Local stablecoins are crucial.

Author: rafi

Translated by: ShenChao TechFlow

Key Points

Dominance of stablecoins pegged to the Singapore Dollar: XSGD is the only issuer of a stablecoin pegged to the Singapore Dollar, and with partnerships with Grab and Alibaba, XSGD dominates the local stablecoin market in Southeast Asia.

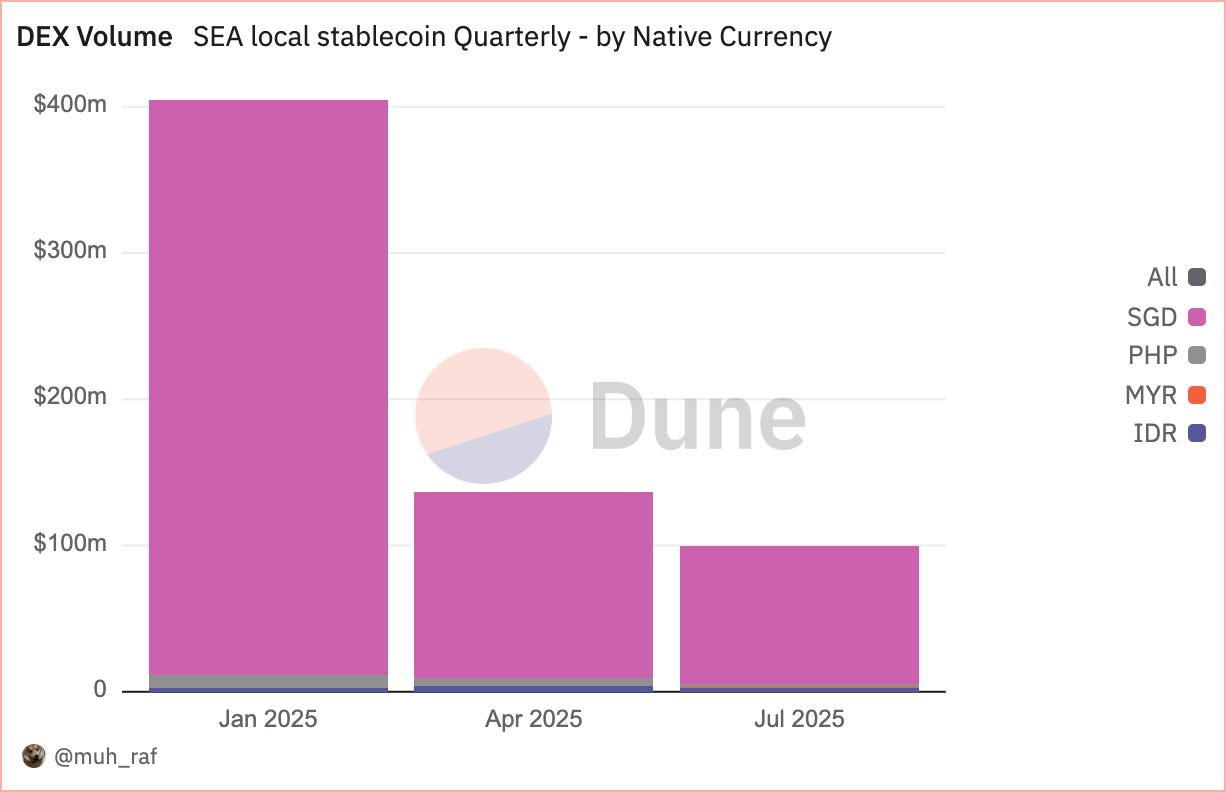

Market Indicators: Operating on over 8 EVM chains, with 8 issuers and support for 5 local currencies. In Q2 2025, the trading volume on decentralized exchanges (DEX) reached $136 million (led by Avalanche chain and Singapore Dollar), down 66% from $404 million in Q1.

Regulatory Progress: The Monetary Authority of Singapore is advancing a stablecoin framework for the Singapore Dollar and SCS pegged to G10 currencies; Indonesia and Malaysia have launched regulatory sandbox experiments.

