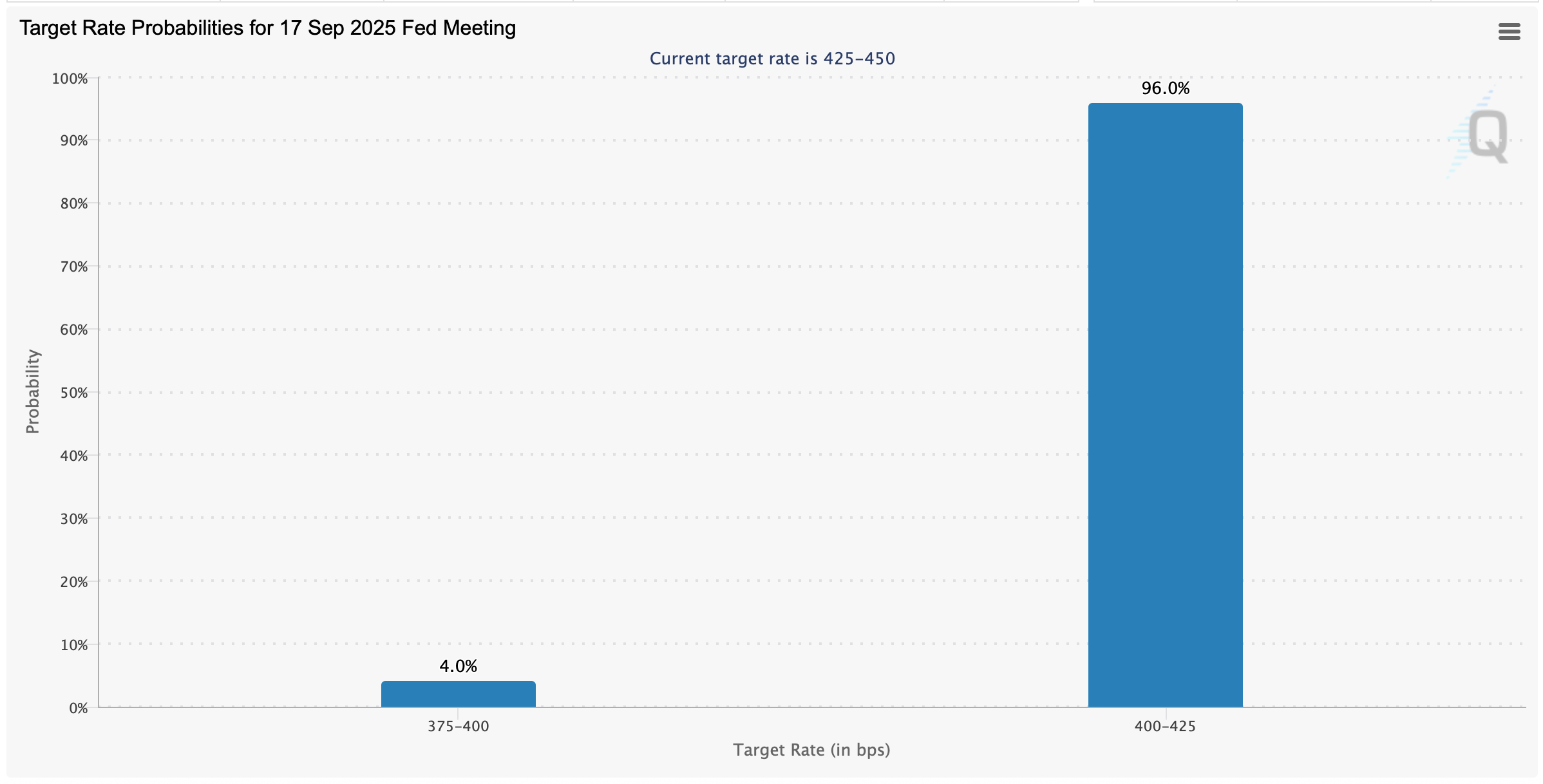

The market has practically baked in a rate trim, and as of 9 a.m. Eastern on Tuesday, CME’s Fedwatch tool is flashing a 96% probability that the U.S. central bank will slice the federal funds rate by 25 basis points (bps). There’s still a slim 4% shot of a heftier 50 bps cut, though odds are stacked against it.

