Hyperliquid

This generation of Perp DEX has fundamentally differentiated itself from the previous generation represented by "GMX, DYDX". Since it is still a Perp DEX, the title will continue to discuss it as a Perp DEX.

Starting as a "Perp DEX", it has rapidly risen to prominence and become well-known.

Hyperliquid is an L1 public chain, similar to Ethereum and Solana. Hyperliquid has grand ambitions to create a blockchain that supports all finance and a high-performance on-chain financial trading infrastructure. Hyperliquid offers both perpetual contract trading and spot trading, and is currently advancing the stablecoin USDH.

Its development path can be glimpsed from the HIP proposals, from HIP-1, HIP-2 to HIP-3, and recently the community has proposed HIP-4. HIP-4 aims to create "Event Markets" similar to Polymarket, further expanding Hyperliquid's product boundaries. Simply put, it is a binary market traded on HyperCore, which differs from traditional perps in that events do not rely on continuous oracles or funding fees; prices are entirely determined by trading actions. This proposal has also received affirmation from Jeff (the discussion on HIP will not be elaborated here; a dedicated research article will be written later).

Hyperliquid is affectionately referred to by the community as "On-chain Binance", a name that has caused some anxiety among Binance executives. Alternatively, Hyperliquid can be called the "AWS of Liquidity", which sounds a bit sexier.

Hyperliquid L1 Technical Architecture and Performance

The Hyperliquid team, starting from "first principles", has developed a high-performance Layer-1 blockchain specifically designed for trading to address issues such as poor liquidity and trading experience, opaque black boxes, and fraud in the crypto market. The architecture is divided into two parts: HyperCore and HyperEVM.

HyperCore is the on-chain matching engine responsible for the Central Limit Order Book (CLOB) for order placement, matching, margin, and settlement, all of which are completed on-chain. Choosing CLOB over AMM was the right decision, as the experience with AMM Perp DEXs was indeed lacking. CLOB is also the common choice among mainstream Perp DEXs (Aster, Lighter, and edgeX also use CLOB, with Aster supporting both AMM and CLOB).

HyperEVM is the general smart contract layer that shares consensus with HyperCore, maintaining compatibility with Ethereum EVM, facilitating the integration of other applications with the exchange state. The consensus uses an improved version of HotStuff called HyperBFT (Proof of Stake), ensuring consistent transaction order across the network without relying on off-chain matching.

This tightly coupled sharding design brings speeds close to centralized exchanges: median trading latency is about 0.2 seconds (99% of trades have a 0.9-second latency), with peak throughput reaching 200,000 transactions per second (official data from HyperLiquid). Hyperliquid's block production and confirmation are very fast, achieving sub-second finality. Due to the fully on-chain order book and matching, it has high transparency while still maintaining outstanding performance, truly achieving "on-chain CEX speed". Currently, Hyperliquid has not explicitly adopted EigenLayer's AVS (Active Validation Service) solution, primarily relying on its own chain and consensus to ensure performance and security, with performance and security provided directly by its own chain, not relying on ETH's re-staking network. As of September 2025, Hyperliquid L1 has 24 active nodes.