Cross-Border Trade: In 2023, only 22% of trade in Southeast Asia occurred within the region, with over-reliance on the US Dollar leading to costly delays and fees. Local stablecoins can streamline settlement processes by providing instant, low-cost transfers and further accelerate through the ASEAN Business Advisory Council's regional QR payment initiative.

Financial Inclusion: Over 260 million people in Southeast Asia still lack bank accounts. Once integrated into super app wallets like GoPay or MoMo, non-USD stablecoins can expand access to affordable financial services, supporting remittances, microtransactions, and everyday digital payments.

Southeast Asia (SEA) has a combined GDP of USD 3.8 trillion, and a population of 671 million, making it the fifth-largest economy globally, competing with other economies and boasting 440 million internet users, driving digital transformation. source

In this context of economic vitality, non-USD stablecoins and digital currencies pegged to regional currencies or a basket of currencies provide transformative tools for Southeast Asia's financial ecosystem. By reducing reliance on the US Dollar, these stablecoins can enhance cross-border trade efficiency, stabilize transactions within the region, and promote financial inclusivity between different economies.

This article explores why non-USD stablecoins are essential for financial institutions in Southeast Asia and policymakers aiming to shape a resilient, integrated economic future.

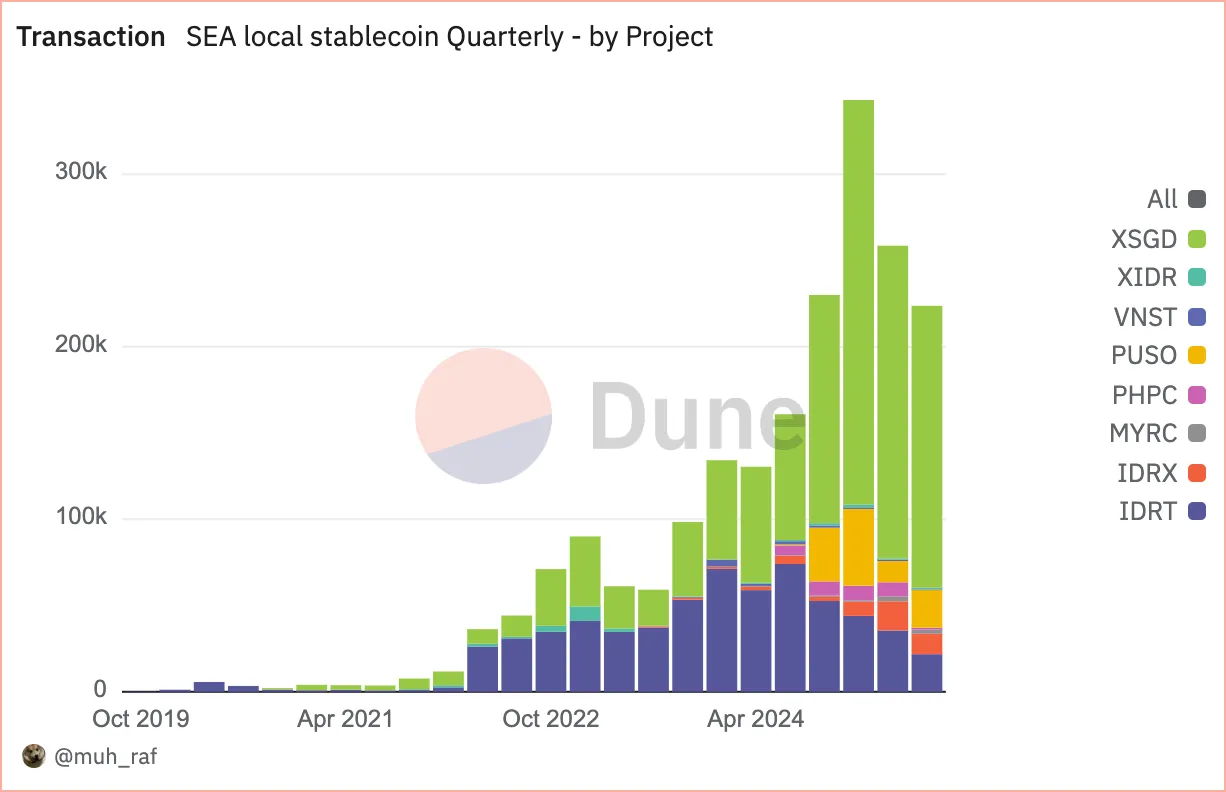

Transactions

Source: https://dune.com/queries/5728202/9297229

Since January 2020, the adoption rate of non-USD stablecoins in Southeast Asia has rapidly increased from 2 projects initially to 8 projects by 2025. This growth is attributed to increased trading volume and the use of diverse blockchain platforms.

