In the current market phase, shorting funding rates on Boros is a choice where the returns outweigh the risks.

Author: @Web3Mario

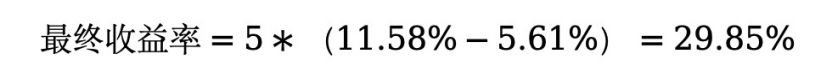

Abstract: In this article, we will analyze the opportunities within a recently popular protocol, specifically the funding rate derivatives market for perpetual contracts on CEX launched by Pendle, known as Boros. The author will provide a comprehensive analysis of this platform from the perspectives of fundamental principles, opportunity risk points, and share an advanced strategy for interest rate arbitrage that the author believes is promising. Overall, in the current market phase, shorting funding rates on Boros is a choice where the returns outweigh the risks, and through the three platforms of Binance, Hyperliquid, and Boros, a Delta Neutral strategy can be implemented, achieving a fixed rate arbitrage combination with a yield of up to 30%.

How the 100% Long / Short Rate ROI on Boros Homepage is Derived

Upon opening the Boros homepage, the first thing that catches the eye is a Market List. At this point, many users unfamiliar with Boros may wonder how the high ROI in the far-right column is derived. The author will introduce Boros in conjunction with this point.

Firstly, the value of Boros lies in its creation of an off-chain yield derivatives trading market, allowing users to engage in leveraged trading, hedging, or speculation on these yield derivatives without directly participating in the native yield scenarios. Currently, it mainly focuses on funding rate derivatives in the perpetual contract market on CEX.

This directly addresses a critical issue in the perpetual contract funding rate arbitrage market, which is the uncertainty of returns brought about by interest rate fluctuations. To illustrate, we know that the core principle of Ethena is to utilize a Delta Neutral arbitrage strategy to earn funding rates from perpetual contracts on CEX, that is, going long on crypto asset spot while shorting the corresponding crypto asset perpetual contract to earn the funding rate, with the resulting earnings distributed to holders of sUSDe. This means that fluctuations in funding rates will significantly impact the yield of sUSDe, thereby affecting the protocol's attractiveness to users. We can clearly observe this fluctuation on the Dashboard of the official website.

The fluctuations in perpetual contract funding rates are not controllable for arbitragers like Ethena, as they mainly depend on the overall trading preferences of users in the cryptocurrency market. Only in a bull market are speculators in the perpetual contract market willing to pay higher funding rates for long contracts, while in a sideways or bear market, funding rates will significantly decrease, even turning negative. This introduces risk to the arbitrage strategy. Therefore, how to hedge against the risks brought by rate fluctuations is a major pain point for these arbitragers. The emergence of Boros provides a solution to this pain point; simply put, you can hedge against funding rate fluctuations by trading the corresponding funding rate derivatives on Boros.

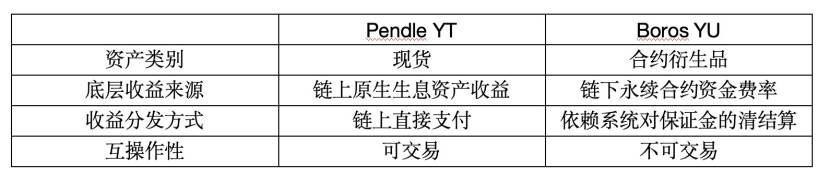

So how is this achieved? Let's look at the basic principles of Boros. Boros has designed a new asset target called YU. Its principle is similar to the YT asset in Pendle, with the main difference being that YT resembles a native crypto asset spot, as the yield settlement occurs on-chain and can be automatically settled through smart contracts. In contrast, YU is a contract derivative, as its yield is anchored to off-chain scenarios, relying on the settlement of the margin accounts of both parties in the contract to track off-chain yields.

Specifically, let's discuss how YU works. For the buyer of YU, it is equivalent to obtaining the ability to earn the corresponding funding rate of the perpetual contract during the future duration. Each unit of YU corresponds to each unit of the native underlying asset, and this yield is paid from the margin of the YU seller through Boros's clearing and settlement mechanism, corresponding to the Underlying APR in the yield interface. The matching rate during the purchase process corresponds to the Implied APR in the interface, which defines the fixed rate that the buyer needs to pay to the YU seller during the duration, and this also relies on the clearing and settlement mechanism.

