For Hyperliquid, this could be a "handy" business.

Written by: David, Deep Tide TechFlow

Yesterday, Hyperliquid released a new proposal, HIP-4.

Amidst the bombardment of various live coins and buyback narratives, this proposal seems to have sparked little discussion within the crypto community; however, upon closer examination of the proposal's content, we find that it points to another hot narrative in the recent crypto market --- prediction markets.

At the core of the proposal is the introduction of a new trading product called "Event Perpetuals."

In simple terms, Hyperliquid wants to add binary prediction market functionality on top of its perpetual contract exchange. Users can bet on events like "Will the Federal Reserve raise interest rates?" or "Will a certain token be listed on Binance this month?"

Notably, the authors of Hyperliquid's proposal are quite interesting: it includes investors from Framework Ventures, team members from the prediction market platform Kalshi, and developers from Felix Protocol and Asula Labs.

It is rare for "competitors to participate in formulating a plan," and Kalshi itself is one of the main players in the compliant prediction market in the U.S.

This may suggest that Hyperliquid's prediction market business is not aimed at disrupting existing players but rather seeking some form of collaboration or differentiated positioning.

As the absolute leader in the perpetual contract space, Hyperliquid's launch of HIP-4 at this time may be a recognition of the enormous potential of prediction markets, seeking to get a piece of the pie, or it could be looking for new narrative support for the HYPE ecosystem.

Now is a handy business

The 2024 U.S. presidential election made Polymarket famous, with trading volume exceeding $3.6 billion. As we enter 2025, prediction markets are even more favored by capital: Polymarket just returned to the U.S. market with the acquisition of QCEX for $1.12 billion, and Kalshi partnered with Robinhood to launch prediction market features, maintaining a monthly trading volume of over $800 million. Even traditional financial giants are stirring.

Time Magazine previously named Polymarket one of the "100 Most Influential Companies of 2025." The reason is simple: prediction markets are redefining the value discovery mechanism of information.

In the face of such market enthusiasm, can Hyperliquid remain unmoved?

Although HIP-4 is currently just a proposal and requires community voting and technical validation, the level of detail in the proposal and the lineup of participants clearly indicate that this is not a spur-of-the-moment decision.

More importantly, for Hyperliquid, this could be a "handy" business.

First, the technical reusability is extremely high.

Prediction markets and perpetual contracts are highly similar in technical architecture: both require order books, matching engines, and margin systems. For Hyperliquid, the development cost of adding Event Perpetuals is relatively low, and the trial-and-error cost is controllable. Even if the final outcome is not as expected, it will not significantly impact the main business.

Second, there is a natural overlap in user groups.

Traders who engage in perpetual contracts and bettors who participate in prediction markets are essentially speculators. They chase volatility, enjoy uncertainty, and are willing to bet on their judgments. Hyperliquid has already gathered a large number of such users; why not provide them with more games to play?

Finally, the HYPE ecosystem needs new stories.

As one of the most successful DEXs of 2024, Hyperliquid's perpetual contract business is already quite mature. However, capital markets always expect growth, and the HYPE token needs more application scenarios to support its valuation. Prediction markets are not only a potential good business but also a good story — they are sexy enough, imaginative enough, and close to the hot topics.

Rather than a strategic transformation, this is more of a low-cost product line exploration. If it succeeds, it opens up a new track; if it fails, the existing user base remains.

HIP-4: A clever product extension

Let’s first understand a core question: Why can't Hyperliquid directly add prediction markets to the existing system?

The proposal gives a vivid example: NFL game predictions.

Suppose the prediction question is "Will the Chiefs win the Super Bowl?" If using traditional perpetual contract methods, continuous oracle price feeds would be needed, updating odds every 3 seconds. But here’s the problem: sports game odds do not change continuously. After a play, the odds can jump instantly.

