CRP-1 aims to align with international regulatory standards by establishing a regulatory framework that balances innovative development and risk prevention, providing clear guidance for the banking sector's participation in crypto asset-related businesses.

Written by: Xiao Sa Legal Team

Driven by the wave of technological innovation, the global crypto asset market has rapidly expanded, while a series of risk issues such as price volatility and money laundering have also emerged, making the demand for effective regulation particularly urgent. In September 2025, the Hong Kong Monetary Authority (HKMA) issued a consultation draft for the new module CRP-1 "Classification of Crypto Assets" in the "Banking Supervisory Policy Manual" (SPM) to align with international regulatory standards. The aim is to establish a regulatory framework that balances innovative development and risk prevention, providing clear guidance for the banking sector's participation in crypto asset-related businesses.

Next, the Sa Jie team will take a closer look at the new requirements of CRP-1, compare them with regulatory policies from other countries and regions, and discuss how these changes will impact players in the crypto space.

01 Interpretation of the Core Content of Hong Kong CRP-1 New Regulations

(1) Basic Definition: Regulatory Scope and Applicable Entities

The new CRP-1 regulations first delineate a clear scope for crypto asset regulation, laying a solid foundation for subsequent implementation. Specifically, the new regulations define crypto assets as those primarily relying on cryptography and distributed ledger technology (DLT) or similar technologies; they can be used for payment or investment purposes, or to acquire goods or services. However, it explicitly states that central bank-issued digital currencies are not included in this scope, allowing for a precise definition of crypto assets while distinguishing them from legal digital currencies, thus preventing overly broad regulation.

In terms of regulatory targets, the new regulations apply to all licensed financial institutions in Hong Kong, including regular banks, restricted license banks, and companies that accept deposits. These institutions are an important part of Hong Kong's financial system, and their crypto-related activities directly impact financial stability. By bringing them under regulation, risks can be controlled from the source.

Regarding risk management, the new regulations adopt a "no one left behind" strategy. Whether it is the crypto assets held by banks themselves, the risks arising from custodial and trading activities for clients, or the risks associated with indirect exposure to crypto assets through financial derivatives, all must be managed. This way, financial institutions cannot exploit loopholes to evade regulation, and all risks related to crypto assets can be strictly managed.

(2) Core Classification

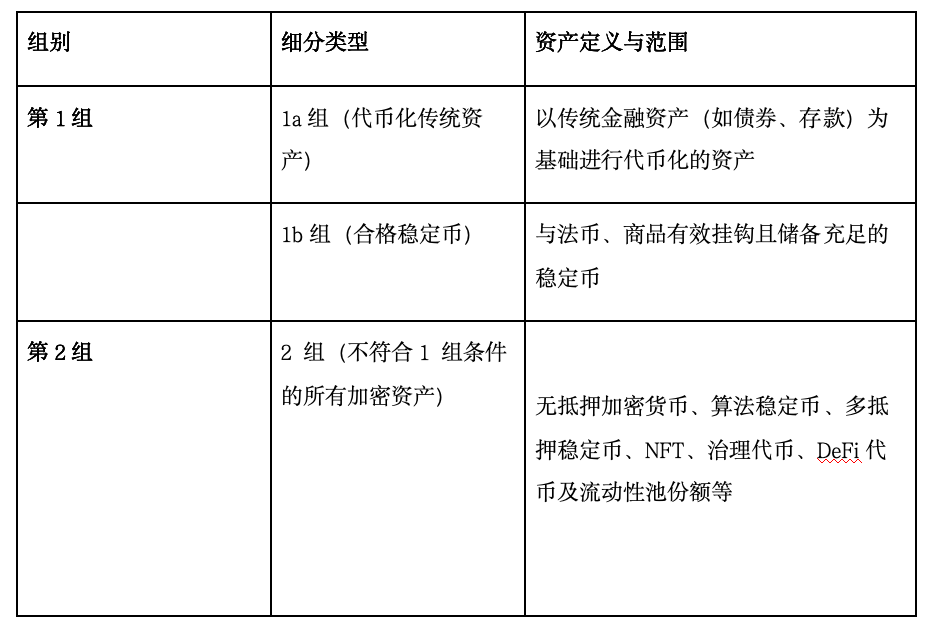

Risk grading is the core logic of the CRP-1 new regulations. The regulations classify crypto assets into Group 1 (low risk) and Group 2 (high risk) based on their risk mitigation capabilities. The following table allows friends to see its core classification at a glance.