Source: CME Fedwatch Tool

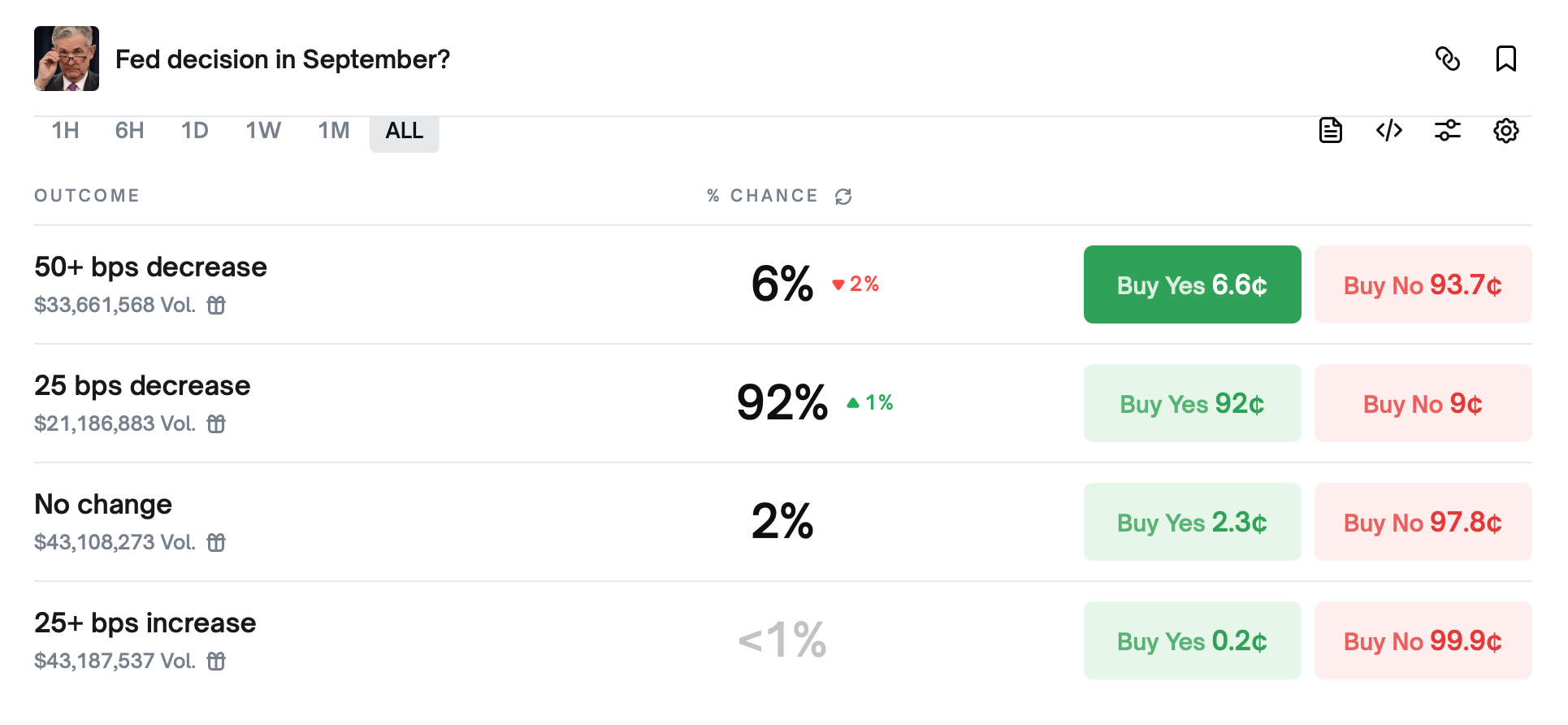

Meanwhile, prediction market Polymarket is leaning heavily on the quarter-point trim, pegging its likelihood at 92%. As of Sept. 16, the day before the FOMC meeting, markets are giving a half-point cut a modest 6% shot and holding steady at no change with just 2%.

