Bitcoin news: Is September volatility hinting at another Alt crash?

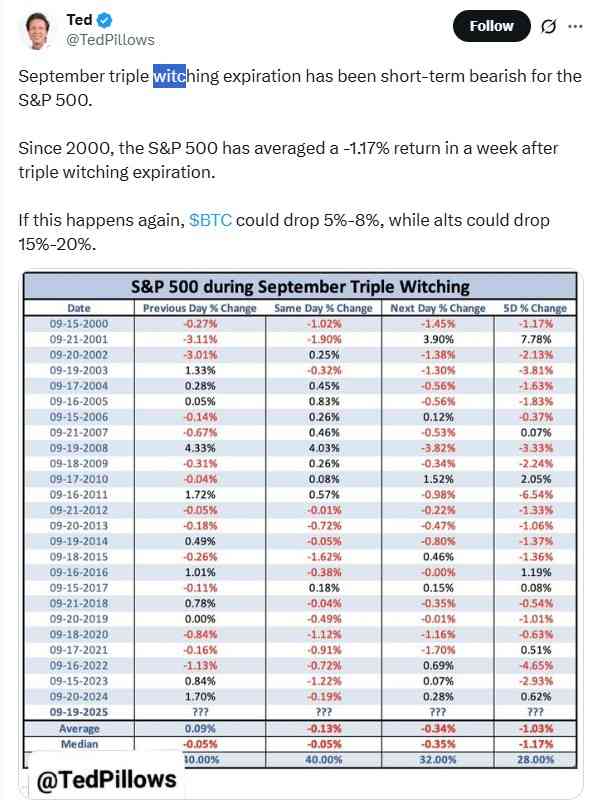

Bitcoin news has again created waves in the crypto industry as recently, financial analyst Ted Pillows tweeted on X that the September triple witching expiration has historically been short-term bearish for the S&P 500. According to him, since 2000, the S&P has averaged a -1.17% return in the week following triple watching.

Source: X

He further stated that if history is repeating itself, Bitcoin may decline 5%-8% and altcoins might see larger losses of 15%-20% in the near term.

Historical Patterns Show September Triple Witching Impact

Looking at the data from 2000 to 2025, the S&P 500 often experiences a decline in the week after triple witching. Like in

-

2000: -1.17%

-

2011: -6.54%

-

2022- -4.65%

-

2023: -2.93%

The average impact over the years is around -1.03% while the median is -1.17%. These numbers suggest a modest short term bearish trend. In crypto, analysts are drawing parallels that are predicting a possible Bitcoin crash similar to equity market reactions.

Bitcoin and Altcoin Price Predictions Amid Fed Rate Cuts

Crypto and Stock Market participants are closely watching upcoming Fed rate cut decisions, as any signals of monetary easing can influence Bitcoin altcoin rallies and also show an impact on stock too.

Historical correlations suggest that after September triple witching the Bitcoin may face a temporary dip, while select altcoins could see a sharper short-term decline.

-

Bitcoin prediction: 5-8% dip possible, from the current price of approximately $116K it might fall to about $110k-$106k. .

-

Altcoin crash prediction: 15-20% potential decline in prices

This matches with the general trend of equities that is hinting at cautious optimism for crypto users looking at altcoin crypto opportunities.

It might also be possible that if the Fed reduced the rate then a surge in prices could be seen, BTC currently trading around $116k might reach to $120k, whereas Alt will also show positive signals despite the dips.

Altcoin Crash Risks and Crypto Market Strategy

During the time of September witching, altcoins often experience heightened volatility which can further lead to sudden altcoin crashes. Traders are advised to monitor:

-

BTC price prediction trends and its movements in prices.

-

Observe and analyse historical altcoin performance.

-

Market Reactions to triple witching and Fed decisions.

Being prepared with risk limit strategies and asset allocation can help mitigate risks during these uncertain periods.

Investor Takeaways for September

-

Sept triple witching has repeatedly triggered short-term drops, invest wisely.

-

BTC and altcoins can expect dips between 5% and 20%.

-

Fed rate cut announcements could influence market recovery or further dips, do your own research before any investments. Keep away from fake news and improper guidance.

-

Investors should watch for bitcoin price prediction and altcoin crash prediction updates before making major moves.

Overall, while historical data points to temporary bearish trends, smart strategies and close monitoring can help investors navigate the BTC news landscape effectively this September.

What is September Triple Witching?

It is the time when stock options, stock futures and index options all expire on the same date, normally the third Friday of September.

The move induces abrupt volatility in the markets as there is adjustment of positions by traders. It can create short-term steep price movements, occasionally affecting BTC and altcoins as well.

Conclusion

This results in temporary market fluctuation, impacting BTC and altcoins. Intelligent action, close price trend monitoring, and knowledge of Fed actions will enable investors to tackle risks and capitalize on opportunities optimally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。