Source: Alea Research

Translation: Zhou, ChainCatcher

In the past few years, DeFi has been building high-throughput trading venues, complex yield primitives, and on-chain money markets. However, a key feature has been fundamentally missing: a neutral clearing layer that can balance risks between different positions and venues.

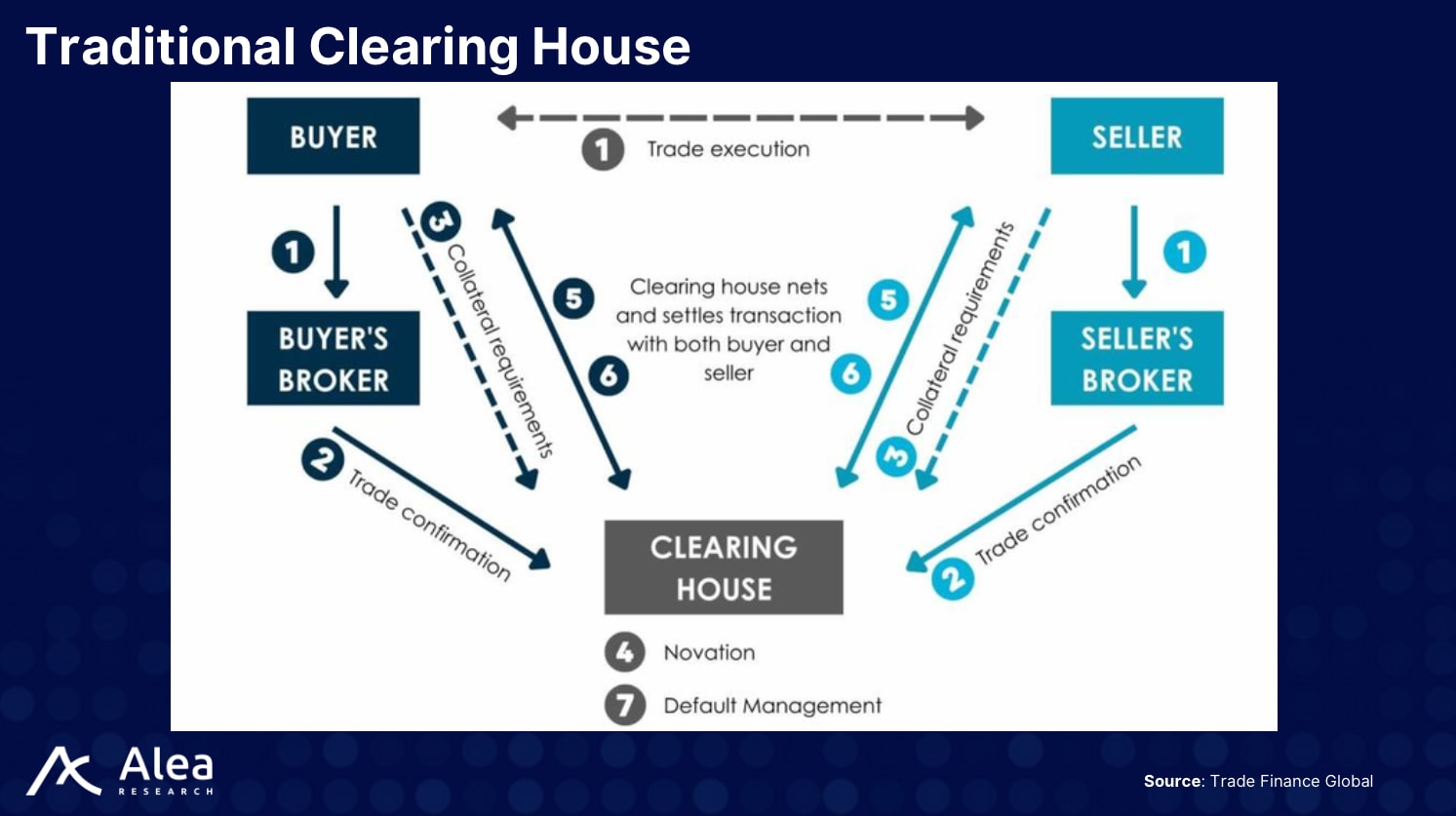

In traditional markets, clearing institutions like LCH and CME sit between counterparties, responsible for net exposures, executing margin rules, and sharing risks.

