The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

Recently, I have communicated with many cryptocurrency friends and found that everyone has different understandings of the underlying logic of the cryptocurrency world. Most cryptocurrency enthusiasts have a speculative attitude towards the market, and their perception of value is also very biased. Today, I will talk about value. Everyone should be clear that the value of all things is artificially assigned. Antique calligraphy and paintings, physical gold, and even bulk commodities are all composed of buyers and sellers, and pricing is also based on human factors. The cryptocurrency world is no different; the essence of value investment is based on the pricing of the majority. The larger the market, the larger the market capitalization; the more participants, the higher the price. So where does the value of the cryptocurrency world lie? Its essence lies in its ability to bypass the regulations of various countries. When it can circumvent the regulations between countries to launder its own wealth, it already has its own value. Understanding this point makes it easy to comprehend why prices are rising higher and higher now, and why the Americans hold the cryptocurrency world in such high regard. The more widely cryptocurrency is used, the more it can siphon off assets from all countries. The most well-known case of this is VIVO bringing back assets from India to the domestic market, utilizing cryptocurrency.

Many friends' understanding of value is linked to physical assets. What I will discuss next may not please many, but honest advice is often hard to hear. When the US dollar is decoupled from physical gold, and the dollar is backed by credit, the value of physical assets has already been eliminated. The financial thinking of physical value should have been abandoned at that time. Those still clinging to physical value thinking may still be stuck in the last century. Just look at the current stock market, especially the tech innovation sector; which company can withstand an audit? Take the US stock market as an example, whether it's Nvidia, Tesla, or Apple, do you really think they are worth trillions in market capitalization? From this, we can conclude that the current market with investment return value is not necessarily linked to physical assets. So where is the anchor of cryptocurrency? When Bitcoin can be used to purchase energy, then energy is the anchor; when it can be exchanged for US dollars, the US dollar is the anchor; when it can be exchanged for goods, goods are also the anchor. Currently, stablecoins are already issued using US Treasury bonds, so the backing of stablecoins is the US, and stablecoins can also be exchanged for Bitcoin, which carries significant implications.

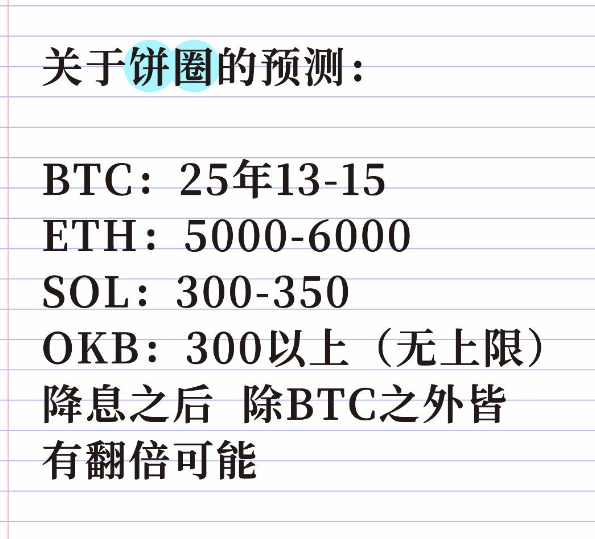

Once you understand this layer, you will clearly know the operational rules of the cryptocurrency world. Since it is linked to US Treasury bonds, the future trend of the cryptocurrency market is likely to be similar to that of US dollar assets. This is also why this year's trend has been almost identical to that of the US stock market, both reaching historical highs. Because the capital structure of the cryptocurrency world is almost the same as that of the US stock market, BlackRock's Micro Strategy and even META are well-known capital in the US market. Understanding this level allows you to comprehend why my price estimates for this year are so high. You can look back at my pinned predictions; these predictions are still conservative estimates. Deeper issues will involve political aspects, so I cannot elaborate further. Just remember one thing: the current feedback from the stock market is a symbol of strength, which reflects on the international level; the current stock market can only rise, especially after interest rate cuts regarding the flow of funds, which will also create competition. Remember, do not think that interest rate cuts will lead to a bear market; we are no longer in a financial realm that can solve problems.

This is also why many friends ask me if it is still possible to enter the market at this stage. My answer is always that spot trading is fine, but leverage needs to wait. Many outsiders feel that the cryptocurrency market is too volatile? This has its pros and cons. If the volatility were like that of traditional stocks, do you think it could siphon off capital and users from other investment markets? This is the characteristic of the cryptocurrency world; high volatility does not necessarily mean that this market is highly speculative; it may also be due to differing perceptions. When everyone thinks the bubble is too big, it may also mean that its inherent value has not been truly realized. For example, at this stage, it cannot be directly exchanged for domestic goods, nor can it obtain official backing, etc. We cannot ignore the achievements that have already been completed; the cryptocurrency world has already completed the largest capital backing. Therefore, the question you should consider now should not be whether the cryptocurrency world will return to zero, but rather how far the future of the cryptocurrency world still is. Considering a market based on existing conditions is the vision that an investor should possess.

Let’s not talk about future use cases or ideological issues. Many people say that cryptocurrency is digital gold, the future currency attribute. This idea is purely nonsense; it is impossible for Bitcoin to replace fiat currency in the future. The issuance rights of fiat currency cannot be decentralized. According to the current development trend, the cryptocurrency world can only possess investment attributes, which means it will be linked to stablecoins. So which cryptocurrencies have investment attributes? It is easy to judge; they are the public chains used for stablecoin issuance, such as the current BNB public chain, Ethereum public chain, and possibly the SOL public chain in the future, as well as the OKB public chain. As long as it is a public chain used for stablecoin issuance, it will promote the innovation of public chains and the expansion of the market. The vast data of public chains will naturally drive up coin prices. Bitcoin is a special cryptocurrency, and its collectible nature as the pioneer is even higher.

