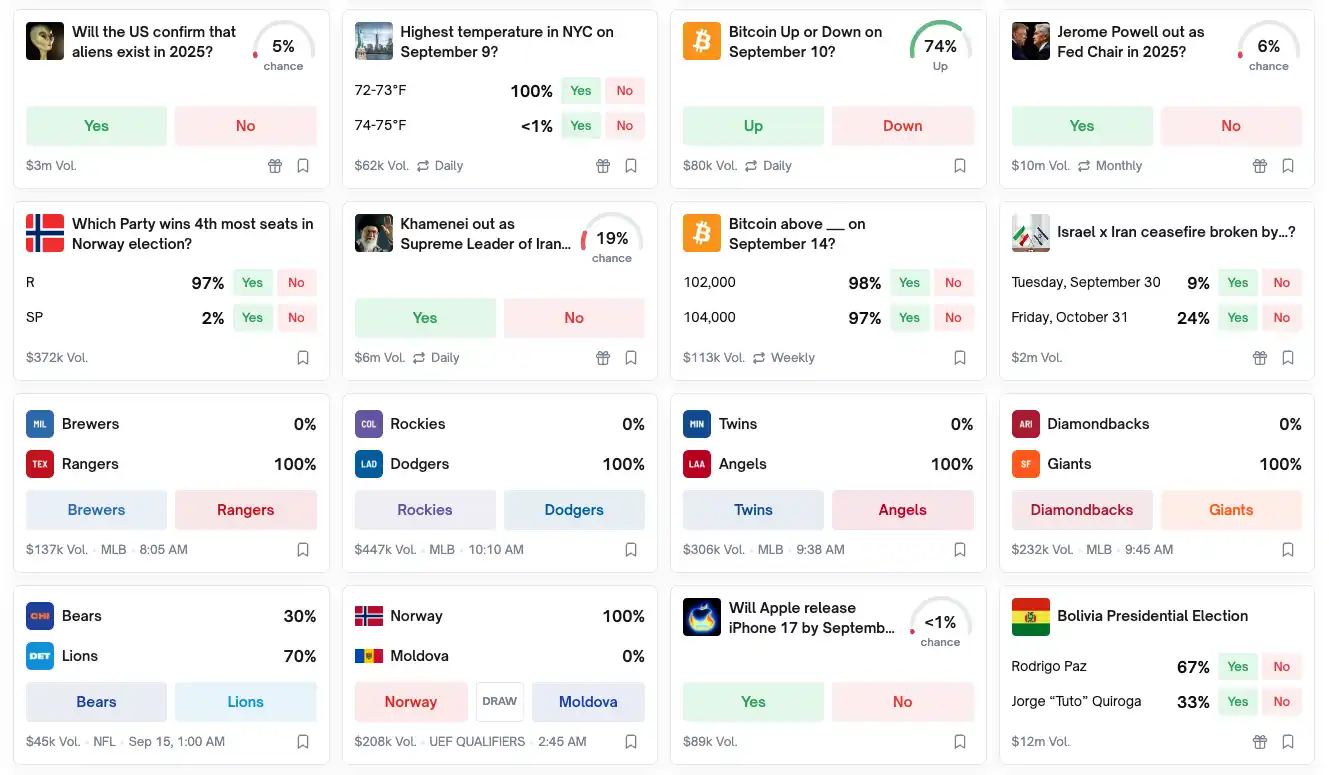

Unlike Memecoins, which are limited to speculating on crypto projects, the tradable subjects in the prediction market are almost limitless, covering politics, economics, sports, entertainment, and various other fields, catering to the "gambling interest" of different groups. Taking Polymarket as an example, it features serious macro topics (such as "Will Bitcoin break its all-time high before a certain date?" or "Will the Federal Reserve cut interest rates at its next meeting?") as well as quirky topics rich in internet culture (such as "Will a member of the boy band Coldplay divorce by the end of the year?" or "Will aliens be officially confirmed to exist in 2025?").

Many seemingly absurd hot topics have corresponding markets on the platform, effectively integrating meme culture into prediction trading. Users can bet on popular memes, celebrity topics, etc., and this entertaining participation lowers the barrier to entry while increasing engagement.

Prediction themes on Polymarket

In contrast, although Memecoins have "Meme" in their name, they are ultimately products of self-entertainment within the crypto circle, making it difficult for outsiders to understand their memes and value. The events that prediction markets bet on are real-world occurrences, making it easier for the public to understand and participate.

Some have vividly described the prediction market as simply moving the behavior of betting on horse races and sports games from offline to on-chain, conducted in a more open and transparent manner. Many ordinary investors who were previously confused about crypto tokens may become interested in betting once they see contracts related to news events on the platform.