In Q2 2025, the trading volume of non-USD stablecoins in Southeast Asia reached 258,000 transactions, with stablecoins pegged to the Singapore Dollar (SGD) (especially XSGD) accounting for 70.1% of the market share, followed by stablecoins pegged to the Indonesian Rupiah (IDR) (IDRT and IDRX), which accounted for 20.3%. This reflects strong regional economic activity and regulatory support, highlighting their key role in Southeast Asia's digital economy.

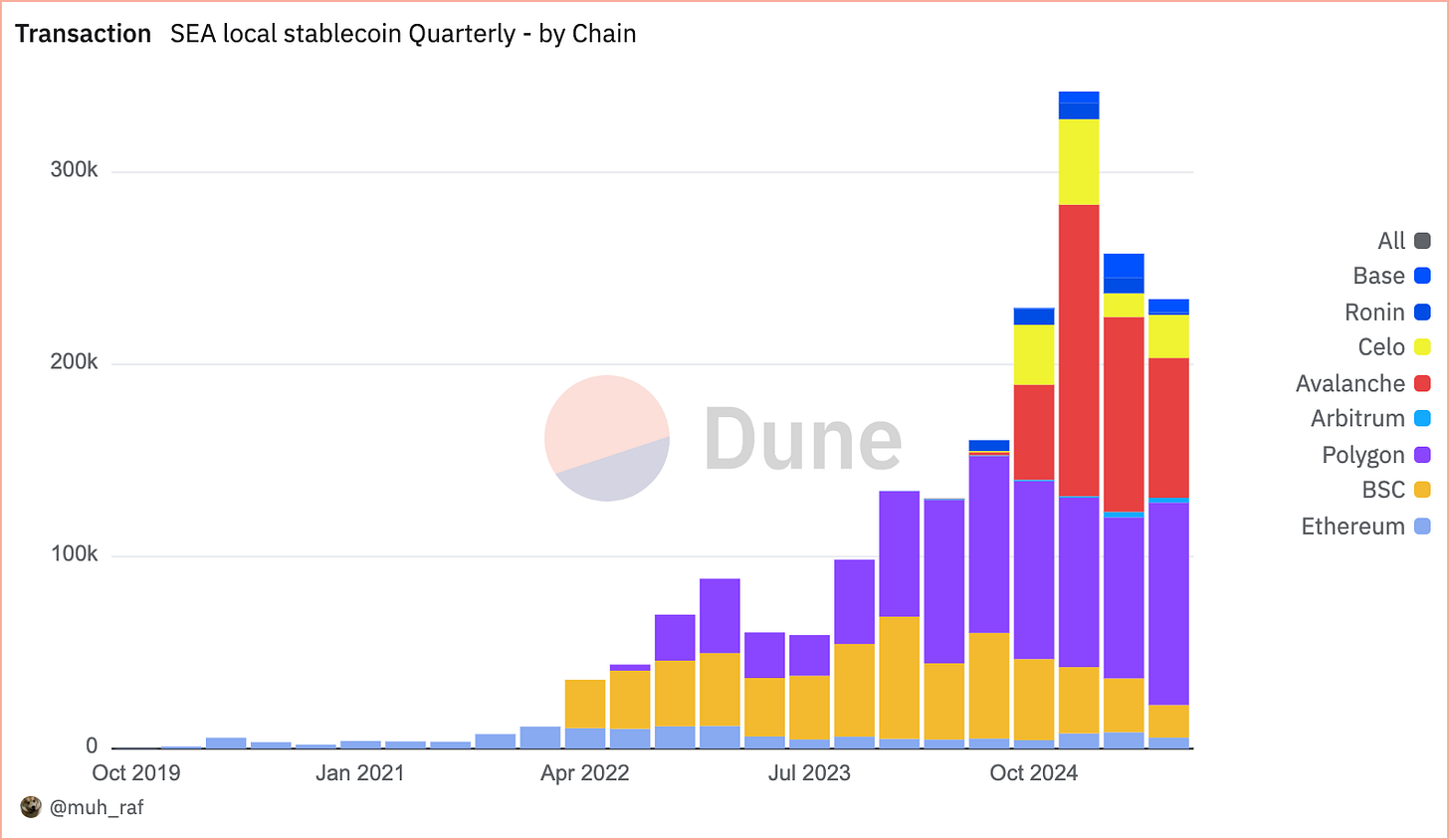

Source: https://dune.com/embeds/5728202/9297229

Over the past four years, since 2020, the trading volume of non-USD stablecoins in Southeast Asia has exceeded 1 million transactions, driven by widespread adoption and strong exposure to EVM chains, which continue to lead market share growth quarter by quarter. In Q2 2025, Avalanche led with a 39.4% market share (101,000 transactions), followed by Polygon (83,000 transactions, 32.5%) and Binance Smart Chain (28,000 transactions, 10.9%). The rapid rise of Avalanche is primarily attributed to the XSGD project, which is currently the only operating stablecoin on the Avalanche chain and has gained significant traction since its launch. XSGD is a stablecoin pegged 1:1 to the Singapore Dollar, issued by StraitsX, a major payment institution licensed by the Monetary Authority of Singapore (MAS).

