I. Outlook

1. Macroeconomic Summary and Future Predictions

Last week, inflation showed a slight rebound, with the August CPI annual rate rising to 2.9%, the core CPI steady at 3.1%, and the PPI annual rate at 2.6%. This "employment weakness + inflation stickiness" pattern puts the Federal Reserve in a dilemma, leading the market to strengthen expectations for a rate cut in September, with most betting on a 25 basis point cut, although some institutions have shifted to predicting a more aggressive 50 basis point cut.

Looking ahead, the Federal Reserve is likely to begin a rate cut cycle in September, but the statement may emphasize a "gradual, data-dependent" stance to avoid excessive easing that could trigger a resurgence of inflation. Overall, risk assets may receive short-term support from liquidity expectations, but without fundamental improvements, sustained increases may be difficult to achieve, while safe-haven assets like gold and U.S. Treasuries are expected to continue attracting funds.

2. Market Movements and Warnings in the Crypto Industry

Last week, the overall crypto market maintained a volatile pattern. Bitcoin fluctuated around $110,000, with limited gains for Ethereum. Market sentiment was neutral but still benefited from expectations of a Federal Reserve rate cut, leading to a slight warming of risk appetite.

Looking ahead, there are significant risks in the market, with policy and inflation data being key variables affecting short-term trends. If data weakens rate cut expectations, risk assets may come under pressure. Additionally, historically, September is often a weak month for the crypto market, and combined with the high valuations and realization risks of some new projects, volatility may be amplified, requiring investors to remain cautiously defensive.

3. Industry and Sector Hotspots

With $6 million in funding led by Momentum, DeAgent AI, which focuses on trustworthy, autonomous, cross-ecosystem smart infrastructure, is the largest AI Agent infrastructure in the SUI, BSC, and BTC ecosystems; with $13.4 million in funding led by Framework, USD.AI is a stablecoin lending protocol designed to convert computing hardware into standardized financial assets, specifically for AI startups.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Brief Analysis of DeAgent AI, which raised $6 million led by Momentum, focusing on trustworthy, autonomous, cross-ecosystem smart infrastructure

Introduction

DeAgent AI is the largest AI Agent infrastructure in the SUI, BSC, and BTC ecosystems, capable of rapidly deploying AI models in various segmented scenarios to achieve autonomous decision-making and execution. By adopting a minimal entropy consensus mechanism, DeAgent AI ensures the consensus, identity, and continuity of AI Agents, promoting the application of decentralized intelligent consensus mechanisms and accelerating humanity's transition to an AI-driven society.

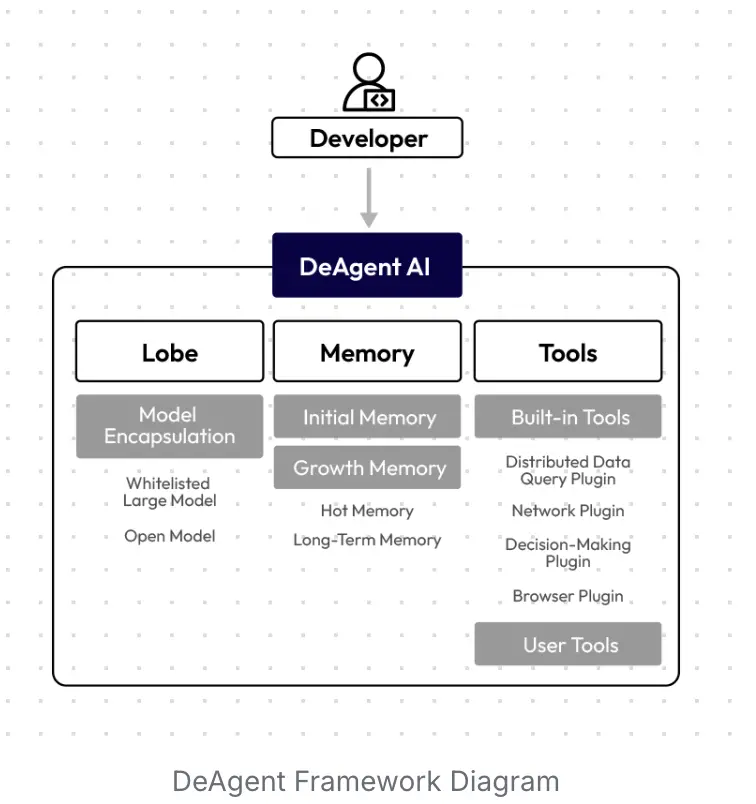

Architecture Overview

The De(cision)Agent framework (DeAgent) is proposed to address three core challenges faced by AI Agents in distributed systems. It provides a structured framework for creating, running, and interacting with AI Agents.

The definition of a DeAgent instance includes the following components:

Lobe (Brain): Represents the cognitive engine of the Agent. It encapsulates the logic for invoking one or more large language models (LLMs), processing inputs, and generating outputs. The Agent creator must specify the Lobe used, which can be predefined or custom implementations.

Memory: Contains the Agent's initial state (genesis memory) and its accumulated interaction history (evolution memory), providing a foundation for the Agent's continuity.

Tools: Specifies a set of capabilities that the Agent can invoke, such as accessing external data, interacting with other systems, or performing specific operations in a distributed environment. It also includes instructions on how the Lobe invokes these tools.

Creation: DeAgent instantiates by publishing its definition (Lobe URI, initial memory state, tool specifications) at a specific address or identifier in a distributed system (such as a blockchain mainnet or decentralized storage network).

Inherited Properties: DeAgent naturally inherits the properties of its underlying distributed system. If the system guarantees the immutability of published data, then the core definition of the Agent will also be immutable. If the system provides strong consistency and ordering guarantees (finality), it lays the foundation for the Agent's identity and continuity.

Technical Neutrality: The DeAgent framework remains neutral regarding the specific encoding format, publishing method, or advanced features (such as native immutability) of the underlying distributed system. However, developers and communities adopting DeAgent on specific platforms should establish clear standards and norms. The minimum requirement for the host system is to achieve a unique final state recognized by participants (i.e., possessing intrinsic consensus and identity).

