Original|Odaily Planet Daily (@OdailyChina)

Last night, after the official announcement of STBL, which focuses on the concept of "second-generation stablecoin + Tether co-innovation project," the price surged dramatically, reaching around $0.22 at its peak, and briefly exceeding $0.3 this afternoon before falling back to around $0.17. On the other hand, Tether CEO Paolo Ardoino has recently stated loudly: “The total number of USDT users is nearly 500 million, with a daily trading volume of about $45 billion, and an average of 17 million daily traders, with Tether's profit margin reaching 99%.”

What exactly is SBTL? Is it related to the stablecoin public chain Stable launched by Tether? Is the identity of Tether co-founder legitimate? What is the background of STBL? Odaily Planet Daily will provide a detailed introduction and brief analysis of these questions in this article.

SBTL: "Second-Generation Stablecoin" Led by Tether's Former CEO

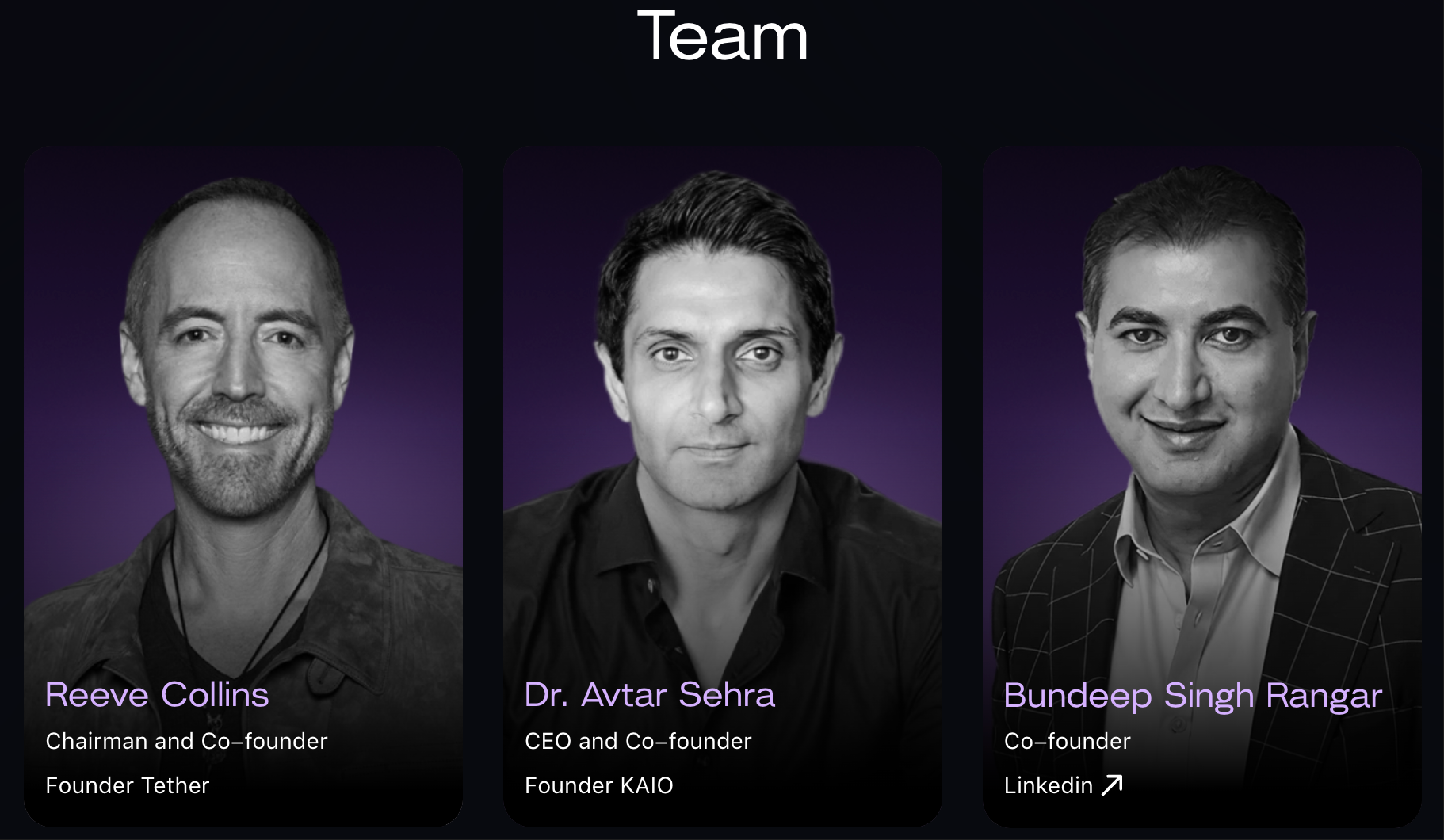

First, it is important to clarify that STBL is not related to the stablecoin L1 public chain Stable previously launched by Tether: the former is prepared and launched by Reeve Collins, former co-founder and CEO of Tether, president of ReserveOne, CEO of M3-Brigade Acquisition V Corp, and Avtar Sehra, founder of KAIO. STBL is an ecological governance token, and will subsequently launch the consumption stablecoin USST and the yield token YLD; the latter is launched by Tether, the issuer behind USDT, supported by Bitfinex and USDT 0, with Tether CEO Paolo Ardoino as an advisor, using USDT as the on-chain native Gas, allowing users to initiate transactions without holding platform tokens, and P2P (peer-to-peer) USDT transfers are completely gas-free.

Therefore, contrary to the many users who mistakenly believe that "STBL is a new stablecoin launched by the stablecoin L1 public chain Stable," in fact, the only connection between STBL and Tether may be that its chairman and co-founder Reeve Collins was involved in the operation of Realcoin (the predecessor of USDT) from 2013 to 2014, and briefly served as CEO of the issuing company Tether.

