Author: Squiffs

Translation: Jiahua, ChainCatcher

The native stablecoin USDH planned by Hyperliquid has become one of the most notable competitions in the DeFi space in recent years, with various institutions and DeFi projects vying for the voting support of validation nodes.

However, Haseeb Qureshi, a partner at the crypto investment firm Dragonfly, claims that this competition has long been marked by "behind-the-scenes dealings." He posted on X (formerly Twitter), stating, "I have heard from multiple bidders that all validation nodes are only interested in Native Markets and are not seriously considering any other parties, as if a backdoor deal has already been reached. The proposal from Native Markets was released shortly after the USDH request for proposals (RFP) was announced, which seems to indicate they received the news in advance."

Under Qureshi's post, CL, a spokesperson for the anonymous crypto trader Hypurrscan, which holds 15% of Hyperliquid's total voting power, publicly expressed support for Native Markets. However, Alex Svanevik, founder of Nansen, which operates Hyperliquid's largest validation node, The Hypurr Collective, strongly refuted Qureshi's accusations.

Svanevik responded, "This is not true. Our team has invested a lot of effort in reviewing proposals and communicating with bidders to find the best solution for Hyperliquid. I have received countless private messages and calls from USDH bidders this week. We have always been proactive in reaching out to them."

Native Markets Proposal

In the past week, the competition for the issuance of USDH has intensified, with DeFi giants including Sky (formerly Maker), Ethena, Paxos, and Agora submitting formal proposals. Notably, Dragonfly has invested in both Agora and Ethena, which have also submitted USDH proposals and are participating in the competition.

Haseeb's accusations primarily target the proposal from Native Markets. This proposal calls for the native minting of stablecoins on HyperEVM while maintaining compliance with the GENIUS Act, and inheriting the fiat on-ramps of its issuer Bridge (a subsidiary of Stripe).

Stripe just announced last week its upcoming permissionless Layer 1 blockchain, Tempo, which is expected to simplify the fiat onboarding process for Hyperliquid, which currently requires on-chain bridging solutions.

The Native Markets team includes Max Fiege, who previously worked at Liquity and Barnbridge, as well as Anish Agnihotri, former president and COO of Uniswap Labs.

Unlike other proposals that suggest using most of the USDH revenue for HYPE buybacks, Native Markets proposes to allocate 50% of reserve earnings to the Hyperliquid assistance fund for HYPE buybacks, while the other 50% will be reinvested for the growth of USDH.

Competition from Ethena, Sky, and Paxos

Paxos quickly proposed a revised proposal last night. This proposal includes a partnership with PayPal to list HYPE on PayPal and Venmo, providing free fiat deposit and withdrawal channels, a $20 million ecosystem incentive, and an "AF priority incentive structure," meaning Paxos will not charge any fees until a TVL milestone is reached.

In the latest developments of this situation, Paxos co-founder Bhau Kotecha expressed his willingness to collaborate with Native Markets.

This idea originated from investor Mike Dudas's tweet, in which he wrote, "Isn't the most obvious USDH solution simply to merge the proposals from Native Markets and Paxos? Native Markets handles the front end (Hyperliquid native, deeply integrated with the ecosystem), while Paxos manages the back end (compliant with the GENIUS Act, with an issuer that already has billions in scale, distributed through PayPal/Venmo)."

Meanwhile, the cross-chain version of the Tether stablecoin USDT0 announced that it will not participate in this competition.

In addition to formal proposals, these protocols are also actively seeking support from the Hyperliquid community. Agora's proposal included a public speech from Jan van Eck, CEO of investment firm VanEck, which has $130 billion in assets, on X. Ethena took a more humorous approach, parodying the lyrics of rapper Eminem's song "Stan" in a playful letter to Hyperliquid founder Jeff Yan.

Sky's proposal has also garnered attention, with co-founder Rune Christiansen posting their proposal in the Hyperliquid Discord group last night. The proposal emphasized the successful history of Sky and DAI, promising Hyperliquid an annual yield of 4.85% on all USDH issued on Hyperliquid, and Sky may deploy its $8 billion balance sheet on Hyperliquid, along with providing a $25 million grant to create the "Hyperliquid Star," aimed at fostering DeFi development on Hyperliquid.

The synthetic dollar protocol Ethena made a strong counterattack on September 9, proposing its own plan. This proposal envisions USDH being 100% backed by USDtb, a stablecoin supported by the BlackRock BUIDL fund. Ethena's proposal also promises to return "at least 95%" of USDH reserve income in the form of HYPE purchases to the Hyperliquid ecosystem, along with providing "at least $75 million in cash and token incentives for the development of HIP-3 front end."