02 Connection and Differences Between CRP-1 and International Rules (BCBS Standards)

(1) Core Logic of BCBS Standards

The Basel Committee on Banking Supervision (BCBS), as the core institution for global banking regulation, released "Prudential Treatment of Crypto Asset Risk Exposures" in December 2022 and will launch "Revisions to the Crypto Asset Standard" in July 2024, establishing a unified global regulatory framework for crypto assets. Its core logic can be summarized as "risk grading and prudent management."

In terms of regulatory objectives, the BCBS standards focus on "preventing and controlling crypto asset risks to ensure banks' capital adequacy," avoiding the transmission of crypto asset risks to the traditional banking system and maintaining global financial stability. In the core framework, BCBS categorizes crypto assets into "Group 1" and "Group 2," setting strict capital requirements for high-risk assets while promoting global regulatory coordination to avoid regulatory arbitrage.

The introduction of BCBS standards stems from the rapid development and accumulation of risks in the global crypto asset market, aiming to provide a unified regulatory benchmark for internationally active banks, balancing "financial stability" and "responsible innovation," and offering a reference framework for regulatory agencies in various countries.

(2) Connection Between CRP-1 and BCBS

The CRP-1 new regulations and BCBS standards align in many key areas, demonstrating Hong Kong's commitment to keeping pace with global regulatory developments as an international financial center.

In terms of asset classification, CRP-1 divides crypto assets into "Group 1" and "Group 2," while BCBS categorizes them into "Group 1" and "Group 2." The core standard for classification in both cases is based on the asset's ability to control risk. For example, compliant stablecoins, which are lower-risk and more reliable assets, fall under "Group 1" in BCBS and correspond to "Group 1" in CRP-1. Both require that such assets have clear legal provisions and effective risk prevention measures. For high-risk assets, both frameworks impose strict requirements on how much capital financial institutions must hold to control risks, fully reflecting the principle that "the greater the risk, the stricter the regulation."

Regarding capital regulatory requirements, CRP-1 largely continues the prudent management approach of BCBS. BCBS stipulates that for certain high-risk crypto assets, financial institutions must hold capital equivalent to 1250% of the asset's value to address risks; CRP-1 applies the same standard to "Group 2b" assets. For liquid crypto assets, BCBS requires that they must be traded on compliant exchanges and meet certain market size criteria. CRP-1 has similar requirements for "Group 2a" assets, mandating trading on regulated exchanges and setting market capitalization and trading volume thresholds to ensure that the invested capital matches the asset's risk.

Additionally, both CRP-1 and BCBS emphasize comprehensive regulation, ensuring that all crypto assets held by banks, as well as those involved in client services and even indirectly related risks, fall under the regulatory scope to avoid the emergence of unregulated "gray areas," achieving the goal of unified global regulation.

03 Specific Impacts of CRP-1 New Regulations on Crypto Asset Users

After the implementation of CRP-1 new regulations, there will be significant adjustments in banks' crypto businesses, directly affecting our friends' buying, selling, and custody of crypto assets, as well as various related issues.

First, regarding trading options, the new regulations have "tightened" the assets and channels available for trading. High-risk Group 2b assets, such as certain NFTs and governance tokens, are no longer allowed for trading by banks and can only be traded on other platforms, which may not be reliable; while Group 1 compliant assets are safe, the variety of options has decreased; Group 2a assets must be traded on licensed exchanges, with stricter account opening reviews and higher thresholds. As for asset security, the new regulations indeed make asset custody safer, allowing for priority recovery of funds even if the platform encounters issues, but the anti-money laundering requirements are too strict, reducing personal privacy, and the price volatility of different assets has also changed.

For friends holding Group 2b assets like NFTs and governance tokens, the Sa Jie team recommends prioritizing platforms regulated by the Hong Kong Monetary Authority or those with international compliance qualifications, and not putting all assets in one place; users who prefer Group 1 compliant assets can enjoy the safety of banks but must accept fewer purchasing options; friends trading Group 2a assets should remember to prepare a full set of materials such as ID cards and bank cards in advance to cope with the strict reviews of exchanges. Regardless of the type of asset held, everyone needs to replan their investment portfolios and pay attention to changes in bank fees, balancing the security benefits brought by the new regulations with privacy protection and operational convenience.

In Conclusion

In summary, it is evident that Hong Kong's CRP-1 new regulations demonstrate significant foresight in the field of crypto asset regulation, providing new ideas and directions for industry development and risk prevention.

Sa Jie recognizes that Hong Kong's crypto asset regulation will enter a phase of dynamic optimization and deepening practice. In the future, regulatory agencies need to keep pace with international trends and strengthen cross-border regulatory coordination; industry participants should establish a regular compliance communication mechanism. We look forward to Hong Kong using CRP-1 as an opportunity to improve regulatory technology, balance investor protection and innovation, and set a global regulatory example.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。