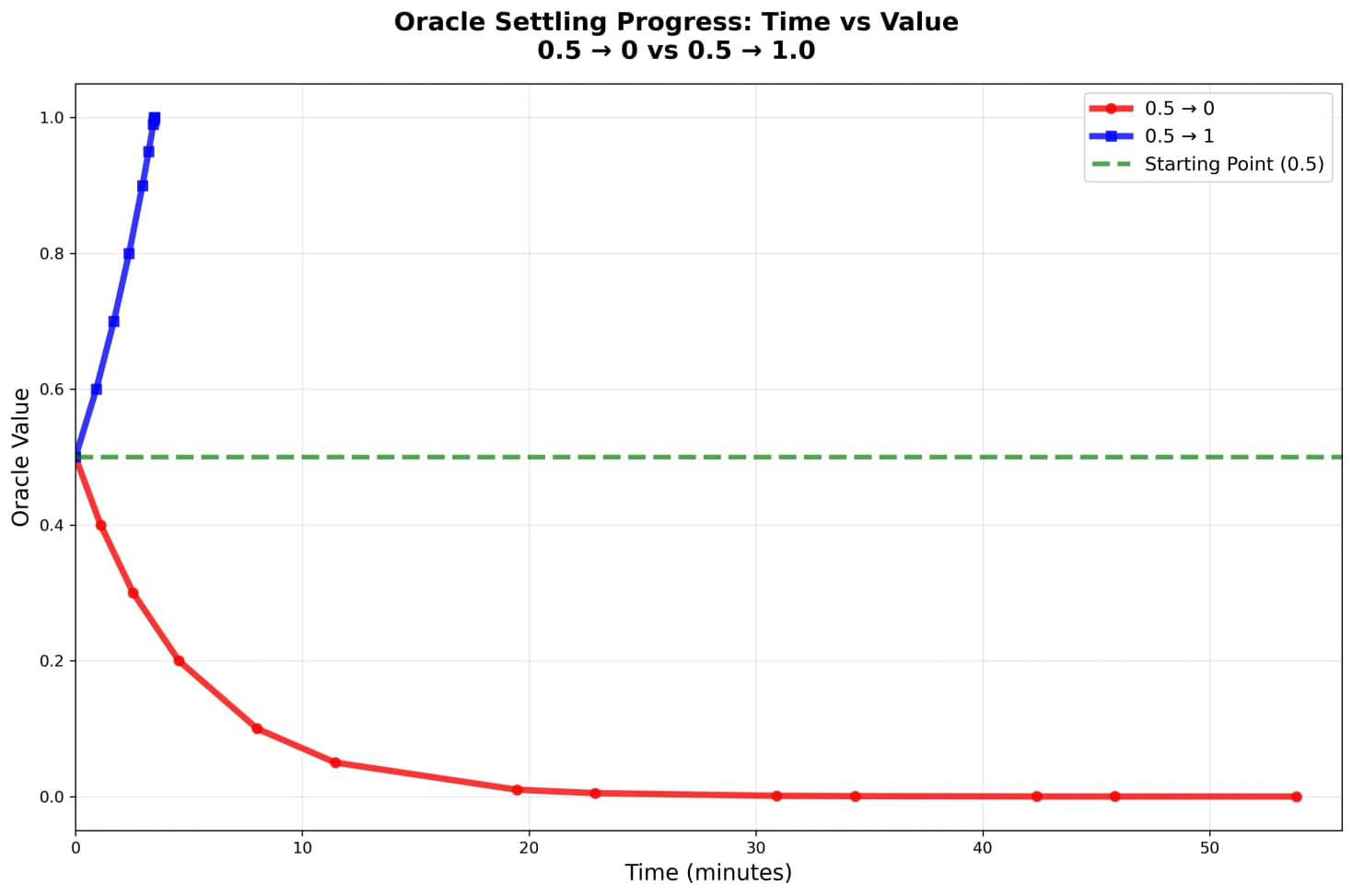

HIP-3 (Hyperliquid's existing market deployment specification) limits the price to change a maximum of 1% per tick. This means that if the game result is determined, it would take a full 50 minutes for the price to jump from 0.5 to 1.0.

During this time, traders who know the result can easily arbitrage.

This is why the new Event Perpetuals in the HIP-4 proposal are needed.