User Experience and Interface

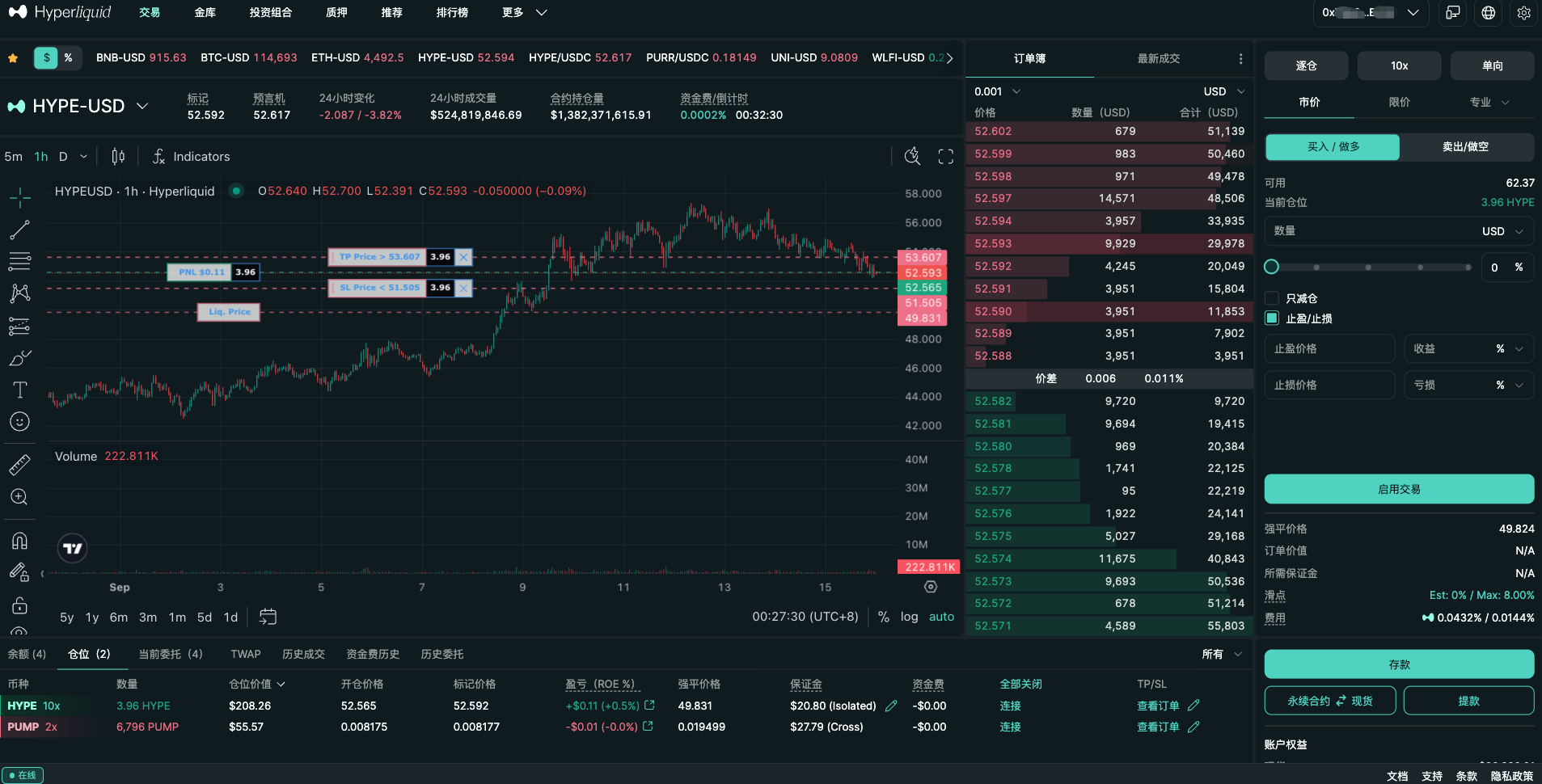

Hyperliquid provides a trading experience consistent with leading CEXs. The user interface adopts a traditional order book + candlestick chart design, supporting advanced order types such as limit orders, take profit, and stop loss, along with professional trading tools. Trade settlement is almost real-time (sub-second), with smooth interface feedback and no lag. It meets the needs of both professional traders and ordinary retail investors. By the way, the sound of opening and closing positions, "ding", is quite pleasant.

Users can access permissionless and non-custodial trading through a web3 wallet, but they need to bridge assets to Hyperliquid L1 for use. Currently, deposits can only be made in USDC through the Arbitrum chain. Then, an Agent wallet is generated (which has trading permissions only, no transfer permissions, and the private key is stored locally), allowing for opening and closing positions without needing to sign again, resulting in a smooth overall experience. Users are unaware of this Agent wallet.

