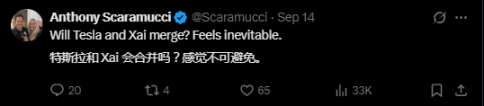

The positive statements from Anthony Scaramucci, founder of SkyBridge Capital, have further fueled expectations of a potential merger between Tesla and xAI.

Written by: Li Xiaoyin, Wall Street Insights

The possibility of a merger between Tesla and Elon Musk's AI startup xAI is evolving from market speculation into serious discussion.

On Sunday, Anthony Scaramucci posted on social media platform X, stating that as Musk accelerates the integration of AI into his business landscape, the merger between Tesla and xAI "feels inevitable." This statement has added fuel to the already rising expectations of a merger.

Scaramucci's tweet came after news broke that Tesla shareholders had submitted a formal proposal. According to reports, the proposal urges the Tesla board to authorize an investment in xAI, marking the first time the capital connection between the two companies has been included in the official agenda.

A deeper signal lies in Tesla's recent disclosure of Musk's new ten-year compensation plan. As previously mentioned by Wall Street Insights, Morgan Stanley analysts noted that the plan includes a key provision allowing performance targets to be adjusted in the event of a "significant" acquisition, which is widely interpreted as paving the way for a potential merger with xAI, making the synergy between the two companies a part of Tesla's long-term strategy.

Shareholder Proposal Boosts Merger Expectations

The direct impetus for bundling Tesla with xAI comes from the investors themselves. According to Tesla's proxy statement, 56-year-old investor Stephen Hawk from Florida submitted a shareholder proposal suggesting that the company invest in xAI. This proposal will be voted on at the company's annual shareholder meeting on November 6, alongside Musk's controversial compensation plan.

In an email, Stephen Hawk stated that his inspiration came from Musk's previous posts on social media hinting at a collaboration between the two. He believes that "formally establishing this partnership is crucial to ensuring clear mutual benefits for both parties."

In fact, Musk himself has been open to this idea. He has not only solicited opinions from fans on the X platform but also told investors in July, "We will act according to the will of the shareholders." This makes the outcome of the shareholder meeting a potentially key step in determining the future relationship between the two companies.

Musk's New Compensation Plan Hints at Merger Signals

For investors, perhaps more significant than the shareholder proposal is Musk's long-term compensation plan, which could be worth up to $1 trillion.

Earlier this month, Morgan Stanley analysts, including Adam Jonas, pointed out in a research report that the plan aims to alleviate investor concerns about Musk spreading his focus across xAI and SpaceX, among other companies.

The report stated that Musk has made it clear he wants to hold at least 25% of Tesla's shares to have veto power in any change of control, and the new plan provides an incentive path for this. More importantly, a supplementary clause regarding acquisitions in the plan has drawn significant market attention. This clause states that "market capitalization and adjusted EBITDA milestone targets may be adjusted to account for Tesla acquisition activities that are deemed to have a significant impact on milestone achievement."

Analysts believe this wording reserves flexible institutional space for the future integration of interests between Tesla and xAI. Morgan Stanley's report explicitly states that this provides a clear "interface" for the merger of the two companies, indicating that such integration is already part of Tesla's long-term strategic considerations.

Tesla's Market Value Expected to Reach $8.5 Trillion

Market expectations for a merger are based on the existing synergies between the two companies.

Musk has always positioned Tesla as a "real-world AI" company, with a core focus on driving autonomous driving and the Optimus humanoid robot. The Grok large language model developed by xAI is currently integrated as an AI companion into Optimus and some Tesla vehicles. Additionally, xAI has been sourcing Tesla's industrial batteries to power its data centers.

Some analysts believe that a merger would unlock tremendous value. Notable tech analyst and co-founder of Deepwater Asset Management, Gene Munster, suggested earlier this month that the combination of Tesla and xAI could help the former reach a lofty market value target of $8.5 trillion.

Now, this viewpoint is becoming mainstream. With xAI's valuation already exceeding $100 billion and seeking a valuation as high as $200 billion, how to allow Tesla shareholders to share in the enormous benefits brought by its AI breakthroughs is a key issue that Musk needs to address.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。