Original Title: Falcon Finance ($FF) Sale Analysis: DWF's Stablecoin Play

Original Author: Stacy Muur

Original Translation: Luffy, Foresight News

Falcon Finance's token FF is about to launch on the Launchpad platform Buidlpad. This is not just another ordinary token sale, but the first public appearance of the flagship stablecoin project under top market maker DWF Labs, and the timing of the sale is impeccable.

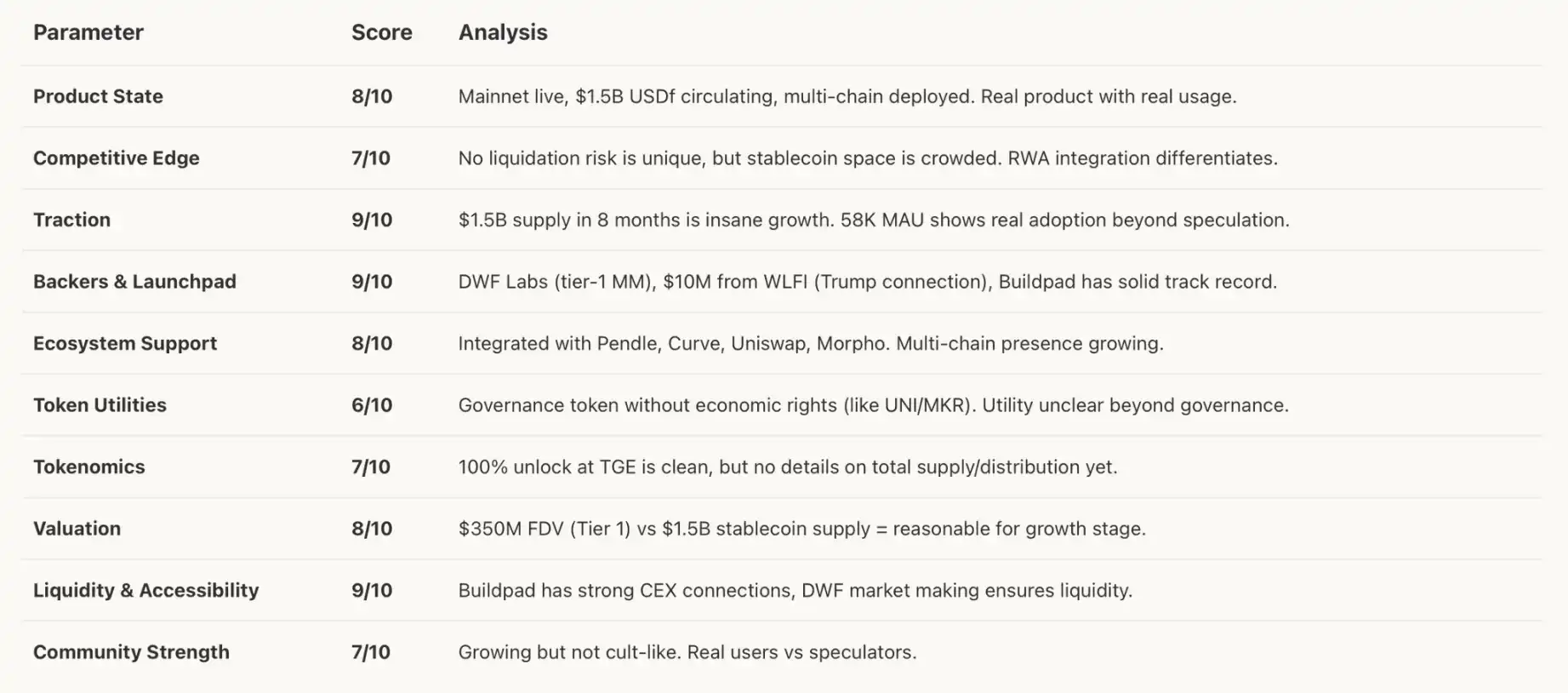

My Rating:

Overall Rating: 7.8/10. Strong fundamentals with clear upward catalysts.

Project Overview

Main Features of Falcon

· Universal Collateral Infrastructure: Users can collateralize Bitcoin, Ethereum, SOL, stablecoins, altcoins, and even tokenized real-world assets (RWAs) to mint the stablecoin USDf.