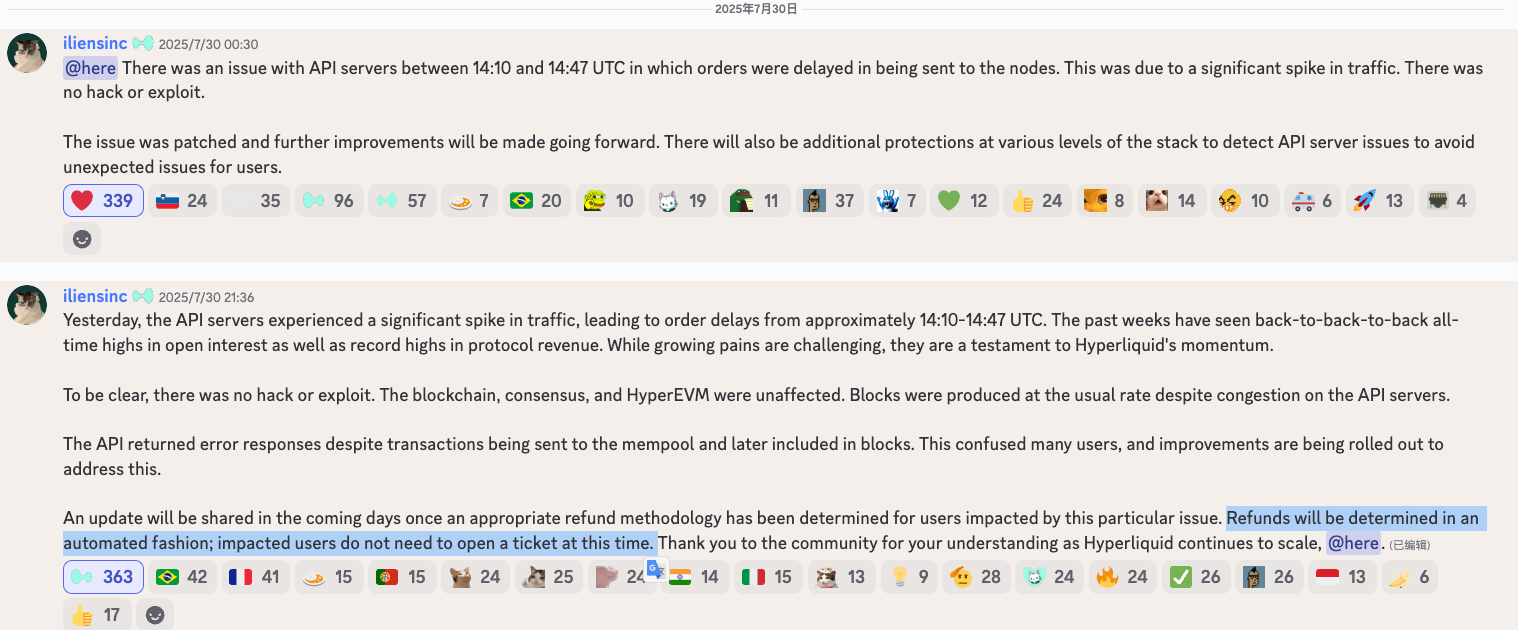

Hyperliquid is closely connected with the community and responds quickly. For example, after a brief outage due to an API failure in July 2025, the team quickly compensated users for about $2 million in losses, demonstrating a "quick response and accountability" approach. Users have a great experience, and the community has given positive feedback.