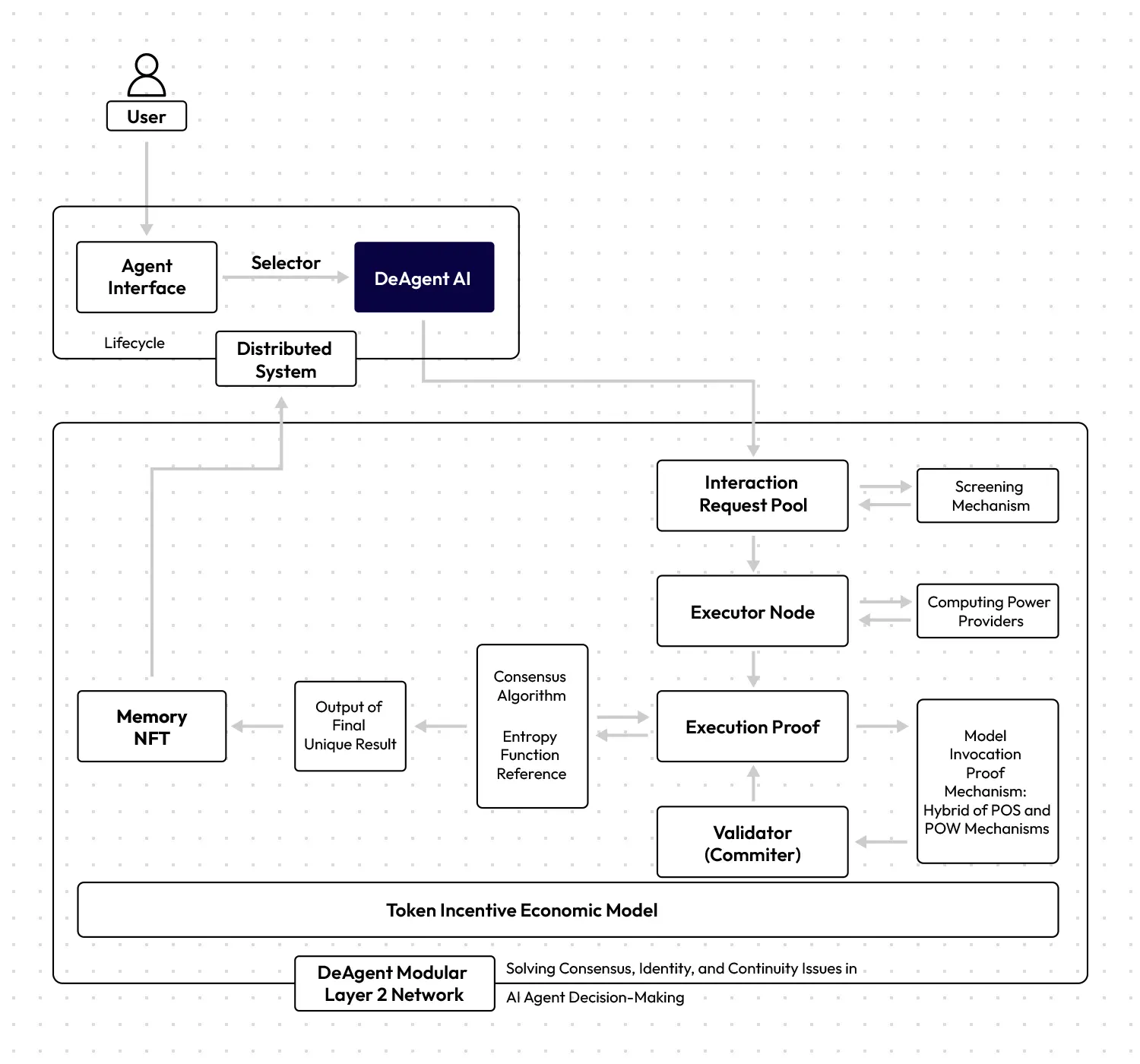

Interaction: Users interact with DeAgent by submitting operations to the Agent address (e.g., transactions in a blockchain context). These operations include interaction payloads (text, images, audio, video inputs, or references to immutable data when the payload is too large). Different platforms need to establish specific operational standards.

Execution: The DeAgent framework relies on Executors. These nodes are responsible for processing interactions and may be centralized, operated by multiple trusted parties, or fully decentralized. Executors monitor interactions with DeAgent in the distributed system, retrieve the Agent's definition and current state (memory), and use the specified Lobe and tools to execute the interaction, generating potential outcomes.

Consensus and Finalization: Executors submit results and execution proofs. Subsequently, a network composed of Committers (validators) applies a consensus protocol (to be detailed later) to select a unique normative result for each interaction cycle, thereby ensuring identity. This result updates the Agent's state (memory) in the distributed system, establishing continuity.

How It Works

1. Lifecycle and Roles: Creator, Executor, Validator

The DeAgent ecosystem involves several key roles:

Agent Creator: Defines the Agent's Lobe, initial Memory, and Tools, and publishes this definition in the distributed system, allowing the Agent to exist.

Agent User: Interacts with the Agent by submitting queries or task operations on the distributed system.

Framework Operators: Responsible for maintaining the operational integrity of the DeAgent ecosystem, including:

Executors: Nodes that run the Agent logic (Lobe + Tools + Memory), which can be private nodes (e.g., running in TEE) or open participants.

Compute Providers (optional): Specialized nodes that provide execution services for specific (usually open-source) models, potentially forming a sub-network with its own incentive mechanism.

Committers (Validators): Nodes responsible for verifying the execution proofs submitted by Executors and reaching consensus on the interaction results for each step. They select the final result based on the consensus mechanism (such as the minimal entropy principle) and submit it to the Agent state chain in the distributed system.

2. Agent Lifecycle

Creation:

The Agent creator publishes the Agent's definition on the distributed system.Interaction Request:

Users submit interaction requests for specific Agents (or Agent groups). These requests may include parameters, such as specified Executors (selectors) or incentive mechanisms (gas fees/tips). Requests enter the interaction pool (similar to a transaction memory pool).State Dependency:

Unlike typical transactions in a transaction pool that may remain valid across multiple blocks, the interaction requests for Agents are highly dependent on their current state. The Agent's response heavily relies on its current Memory. Once the Agent's state is updated due to a confirmed interaction, previous interaction requests targeting the old state become invalid and are discarded.Execution:

Executors select requests from the interaction pool (based on incentives, selectors, or internal policies) and use the specified Lobe, the Agent's current Memory state, and available tools to execute the logic.Candidate Submission:

Executors submit their results (responses, Memory updates, tool usage, execution proofs) to the candidate pool. Multiple Executors may handle the same interaction request, resulting in multiple candidate outcomes.Consensus & Finalization:

Within a defined time window (related to the Agent's "tick rate" or timeout), Committers evaluate the results in the candidate pool. Through a consensus mechanism (such as PoS voting, PBFT) and possible selection heuristics (like the minimal entropy principle), a unique normative result is ultimately selected.State Update:

The selected result is submitted to the distributed system, updating the Agent's official Memory/state chain. This ensures:

Identity: Only one result is confirmed at each step.

Continuity: The evolution of the state is predictable.

Death:

If an Agent remains inactive within the scheduled time (without confirmed interactions), it can be considered "dead" or dormant. Subsequently, interaction requests directed at it may be ignored by Executors.

Tron Commentary

The advantage of DeAgent AI lies in its provision of decentralized AI Agent infrastructure, capable of rapid deployment across ecosystems such as SUI, BSC, and BTC, while ensuring identity, continuity, and trustworthy execution through a minimal entropy consensus mechanism, thus achieving autonomous decision-making and distributed intelligent collaboration. Its disadvantage, however, is its reliance on the performance and consensus efficiency of the underlying distributed system, leading to higher execution costs and complexity, while still needing further improvement in standardization and cross-platform compatibility.

1.2. Interpretation of the $13.4 million funding led by Framework, aimed at transforming computing hardware into standardized financial assets through the stablecoin lending protocol USD.AI