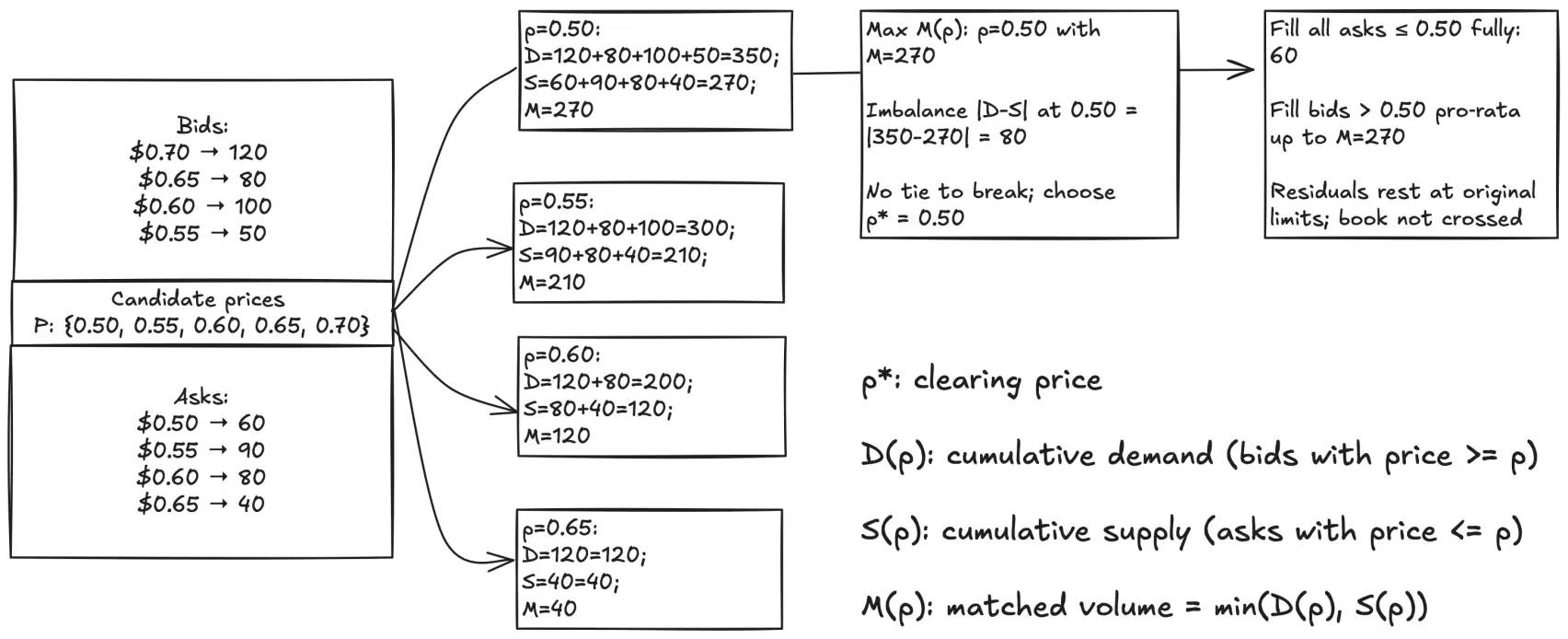

Event Perpetuals remove two core mechanisms of perpetual contracts: continuous oracle feeds and funding rates. Prices are entirely determined by market trading, with the final result (0 or 1) confirmed only through an oracle at the end of the event.

Interesting designs include:

Opening auction mechanism: 15 minutes of collective bidding to avoid initial price chaos

1x isolated margin: no leverage, reducing liquidation risk

Slot reuse: new markets can be deployed immediately after market settlement, improving capital efficiency

On the surface, this is a technical innovation; essentially, this may be a business exploration that Hyperliquid wants to undertake.

The attempt to move from a single product to a product matrix is evident. No matter how successful perpetual contracts are, they are just one product. If Event Perpetuals work, it means Hyperliquid's infrastructure can support more financial products:

Today it's prediction markets, tomorrow it could be options, and the day after it could be structured products.

More importantly, Hyperliquid has chosen a clever way to expand: letting others create markets.

According to the proposal, any team that wants to create a prediction market on Hyperliquid (referred to as "Builder" in the proposal) needs to stake 1 million HYPE tokens. These Builders are responsible for:

Deciding what market to create (e.g., "Will Trump buy Bitcoin?")

