Polkadot New Supply Model Could Boost Scarcity and Long-Term Value

The community that runs the polkadot blockchain, mainly denoted as Polkadot DAO, has come up with a key decision that will change the current scenario of the platform. They voted to cap the total issuance of DOT-tokens at 2.1 billion. This decision is the result of Referendum 1710, which achieved 81% supporting votes.

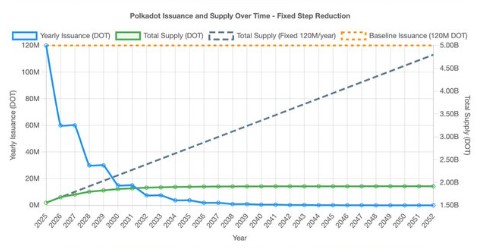

Before this change, DOT had no total limit, and blockchain minted 120 million DOT-tokens every year. This unlimited allotment often stops the tokens growth. With the Polkadot new supply, the token will become more limited, which could make it more valuable over time.

Lower Emissions and Higher Scarcity

As of today, DOT has around 1.6B circulating supply. According to the latest rules, new tokens will be issued in smaller amounts every two years starting on Pi Day (March 14), unlike the previous model of every year. This change is hoped to lead more demand due to lower cap.

Source: Polkadot_Official

If we calculate according to the latest module, by 2040, the total circulation is expected to be around 1.91 billion DOT, much less than the 3.4 billion tokens that would have existed under the old system. The move is designed to make the asset stronger, scarcer, and more aligned with long term growth.

DOT-Price and Market Update

After the announcement, DOT’s price fell 2.2% to $4.32 in the past 24 hours. However, it is still up 9.8% in the past week. The token’s market capitalization is $6.6 billion, and the circulating cap is 1.61 billion.

Source: CoinMarketCap

Price Impact Insights from Similar Cases

Looking at previous crypto projects, bitcoin’s fixed-supply of 21 million fixed supply helped it become “golden asset” and push its prices higher over the years, while Litecoin’s capped pool also provided scarcity value.

On the other hand, tokens like Terra (LUNA) increased their supply rapidly, which caused a price collapse. From these examples, we can see that limiting supply generally supports token value, but prices may still go up or down in the short term, like the recent 2.2% dip, which is normal as markets react to the news.

Now the thing to watch is how warmly the market accepts the new change but a major change. Will it lead to its new price rally after a little dip or resulting in a long term cause, and if accepted then how long it will take to rise as a new community driven star.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。