Author | @poopmandefi

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor’s Note: Among the many narratives in the crypto market, perpetual contract DEXs are undoubtedly the most lucrative track in recent times. Aster (ASTER) saw a peak increase of nearly 6000% after its TGE, while Avantis (AVNT) recorded a high of 155% after landing on Binance Alpha. Just today, the perpetual contract DEX sector experienced a broad rally, and the performance of these projects not only validates the market's attention to this sector but also reflects the sensitivity of capital to "new narratives." On the surface, Hyperliquid still holds the top position, but the success of Aster and Avantis shows that differentiated positioning and innovative mechanisms can still open up breakthroughs for latecomers.

This article will focus on several of the most promising new PerpDEXs, dissecting their models, competitive advantages, and airdrop strategies, attempting to answer a core question: Can the perpetual contract DEX sector give birth to the next Aster?

1. Motivation to Participate

Everyone loves leverage. It brings both adrenaline rush and amplifies capital efficiency in a bull market.

Before Hyperliquid emerged, there had already been attempts at on-chain perpetual contract exchanges (PerpDEX), with the most representative being dYdX and GMX. That was the moment people truly saw the potential of PerpDEX.

Fast forward to today, Hyperliquid has become the absolute protagonist of the sector. Its perpetual contract trading volume accounts for 5.3% of CEX perpetual contracts, equivalent to eating into 27% of Bybit's trading volume and up to 11% of Binance's trading volume. There are many success factors behind this, which I will elaborate on later.

Although many believe Hyperliquid has monopolized PerpDEX, I firmly believe that challengers have never disappeared. History has repeatedly proven: from Apple vs. Samsung to Xiaomi's breakout, as long as one can find a differentiated advantage in a specific market segment, it is possible to become a strong competitor.

Therefore, the arrival of the "PerpDEX Airdrop Season" is almost inevitable. Why?

First, Hyperliquid's airdrop itself is one of the largest in history. They distributed 31% of the tokens to users, with an initial market value of about $3 billion. Almost all early supporters have made a fortune, and this "wealth effect" is one of the key reasons Hyperliquid can quickly occupy users' minds.

Today, the vast majority of users and liquidity providers have similar expectations for emerging PerpDEXs. To gain attention and stickiness, new projects often have to adopt more aggressive or clever airdrop strategies. Regardless of the form, this means we have entered a new "PerpDEX Airdrop Season."

However, it should be noted that this discussion is not about the airdrop itself, but rather focuses on what I see as the most promising new PerpDEXs. I hope that after reading, you can more clearly judge: which PerpDEX to choose for use.