Setting market parameters (settlement time, oracle source, etc.)

Maintaining market operations (providing initial liquidity, promotion, etc.)

In return, Builders can earn up to 50% of the trading fees from that market.

This design is clever. Hyperliquid does not need to judge "which prediction markets will be popular," but rather lets the market decide. Teams willing to stake 1 million HYPE will naturally choose markets with liquidity potential carefully. If the market created by the Builder has no participants, the loss is the Builder's opportunity cost; if the market is popular, both Hyperliquid and the Builder win.

This also explains why there are members from the Kalshi team involved in writing this HIP-4 proposal.

They may be the type of professional Builders that Hyperliquid wants to attract. Kalshi has mature market operation experience and knows what kind of prediction markets have liquidity. If they are willing to come to Hyperliquid to create markets, they bring not only a market but also a complete set of already validated operational methodologies.

For a DEX with a TVL exceeding $2 billion, such a trial-and-error model is quite smart.

Challenges and Opportunities

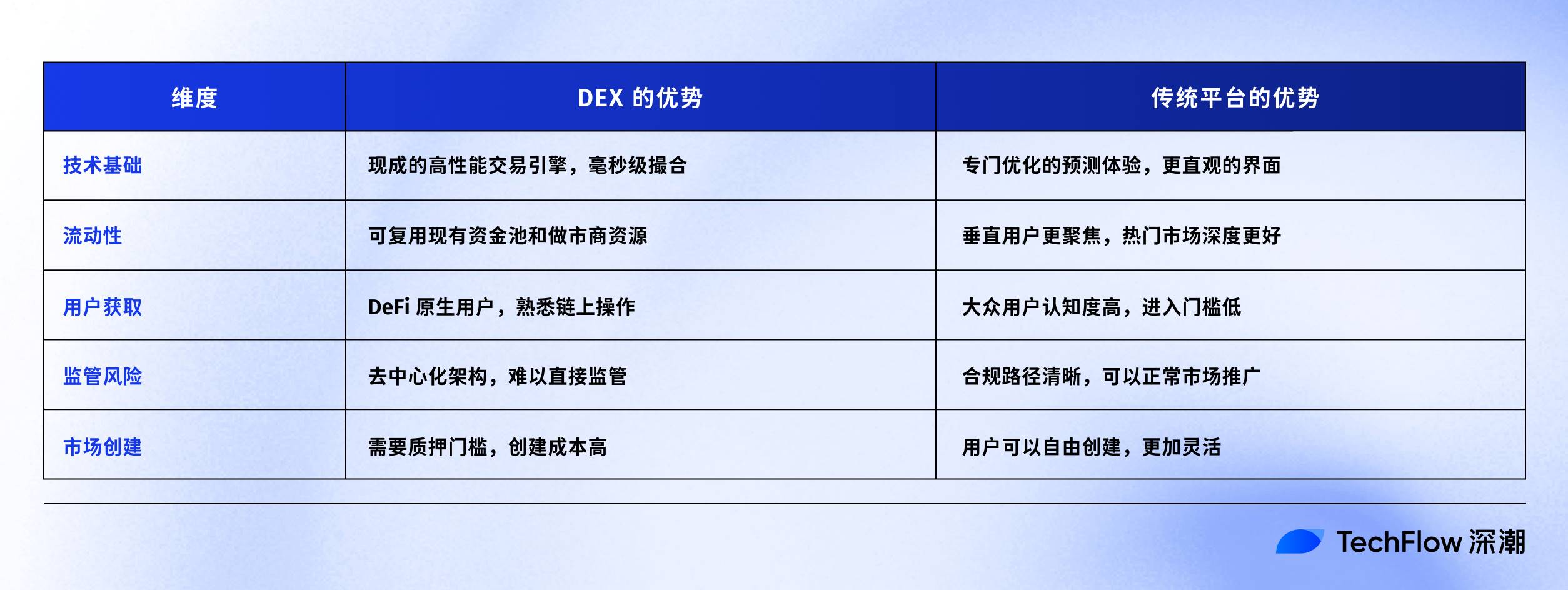

In theory, it seems logical for a DEX to engage in prediction markets.