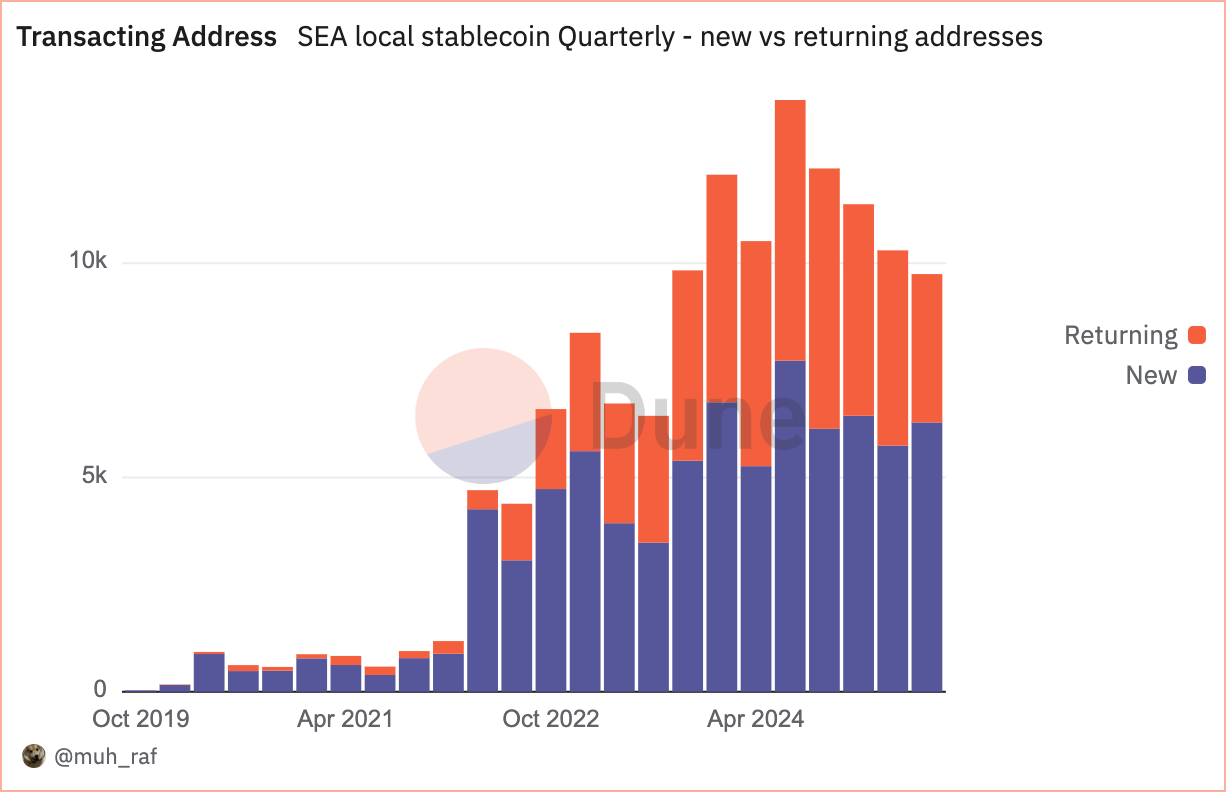

Active Addresses

Source: https://dune.com/queries/5728541/9297706

Since Q2 2025, the number of active (trading) addresses for non-USD stablecoins in Southeast Asia has significantly increased to over 10,000, with 4,558 being returning addresses and 5,743 being new addresses, indicating steady growth and increased engagement among stablecoin users.