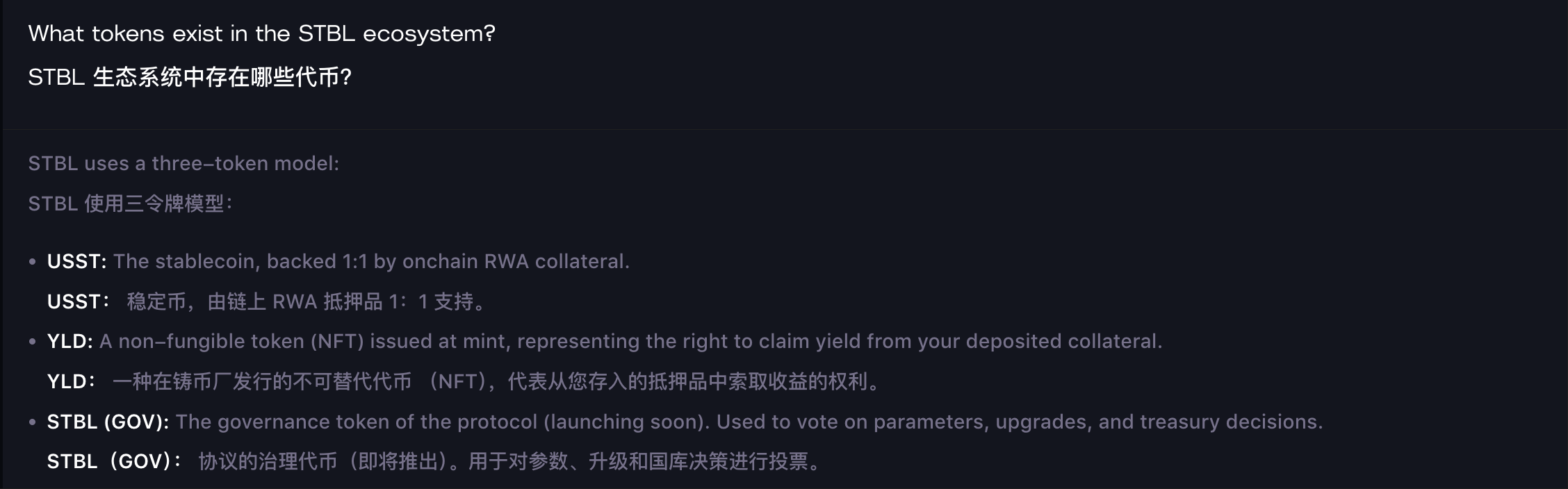

According to a lengthy article previously published by Reeve Collins here and information from the STBL official website, the STBL ecosystem mainly consists of:

- STBL is a governance token, allowing holders to vote on collateral types, ratios, and upgrades, ensuring that STBL is secure, compliant, and community-driven. It is worth mentioning that this token is completely non-custodial.

- USST is a consumption stablecoin, supported 1:1 by on-chain RWA collateral, allowing for instant, over-collateralization, with no hidden fees or lock-ups, and can be used for supported partner agreements and exchanges for trading, DeFi protocols, cross-chain bridging, and fund management. Currently supported collateral includes USDY and OUSG from ONDO, as well as BUIDL from BlackRock.

- YLD is an NFT that users can use to receive scheduled yields, primarily used to retain collateral yields and increase over time.

In other words, unlike the operational model of "first-generation stablecoins" like Tether and Circle—where the issuer monopolizes the interest or income generated from the reserve funds corresponding to the stablecoins—STBL aims to "return wealth to the people" through the YLD NFT. Thus, if the first-generation stablecoins (like USDT, USDC) solved the problem of "how to establish a reliable digital dollar on the blockchain," then the goal of the second-generation stablecoin (i.e., USST) is to financialize the dollar. Reeve's original words were—“Yield is no longer limited to the issuer's balance sheet. Principal and yield are split into two programmable cash flows.”

In addition, SBTL has the support of Wave Digital Assets, an investment company based in Los Angeles and registered with the SEC in the U.S. Reports indicate that this institution has asset management scale exceeding $1 billion, having previously spun off from a venture capital firm with a scale of up to $400 million, and has gained attention for its risk-aware and regulated investments.

The Ambition of STBL: Diminishing Issuers, Benefiting Many

Currently, STBL's ambition is significant, and its core lies in one sentence—distributing the business profits generated by reserve collateral such as U.S. Treasury bonds and gold from stablecoin issuers to users, while institutions, governments, and DeFi protocols gain broader liquidity assets.

Specifically, the USST stablecoin and YLD NFT "growth flywheel" within the STBL ecosystem offer certain benefits to different groups and roles:

- For consumers, holding USST stablecoins ultimately contributes to serving the entire ecological network rather than just the interests of the issuer;

- For institutions, USST and YLD can transform idle cash assets into transparent, compliant, and revenue-generating assets and cash flows;

- For sovereign governments, the issuance of USST will become a significant case study, meaning they can produce a digital stablecoin linked to their national bonds, thereby maintaining national sovereignty; and they can also release new sources of value that traditional fiat currencies cannot provide—namely, achieving the preservation and appreciation of their national currency.

- For DeFi protocols, the built-in yield combinable modules of the USST and YLD system will provide more diverse and flexible support for various businesses such as derivatives and transfers.

Summary: The Future of STBL Relies on the Issuance Volume of USST

Although the current "STBL-USST-YLD" ecosystem can operate smoothly, in the long run, the price performance of STBL as a governance token will still be primarily determined by the issuance scale of USST and the corresponding yield from collateral. If YLD yields are substantial, USST will undoubtedly open a new development path for the stablecoin market—a path distinct from Tether and Circle's monopolization of collateral yield; however, given the current scale of the stablecoin market, the issuance of USST undoubtedly faces fierce competition and an uncertain future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。