Introduction

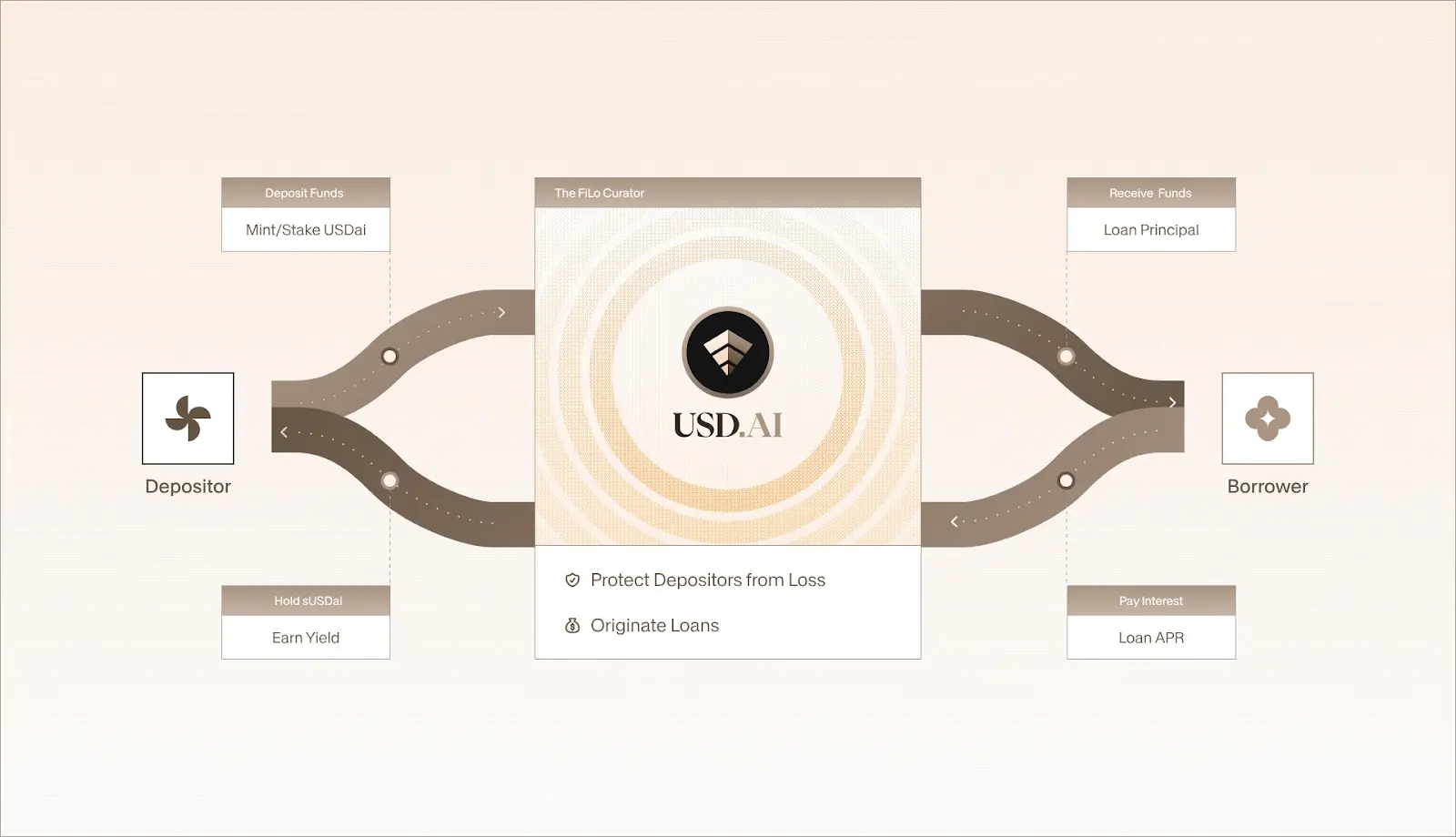

USD.AI, developed by Permian Labs, is a GPU-collateralized stablecoin lending protocol designed specifically for AI startups. It issues USDai (a token pegged to the U.S. dollar) and sUSDai (a yield-generating variant), allowing computing power resources (GPUs) to be used as collateral.

Architecture Analysis

Decentralized Stargate: A yield-bearing synthetic dollar supported by government bonds, AI infrastructure, and DePIN network assets.

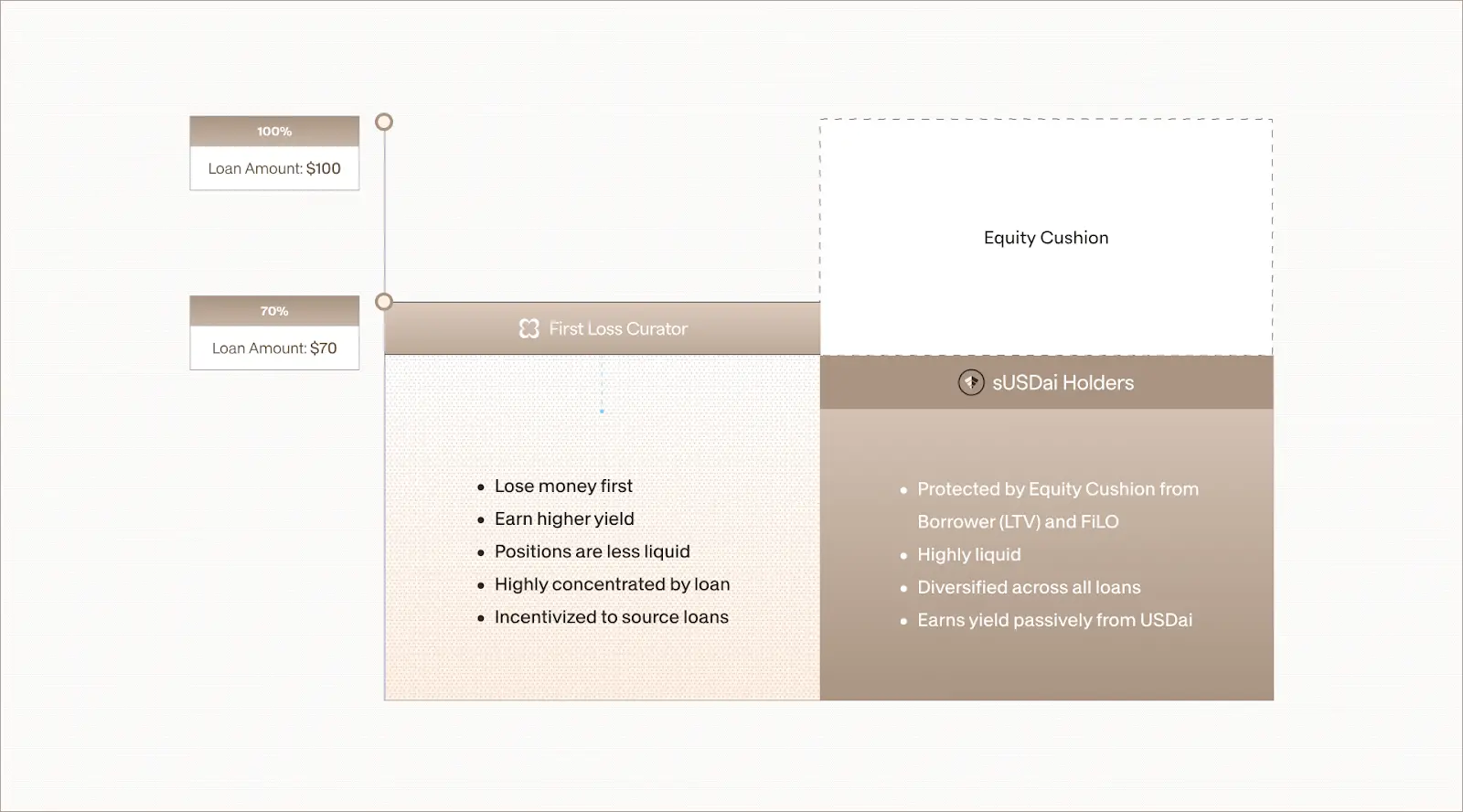

The USD.AI protocol operates around three core participants:

Depositors — Deposit USDC/USDT into the protocol, earning yields by minting USDai and staking it as sUSDai.

Borrowers — Typically non-hyper-scale infrastructure operators in need of hardware financing.

Curators — Provide first-loss capital, receive corresponding premiums, and separate capital from operators through a tokenization mechanism (CALIBER).

The uniqueness of this structure lies in its separation of capital from operators through CALIBER. The collateral is the hardware itself, while the risk is restructured into a standardized, investable form. This is similar to how "mortgage-backed securities" unlock the scale of real estate finance. Through this abstraction mechanism, transforming computing power into an asset class usable for credit, USD.AI opens up previously inaccessible capital sources for long-tail infrastructure and turns an overlooked scenario into a new frontier for revenue and tax optimization.

The three pillars of the USD.AI protocol

CALIBER — A tokenization framework for yields, enabling the tokenization of traditionally non-tokenizable assets.

FiLo — A risk curation process aimed at scalability, allowing future asset financing needs to be audited and publicly financed.