Additionally, some platforms (like MYRIAD) have started embedding the logic of prediction behavior directly into social media or mobile apps through plugins, allowing users to participate in betting while scrolling through Twitter or using an app, thereby increasing participation. All of this makes the prediction market more likely to break through barriers and attract long-tail users beyond traditional crypto assets like Bitcoin.

The Reverse Impact of Prediction Markets on the Real World

The fairness and informational value of prediction markets are also praised by some viewpoints. Since the final settlement of contracts is based on objective facts, there is no room for human manipulation, making the results relatively fair and transparent. In the realm of Memecoins, retail investors often worry about malicious actions by development teams or price manipulation by whales, but these issues are not present in prediction markets. At the same time, participants with high information sensitivity can profit by betting early, and this process, in turn, provides signals for market prices, which is seen as the original design intention of "using money to predict the future."

For example, when the true probability of an event is underestimated, traders with insider information or professional insights will buy a large number of corresponding contracts, thereby pushing the price closer to a reasonable level. This arbitrage process is a correction of erroneous odds. Research has pointed out that it is precisely because of these rational arbitrageurs that mature prediction markets often provide more accurate event probabilities than polls, which are referenced by media and institutions.

Of course, excessive speculation can also obscure the effectiveness of information. If a large influx of uninformed, purely trend-following speculative funds enters, it may temporarily cause contract prices to deviate from reasonable probabilities. However, practice shows that as long as there are enough rational players, significant deviations are usually corrected quickly, and extreme persistent mispricing is relatively rare.

Overall, prediction markets have unique value in aggregating public opinion and information. The more diverse and rich the participants and information, the more meaningful the results. This model of "embedding speculation in prediction" has even gained recognition from some mainstream figures. Since prediction markets emphasize trading based on information and judgment, many supporters avoid using the term "gambling" and instead refer to it as "information markets" to enhance its social acceptance.

This rebranding has proven effective, as many VCs and government officials increasingly use prediction market data as a basis for sharing their viewpoints. Compared to the impression that Memecoins give of being "purely gambling," prediction markets are striving to create an atmosphere of higher intelligence and greater value in investment games, thereby attracting a broader participant base.

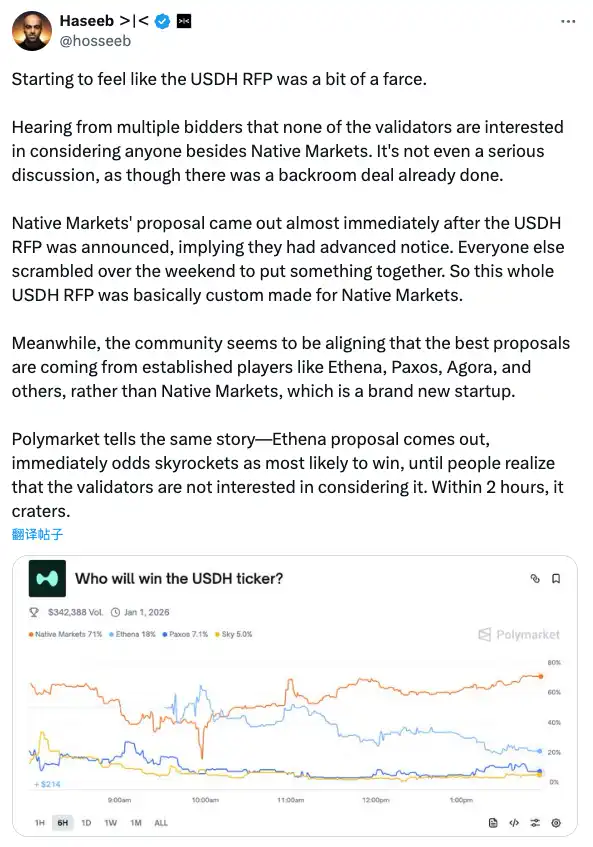

Hasseb, a partner at Dragonfly, cited Polymarket's prediction insights during discussions about USDH.

It is worth noting that the capital market is also chasing this new trend. Since last year, several prediction market platforms have received significant funding, and their valuations have rapidly increased. Shortly after winning the lawsuit, Kalshi announced it had completed a $100 million financing round, reaching a post-investment valuation of $1 billion. Polymarket also raised $200 million in early 2025, bringing its valuation to approximately $2 billion.

Emerging startups are springing up, and interest from capital is increasing. In this sector, institutional investment has grown from just $3 million in 2021 to $370 million today.

Thomas Peterffy, the founder of the established online brokerage Interactive Brokers, publicly predicted in a CNBC interview in November 2024 that the scale of prediction markets could surpass that of the stock market in the next 15 years, as they uniquely price various public expectations.

After experiencing the ebb and flow of the Memecoins craze, the prediction market may be poised to become the new arena for speculative capital competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。