2. Internal Comparison

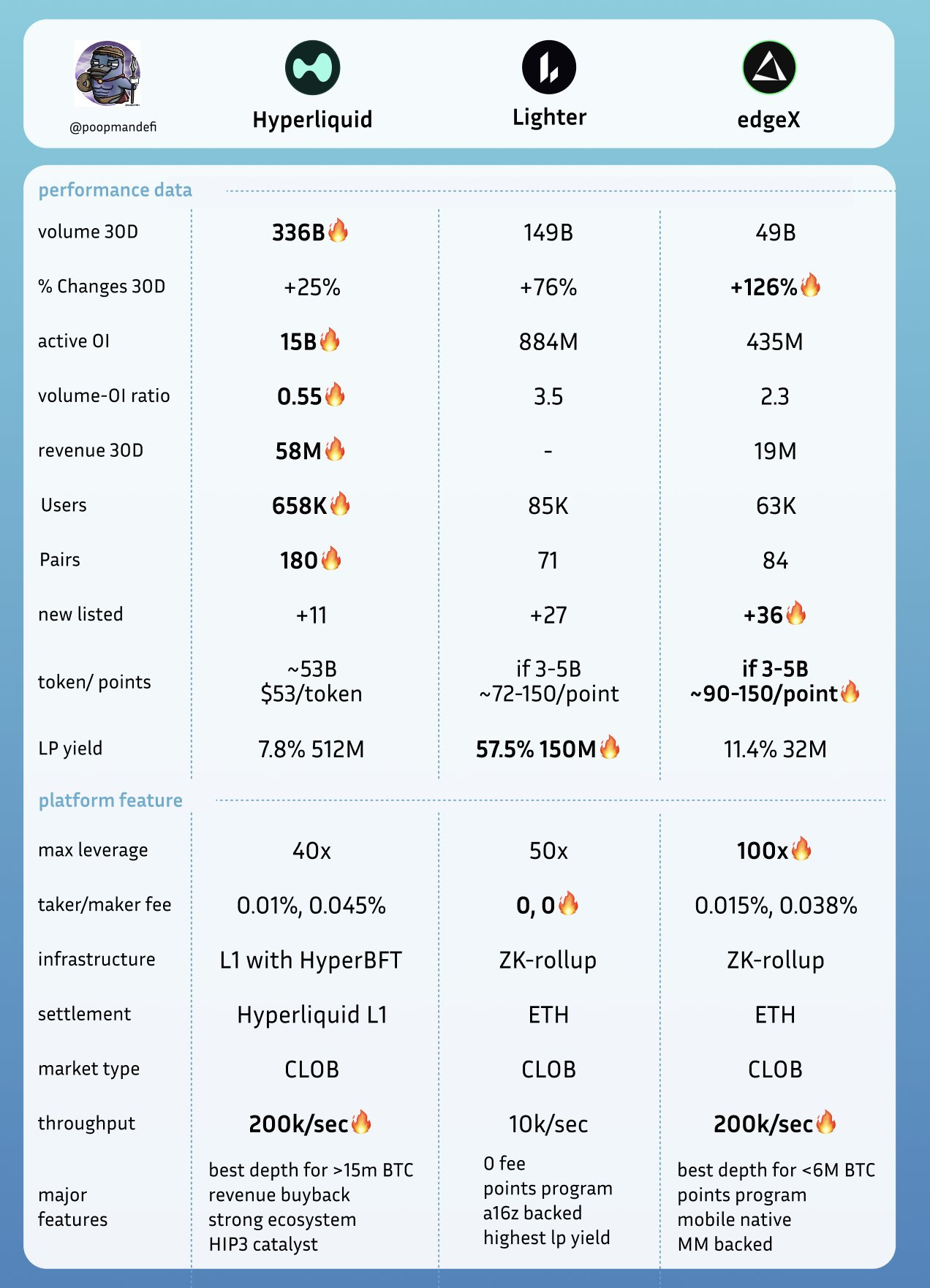

Let’s start with a summary table:

Source: Perpetual Pulse, Hyperliquid Data, Defillama, @andyandhii, @hansolar21, @ruiixyz

Next, I will elaborate on the following core points:

Hyperliquid:

- Based on L1, using a CLOB (Centralized Limit Order Book) model

- Extremely friendly liquidity depth for large traders

- 99% revenue buyback

- Speedbump mechanism, making the market-making environment fairer

- Supports 180+ trading pairs and provides pre-market trading mechanisms

- HyperEVM and Buildercode are growing well

- HIP-3 proposal and USDH stablecoin are seen as key catalysts

Lighter:

- Based on L2, also using CLOB

- Zero fees

- Offers higher LP returns

- Backed by a16z and Lightspeed, led by former Citadel high-frequency traders

- Marketing strategy focuses on node tasks and hype creation

- Custom ZK circuits with an exit guarantee mechanism

EdgeX:

- Based on L2 StarkEx, also using CLOB

- Targeting ordinary users, providing minimal spreads

- Native mobile experience (especially catering to Asian user preferences)

- Strong revenue performance, less reliance on mining, and lower trading volume/open interest ratio

- Supported by professional market makers, with an experienced team

3. Hyperliquid

Hyperliquid is currently the most successful decentralized perpetual contract exchange (PerpDEX) in the world.

It is best known for its dual-layer architecture: Hypercore and HyperEVM.