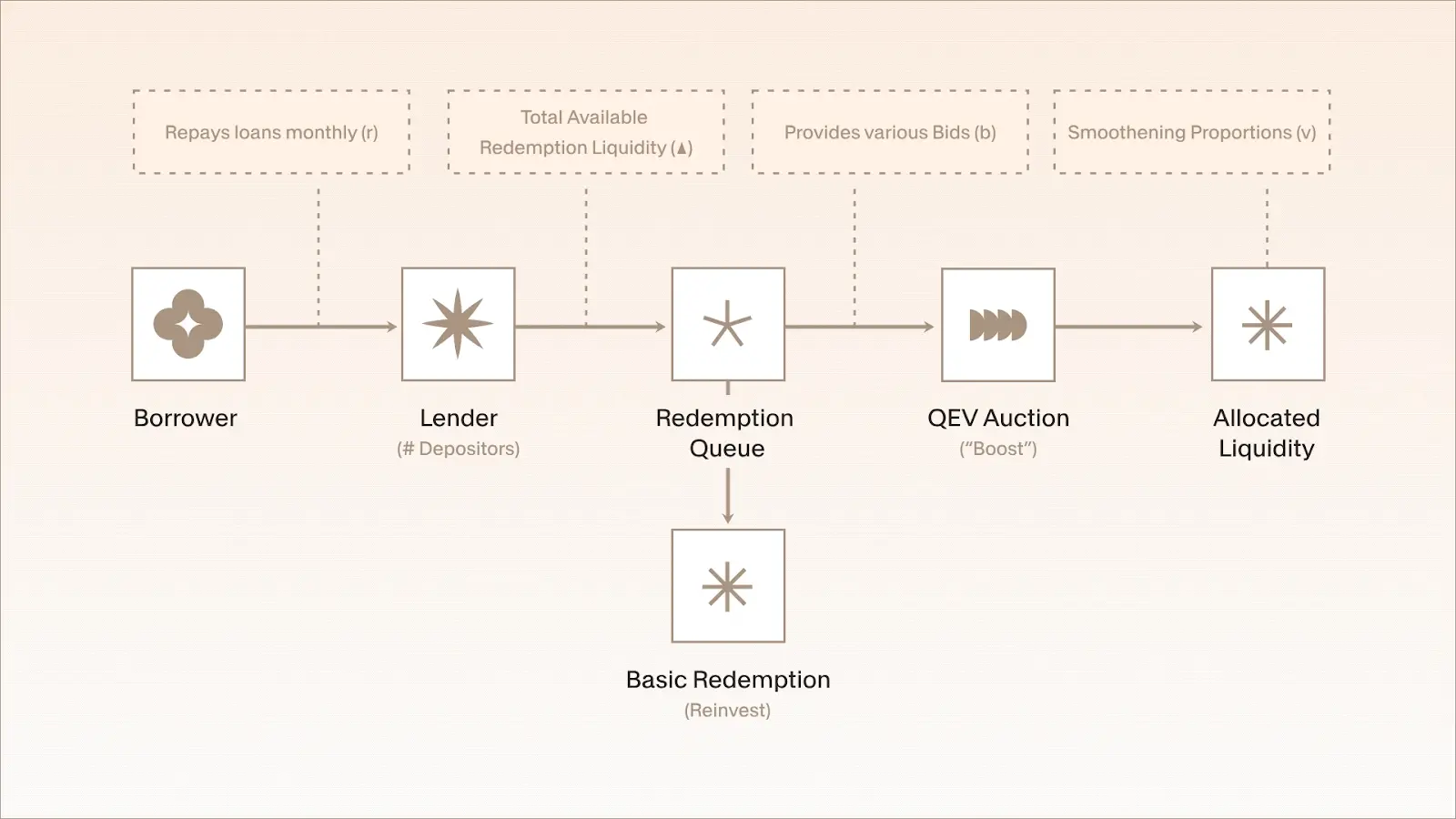

QEV — A liquidity system for redemptions, ensuring fair and transparent liquidity acquisition.

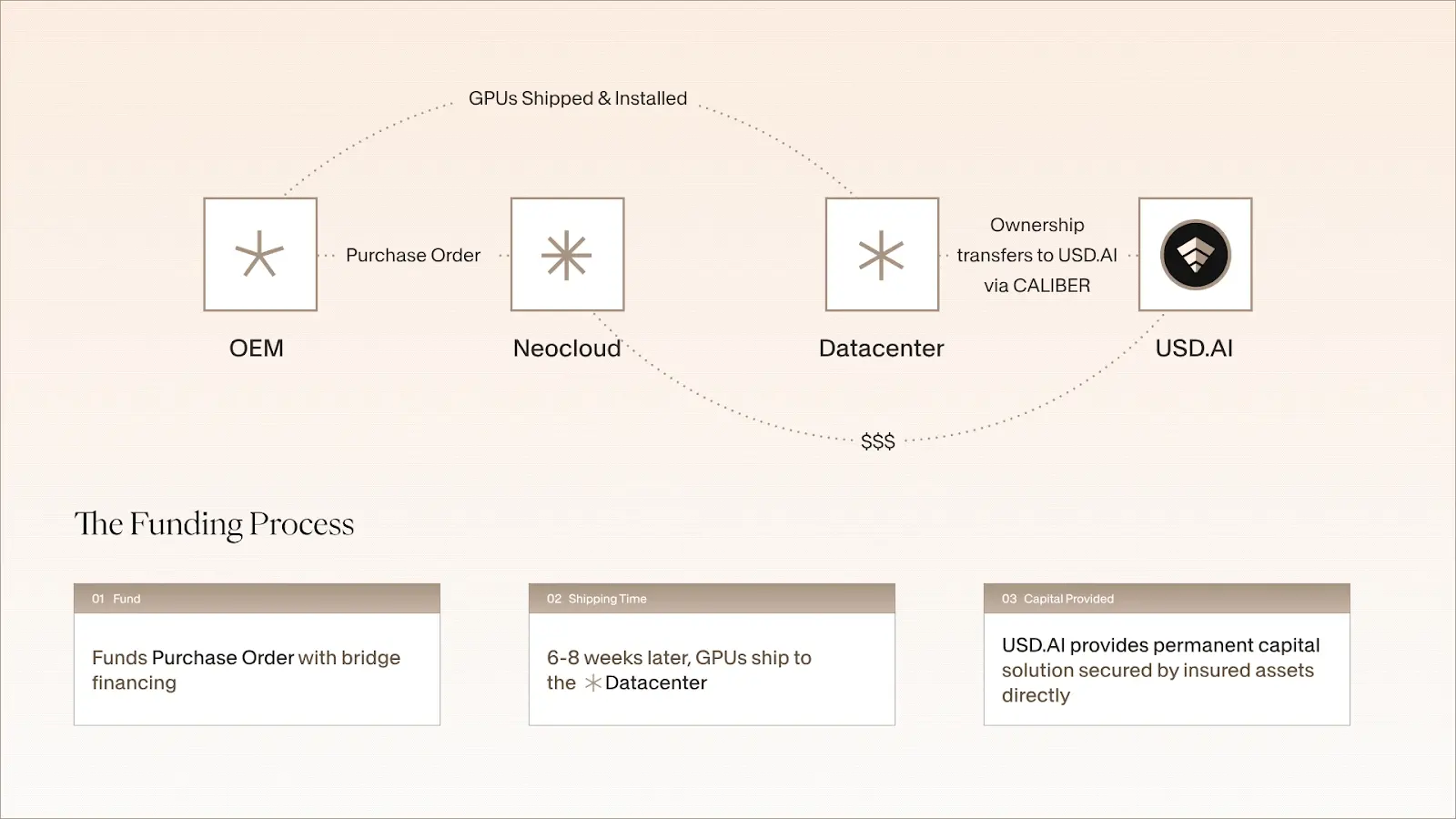

The three core stages of the USD.AI protocol operation process

Asset Creation

Hardware assets (e.g., GPUs) are produced and delivered by Original Equipment Manufacturers (OEMs), at which point the assets remain on the borrower's balance sheet.Tokenization and Isolation

Assets are tokenized through the CALIBER standard, structuring capital into a standardized, investable form while removing the assets from the borrower's balance sheet, achieving separation of capital from operators.Liquidity and Yield

Tokenized assets enter the USD.AI protocol, used to issue USDai/sUSDai, providing yield channels for depositors and releasing new capital liquidity for hardware infrastructure.