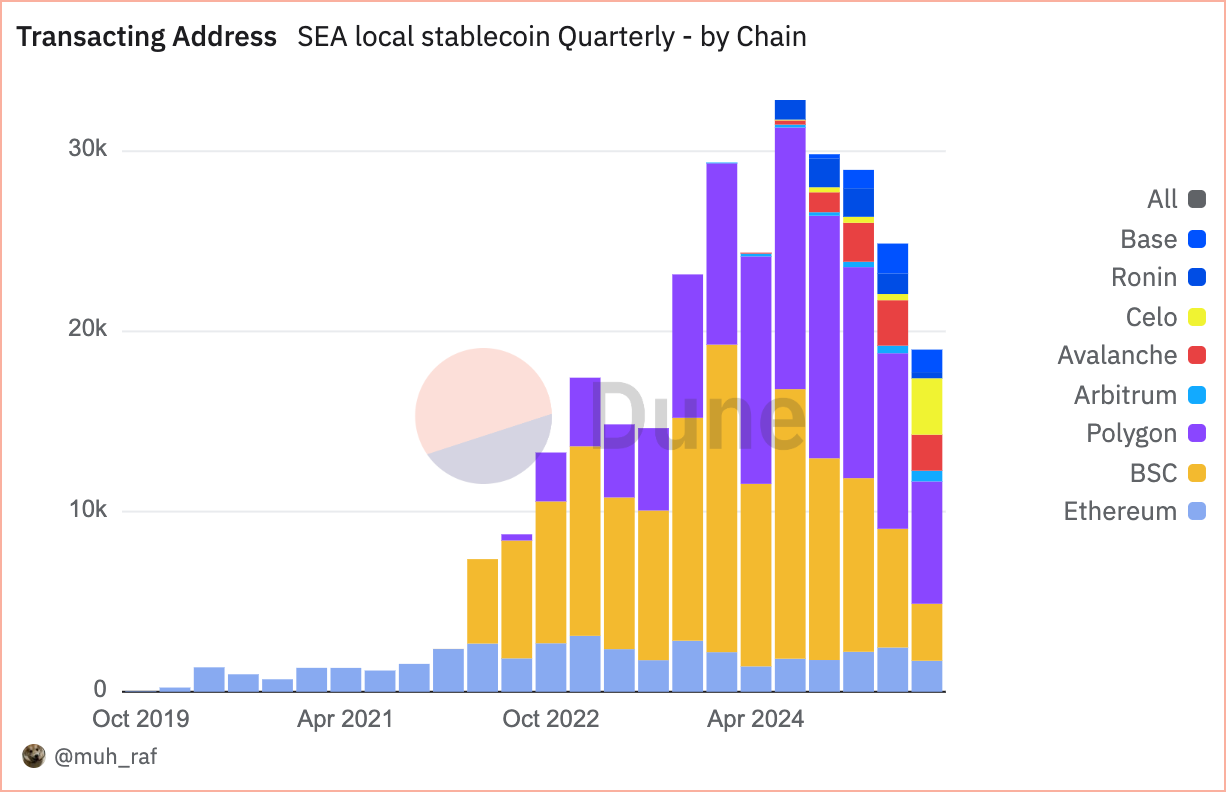

Source: https://dune.com/queries/5728383/9297467

Unlike the transaction count that reflects overall activity levels, active (trading) addresses reflect user engagement and adoption rates. In Q2 2025, among Southeast Asia's non-USD stablecoins, Polygon led with a 39.2% share, followed by Binance Smart Chain (BSC) with a 23.1% share, and Avalanche with a 10.1% share.

