Crypto Surge as PPI Inflation Data Falls, But Is 50bps Rate Cut Ahead?

Markets usually celebrate when prices cool down. That’s what happened today when PPI Inflation data falls more than crypto analysts expected. Crypto coins like Bitcoin, Ethereum, XRP, and Solana all jumped.

The total crypto market cap touched $3.96 trillion, up 3% in just a few hours. But the happiness didn’t last long. President Donald Trump attacked Fed Chair Jerome Powell, saying rates must be reduced “BIG” right now.

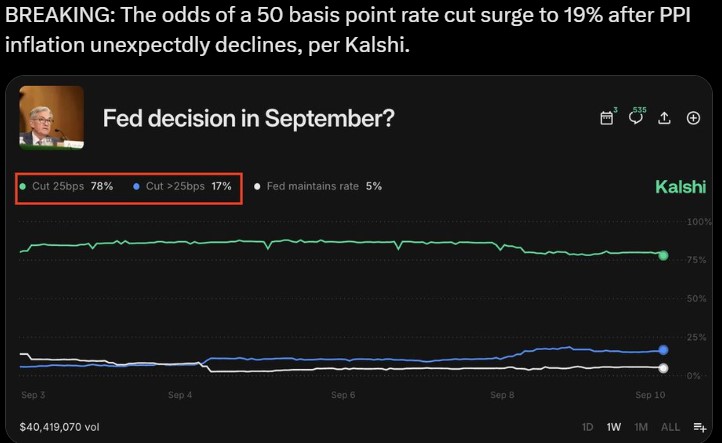

Soon after, chances of a 50bps rate cut went up to 19%, according to Kalshi. With the FOMC meeting coming next week, traders now wonder: is this the start of a dream run—or could it turn into a risky trap?

PPI Inflation Falls Sharply : Why Today’s Report Surprised Everyone

The August PPI report today gave a huge shock to analysts. Here’s the data as per Crypto Rover X post :

-

Headline Producer Price Index was 2.6% against 3.3% expected

-

Core Producer Price Index came at 2.8% instead of 3.5%

-

July headline number revised lower to 3.1% from 3.3%

-

Core July revised to 3.4% from 3.7%

The month-over-month PPI turned negative—only the second time since March 2024. This means inflation is cooling faster than experts thought.

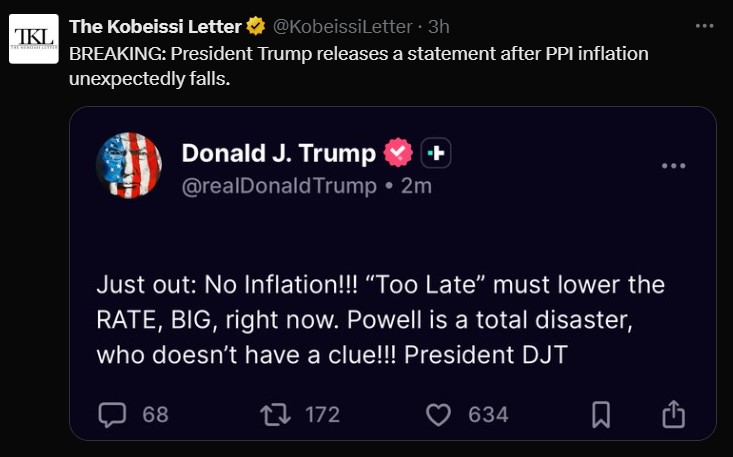

Trump Fires Back: “Lower the Rate, BIG!” — Political Drama Hits Powell

The positive mood didn’t last. Just hours after the PPI inflation news, Trump posted a strong statement:

Source: The Kobeissi Letter

This direct attack on Powell pushed traders to bet on deeper cuts. Odds of a 50bps cut soared to 19%.

Here’s the issue: inflation data gives Powell a reason to cut rates, but Trump’s loud demand makes the whole thing look political. If the Fed moves too fast, people may feel the decision was forced, not logical. That can hurt confidence in the system.

What to Expect Next Week? Fed FOMC Meeting Choices

The upcoming FOMC Fed meeting is now the main event. Here are the possible outcomes:

-

25bps Cut: This was the most likely option before today. A small cut looks safe after cooling price increase. If this happens, markets cheer and currencies stays strong.

-

50bps Rate Cut Meaning : Now this option is gaining weight. With the PPI Inflation data falls headline surfaces, some argue the Fed can go bigger, but confidence may drop even if prices jump for a while.

-

-

No Changes: Almost impossible now. If Powell keeps rates the same, it could anger both traders and politicians.

So next week’s meeting is not just about numbers—it’s about trust.

Crypto Market Outlook: Rally or Storm Ahead?

Right now, the crypto market is surging. But cryptocurrency runs on big money flows, and that depends on the Fed.

-

Positive case: Lower inflation + relief = more liquidity → chance for another rally like 2020.

-

Negative case: A surprise 50bps cut signals panic → people fear bigger problems → volatility comes back.

This means the market stands at a clear crossroad: either the latest PPI CPI data crypto impact power a big rally , or the Fed’s decision sparks turbulence.

Conclusion

The headline PPI Inflation data falls gave crypto a big boost, pushing the market near $4T. But Trump’s fiery call for “BIG” cuts and the sudden jump in rate cut odds created fresh doubt.

Next week’s Fed meeting is now the key moment. It will decide whether this rally continues strongly—or whether hidden risks bring new shocks. Traders must stay ready, because the real move begins when Powell speaks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。