Liquidity and Trading Depth

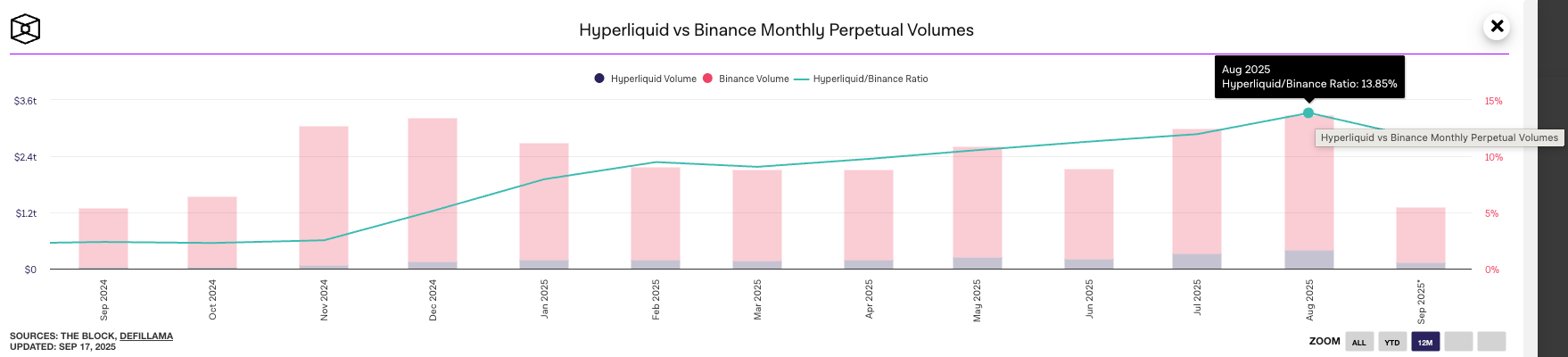

As a leader, Hyperliquid possesses extremely deep liquidity and trading volume. Its daily trading volume often reaches tens of billions of dollars, with a single month in July 2025 seeing perpetual trading volume as high as approximately $319 billion, driving the total on-chain perpetual trading volume to a new high (approximately $487 billion), with Hyperliquid accounting for about 65%. In mid-2025, Hyperliquid's market share stabilized between 75-80%, far exceeding other competitors. In August 2025, the monthly perpetual trading volume accounted for 13.85% of Binance contracts, the highest historical ratio. (Data from The Block)

The platform supports over a hundred trading pairs, covering mainstream coins and long-tail assets, with quick responses to listings. Due to the on-chain order book model, users can see the depth of their orders and matching transparently; combined with the entry of professional market makers and the introduction of the HLP market-making pool, Hyperliquid achieves extremely low spreads and low slippage for large trades on mainstream coins.

Its total locked value (TVL) is also far higher than competitors: as of September 2025, the platform's TVL is approximately $2.7 billion. This massive capital volume and depth enable Hyperliquid's contract market to have trading depth close to that of Binance for most coins and stable funding rates.

The fee structure and incentive mechanism are similar to those of CEXs. Hyperliquid's base trading fees are Maker 1.5bps, Taker 4.5bps, which is slightly lower than mainstream CEXs. Currently, users holding HYPE tokens can enjoy fee discounts, with a maximum discount of 40% (requiring a stake of over 500,000 HYPE), similar to Binance's BNB and VIP level binding.

Vaults

Hyperliquid's vaults consist of three parts: AF, HLP, and user vaults.