Source: Polymarket

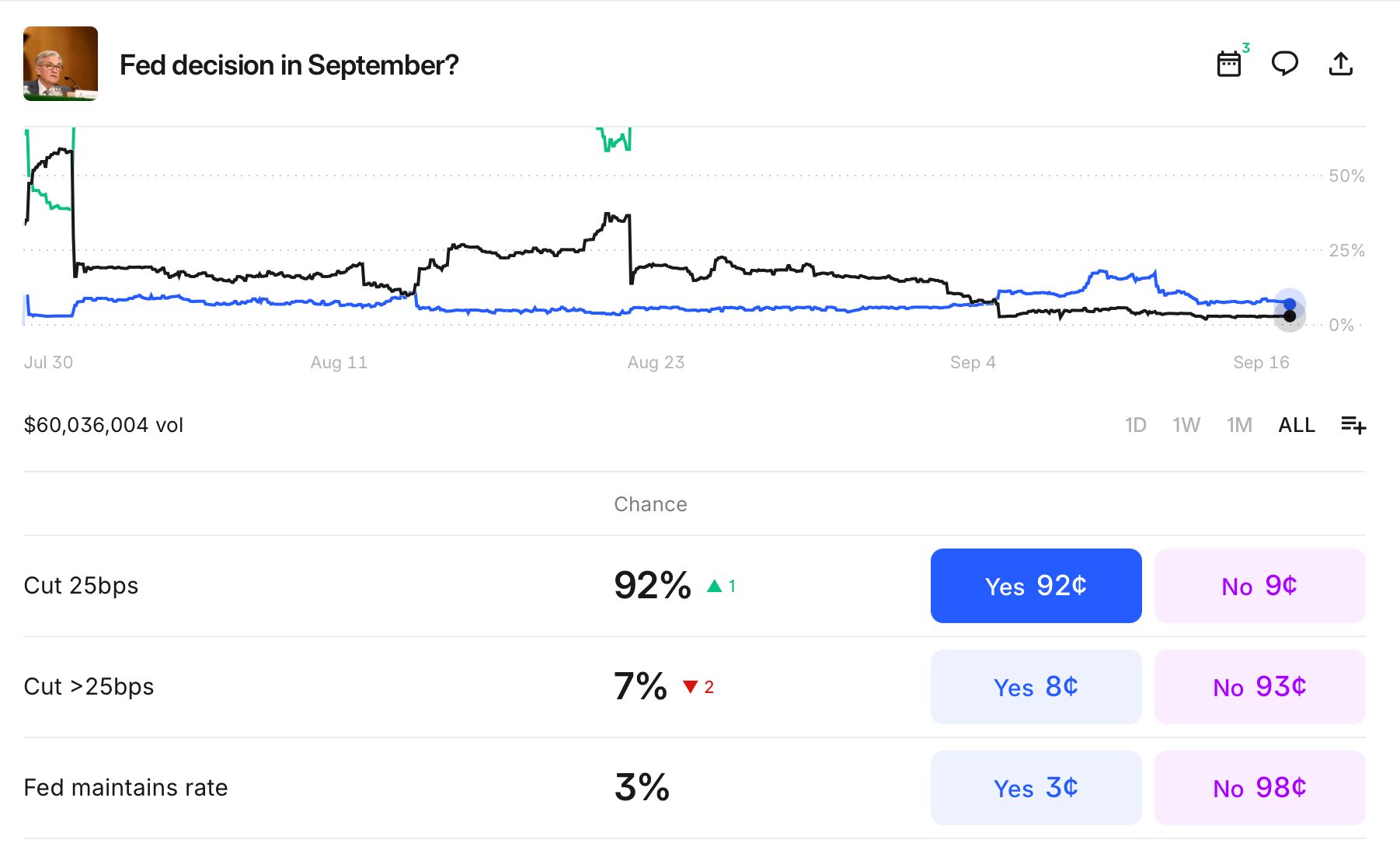

Likewise, prediction marketplace Kalshi mirrors Polymarket’s call, putting a quarter-point trim at 92% and leaving an 8% chance for something bigger. Ahead of the FOMC showdown, Walter Bloomberg’s X account spilled the tea on how Wall Street heavyweights are lining up their bets.

Source: Kalshi

Bank of America is less about tomorrow’s numbers and more about Powell’s delivery, eyeing a December trim with follow-ups in 2026. The X post says Citi thinks the “risks skew dovish,” even floating the idea of Miran and Bowman banging the table for a chunky 50 bps cut.

Deutsche calls rate trims “risk management,” penciling in 25 bps reductions for September, October, and December. Goldman’s watching labor like a hawk, hinting that quantitative tightening might wrap in October, with 25 bps cuts in October and December—or even a 50 bps slash if jobs tank.

JPMorgan expects two to three dissenters begging for a deeper slice but still sees 25 bps trims in October and December before pausing. And Wells Fargo? Walter Bloomberg’s X post claims they’re betting on a full labor-driven cut parade with 25 bps trims rolling out in October, December, March, and June.

Additionally, Stephen Miran, who once chaired the White House Council of Economic Advisers and served as a top economic hand to President Donald Trump, is stepping into the Federal Reserve. Traders and Fed watchers alike see his arrival as a potential fast track for Trump’s playbook on interest rates and monetary policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。