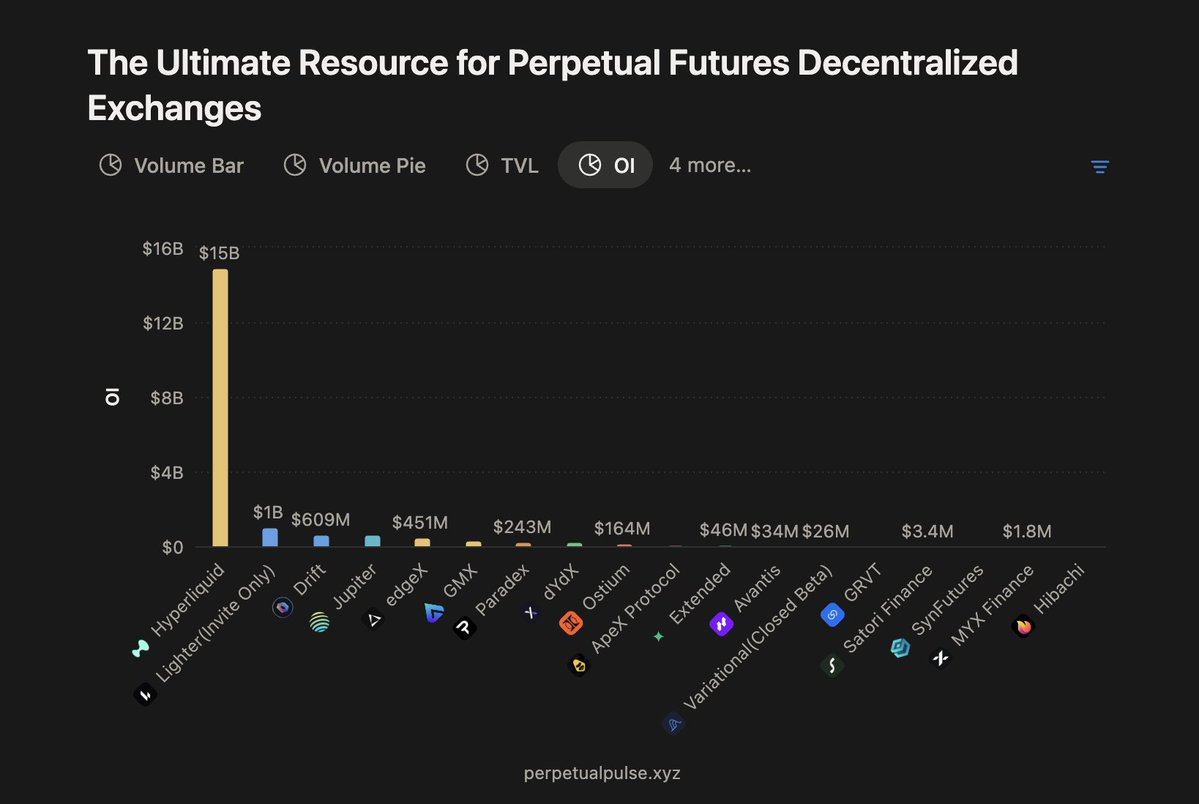

Currently, Hyperliquid occupies over 78% of the PerpDEX market share, with several key reasons behind this:

3.1. Best Depth + Speed Bump Mechanism Protecting Large Traders

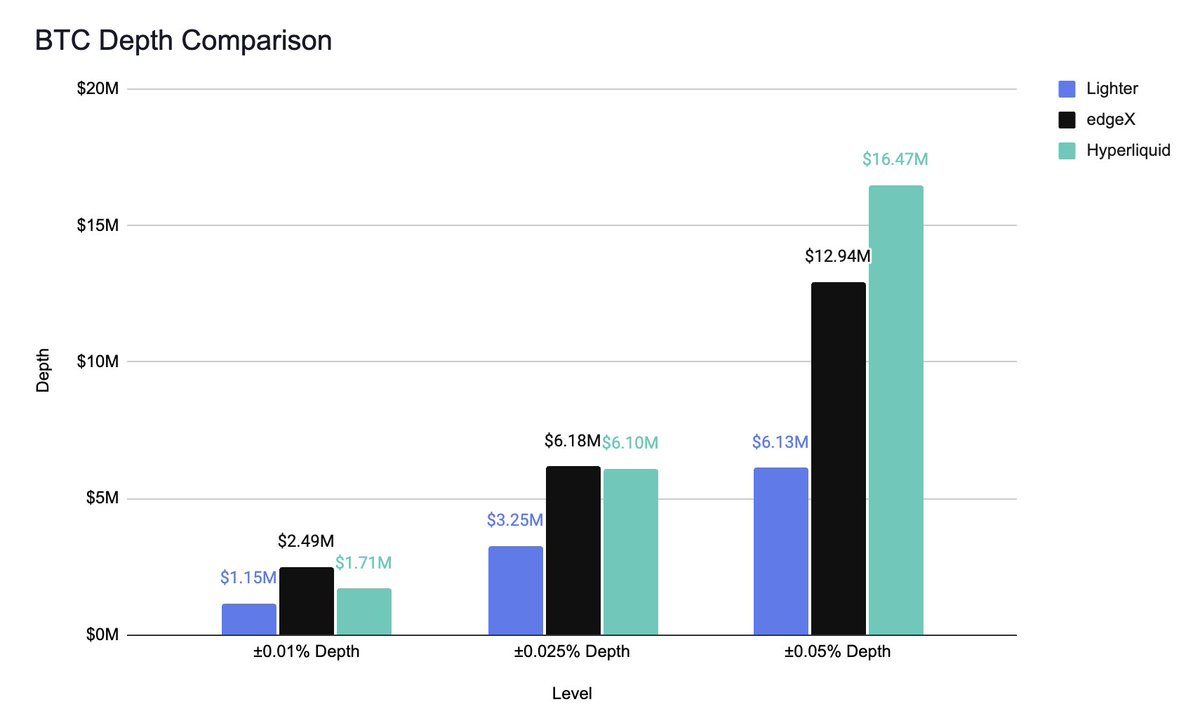

Referencing @andyandhii

For traders, depth and spreads are crucial. Smaller spreads and deeper liquidity mean better quotes and less slippage.