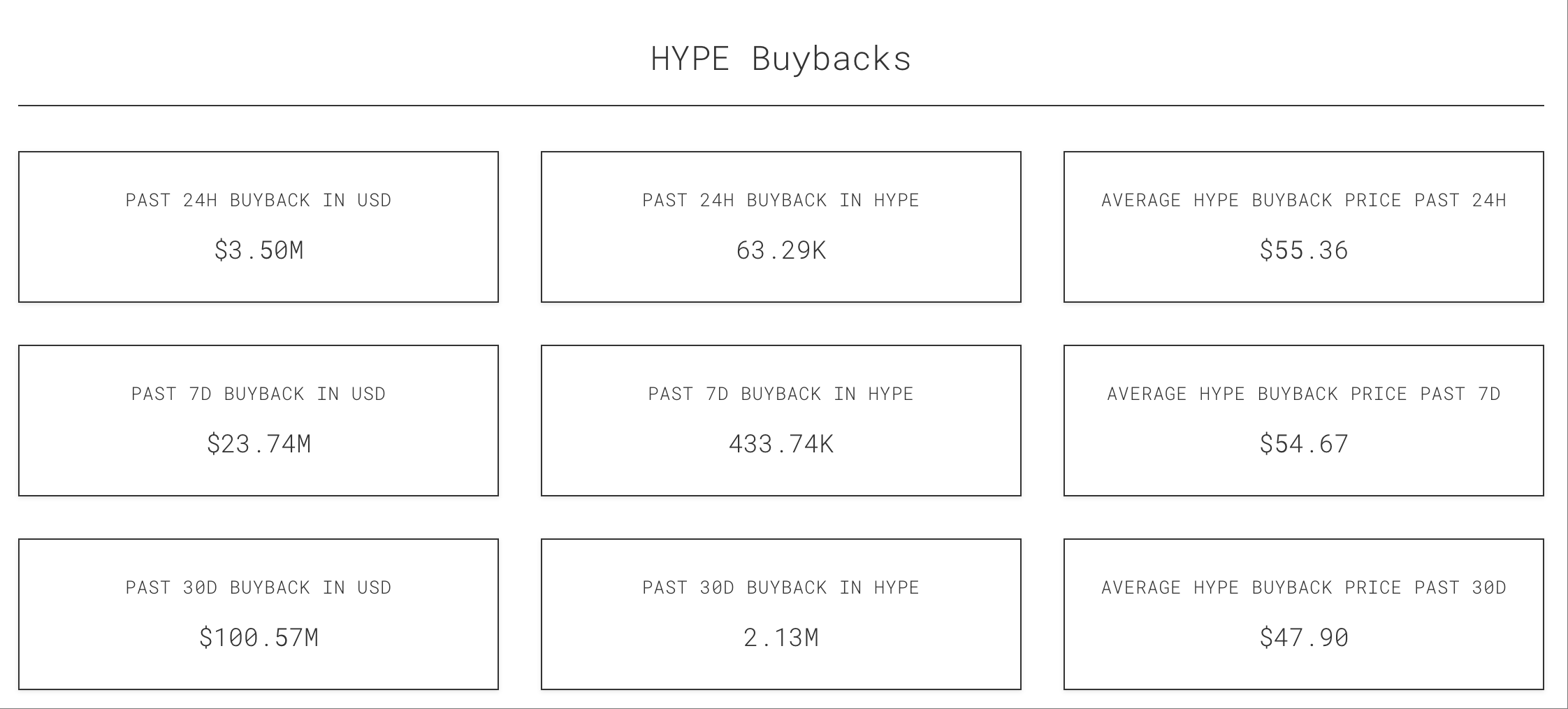

Protocol Vault A: Assistance Fund (AF) AF is positioned as the protocol's "treasury"/buy-side engine. It is mainly used for repurchasing (and often burning) HYPE; it is also used for user compensation during special events (automatically compensating about $2 million USDC after the API interruption on July 29, 2025). The assets of AF are primarily in HYPE, reducing slippage and execution complexity during large trades/compensations.

Approximately 93% of the platform's trading fees are injected into this fund for repurchasing and burning HYPE tokens, with another 7% allocated to the HLP market-making pool. This design creates a positive feedback loop: increased trading volume → higher fee income → more tokens repurchased and burned (increasing token value) and benefiting the market-making pool → attracting more users and liquidity.

Data source: asxn

Protocol Vault B: HLP (Hyperliquidity Provider)

HLP is positioned as protocol-level market-making + liquidation backup (including the Liquidator component). Anyone can deposit USDC to participate in HLP's PnL distribution, with the current annual interest rate around 6.7%, with no management/performance fees (unlike user vaults). Deposits can be redeemed after 4 days. The HLP mechanism makes market-making liquidity "open and transparently regulated", reducing reliance on private agreements with market makers in traditional markets.

User Vaults

Composed of a Vault Leader (manager, trading with their own strategy) and Depositor (investor, sharing PnL based on their contributions). It is similar to a secondary fund and CEX's copy trading system. The Leader takes a 10% profit share (only when profitable), and the protocol vault does not take a cut.