Why are these three stages necessary? The reason is that USD.AI is not a "credit protocol." "Credit," by definition, is an assessment of a business or counterparty's ability to repay loans. USD.AI does not issue loans to businesses or individuals—it merely provides liquidity for the assets themselves.

This is similar to Aave: Aave does not care who the borrower is; it only cares what you have collateralized.

Core Content of the Three Pillars

1. CALIBER — Yield Tokenization Framework

Core Content:

CALIBER is the foundational abstraction layer of USD.AI, used to convert traditionally non-tokenizable assets (e.g., GPUs, AI infrastructure, DePIN nodes) into standardized, investable tokenized assets.

Through CALIBER, asset ownership is removed from the operator's balance sheet and transformed into standardized financial assets on-chain.

Operating Mechanism:

Hardware assets are provided by Original Equipment Manufacturers (OEMs).

Borrowers/operators submit assets to the CALIBER framework for collateralization and tokenization.

Assets are converted into on-chain tokens (e.g., the collateral asset pool behind USDai).

Capital and operators are thoroughly separated: operators are only responsible for using the assets, while capital participants (depositors, curators) receive returns through tokenized assets.

2. FiLo — Risk Curation and Scalability Mechanism

Core Content:

FiLo's role is to audit and curate future asset financing needs, making them available for public financing.

Through a transparent risk assessment process, FiLo helps investors identify quality asset financing opportunities and achieve scalable expansion.

Operating Mechanism:

Borrowers submit financing needs (e.g., GPU procurement, AI node deployment).

Curators audit the need, provide first-loss capital, and assume initial risk.

Approved asset financing needs enter the public market, attracting larger-scale funding participation.

Depositors can choose to deposit USDC/USDT, exchange for USDai, and further stake as sUSDai to earn yields.

Through first-loss capital + curation mechanism, the risk exposure of ordinary investors is reduced, achieving scalable infrastructure financing.

3. QEV — Liquidity and Redemption System

Core Content:

QEV is the liquidity assurance layer of USD.AI, ensuring that tokenized assets can be redeemed fairly and transparently.

It provides exit mechanisms for depositors and liquidity providers, maintaining the peg of USDai/sUSDai to the value of the U.S. dollar.

Operating Mechanism:

Depositors can redeem their held USDai/sUSDai at any time.

The QEV system executes redemptions or rebalancing based on market liquidity and collateral asset conditions.

When certain assets mature or generate yields, QEV allocates funds and returns to relevant participants (depositors, curators).

Ensures transparent and predictable liquidity exits, avoiding liquidity gaps due to the unique characteristics of underlying assets (e.g., hardware depreciation or usage cycles).

Tron Commentary

The advantage of USD.AI lies in its unique design of three pillars (CALIBER, FiLo, QEV), which can tokenize assets like GPUs and other AI infrastructure, strictly isolating capital from operators, achieving risk layering and scalable financing, while providing depositors with stable yields and a transparent redemption mechanism. Its disadvantage, however, is that the process is relatively complex, with a time lag from asset generation by OEMs to tokenization, and it is highly dependent on the value fluctuations and liquidity of the underlying hardware, which may affect capital efficiency and market acceptance.

2. Key Project Details of the Week

2.1. Detailed Explanation of the Innovative Project XMAQUINA—Empowering Global Communities to Share the Physical AI Dividend

Introduction

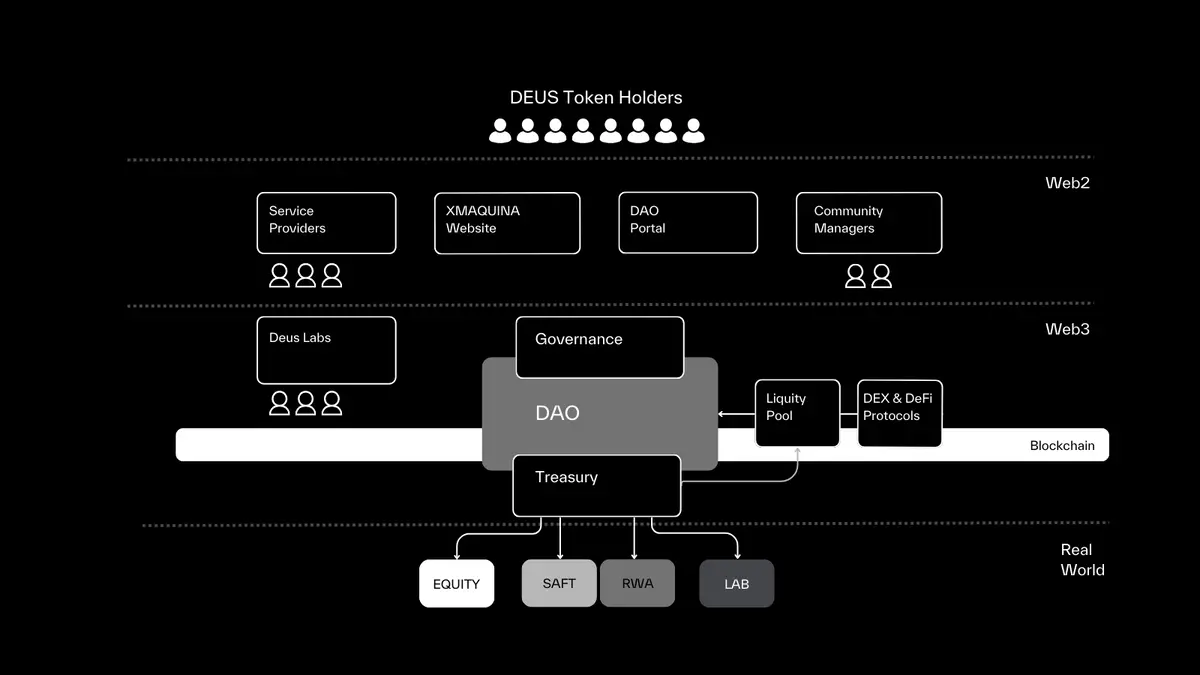

XMAQUINA is a decentralized autonomous organization (DAO) with the mission of "ensuring that every member has true rights in the intelligent era." In the face of rapidly advancing automation, XMAQUINA brings together visionaries and doers, providing them with access and participation opportunities in the core enterprises and systems of the future.

Here, members are not just observers but also participants and beneficiaries. Through the DAO mechanism, XMAQUINA enables members to collectively shape the upcoming "humanoid intelligent era" and share the value and outcomes that arise from it.

Architecture Analysis

This is a global community built on two core pillars.