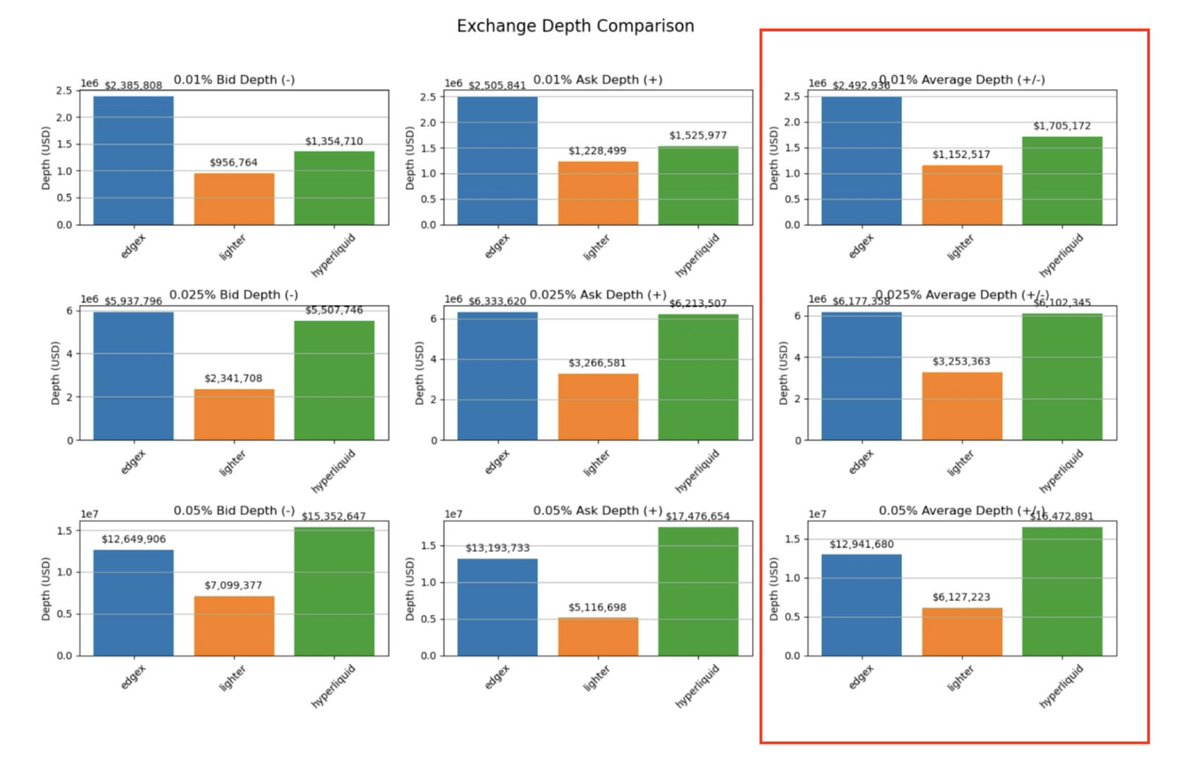

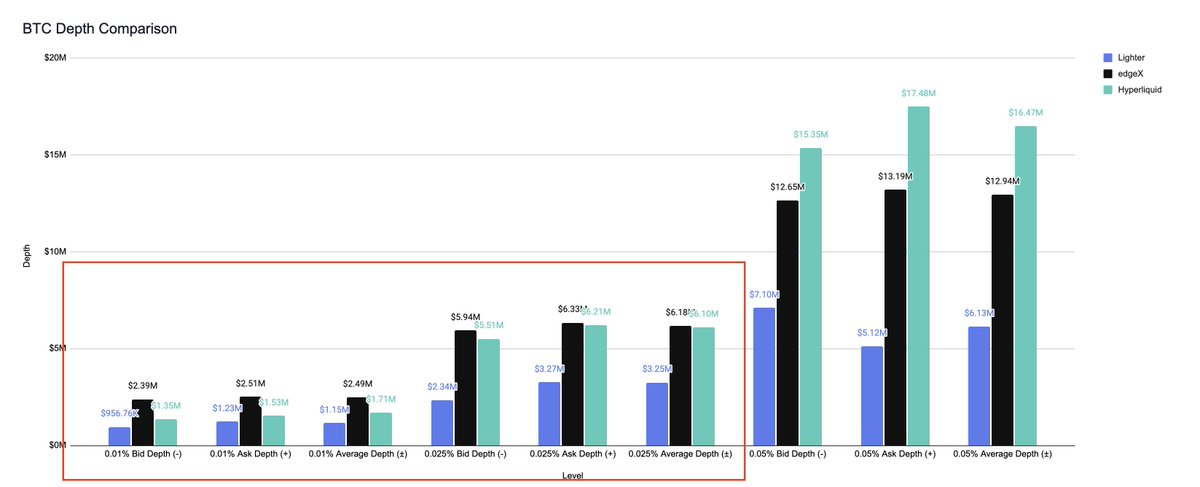

Taking the BTC trading pair as an example, @andyandhii compared 1-hour data from Lighter, EdgeX, and Hyperliquid Websocket in a test.