Community Development and Team

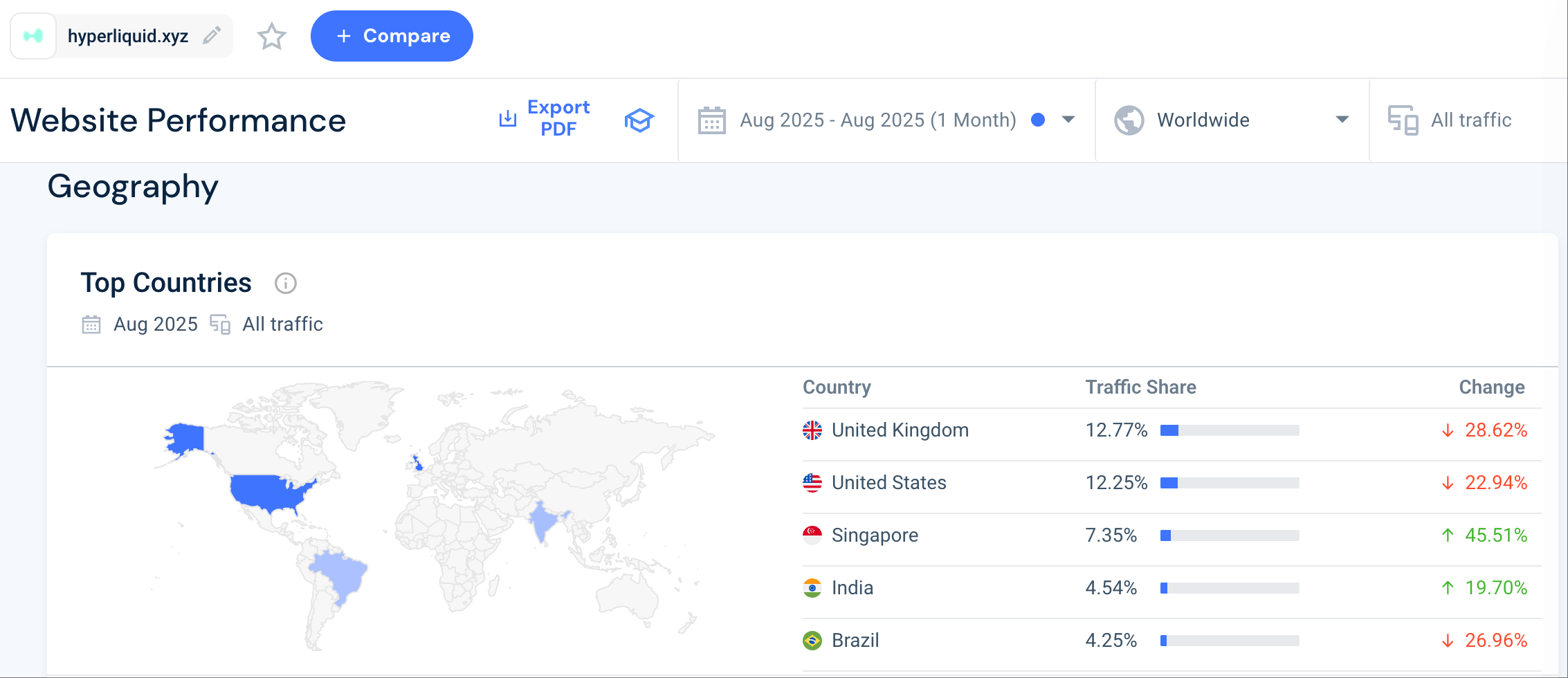

Community Development: Hyperliquid has a highly active global community, with stronger engagement in Europe and the US compared to the Chinese-speaking region. The official presence on social media platforms like X (Twitter) is high, maintaining a long-term market share at the top, creating a network effect in the perp DEX field.

The enthusiasm of community discussions is also reflected in the token value; Hyperliquid airdropped its genesis token HYPE in November 2024, distributing a total of 310 million tokens (31% of the total) to early users. After the HYPE airdrop, the total market capitalization briefly reached tens of billions of dollars, providing substantial returns to early community participants and establishing a good reputation in the decentralized community. User growth primarily relies on word-of-mouth and the attraction of excellent products rather than excessive marketing. This is somewhat reminiscent of Tesla.

Team Background and Funding Situation: Hyperliquid was founded by Jeff Yan, who previously worked at the traditional financial high-frequency trading firm Hudson River Trading and has a background from Harvard University. The core team consists of only about 11 members, known for their elite small team and rapid iteration. According to Jeff, the project has been entirely self-funded since its inception, rejecting venture capital investments to ensure independent decision-making and prioritize user interests. This approach of "no VC, no reserved private placement" has enhanced community trust and allowed the team to focus more on technology and the product itself. Most team members come from world-renowned universities and top technology and financial institutions, and reports indicate that some traditional finance executives have joined as advisors (including former CEOs of large banks serving on the board). However, market rumors suggest that Hyperliquid may have raised funds through associated listed entities, indicating strong financial backing (the platform's treasury holds over $500 million in reserves). Overall, the Hyperliquid team is low-key and pragmatic, leveraging their deep technical and trading backgrounds to make the project an industry leader within two years. This background also explains their relentless pursuit of product refinement and user experience.

