Crypto markets eye Stephen Miran Fed role before Sept. 17 decision

Stephen Miran arrival at the Federal Reserve — what crypto traders should watch

The U.S. Senate narrowly confirmed Stephen Miran to the Federal Reserve Board in a 48–47 vote, days before a key FOMC meeting on Sept. 17

Source : Bloomberg

What happened

The Senate voted along party lines to approve President Trump’s pick, Stephen Miran . The move was fast-tracked and came only weeks after his nomination. Democrats warned the vote could weaken Federal reserve independence because he has been the White House’s top economic adviser and has not fully stepped away from that role.

Will Stephen Miran vote at the Sept. 17 meeting?

Yes. With his confirmation completed just before the Federal Reserve’s policy meeting, Miran can take his seat and be one of the voting governors when the Fed decides on interest rates.

Many market watchers expect the low cut rates by 25 basis points on Sept. 17, and he is widely expected to push for an even larger cut. This timing makes his vote politically and economically important.

Why This Matters For Crypto Markets

Crypto prices often move with interest-rate news. A rate cut usually lowers short-term yields on safe assets and can push investors toward riskier assets like bitcoin and altcoins.

If Miran supports a bigger cut than the Federal plans, traders may start pricing in faster or larger easing and that can lift crypto prices in the short term. Lower interest rates also tend to weaken the dollar, which historically helps dollar-priced crypto assets.

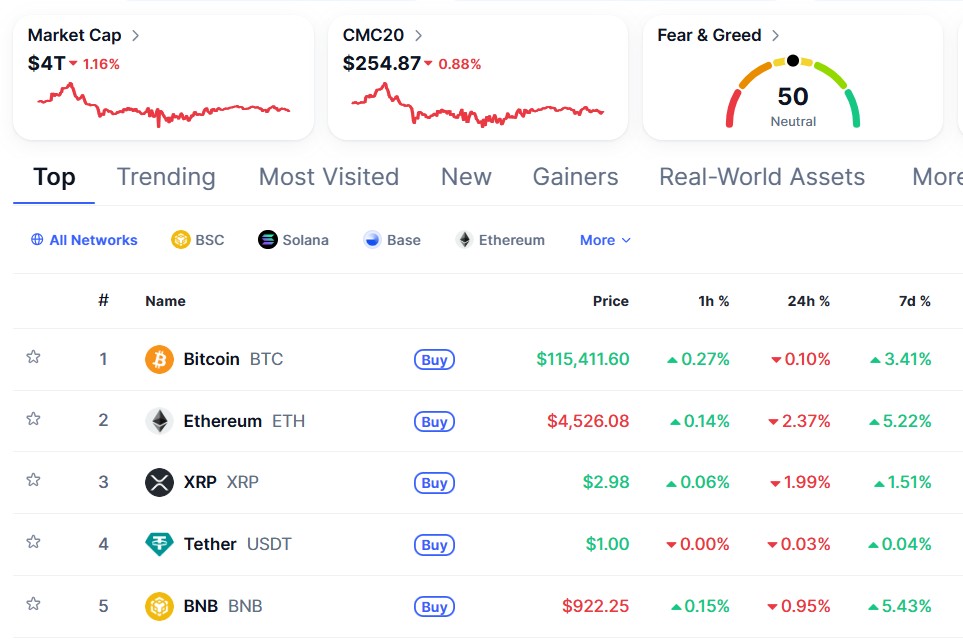

Source : Coinmarketcap

At the time of writing the global crypto market stands at $4T with slight down in the past 24hrs. Bitcoin and Ethereum are trading at $115,411 and $4526 respectively. The overall crypto market is neutral on fear and greed index. Now it's major time to watch the Bitcoin market as it is very volatile and directly connects with Trump and federal funds rate cut news.

Market paths to watch

-

Bitcoin and large-cap altcoins. Expect higher volatility in the hours around the Fed statement and Powell’s press conference.

-

Stablecoins & DeFi lending. If rates fall, yields from fiat and short-term bonds drop some capital could move into DeFi lending or staking in search of yield.

-

Risk sentiment. Any sign Miran will push for a deeper cut could spark rallies in meme coins and small-cap tokens, but these moves are often short-lived and risky.

Political risks and Fed independence

Senator Elizabeth Warren and other Democrats warned that Miran's strong connection with Trump presents a conflict of interest. Trump has put pressure on the Fed for months, demanding interest rate cuts to give the US economy a boost and make it cheaper for the government to borrow.

For instance, attempts to remove Lisa Cook, another Fed governor, On Monday, a US appeals court denied the justice department's request to lift an earlier ruling to temporarily block Trump from removing Cook.

The Trump administration battle adds political uncertainty to Fed decisions and could raise heat in markets. These debate might increase volatility in markets that detest ambiguity, like cryptocurrency, and adds political uncertainty to Fed decisions.

What Crypto Traders Should Do Now

Expect volatility around the week. Traders should prepare for fast moves, and treat any rally as an opportunity to manage risk, not assume permanent gains. Keep an eye on on-chain metrics for early signs of big moves.

Stephen Miran’s confirmation adds a new, pro-cut voice to the Fed right before a likely rate cut. That makes the Sept. 17 meeting more consequential for risk assets, including crypto.

Also read: What is the primary use of a private key? Ari wallet daily quiz免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。