The results showed that Hyperliquid maintained depth while handling large orders exceeding $16 million, and its performance at a $6 million order size was comparable to EdgeX. This fully demonstrates that Hyperliquid is indeed the best place for large trades.

One reason Hyperliquid has deeper liquidity is its "priority cancellation" mechanism during block construction. By introducing a 210-millisecond delay on market orders, the system protects "later" market makers, preventing them from being "rushed" by competitors due to delayed disadvantages. This way, more market makers are motivated to stay on the platform and continuously provide liquidity.

Although there is still controversy over "whales being rushed," I believe this transparency actually brings more openness and even strengthens the network effect under the influence of traders like James Wyne.

3.2. Strong Revenue Buyback + Healthy Volume/OI Ratio

Hyperliquid's daily trading volume for perpetual contracts has long maintained between $8–10 billion, with total open interest (OI) exceeding $15 billion, nearly 15 times that of the second-largest PerpDEX in the market.

The volume/OI ratio is often used to identify wash trading behavior. Hyperliquid's ratio is about 0.55, which is considered extremely healthy, indicating that trading activity is quite organic.

Thanks to strong volume and OI, the protocol's revenue is also very substantial. However, Hyperliquid does not keep these fees for itself but uses 99% of the order/market order fees for HYPE buybacks. Additionally, the platform does not charge liquidation fees.

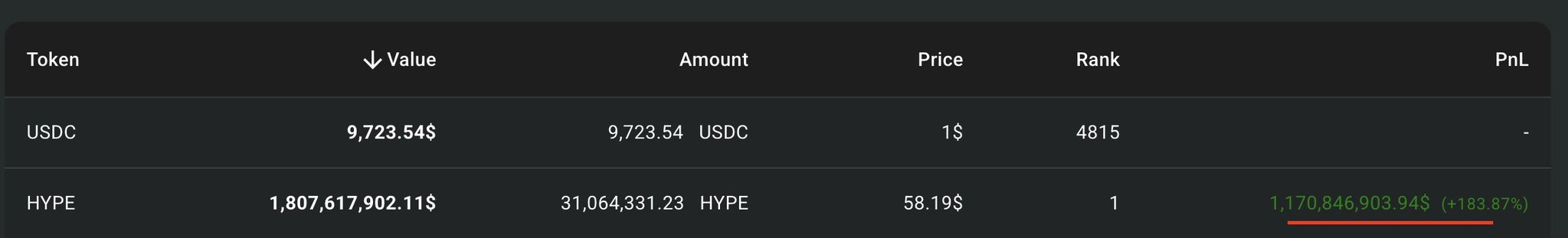

On average, Hyperliquid buys back $2–3 million of HYPE daily based on trading volume. To date, the protocol has accumulated a buyback scale of about $1.8 billion, of which $630 million has actually been spent on buybacks, with a net profit of about $1.17 billion.

This large-scale buyback, highly tied to fundamentals, quickly became the core means for Hyperliquid to build its moat.

3.3. Over 180 Trading Pairs + (Pre-Market) Listings

In the past three months, Hyperliquid has added 11 trading pairs, bringing the total to over 180+. In contrast, Binance added only about 60 during the same period (including Alpha listings).

Clearly, pre-market trading has become a key battleground for early trading volume, and Hyperliquid has invested heavily in this aspect. Recent pre-market launches like XPL, Pump, and WLFI have brought millions of dollars in trading volume, OI, and funding rate income to the platform.

Of course, pre-markets also come with risks. If someone buys out all available liquidity on-chain or on Hyperliquid and then triggers liquidations by amplifying leverage, it could lead to low-cost, high-impact manipulation. Therefore, risk management for illiquid trading pairs is particularly important.

3.4. Growth Engines: HyperEVM, Buildercode, USDH, and HIP-3

In addition to Hypercore, another major advantage of Hyperliquid is its constantly expanding ecosystem.

HyperEVM: Equivalent to leverage for HYPE. All dApps within the ecosystem are linked to HYPE to varying degrees, enhancing its utility. Currently, HyperEVM's TVL has reached $2.6 billion, with nearly 100 projects in the ecosystem.