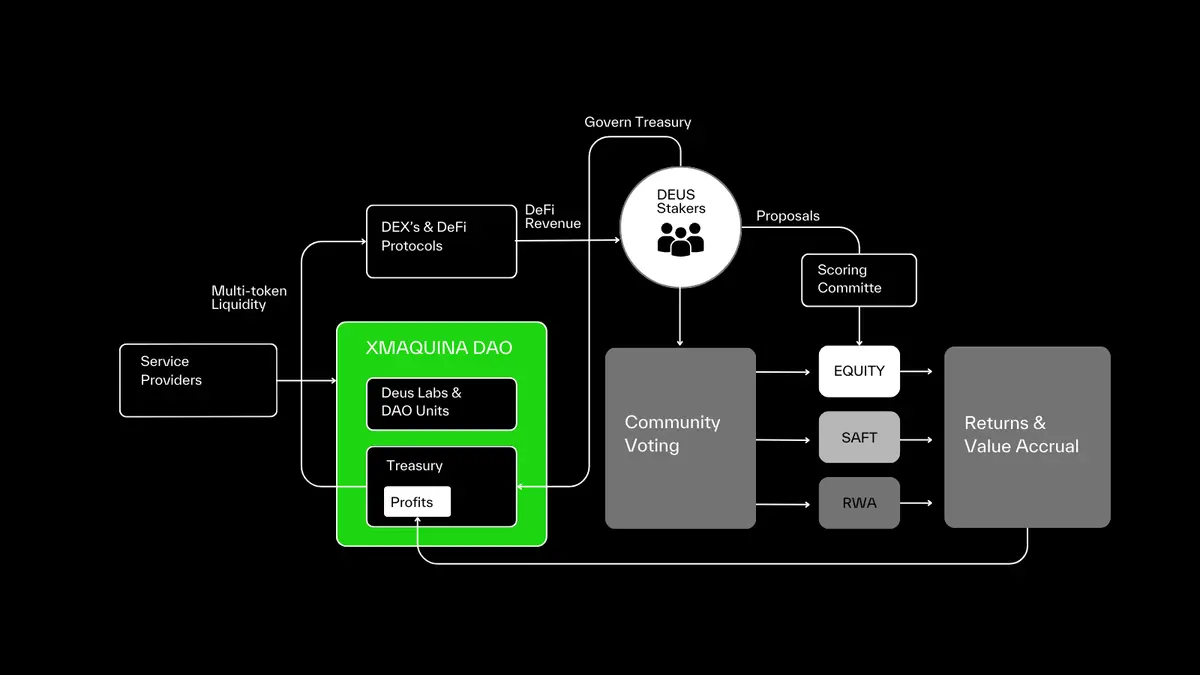

1. The DAO

A decentralized autonomous organization (DAO) born for "decentralized physical artificial intelligence (Physical AI)."

The DAO is driven by a global community that brings together builders, technical experts, and forward thinkers, united by the common mission of decentralizing the next technological revolution—physical artificial intelligence (Physical AI).

The DAO manages a multi-asset treasury, with funds strategically allocated to projects related to robotics, physical artificial intelligence, and decentralized infrastructure. Every decision is made under a mechanism of strategic focus and community oversight.

DAO Contributors

Community Members: Gain governance rights by staking DEUS tokens, participating in voting and decision-making. Influence depends on the amount and duration of staking.

Northstar Council: Composed of up to six representatives, responsible for overseeing the direction and long-term strategy of the DAO, ensuring alignment with the DAO's mission and charter.

Scoring Committee: Comprised of experts from venture capital, robotics, decentralized technology, etc., responsible for evaluating proposals, writing memos, and providing strategic advice to help the DAO make informed decisions when allocating resources during voting.

Execution Engine: The operational team commissioned by the DAO, responsible for implementing key plans, covering investment screening, legal compliance, tokenomics design, governance optimization, operations and communications, as well as treasury and DeFi management. It will gradually decentralize in the future, with more responsibilities taken over by the community and automated systems.

DEUS Labs: The innovation incubator of XMAQUINA, focusing on the intersection of robotics and Web3. Open to all members, it promotes the incubation of open-source projects and applications, expanding the utility and ecological value of DEUS tokens.

Main Functions of the Execution Engine

Deal Sourcing: Discover and evaluate high-potential opportunities in robotics, DePIN, and other fields.

Legal: Ensure the DAO complies with relevant legal and tax regulations.

Tokenomics & Incentives: Optimize the DEUS token economic model, incentivize community contributions, and maintain long-term sustainability.

Governance: Promote transparent and fair governance processes, proposing improvements for community voting.

Comms & Ops: Responsible for daily operations, marketing, community growth, and engagement.

Treasury & DeFi: Develop asset management and DeFi strategies, ensuring transparency and robustness of funds.

Mission of DEUS Labs

Incubate innovative projects at the intersection of Web3 and robotics, developing new products or derivative projects to enhance the value of DEUS tokens and the strength of the DAO.

Promote media and research to enhance XMAQUINA's visibility in the field of Physical AI.

Collaborate with universities, research institutions, and industry partners to transform early concepts into marketable products. Projects achieving a minimum viable product (MVP) can be submitted for DAO voting to obtain funding support, ultimately creating lasting value for the ecosystem.

Core Assets of the DAO

The DAO manages and co-governs tokens, equity, and other strategic assets, forming a diversified value base.

Multi-Token Treasury

Accumulated from the Genesis Auction, it includes ETH, BTC, PEAQ, stablecoins, and other high-quality DePIN and DePAI tokens. When not directly used, these assets can generate yields through DeFi.Humanoid Companies

Holds equity in rapidly growing humanoid robotics and Physical AI enterprises.Robotics Supply Chain

Invests in and supports innovators driving the robotics ecosystem, including actuators, sensors, chips, and related infrastructure.DePIN & DePAI Protocols

Early layout of decentralized physical AI and infrastructure networks, laying the foundation for a future decentralized machine economy.Machine RWAs

Autonomous machines deployed in the real world, capable of continuously generating tangible and stable value.

2. DAO Treasury

Initial Asset Allocation

70% Humanoid Company Equity

Invest in rapidly growing private enterprises, focusing on humanoid robotics and Physical AI. The market expects active humanoid robots to grow tenfold annually over the next six years. The DAO builds a diversified portfolio by holding equity in companies across regions and scenarios.15% DePIN and DePAI Tokens

Early layout in decentralized physical infrastructure (DePIN) and decentralized physical AI (DePAI) projects, typically intervening through SAFT around seed rounds. These assets play a key role in data collection, positioning, and spatial computing, forming the basis for the scaling of Physical AI.15% Machine RWAs

Holds tokenized autonomous systems (robot fleets, vertical farms, service robots, etc.), managed by the DAO and governed on-chain, directly generating stable economic value.Liquidity

A portion of funds is retained in stablecoins for flexible responses to community proposals, avoiding passive asset liquidation.