The technical architecture is highly reusable. Order books, matching engines, settlement systems, margin management… these core components of perpetual contract DEXs are also needed for prediction markets.

But reality may not be that simple.

The vitality of prediction markets comes from the diverse markets created by users.

On Polymarket, any user can create a market, and this UGC model keeps the platform fresh and engaging.

However, in Hyperliquid's HIP-4 proposal, creating a market requires staking 1 million HYPE. At current prices, this amounts to a multi-million dollar barrier. While this can ensure market quality and prevent the proliferation of junk markets, it may also stifle innovation and diversity.

Another challenge is the dispersion of liquidity.

Perpetual contracts can share liquidity; the depth of ETH/USD can support all ETH-related trades. But prediction markets cannot; each event is an independent liquidity pool.

This means that even if Hyperliquid has a TVL of $2 billion, once dispersed across hundreds or thousands of prediction markets, the depth of each market may be quite limited. Shallow liquidity can lead to excessive slippage and a decline in user experience.

Additionally, users see Polymarket and Kalshi and immediately recognize them as prediction markets, while Hyperliquid still holds a mental positioning as a perpetual DEX in the crypto world. If the proposal is implemented, subsequent user education and promotion will be key.

So, where are Hyperliquid's opportunities?

Certain predictions focused on the crypto vertical may be the most realistic path. For example, whether a certain token will be listed on a major CEX this month, or whether a key Ethereum upgrade will be delayed…

In these markets, Hyperliquid's users may understand better, be more interested, and be more willing to bet than Polymarket's users.

Is it a good thing for $HYPE?

In the short term, the impact may be limited.

First, this is just a proposal and has not yet been officially implemented. Even if it passes the vote, it will take at least a few months from development to launch to generating actual revenue. The market may experience some speculative hype, but it is unlikely to provide sustained price support.

Secondly, there is uncertainty regarding the revenue scale of prediction markets. Even if Hyperliquid can capture 10% of the market share from Polymarket (with a monthly trading volume of $80 million), based on the typical DEX fee rate of 0.1%, the monthly revenue would only be $80,000. For a project valued in the billions, this incremental revenue is negligible.

However, in the medium to long term, the significance may extend beyond financials.

First, the increase in demand for staking.

If HIP-4 successfully attracts 10-20 Builders to create markets, it would mean 10-20 million HYPE being locked up. Although this is not a large amount relative to the total supply, it represents a tangible reduction in circulation.

More importantly, this demonstrates the value of HYPE as a "license" — holding HYPE not only allows participation in governance but also provides business opportunities.

Second, enhancing brand value.

If professional teams like Kalshi are indeed willing to stake HYPE to create markets, it sends a strong signal: professional prediction market brands recognize Hyperliquid's future. This endorsement effect may be more valuable than direct revenue contributions.

The crypto market has never lacked money; what it lacks is a story. The narrative of perpetual contract DEXs has already been told. If they can successfully enter the prediction market, each additional possibility adds another variable to the valuation model.

Exploring the boundaries of DEX

I believe the interesting aspect of the HIP-4 proposal lies in a fascinating trend: DEXs are testing their boundaries.

From simple token swaps to perpetual contracts, and now potentially to prediction markets, successful DEXs are always actively expanding, turning handy businesses into leverage for increasing their valuation and operations.

Moreover, this expansion does not resemble the previously popular tactics of crypto projects, where any change is almost immediately announced to attract attention. It feels more like a relatively low-key exploration, testing the boundaries of technology, user acceptance, and regulatory tolerance.

For those following Hyperliquid, the best approach is not to overinterpret individual proposals but to pay attention to the trends behind the proposals.

HIP-4 may succeed or fail, but the direction it represents, such as the platformization, ecosystem development, and integration of DEXs, is likely to be the future direction. Projects that successfully expand their boundaries will achieve higher valuation multiples; those that remain stagnant will gradually be marginalized.

As for whether Hyperliquid can gain a share of the prediction market with Event Perpetuals?

Let the market answer that. After all, this is itself a prediction worth betting on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。