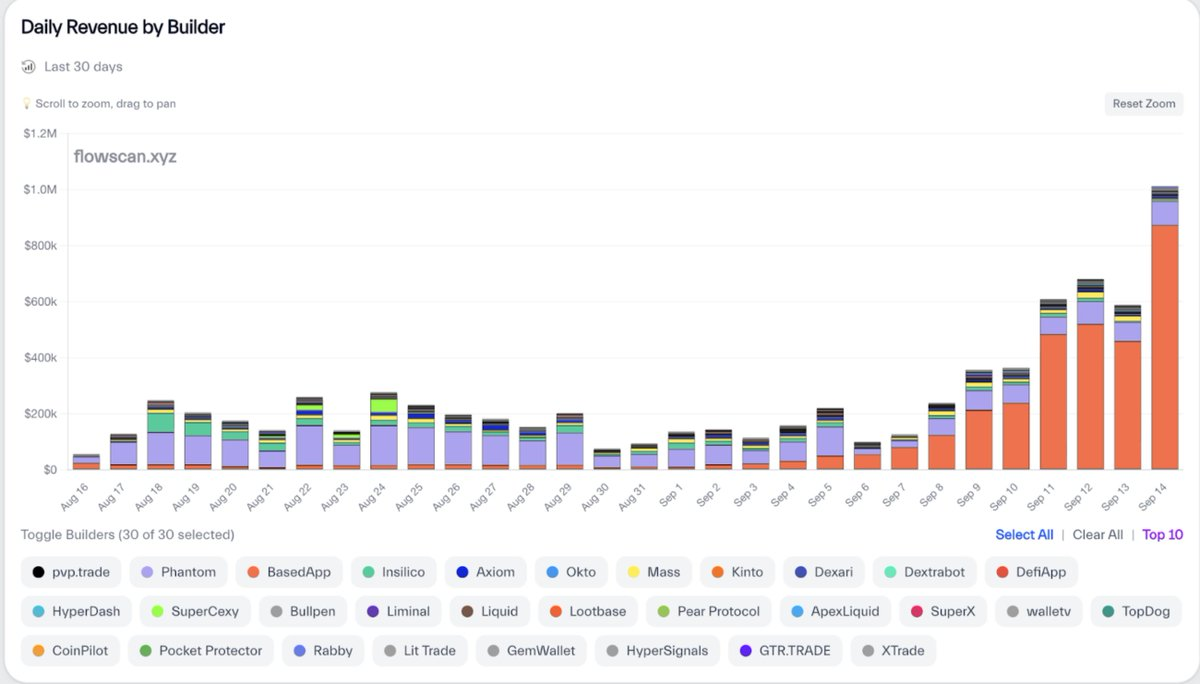

Buildercode: Developers can share transaction fees by building applications on Hyperliquid. Currently, projects like @phantom, @BasedOneX, and @pvpdottrade have integrated, generating over $23 million in revenue to date. This mechanism effectively incentivizes developers and further amplifies Hyperliquid's liquidity and network effects.

USDH: Set to be launched by the native market, becoming another source of income for HYPE.

HIP-3: The biggest potential catalyst. It allows anyone to bid for markets and deploy new assets by staking $1 million worth of HYPE, which can be reduced.

This will further expand Hyperliquid's asset coverage, driving more trading volume and buybacks, creating a buy pressure-volume-revenue flywheel effect, thereby amplifying the utility of HYPE.

Highlights of Hyperliquid

- First-mover advantage

- One of the largest airdrops in DeFi history (31% allocated to holders)

- The core venue for HYPE trading

- Deep liquidity support for BTC trades over $15 million

- The most trading pairs and the fastest pre-market listing mechanism among PerpDEXs

- Continuously expanding HyperEVM + Buildercode ecosystem

- HIP-3 as an important catalyst for market expansion and revenue growth

- 99% of revenue used for buybacks

4. Lighter

4.1. Strong Capital Support

Lighter received early investments from institutions like a16z, Lightspeed, and Coatue in 2023. The project was initially positioned as a spot DEX but later transformed into a perpetual contract DEX. The team is led by former Citadel high-frequency trader @vnovakovski.

4.2. Zero Fee Strategy

To capture market share from Hyperliquid, Lighter launched a zero-fee model for both limit and market orders.

This has become one of its most powerful features: attracting a large number of traders and market makers, thereby boosting platform trading volume. Theoretically, this benefits both traders and market makers (but may not necessarily benefit the platform itself).

Under regular trading conditions, the platform performs decently, but in terms of liquidity depth for large trades, it still slightly lags behind Hyperliquid.

However, there are some controversies surrounding this model:

- Due to the completely zero fees, the volume/OI ratio is as high as ~3.5, about 7 times that of Hyperliquid, which may indicate a high proportion of wash trading behavior.

- To address this issue, Lighter has introduced a self-trade protection mechanism to mitigate witch attacks.