The Essential Reasons for Rapid Growth

There are many discussions about the reasons for Hyperliquid's success. In addition to the aforementioned visionary team, outstanding product technology, and user experience, we can discuss it from the perspectives of "Dao" and "Shu", examining what Hyperliquid did right at different stages.

First, let's look at the "Shu" level.

Stage One: Airdrop Incentives

Before the HYPE TGE, there were expectations for an airdrop, and most users came to gain points and airdrops by boosting trading volume. At this time, Hyperliquid did not receive much attention from mainstream CEXs and was not seen as a competitor; many believed Hyperliquid would fade into obscurity like GMX and DYDX after the TGE.

Stage Two: Compliance and Regulatory Dividends

After the HYPE TGE, Hyperliquid's trading volume increased rather than decreased, and people began to realize something was amiss. The consensus was that the crypto market, under pressure from regulatory compliance, made it difficult for mainstream CEXs to operate in the European and American markets, such as Binance. This portion of "lost" users was absorbed by Hyperliquid (as can be seen from the user access distribution on the Hyperliquid website). Additionally, some users who found KYC "inconvenient" also found a suitable tool.

At this point, Hyperliquid was already seen as a competitor by Binance, OKX, Bitget, and others, and they began to take "action" to target Hyperliquid. (Traces can be found in the community, but this will not be elaborated here.)

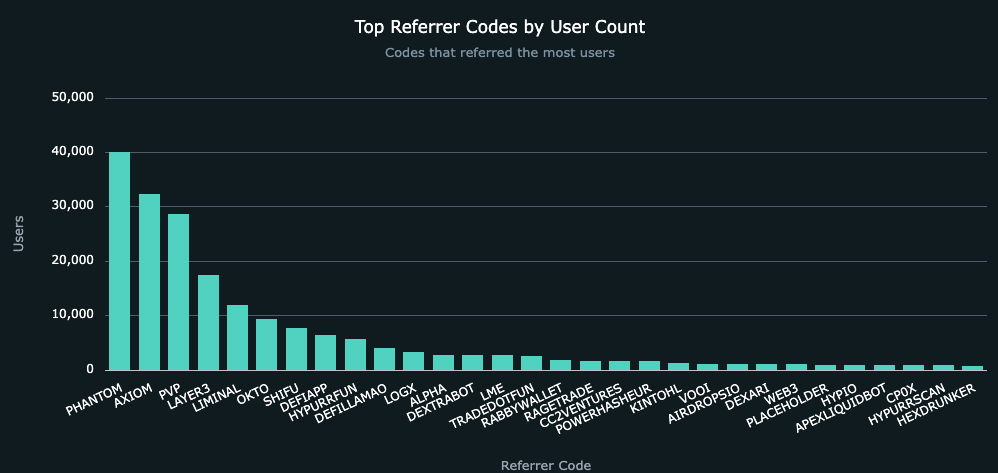

Stage Three: Build Codes - Channel Distribution is Key

KOL rebates and affiliate programs are common user acquisition methods for CEXs. In addition to branding, PR, community, SEO, and campaigns, BD-oriented KOL rebates are essential growth paths.

Different CEXs have varying proportions of users brought in by KOL rebates; for example, Binance may be around 50%, while Bitget may be around 70%. Moreover, smaller CEXs tend to offer higher KOL rebate percentages, with user and trading volume proportions also being higher. Many small CEXs even offer rebates of 90%-100%, using a "customer loss-subsidy rebate" "flywheel" for growth.

However, Hyperliquid's rebate percentage is only 10%, and it is limited to the first $1 billion in trading volume. Based on an average fee rate of 3 bps, if the person you invited contributes $300K in fees, you can only earn $30K in income. Rebate invitations are not Hyperliquid's focus; rather, it is Build Codes.