Let's illustrate with an example. Suppose a trader buys 5 YU long positions in the ETHUSDT-Binance YU market with an expiration date of December 25, 2026. This means that from this moment until the expiration date, you will continuously earn the funding rate obtained from shorting 5 ETH positions. This yield will be settled from the YU seller's margin account every 8 hours along with Binance's rate settlement, and you will also pay interest to the seller at the matching rate at the time of opening the position. As a result, as long as the interest you accumulate by the expiration date is less than the interest you earn, this trade is a positive ROI; otherwise, it results in a loss. Additionally, if you choose to close your position early before the expiration date, your profit condition will also depend on the matching rate of your closing trade.

Having introduced these points, let's look at the current state of Boros. We can see that the ROI for shorting YU is very high, and in markets with a longer expiration date, the final ROI can easily exceed 100%. This means that if the Implied APR remains at the current level compared to the Underlying APR, your investment return rate at the expiration date will be 100%. This is mainly because, following the FED's interest rate decision in September, Powell's "hawkish defensive rate cut" speech, and the corresponding dot plot showing the conservative attitude of various committee members towards significant rate cuts, market sentiment has shifted from greed before the decision to a neutral level, leading to a rapid decline in funding rates, even turning negative. Therefore, at this time, shorting YU allows you to pay interest according to the Underlying APR while earning fixed rate returns from the Impiled APR. Corresponding to the current actual values, since the Underlying APR is negative, you are effectively earning on both sides, which is also the reason why the current instantaneous return rate exceeds 100%. If this interest rate difference can be sustained for a period, the final actual return rate will also be quite good.

The underlying reason is that Boros is still in its early stages, and liquidity is not high, resulting in significant potential trading slippage, which hinders traders' transactions. This is reflected in the performance of the interest rate chart, where the Impiled APR cannot effectively follow the changes in the Underlying APR. Of course, for users with small capital, the amplification of the interest rate difference is also an opportunity, especially since Boros allows traders to open positions with a maximum leverage of 3x. Therefore, when opening positions at appropriate times with slippage and Impiled, the returns can be quite considerable. However, when leverage is applied, one must consider the liquidation risk brought by Impiled APR fluctuations.

Additionally, from the product front, Boros has also designed a Vault function to enrich liquidity sources. Through a DeFi implementation similar to Uniswap V2, it provides users with an LP Staking Pool experience to offer liquidity, thereby reducing the learning cost of the product. Since the official documentation regarding this part has not provided detailed explanations, we will not elaborate on it here. However, the author believes the idea should be to distribute the funds in the Staking Pool according to the AMM's Bonding Curve form in the order book, forming a supplement to the order depth. However, providing liquidity in this market may face impermanent loss, so it is recommended that readers wait for more detailed information to be disclosed before choosing to participate.

Sharing an Advanced Interest Rate Arbitrage Strategy to Achieve a 30% Yield with Delta Neutral Fixed Income Arbitrage

After introducing the basic situation of Boros, the author hopes to share an advanced interest rate arbitrage strategy that utilizes Binance, Hyperliquid, and Boros to achieve Delta Neutral fixed income arbitrage. Boros has recently launched the BTC and ETH perpetual contract YU markets on Hyperliquid, which provides a premise for this strategy.

From this chart, we can intuitively see that the funding rate on Hyperliquid is significantly higher than that on Binance. So what causes this situation? Or we need to explore whether this situation is caused by instantaneous trading or will persist for a while, which requires tracing back to the calculation logic of funding rates in the CEX perpetual contract market.