4.3. Custom ZK Circuits and "Exit Guarantee"

As a zk-rollup-based protocol, Lighter naturally inherits the security of Ethereum.

On this basis, the team has also built a set of self-developed zero-knowledge circuits (ZK circuits) and introduced a data structure called the order book tree. This design allows for efficient verification of matching and liquidation integrity without sacrificing execution speed.

To reduce transaction latency, Lighter adopts a "pre-commitment + batch proof" model: the Sequencer first signs the transactions and publishes the results to a public data source, allowing users to quickly obtain "quasi-finality." Subsequently, the system generates zero-knowledge proofs (zk proofs) in a batch manner. This way, transaction execution is not delayed by waiting for proofs, as execution relies on the Sequencer's pre-signatures (pre-commitments).

Additionally, Lighter has designed an independent security circuit: when a user can prove that a certain proof is inconsistent with a previous pre-commitment, they can trigger an "exit" to safely retrieve funds back to L1. This exit guarantee mechanism provides users with an additional safety net for their funds.

4.4. Points Program and Market Hype

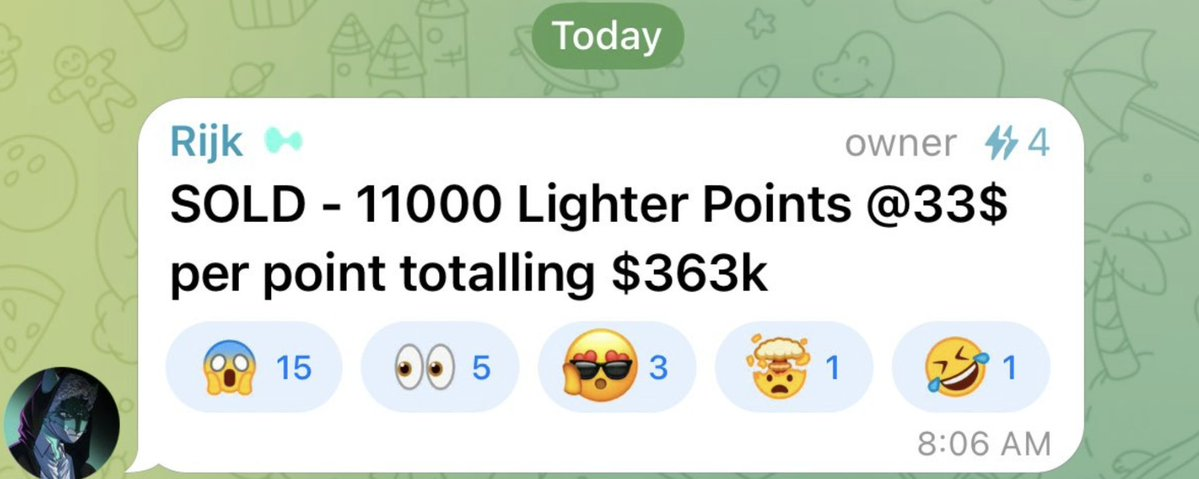

Recently, discussions around Lighter Points have been heating up on crypto Twitter.

Screenshots show that points are trading at about $33/point in the OTC market, with a cumulative transaction volume of $363,000. Since the total supply of points has not yet been disclosed, it is currently difficult to provide a reasonable token valuation. However, we can refer to Hyperliquid's path: at that time, Hyperliquid airdropped 30% of the tokens to the community, with an initial valuation of about $3 billion. If Lighter adopts a similar distribution strategy, its overall valuation is likely to be at least in the range of ≥$3 billion.

Although the final valuation of the airdrop still carries a high degree of uncertainty, one thing is certain: speculative trading of points has become one of the important driving forces behind the growth of Lighter's trading volume and open interest (OI).

Highlights of Lighter

- Zero fees

- Offers the highest LLP returns

- Backed by institutions like a16z and Lightspeed

- Self-developed ZK circuits for verifiable and fast matching transactions

- OTC points trading driving market hype

5. EdgeX

5.1. Smaller Spreads and Depth More Suitable for Ordinary Traders

If Hyperliquid is the main stage for whales, then EdgeX shows better depth for trading volumes below $6 million (using BTC as an example)—which precisely covers the actual range of the vast majority of ordinary traders.

For retail investors, such liquidity not only means better prices when placing orders but also allows them to further participate in mining or yield activities on EdgeX, balancing trading experience with additional returns.