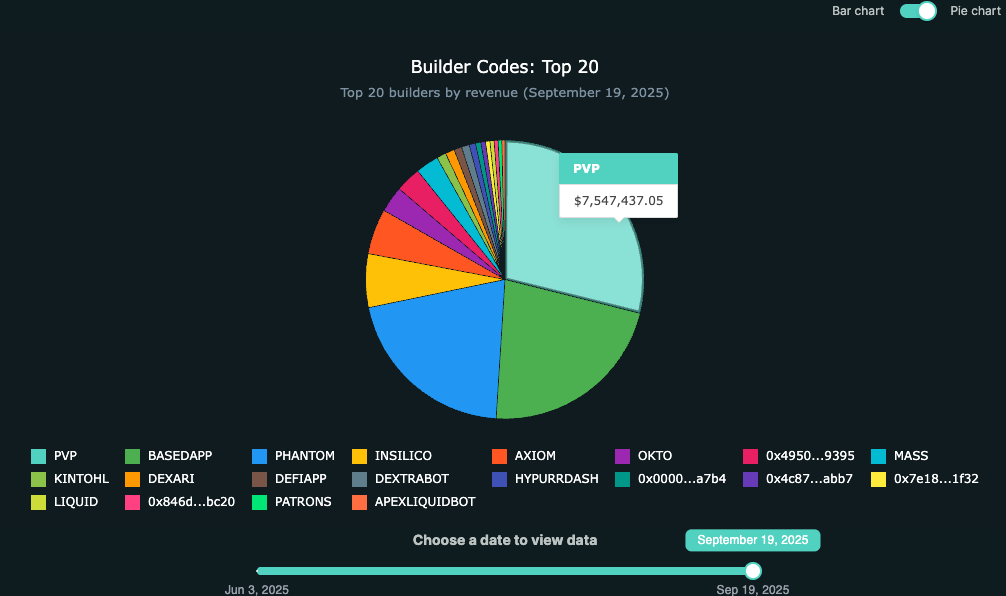

Few people realize the true power of Build Codes; it is a distribution strategy with genuine exponential potential. For developers, there is no longer a need to build high-performance order books or attract liquidity because Hyperliquid provides the necessary infrastructure. For Hyperliquid, there is no longer a need to manage product promotion, user acquisition, or even product innovation, as all of this is entrusted to the builder network. It is somewhat similar to a Swiss team (with UBS background) I was previously part of that created a Perp DEX using a white label solution; the direction was correct, but the product strength was lacking. In fact, previous Binance Broker and OKX's cloud exchange/node solutions were similar, but the essential difference of Build Codes is that it is easy to integrate, has low barriers to entry, and is publicly transparent on-chain.

Currently, Phantom wallet, Axiom, UXUY, PVP.trade, and others have integrated this solution, and Phantom has already contributed approximately 40K new users, while PVP.trade contributed $7.5 million in revenue in a single day. I have also completed the development of a basic version of a Perp DEX and am preparing to leverage previous experience and channel resources for growth; those interested can discuss together.

In addition to Build Codes, there are also powerful tools like CoreWriter and HIP-3, but the barriers are slightly higher, and due to space limitations, I will not elaborate on them here.

"Dao" - Those who have the Dao receive more assistance

Although the analysis of the reasons for Hyperliquid's success above is relatively detailed, it is not the essence. Many interpretations of Hyperliquid's success remain superficial.

But the essence can be summed up in one sentence: Hyperliquid has taken up the banner of "blockchain spirit" — openness, transparency, decentralization, and user sovereignty. Just as Binance once carried this banner against traditional finance, BTC maximalists, industry OGs, and ordinary crypto users all stood by Binance. What truly gathers "people's hearts" is the genuine blockchain spirit.

From the user's perspective, many CEXs currently do face issues such as centralized black boxes, customer losses, and acting as counterparties to users. From the perspective of CEX owners, they also face increasingly stringent compliance and regulatory challenges. Therefore, many CEXs are turning to DEXs.

Thus, the heir apparent of Binance - Aster has emerged. For specifics, see the next article: "In-depth Analysis of Perp DEX: HyperLiquid, Aster, Lighter, edgeX (2)".

_ (The above is just my personal opinion and not investment advice; please feel free to point out any errors.) _

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。