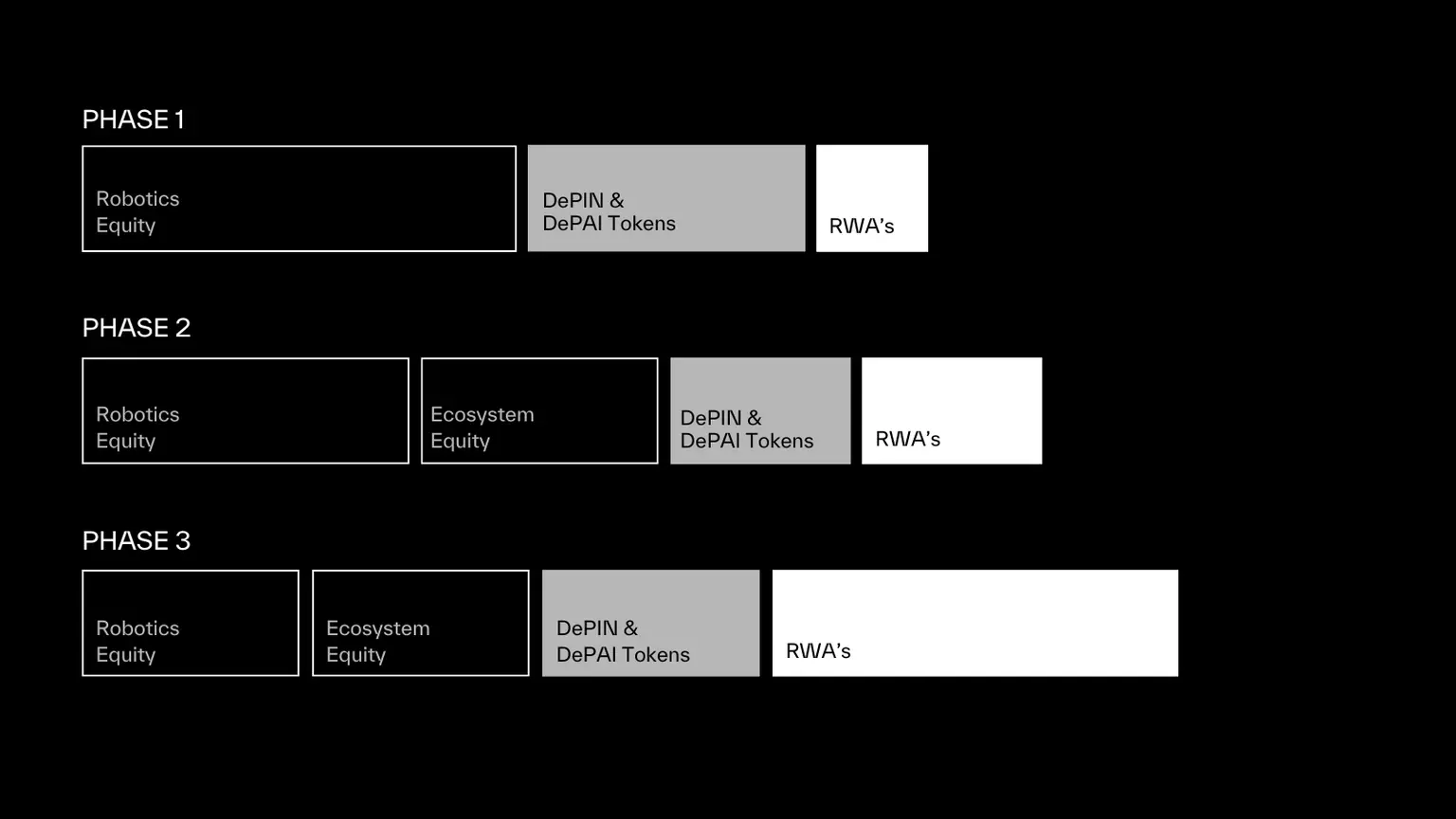

Treasury Evolution Stages

Stage One: Accumulation

Focus on acquiring equity in the most promising humanoid robotics companies, aiming for long-term growth.Stage Two: Expansion & Diversification

As robotics enter the actual deployment phase, the investment scope expands to AI cloud, coordination protocols, fleet operations, etc., with more funds flowing into Machine RWAs.Stage Three: Tokenization & Maturity

Machine assets owned by the DAO generate on-chain income, which can be used as collateral to participate in Machine DeFi, ultimately achieving a machine economy co-owned and governed by the community.

Revenue Sources and Distribution

On-Chain Crypto Yield

Comes from staking crypto assets, stablecoin DeFi strategies, and DEUS liquidity pools.

Revenue distribution mechanism (during the accumulation phase):

50% enters the treasury (to expand robotics and DePAI holdings);

50% flows into the Profit Bucket (governed by DEUS holders, used for buybacks, staking rewards, etc.).

Machine Yield

Comes from real-world autonomous systems (vertical farms, robot cafes, service machines, etc.).

Revenue is denominated in fiat currency and converted into stablecoins through decentralized bridging, transparently distributed on-chain.

Distribution mechanism is consistent with crypto yield:

50% flows back to the treasury, expanding strategic assets;

50% is allocated to the Profit Bucket, benefiting DEUS holders.

Core Goals

Through a combination of equity, tokens, and machine assets, the DAO treasury achieves:

Long-term value growth (robotics and DePAI equity/tokens);

Stable cash flow (machine assets and on-chain yields);

Governance and community consensus-driven value distribution.

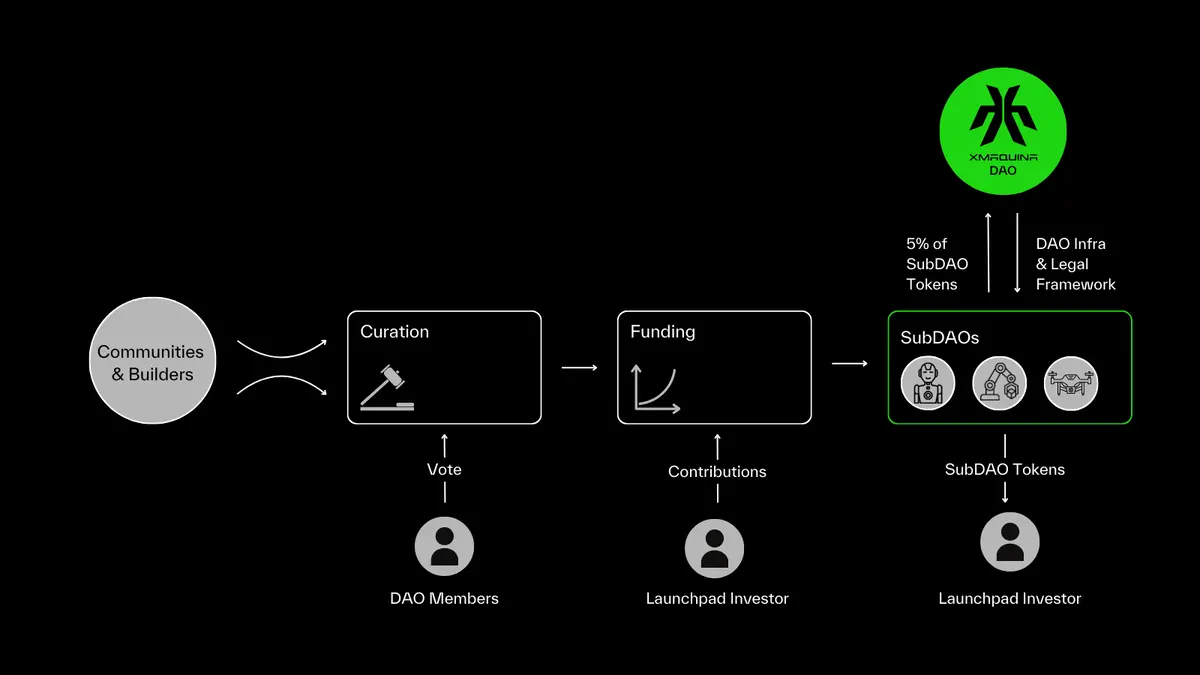

3. The Machine Economy Launchpad

Launchpad and SubDAOs

The Launchpad is a decentralized infrastructure layer owned by the community, used to create SubDAOs.

SubDAOs are independent, asset-oriented decentralized autonomous organizations with their own governance systems, assets, and operational models.

Leveraging XMAQUINA's legal and technical framework, SubDAOs can hold real-world machine assets, equity in robotics companies, and coordinate funding to promote the deployment of Physical AI.

The Launchpad is planned to launch in the first quarter of 2025, providing a seamless entry for the community and builders into the machine economy ecosystem.

Application Scenario Examples

- Private Market Access SubDAO

Example: The community can form a SubDAO through the Launchpad to jointly invest in a Chinese robotics company, Engine AI.

Participants pool funds, and the SubDAO manages the investment process collectively, issuing tokens representing ownership stakes and granting governance rights.

Model Advantage: Allows retail investors to transparently and collaboratively access high-barrier market opportunities.