The fragmentation and over-collateralization in DeFi indicate that without proper clearing infrastructure, exchanges will sever risk logic, excessively lock up collateral, and still suffer from periodic crises. The potential $35 trillion opportunity in on-chain derivatives and RWA markets is being completely overlooked.

Pascal Protocol aims to be the clearinghouse for DeFi, serving as a neutral middleware that calculates margin based on portfolio netting and VaR-based models, executes clearing in a deterministic manner, and allows for net exposure across platforms.

This article will explore clearing opportunities, Pascal's solution, and the upcoming $PASC TGE.

Why DeFi Needs Clearing

Clearing occurs between the trade and its settlement, ensuring that funds and assets flow to the correct party at the right time without counterparty risk. Clearinghouses net exposures at the portfolio level and calculate margins, ensuring that participants only need to post collateral for actual risks.

In DeFi, this layer is almost non-existent.

Each platform requires its own collateral, ignoring cross-asset correlations. Positions are managed independently, and when volatility spikes, liquidations cascade across protocols. To ensure safety, some platforms lock up 150% to 200% of collateral, while others cut corners, leading to systemic fragility. This fragmentation prevents on-chain derivatives from realizing their true potential.

The Pascal team believes that unified clearing is crucial for unlocking capital-efficient DeFi products. By netting exposures across exchanges and products, margin requirements can be significantly reduced, similar to how portfolio margin in traditional finance releases capital for hedging strategies.

With a neutral clearing layer, traders can go long on BTC, short on ETH, and sell covered calls on both, only needing to post collateral for net risks. The result is deeper liquidity, lower capital costs, and a safer system for all participants.

Market Momentum and Opportunities

Pascal's ambitions extend beyond crypto perpetual trading. The protocol envisions a future where RWA derivatives, interest rate products, and cross-asset structured trades will all be cleared on-chain.

The company recently partnered with Treehouse to develop a decentralized fixed income market, indicating a product pipeline that requires complex margin mechanisms.

The nominal trading volume of the global derivatives market far exceeds that of the spot market, and traditional clearing institutions like the London Clearing House (LCH) or the Chicago Mercantile Exchange (CME) charge billions in fees annually, presenting a massive opportunity. Specifically, LCH's Swapclear (interest rate swaps) department alone has a nominal trading volume exceeding $10 trillion each year.

By bringing these economic structures on-chain, Pascal positions itself as the LCH/CME of DeFi, capturing value from all scenarios that access its clearing infrastructure.

Pascal's Clearing Engine

Pascal's solution is to introduce a modular clearing engine that any exchange, DAO, or protocol can connect to. Key features include:

Portfolio netting: Netting risks across multiple positions and scenarios, hedging exposures, and reducing collateral requirements.

VaR-based margin: Moving away from fixed margin ratios to dynamically calculating margins based on Value-at-Risk, reflecting actual exposures and correlations.

Transparent logic: All settlement and clearing rules are enforced by smart contracts; risk parameters and calculations can be audited on-chain.

Composable infrastructure: From perpetual contract DEXs to structured product issuers, any DeFi protocol can integrate Pascal to outsource risk management.

This approach separates risk management from order books and automated market makers (AMMs), turning clearing into a shared service. For example, the decentralized derivatives exchange Jetstream clears every trade through Pascal, while partners like Treehouse are testing smart clearing for decentralized interest rate products.