Note: In the "Grouped by Chain" view, addresses trading stablecoins across multiple chains (like Polygon and Base) are counted as separate addresses on each chain, resulting in a total higher than the "Ungrouped" view (deduplicated data).

DEX Trading Volume

Source: https://dune.com/queries/5748360/9327460

In Q2 2025, DEX trading volume fell 66% from $404 million in Q1 to $136 million. Avalanche led with a 51% share ($69 million), followed by Polygon at 33% ($45 million) and Ethereum at 9% ($12 million). This decline highlights the trend of blockchain shifting towards scalability, with Avalanche and Polygon dominating.

Source: https://dune.com/queries/5748398/9327527

As mentioned, in Q2 2025, the DEX trading volume in local currency reached $132 million, with stablecoins pegged to the Singapore Dollar dominating the Southeast Asia non-USD stablecoin market. Assets priced in Singapore Dollars accounted for 93.1% ($127 million), followed by Philippine Peso (PHP) at 3.9% ($5 million), and Indonesian Rupiah (IDR) at 2.7% ($3.6 million). This underscores the dominance of the Singapore Dollar in regional DEX activity.

Southeast Asia Stablecoins: Opportunities and Challenges

Opportunities

- Enhancing Cross-Border Trade Efficiency

In 2023, 22% of trade within Southeast Asia was conducted within the region, but transactions are often processed through USD-based correspondent banks, resulting in high fees and delays of up to 2 days. Stablecoins pegged to Southeast Asian currencies provide a more efficient alternative, enabling near-instant settlements at lower costs. On this basis, the ASEAN Business Advisory Council (BAC) has adopted cross-border QR code payments settled in local currencies. Collaboration between BAC and Southeast Asian stablecoin issuers is expected to further reduce remittance costs and improve exchange rates.

- Promoting Financial Inclusion

260 million people in Southeast Asia lack banking services or do not have bank accounts, and non-USD stablecoins can fill the gap in financial services. Mobile-based stablecoin wallets integrated with platforms like Indonesia's GoPay or Vietnam's MoMo can facilitate low-cost remittances and microtransactions.

Challenges

- Regulatory Uncertainty and Fragmentation

The diverse regulatory frameworks in Southeast Asia create uncertainty for stablecoin issuers and users. There are significant policy differences among countries, with Singapore's policies being relatively progressive, while other countries have stricter regulations, which may lead to compliance challenges and uneven adoption.

Recommendation: Southeast Asian policymakers should collaborate to develop a unified regulatory framework for stablecoins, establishing clear guidelines on licensing, consumer protection, and anti-money laundering (AML) compliance to build trust and consistency.

- Market Volatility and Currency Peg Risks

Stablecoins pegged to regional currencies are susceptible to fluctuations in the local currency, which may undermine their stability and user confidence. Insufficient reserve backing or poor management could further exacerbate risks.

Recommendation: Stablecoin issuers should maintain transparent, fully-backed reserves and undergo regular independent third-party audits. Diversifying the basket of pegged currencies can also reduce volatility risks.

Conclusion

In Q2 2025, the Southeast Asian non-USD stablecoin market experienced significant growth, led by XSGD, the only issuer pegged to the Singapore Dollar, driven by partnerships with Grab and Alibaba. Operating on over 8 EVM chains, with 8 issuers and support for 5 local currencies, the trading volume on decentralized exchanges (DEX) reached $136 million, primarily concentrated on Avalanche and the Singapore Dollar, but down 66% from $404 million in Q1. The Monetary Authority of Singapore (MAS) is advancing a stablecoin framework for the Singapore Dollar and G10 currencies, while Indonesia and Malaysia have introduced regulatory sandboxes.

This growth highlights the potential of non-USD stablecoins to enhance cross-border trade and financial inclusion in Southeast Asia, but factors such as regulatory fragmentation, currency volatility, cybersecurity risks, and uneven digital infrastructure need to be managed carefully to achieve sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。