The future development situation of the cryptocurrency world can basically be seen at a glance. From the perspective of currency attributes, the future can only be a coexistence relationship between stablecoins and fiat currencies. Fiat currency can solve visible transactions, while stablecoins can solve invisible transactions. For instance, during the Russia-Ukraine conflict, energy trade between Europe and Russia was settled in Bitcoin, which is the value of cryptocurrency. What I want to illustrate is that everyone should start from a practical perspective. I firmly believe that the times create heroes. It is the current situation that creates heroes; in simple terms, it is the existing market demand that leads to the emergence of corresponding products. Reflecting on the cryptocurrency world, the current underground businesses will have underground channels, and thus underground currencies will be born. Before the emergence of the cryptocurrency world, there were already black and gray industries; existence is reasonable.

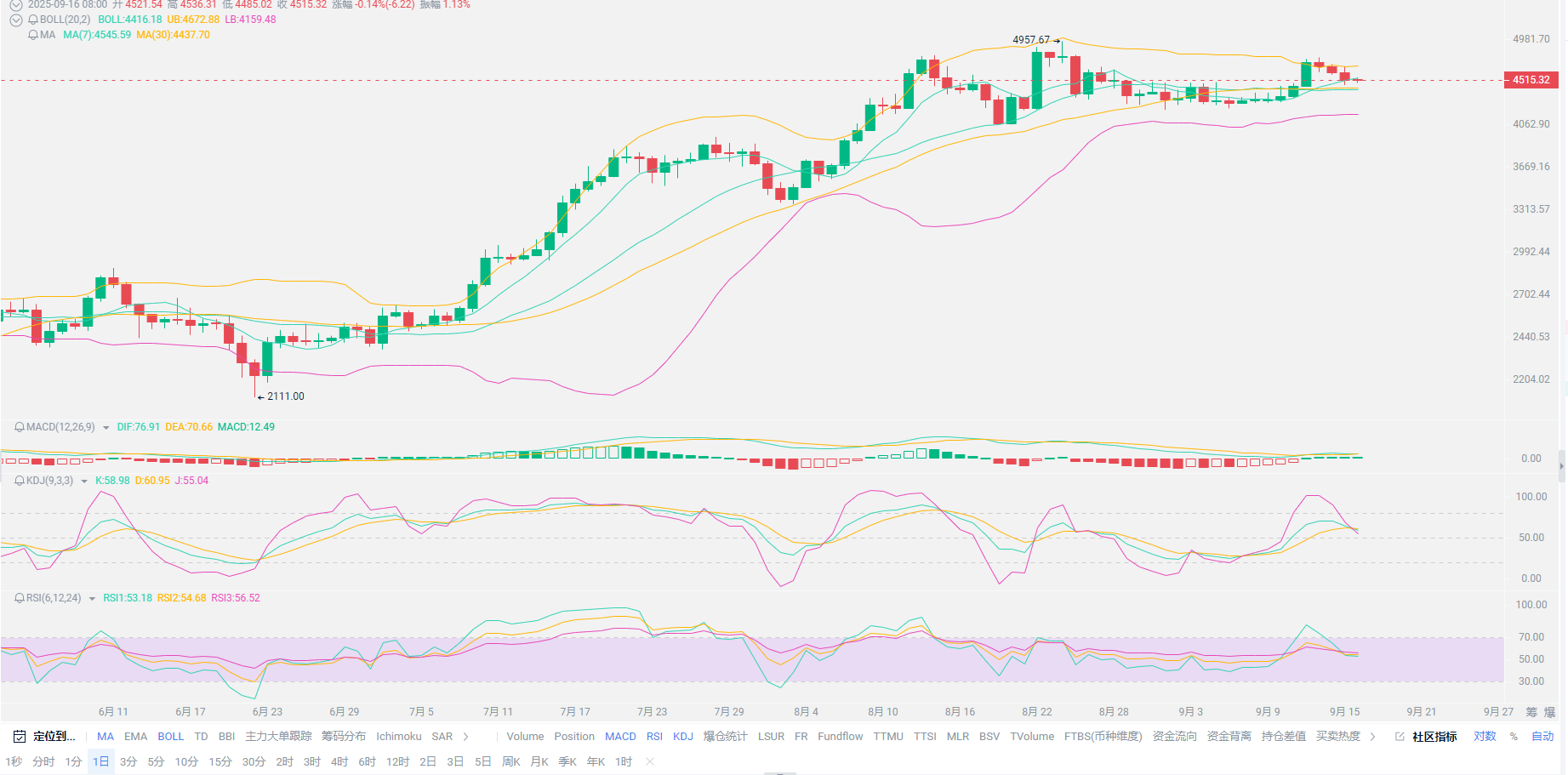

In summary: The overall trend is not significantly different from our previous assessments, but there has been a downward adjustment trend in the short term; this can be understood as coinciding with tariff negotiations and the recent interest rate cut meetings, which will withdraw some funds due to risk aversion. Especially the impact of tariffs is significant, leading to a reduced desire for interest rate cuts. There is some fear that if tariff issues arise, will it lead to the collapse of interest rate cuts? This is the only factor that can affect the basis points and frequency of interest rate cuts. My thought is simple: if you are entering the market from a long-term investment perspective, then you can disregard cost issues at this stage. If you are entering from a short-term speculative perspective, then this stage is not suitable for entry. As an old saying goes, several cryptocurrencies mentioned in the article have not yet reached this year's new highs; at least from a trend perspective, new highs will only appear after interest rate cuts, and those who can hold spot until the end of the year can rest assured. However, contract users are an exception. Predictions for you:

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on one piece or one territory, but aiming to win the game. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。