· No Liquidation Risk: Unlike traditional Collateralized Debt Position (CDP) protocols, Falcon employs an over-collateralization mechanism with no liquidation process.

· Yield Generation: Users can stake USDf to earn sUSDf for higher returns.

· Multi-Chain Strategy: Deployed on Ethereum, Arbitrum, and Base, with plans to expand to the Solana network.

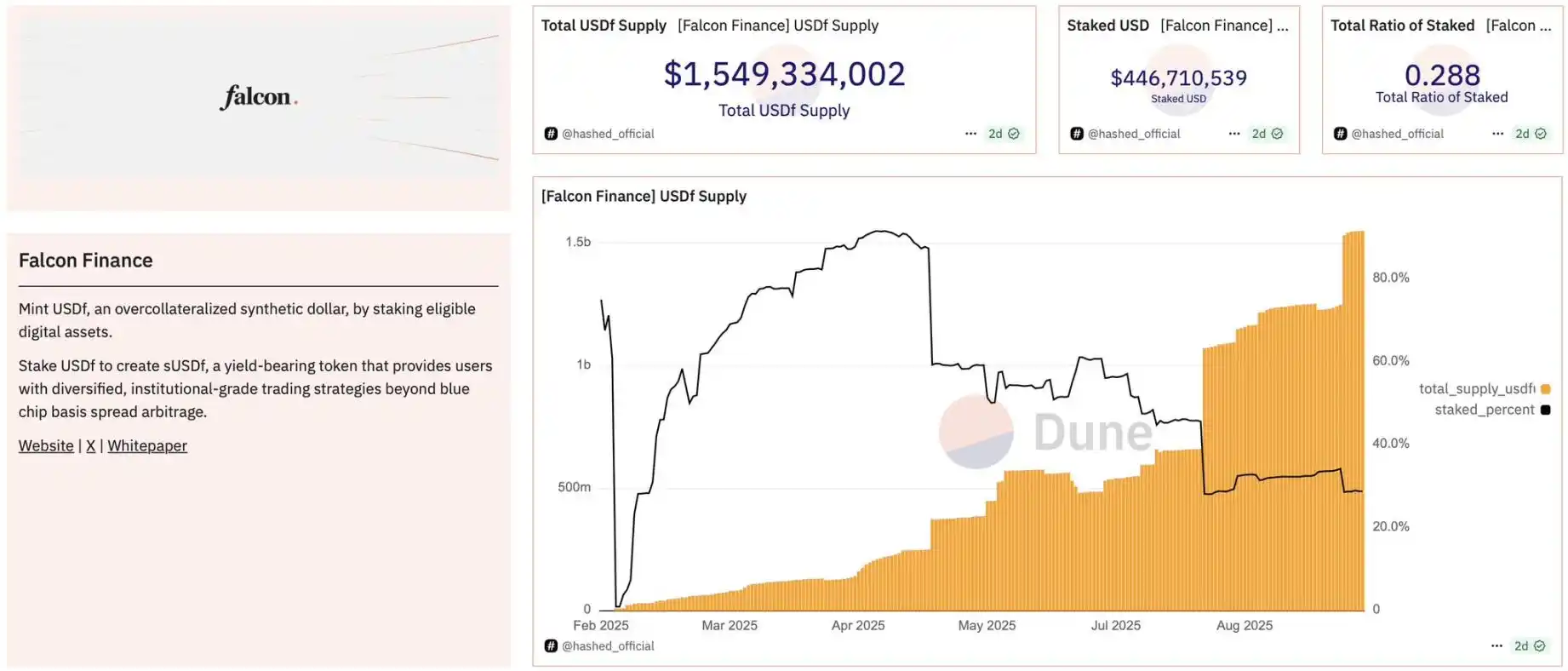

Current Traction

· USDf circulation reached $1.5 billion, ranking 8th among stablecoins just 8 months after launch.

· Reserves exceed $1.6 billion.

· Over 58,000 monthly active users.

· Total Value Locked (TVL) on Pendle exceeds $273.4 million.

Core Advantages of Falcon

Proven Product-Market Fit

Unlike most token sales that rely on "promissory financing," Falcon's stablecoin already has a circulating market value of $1.5 billion. This is not a short-term operation to "inflate TVL," but a reflection of real stablecoin demand.