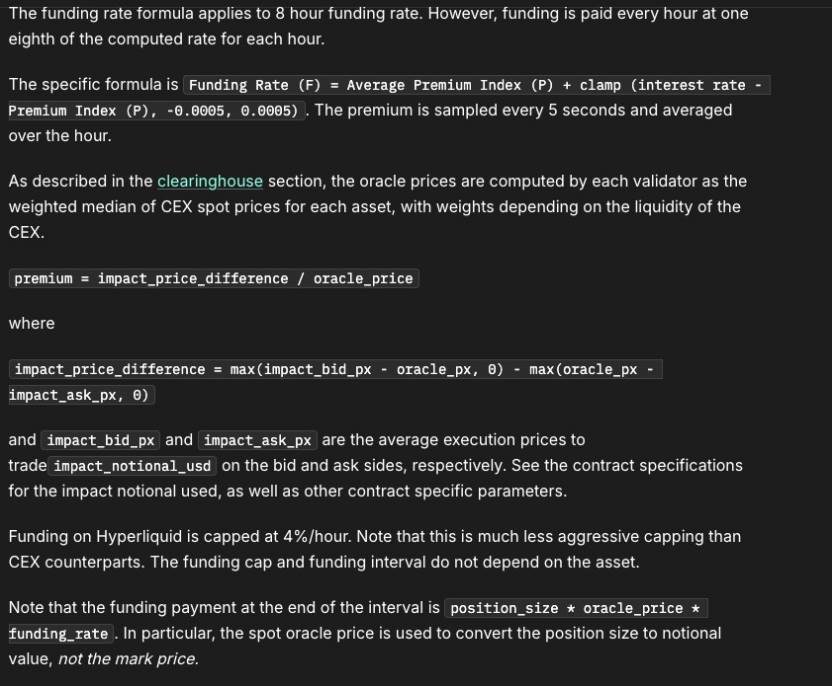

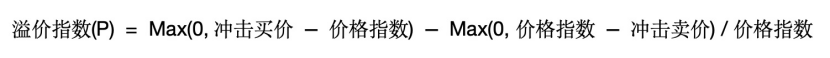

Generally, we have an intuitive judgment: when the Spot index price is higher than the marked price of the perpetual contract, the contract market is in a backwardation state, and shorts pay rates to longs, and vice versa. However, this is not always the case. In fact, there is another crucial influencing factor in the calculation of funding rates, which is order depth. Let's look at the introduction documents for funding rate calculations from both exchanges.

In simple terms, the funding rate calculation formulas for both are as follows:

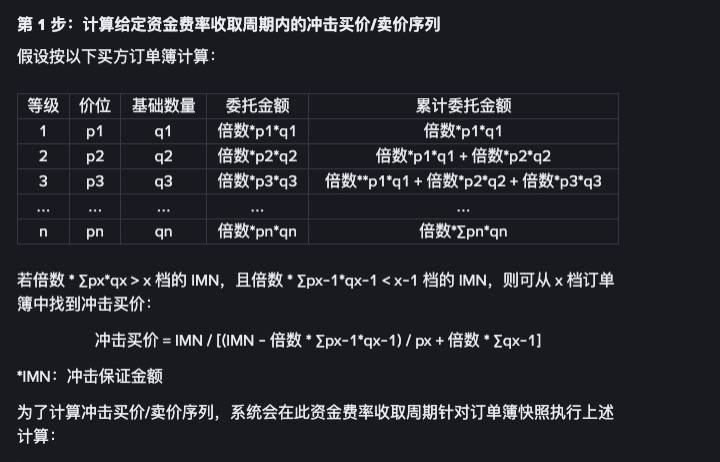

The differences lie in the settings of MAXRATE and MINRATE, as well as slight variations in the calculation of the premium index, which can be roughly understood as a piecewise function with maximum and minimum values. The calculation of the premium index also takes into account the depth of the order book, specifically reflected in the calculations of the impact bid price (impactbidpx) and impact ask price (impactaskpx). The calculation process for this value requires combining the instantaneous order book shape at a certain moment of information collection to compute it. Essentially, a preset order volume is used to calculate the final transaction prices for buying and selling based on the current order depth, which serves as the impact bid and ask prices. This collection is conducted periodically over a period of time, and a weighted result is ultimately calculated. Regarding the price index, there are also slight differences between the two; Binance uses the price from its own Spot market as the price index, while Hyperliquid uses a multi-exchange weighted price calculated by an oracle as the price index. This is reasonable, as there is still a significant difference in liquidity depth between the two in the spot market.

So let's consider a question: why is the funding rate on Hyperliquid still relatively high when the funding rate on Binance is negative? The reason lies in the differing depths of the two; in other words, the sell order depth on Hyperliquid is not strong at this time, resulting in the impact price being higher than the price index, which keeps the final premium index relatively large. This also aligns with the market phases of the two. Therefore, we can conclude that this interest rate pattern should persist for a while, rather than being a momentary state.

Is it possible to arbitrage this interest rate difference through some opening strategy? The answer is yes. We can go long in the lower-rate Binance and short in Hyperliquid, thus achieving a Delta Neutral interest rate arbitrage model. So what role does Boros play in this? It locks in the interest rate difference; we can use Boros to lock in the variable interest rates, thereby implementing a fixed-rate Delta Neutral arbitrage strategy. Based on the current data, assuming we open 5x leverage in the ETH-USD markets on both exchanges and use Boros to lock in the rates, we can obtain:

Of course, more detailed considerations need to be made regarding the margin occupied by Boros against the principal, as well as the position balance between Binance and Hyperliquid to avoid unilateral liquidation. Interested parties can further discuss with the author.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。