Sky and Ethena are the third and fourth largest stablecoins by market capitalization, following Circle's USDC and Tether's USDT. Ethena's USDe has a market cap of nearly $13 billion, while Sky's DAI has a market cap of about $5 billion. However, the combined market share of both is still far below the two market giants: USDC has a market cap of $72 billion, and USDT has a market cap of $169 billion.

As traditional institutions and DeFi projects continue to ramp up competition, the builders of HyperEVM are focused on their future mission. Charlie, a contributor to Felix Protocol, told The Defiant, "The real work of the entire USDH scheme will only begin at launch, as the real question will be how to scale it to $5 billion."

He referenced a post on X, explaining that for USDH to have a real impact on Hyperliquid, it needs to focus on more than just yield rebates or HYPE token buybacks. "If they think this is the way to win the selection, I wouldn't rule out USDT/USDe/USDC joining this incentive game as well. We need to see a clearer path to shake USDC's dominance for these USDH proposals to become more attractive."

It is worth noting that although Tether's subsidiary USDT0 withdrew from the competition earlier today, it remains unclear whether this means Tether officially withdraws as well, and Circle has remained silent on the matter so far.

Growth of Hyperliquid

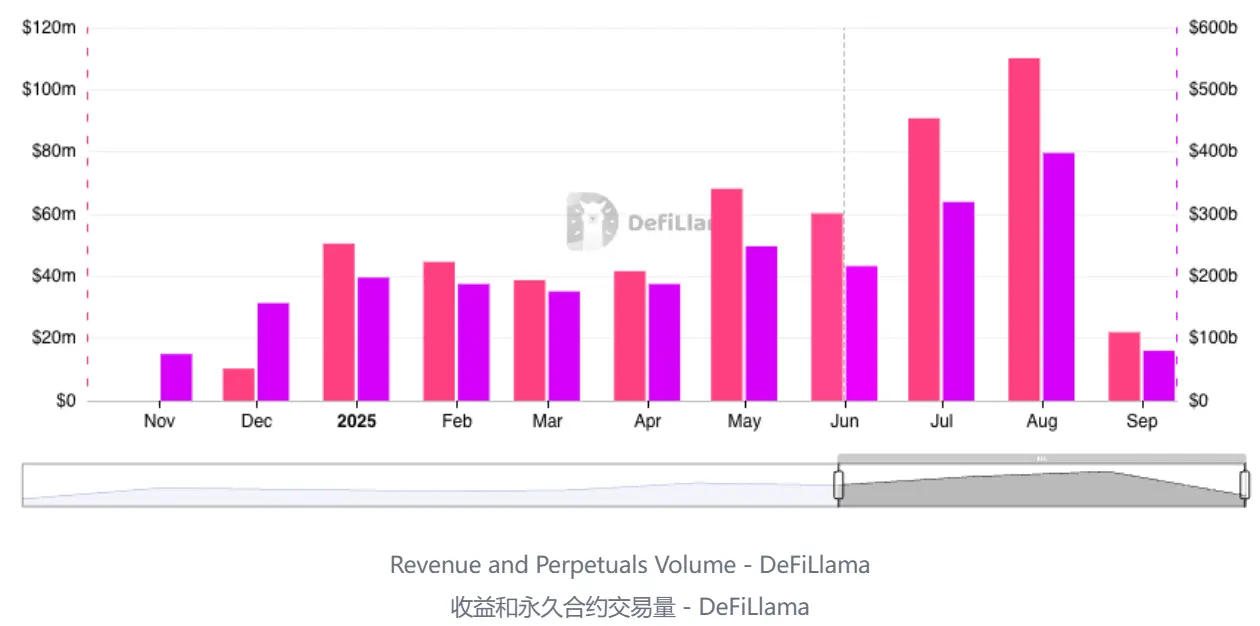

The growth of perpetual contract exchanges and Layer 1 has been a recurring theme for 2025.

Hyperliquid currently accounts for over 35% of all cryptocurrency revenue, with an annual revenue of $1.28 billion, of which 99% flows to the Hyperliquid assistance foundation for HYPE token buybacks.

Hyperliquid's Layer 1 blockchain HyperEVM has been on a continuous upward trend since its mainnet launch in February, currently ranking as the eighth largest blockchain with a total locked value (TVL) of $2.6 billion, while its TVL was only $400 million at the beginning of 2025.

Meanwhile, the HYPE token has been one of the best-performing crypto assets since its launch in November 2024. The token debuted with a fully diluted valuation of about $3 billion and has surged over 1700% since its release, reaching an all-time high of $55.7 overnight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。