Heavyweight Institutional Support

· DWF Labs: A top market maker with strong financial backing and close cooperation with major exchanges.

· $10 million investment from WLFI: Associated with the Trump family, which could bring regulatory tailwinds and mainstream attention to the project.

· Past performance of Buidlpad platform: Previous projects like Lombard have performed well.

Excellent Market Timing

· Rising interest in stablecoin narratives, with regulatory frameworks becoming clearer.

· Accelerating trend of tokenizing real-world assets (RWA).

· Friendly cryptocurrency policies from the Trump administration are about to be implemented.

· Decentralized finance (DeFi) yield products are gaining recognition from institutional investors.

Sustainable Revenue Flywheel

Unlike pure governance tokens, Falcon has real sources of income:

· USDf minting fees.

· Interest income from sUSDf staking operations.

· Fees related to RWA integration.

· Revenue from cross-chain expansion.

Main Risks of Falcon

Doubtful Token Utility

The biggest concern: FF is only a governance token and does not have economic rights to profits. Unlike MKR or AAVE, where token holders can participate in protocol profit distribution, FF holders only have voting rights. This limits the long-term value accumulation potential of the token.

Intense Competition in the Stablecoin Market

The competition in the stablecoin space is "brutal": USDC and USDT dominate, while newcomers like PYUSD (PayPal stablecoin) and FDUSD (Fidelity stablecoin) have backing from large institutions. Falcon needs to prove that its stablecoin demand can surpass the "DeFi yield mining" scenario and is sustainable.

Regulatory Uncertainty

Despite connections to the Trump camp, stablecoin regulatory policies are still evolving. Any negative regulatory developments could impact the overall project model.

Controversies Surrounding DWF Labs' Reputation

Despite being a top market maker, DWF Labs has faced criticism for employing "pump and dump" strategies in some investments, making its involvement a double-edged sword for the project.

Sale Terms Analysis

Advantages

· Dual Pricing Mechanism: USDf/sUSDf stakers can enjoy a fully diluted valuation (FDV) discount of $350 million, while non-stakers will have a valuation of $450 million.

· 100% TGE Unlock: No lock-up period, allowing for direct withdrawal if needed, providing high flexibility.

· Reasonable Financing Scale: A financing amount of $4 million is not too high and is sufficient to support project advancement.

· Low Entry Barrier: Investment amounts range from $50 to $4,000, allowing ordinary retail investors to participate.

Disadvantages

· High Valuation Risk: Even at a $350 million FDV, the pricing remains high for a governance token without profit sharing.

· Only USD1 Payment Supported: Forces users into the WLFI ecosystem, which, while a strategic layout, limits user payment options.

Catalysts and Upside Scenarios

Short-Term Catalysts (1-3 months)

· TGE and Exchange Listing: With DWF's resources, it is highly likely to be listed on major exchanges like Binance, OKX, and Bybit.

· Cross-Chain Expansion: Deployment to the Solana network could double the user base.

· RWA Product Launch: Integration of tokenized government bonds and other assets.

Mid-Term Catalysts (3-12 months)

· Institutional Adoption: Corporate finance departments will use USDf for yield management.

· Regulatory Clarity: Implementation of stablecoin regulatory frameworks could drive the entire industry upward.

· DeFi Ecosystem Integration: More protocols will include USDf as acceptable collateral.

· Revenue Sharing Mechanism: The token economic model may upgrade to allow FF holders to participate in protocol fee distribution.

Price Predictions

Optimistic Scenario (30% probability)

· Target Valuation: Fully diluted valuation (FDV) exceeds $1 billion (3-4 times the $350 million entry price).

· Driving Factors: Listing on major centralized exchanges, airdrop enthusiasm, and large-scale institutional adoption; time frame: 3-6 months post-TGE.

Base Scenario (55% probability)

· Target Valuation: FDV reaches $500-700 million (1.5-2 times the entry price).

· Growth Logic: Steady growth achieved through DeFi ecosystem penetration; time frame: 6-12 months.

Pessimistic Scenario (15% probability)

· Target Valuation: FDV drops to $200-300 million (breakeven to a 15% loss).

· Risk Triggers: Intensified competition in the stablecoin market, regulatory issues erupting, or DWF Labs withdrawing.

