Faster crypto ETF approvals after SEC Generic listing move

SEC generic listing standards for crypto ETFs

Big news today — The U.S. Securities and Exchange Commission has approved new rules that let exchanges use a generic path to list commodity-based trust shares. This change, which is the SEC Generic listing approval by market watchers, will let exchanges list products that hold digital assets without the commission reviewing every single filing. This is the framework we've been waiting for. Get ready for a wave of spot crypto ETP launches in coming weeks and months.

Source : Website

What the New Framework Mean for Crypto ETFs

The new rule lets Nasdaq and Cboe adopt crypto ETP and ETFs listing standards that speed up approvals. Instead of two long filings and months of waiting, exchanges can list qualifying products faster. The Security Exchange Commision said the move will help investor choice and support innovation in digital asset products.

This is being called a framework for spot cryptocurrency ETFs and products that were harder to list before. The new process will cut the maximum time from filing to launch to 75 days from 240 days, or longer still.

Why Industry Leaders Call it a Watershed Moment

Industry people say this opens the door to many new funds. Teddy Fusaro of Bitwise called the decision “a watershed moment” for regulation of digital assets, noting that the rules overturn years of slow approvals. Expect managers to push to list funds that track tokens beyond just bitcoin and ethereum.

In a press release, SEC Chair Paul Atkins described the approval by commission members as a way to foster innovation and reduce barriers to digital asset products.

From 2013 to today: The road to SEC Generic listing

This change builds on past steps. The first bitcoin ETF filings began in 2013 and the first U.S. spot bitcoin ETPs only started trading after approvals in January 2024. That earlier approval changed the market and showed how big ETF flows can move prices and attention. Now the SEC’s move to a generic standard is the next evolution.

How the Markets is Reacting after Approval

Faster approvals usually mean more choice for investors and more competition between products. That can push down costs, tighten trading spreads and bring more money into the cryptocurrency market through regulated channels.

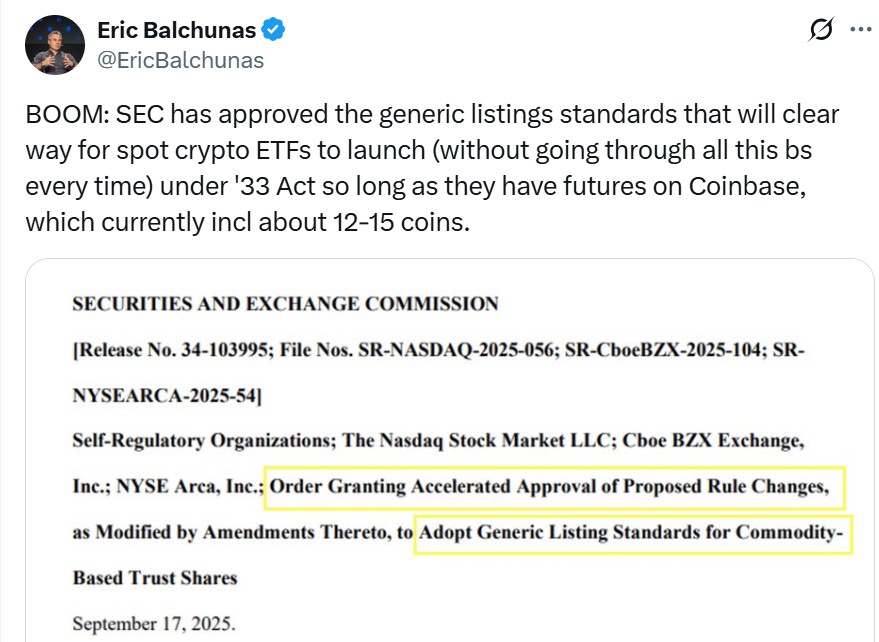

The crypto ETF approval news are buzzing on the social media and internet and making headlines over the top. Bloomberg analyst Eric Balchunas also shared a post stating now these ETFs will not have to go through all this long wait every time.

Source : X

Which Coins Could be First Under the New Framework

Companies who filed for funds tracking Solana, XRP and other coins may have a clearer path. Reports say funds tied to Solana and XRP may be among the first to try this new route. Investors are already waiting on a list of coins eligible for spots and upcoming crypto ETFs after approval. But filing is one step product design, legal work and service providers must still be in place.

Final word: SEC Generic listing sets up busy months ahead

The SEC’s decision to allow a SEC Generic listing path is a big regulatory step. It does not mean every coin or fund will appear immediately, but it clears a legal road many managers had been waiting for. If you are a cryptocurrency investor, expect a busy period ahead as the market adjusts.

Also read: Hamster Kombat Daily Combo 18 September 2025: Play To Earn免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。