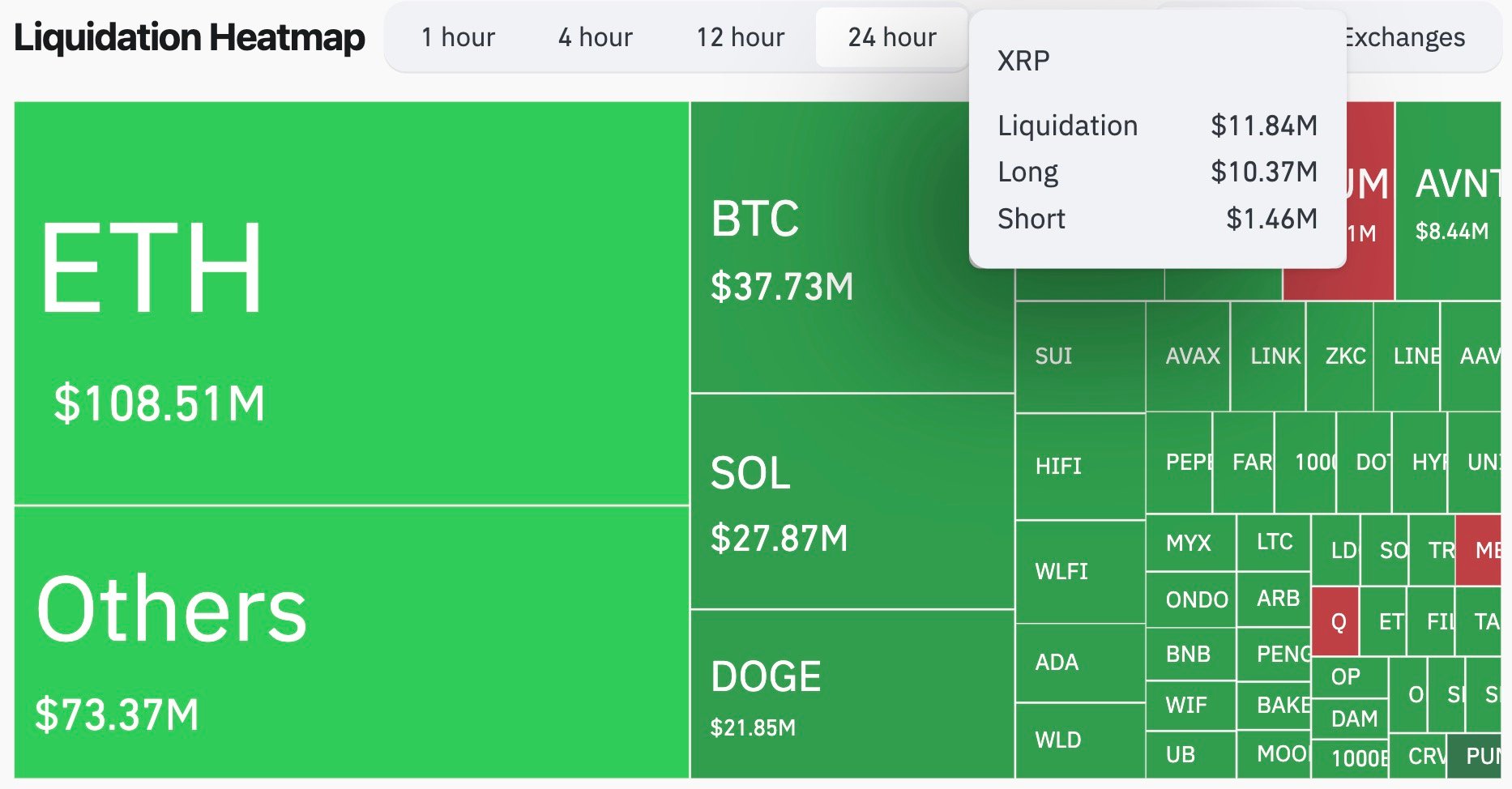

XRP traders have been caught on the wrong side of the market over the last day, with fresh data by CoinGlass showing a big gap between long and short liquidations. In total, $11.84 million in XRP was wiped out in the last 24 hours.

Of that, $10.37 million came from long positions, while just $1.46 million came from shorts. This means there is now a massive 710% difference, showing just how one-sided leverage had become before the market moved against it.

You Might Also Like

Tue, 09/16/2025 - 07:56 'Rich Dad Poor Dad' Author Teases 'End the Fed' Documentary, and Here Comes BitcoinByYuri Molchan

HOT Stories XRP ETF Launch to Test Investor Demand Cardano's Charles Hoskinson Teases DC Appearance Crypto Market Prediction: Bitcoin Needs One Push for $150,000, XRP Lost $3 Again, Dogecoin (DOGE) Biggest $0.30 Crash From JulyXRP Price Sees New Golden Cross, Shiba Inu Crashes 70% in Key Metric, Dogecoin On Verge of Death Cross — Crypto News Digest

It is easier to spot the difference when you compare it to wider crypto liquidations. Ethereum was top of the list with $108.5 million, Bitcoin came in at $37.7 million and Solana got $27.8 million. What makes XRP stand out is that its total is lower in dollar terms, while the scale of the imbalance is huge.

Source: CoinGlass

It was price action that led to the surge.

XRP price outlook

The chart shows XRP dipping to $2.96 in the early hours before recovering back toward $2.99. There has been some volatility, but the trading range has stayed pretty tight compared to the liquidation figures, making it look stable on spot markets while derivatives traders took the hardest hit.

The difference between what you can see on price charts and what is actually happening with leveraged positions is as obvious as it has ever been.

You Might Also Like

Tue, 09/16/2025 - 06:43 XRP ETF Launch to Test Investor Demand ByAlex Dovbnya

At the moment, the $3 level is still the main reference point. If the XRP price can hold onto that line, it might help to steady things after a day of forced selling. If it does not, the liquidation trend could carry on, as traders who have just reset their positions might have to make adjustments again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。