Conclusion

Falcon Finance is a project with real implementation capabilities. As a functional stablecoin protocol, Falcon has achieved a $1.5 billion actual usage rate, has institutional backing, and has clear growth catalysts. The terms of the token sale are reasonable, and the timing aligns with multiple macro trends.

The main risk lies in the weaker utility of FF compared to governance tokens with profit-sharing mechanisms.

My conclusion: For investors optimistic about stablecoins, RWA tokenization trends, and the Trump administration's cryptocurrency policies, this is a high-certainty investment opportunity. Given the project's current progress and backing, the $350 million FDV entry price is attractive.

Action Plan

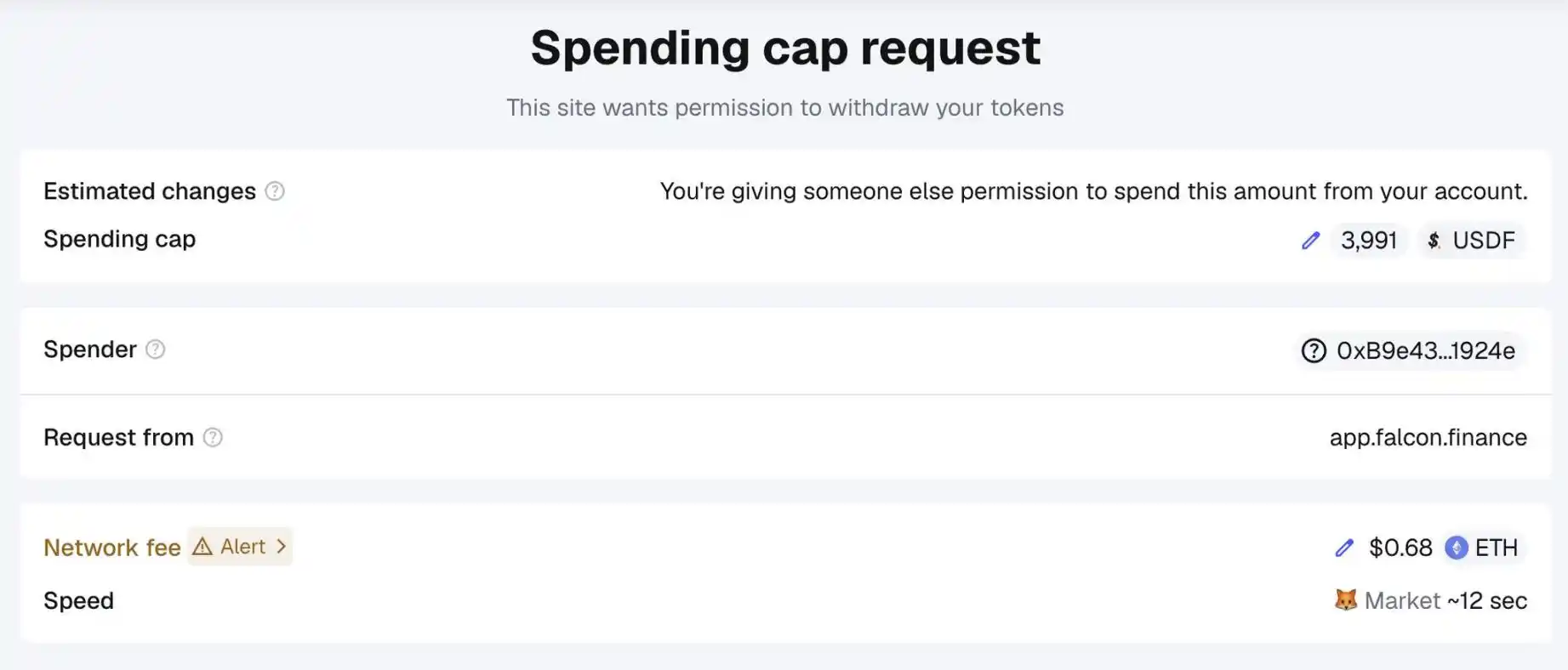

· Aim to secure the $350 million valuation tier (immediately stake USDf/sUSDf).

· Complete identity verification on Buidlpad.

· If you agree with the project logic, consider participating in the investment up to the limit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。