Fed’s Historic Rate Cut: S&P 500 Rally, Crypto Boost, and AI Growth

The U.S. Federal Reserve is preparing to cut interest rates this week, and it is shaping up to be a historic move. Stock markets are already on their record highs, and inflation remains above target, making this rate cut different from most seen in the past.

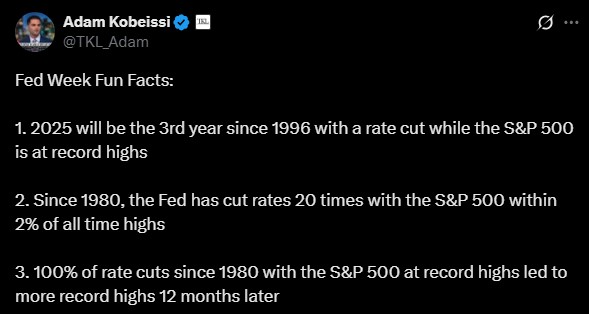

Now the question is what impact will be of these on the markets, the economy, and the fast growing artificial intelligence sector and what makes this Fed’s Historic Rate Cut? Let's get a structured go through from the vision of Adam Kobeissi.

Source: Adam Kobeissi

A Rare Rate Cut at Market Highs

Since 1980, the Fed has cut rates 20 times when the S&P 500 was trading within 2% of its all time high. Each time, the market did not fall, instead, it went on to set even more records over the following 12 months.

This week’s decision would be only the third time since 1996 that rate cut has come at such market highs, making it a rare historical moment.

Source: S&P Global

Lessons from the Past: 1996 Rally

The clearest example is 1996. That year, the Fed lowered rates with the S&P 500 already at record levels. The market responded with a powerful rally, climbing 22% in just one year. Investors see that period as proof that rate cuts can act like rocket fuel for an already strong bull market.

Why Is This Time Different?

This cut is not just about supporting growth, it is happening while inflation is still above 2.9%. That has not happened in more than 30 years. Normally, the Fed cuts rates after inflation has cooled to safer levels. Doing it now suggests the central bank is more focused on avoiding an economic slowdown than waiting for perfect inflation numbers.

Source: Trading Economics

How Does It Matter For the Crypto World ?

Lower interest rates don’t just help stocks, they often push money into crypto too. When borrowing is cheaper, investors usually look for faster growth and higher returns. Bitcoin and other digital coins could benefit, just like they did after past Fed cuts. With AI and blockchain growing side by side, it is high;y possible that the crypto-market will see a fresh wave of high demand in the upcoming months.

Looking Ahead: What Could Happen Next

If history repeats, Wall Street could see another wave of record highs in the next 12 months. But unlike the 1990s, the next phase of growth may not be led by traditional industries, it could be powered by artificial intelligence, robotics, and automation, as the U.S. is currently in what many call it “AI Revolution.”

The Fed’s rate-cut is more than just a policy shift, it could be the spark that shapes the next era of growth, so, are you ready for the future, where finance and technology move together?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。