$PASC TGE and Governance

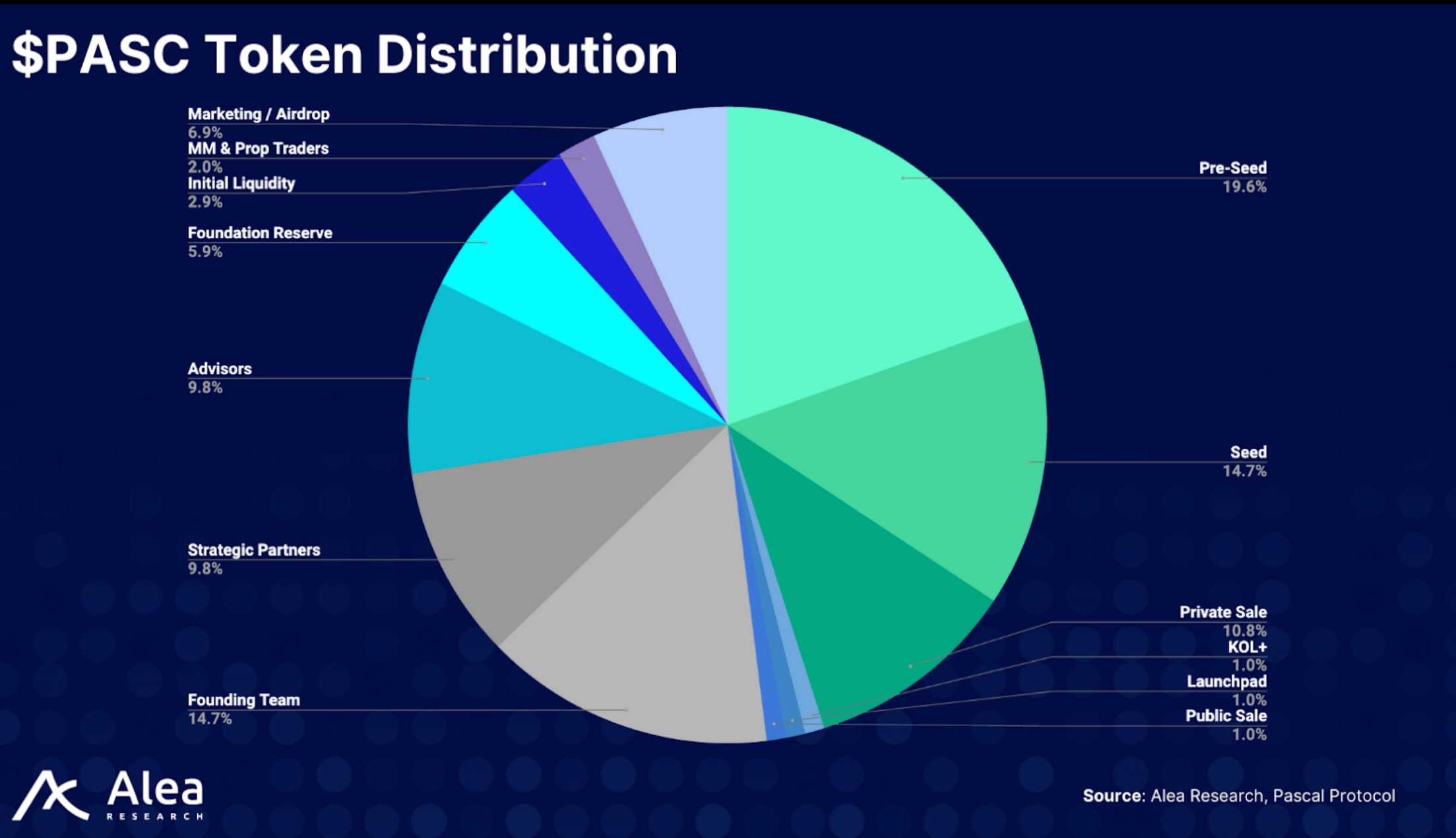

The $PASC token will undergo its TGE on September 9, granting holders rights to the clearinghouse. The token distribution is as follows:

Additionally, $PASC stakers can earn an annual yield of 15–35% based on the staking duration, receive Jetstream points that can be exchanged for $JETS tokens during Jetstream's TGE, and share 20% of Pascal's fees in USDC.

Initially, about 6.5% of the token supply will be unlocked, with the remaining portion smoothed out through vesting. Liquidity will be injected through Uniswap, with LP incentives provided to deepen the market.

$PASC holders can propose and vote on matters such as risk parameters, fee structures, new asset support, and cross-chain expansion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。