Machine RWA SubDAO

Example: In partnership with iFarm, the community forms a SubDAO to jointly invest in a vertical strawberry farm in the UAE.

The SubDAO holds the farm's machine assets and receives revenue from agricultural sales. Token holders can govern operations, reinvest, or receive dividends.

Model Advantage: Lowers the barrier to entry into capital-intensive industries, opening high-performance machine assets (such as autonomous fleets, drone agriculture, and even future humanoid robots) to a broader community.

Core Functions

SubDAO Formation: Can set exclusive governance and operational logic based on asset or mission objectives.

Fund Coordination: Supports on-chain crowdfunding, referencing the Genesis Auction model, to transparently raise funds for robot deployment and asset acquisition.

Asset Holding and Tokenization: SubDAOs can hold Physical AI assets and issue tokens representing ownership, access rights, or revenue rights.

Ecological Integration: SubDAOs can operate independently while accessing XMAQUINA's legal templates, development tools, and DeFi infrastructure, and can submit financing proposals to the main DAO.

Fee and Distribution Strategy

Each SubDAO created through the Launchpad will contribute value to the main DAO:

5% of SubDAO tokens → Allocated to the XMAQUINA DAO treasury.

5% of crowdfunding capital → Entering the DAO treasury as a service fee.

These fees directly enhance the DAO's treasury and strategic execution capabilities, ensuring that the success of each SubDAO not only advances its own mission but also benefits the entire XMAQUINA ecosystem.

Expected Impact

The Launchpad will bring new capital to the ecosystem, driving growth and innovation.

It will attract a diverse range of participants, including developers, researchers, operators, and users, forming an active community around the decentralized robotics economy.

Tron Commentary

XMAQUINA's advantage lies in its forward-looking entry into the "Physical AI + Web3" track, combining DAO governance, multi-asset treasury, SubDAO mechanisms, and machine-based RWAs, providing the community with real asset participation rights and long-term growth potential. It not only focuses on the future applications of robotics and AI but also enhances community cohesion through token economics and decentralized governance, possessing a unique advantage in building a global machine economy ecosystem.

Potential disadvantages or challenges include its high dependence on the development of cutting-edge industries (humanoid robotics, DePIN/DePAI, etc., which are still in early stages), facing risks such as long technology and business implementation cycles, regulatory and legal compliance uncertainties, and the complexity of community governance. How to maintain transparency, compliance, and robust execution while rapidly developing will be a key test for XMAQUINA's long-term success.

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

Key resistance this week: $117,400, $122,200, $123,700

Key support this week: $114,800, $113,300, $107,300

ETH

Analysis

Key resistance this week: $4,770, $4,960

Key support this week: $4,580, $4,500, $4,200

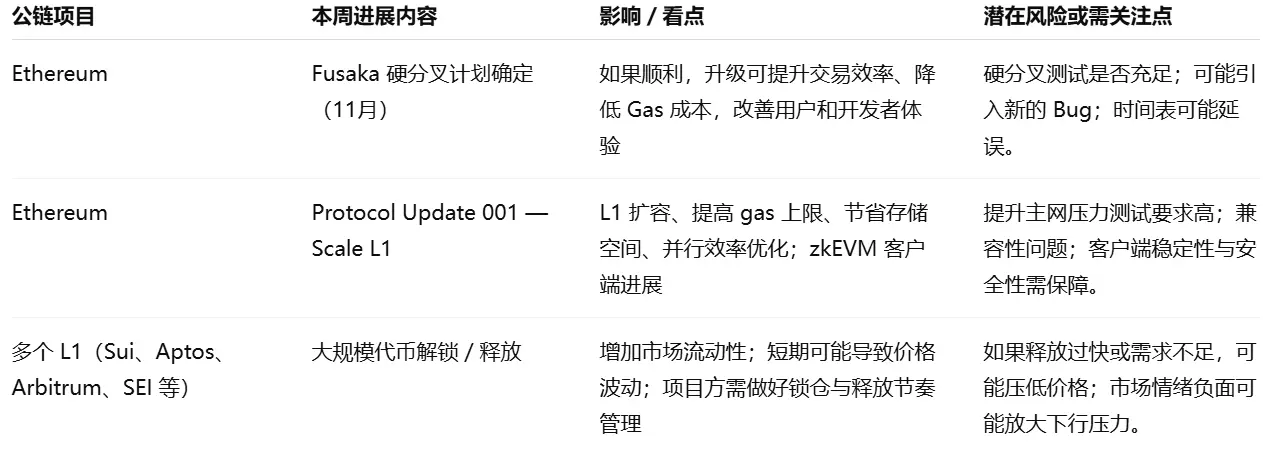

2. Public Chain Data

2.1. BTC Layer 2 Summary

2.2. EVM & Non-EVM Layer 1 Summary

2.3. EVM Layer 2 Summary

3. Macroeconomic Data Review and Key Data Release Points for Next Week

The annual CPI for August rose from about 2.7% in July to 2.9%, while the core CPI (excluding food and energy) remained around 3.1%. This indicates a rebound in price pressure on the consumer side. PPI (Producer Price Index) weakened: unlike the consumer side, upstream wholesale prices fell month-on-month, with August PPI showing a monthly decline (-0.1%) and an annual rate of about 2.6%, with core PPI also showing weakness. This suggests that inflation pressure on the supply side and wholesale level is diminishing.

Important macro data points for this week (September 15-19) include:

September 16: U.S. August retail sales month-on-month

September 18: U.S. Federal Reserve interest rate decision (upper limit) as of September 17

4. Regulatory Policies

United States

Nasdaq Promotes Tokenized Securities Trading: Nasdaq has submitted a proposal to the SEC to allow trading of "tokenized securities" on its main market. If approved, it will become the first mainstream exchange in the U.S. to deeply integrate traditional and digital assets.

Senate Democratic Legislative Framework: Twelve Democratic senators have proposed a legislative framework aimed at regulating the issuance and trading of digital assets, focusing on consumer protection, preventing illegal activities, and enhancing transparency.

India

Refusal of Comprehensive Legislation: Government documents indicate that India does not plan to introduce comprehensive cryptocurrency legislation at this time, citing that "legalization may bring systemic risks" and believing that regulations alone are insufficient to fully mitigate risks. Current regulation remains focused on registration and taxation.

Investor Attitude Survey: The latest survey shows that 93% of Indian crypto investors want a regulatory framework, and 84% believe the current tax system is unfair, with strong public demand.

Kazakhstan

- Proposal to Establish a Crypto Reserve Fund: President Tokayev proposed the establishment of a "crypto reserve fund" in the national report, as an important part of modernizing national fund management and promoting the digital asset ecosystem.

United Arab Emirates

- Real Estate Supports Crypto Payments: RAK Properties, a developer in Ras Al Khaimah (RAK), has partnered with fintech company Hubpay to allow international buyers to purchase real estate using cryptocurrency, initially implemented in the Mina seaside community.

Japan

- Tax Reform Plan: Considering reducing the tax rate on crypto assets from as high as 55% to about 20% to attract Web3 innovation and investment.

Belarus

- Promoting Digital Token Rules: The president has called on regulatory authorities to accelerate the formulation of token rules to strengthen investor protection, planning to make Belarus a crypto-friendly innovation center.

Overall Trends

Global Regulatory Orientation: Shifting from "prohibition/strict restrictions" to "establishing clear rules + promoting innovation."

Focus Areas: Stablecoin regulation, investor protection, anti-money laundering measures, and how to balance promoting innovation and preventing risks.

Regional Differences:

Asia: Japan leans towards incentives, while India remains cautiously observant;

Middle East/Central Asia: The UAE and Kazakhstan actively promote the crypto ecosystem;

Europe and America: More focused on legislative frameworks, legal clarity, and market structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。