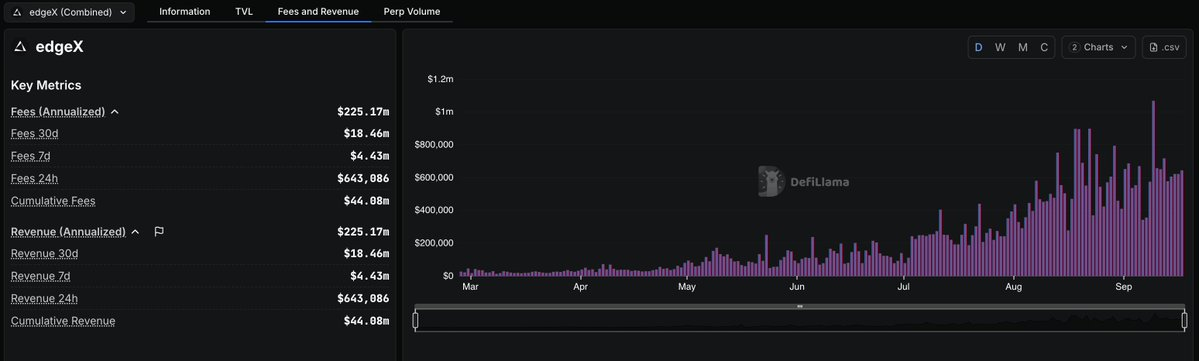

5.2. High Revenue + Points Program (No Native Token Yet)

Although EdgeX has not yet issued a native token, it has already become the second-largest revenue PerpDEX listed on Defillama, achieving approximately $18 million – $20 million in revenue over the past 30 days (about 5% of Hyperliquid's revenue).

This revenue comes from limit order fees (0.015%), market order fees (0.038%), and liquidation fees, and has shown steady growth over the past three months.

EdgeX's points program is still ongoing, with a volume/OI ratio of about 2.3, indicating a certain degree of wash trading, but not severe.

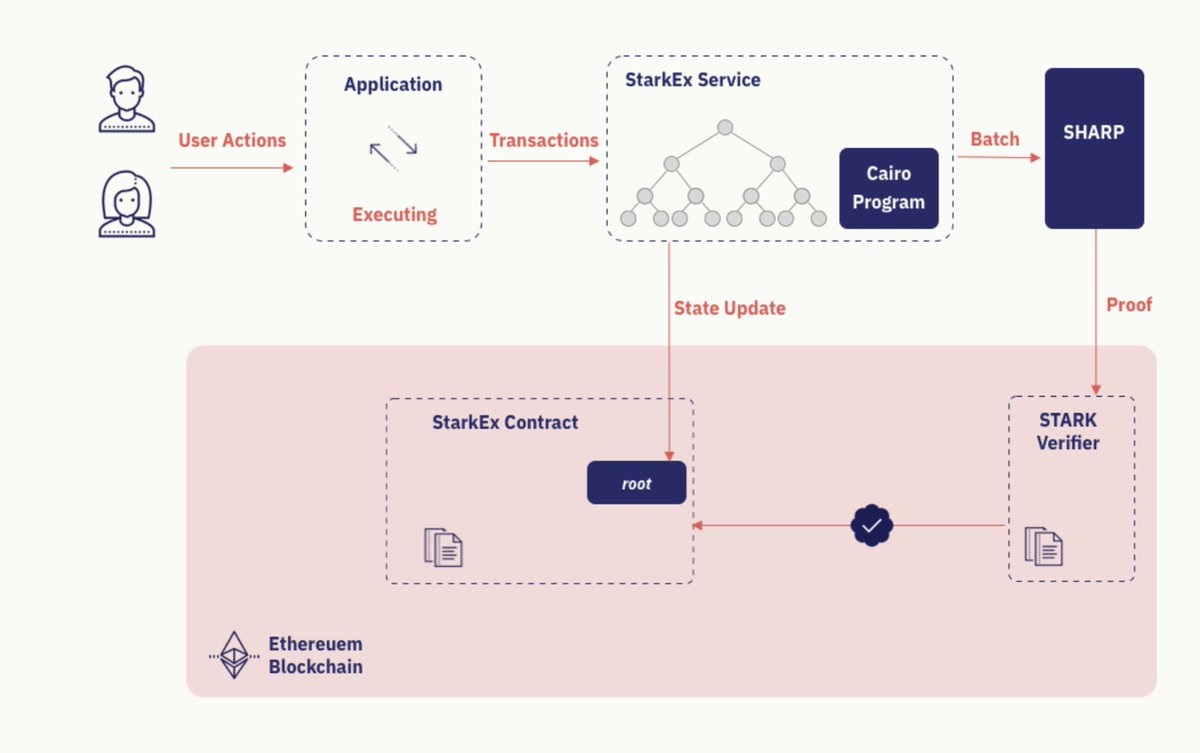

5.3. Perpetual Contracts Based on StarkEX and Forced Withdrawals

EdgeX uses StarkEX perpetual contracts to achieve trustless settlement and censorship resistance (such as forced withdrawals).

Since it operates on Layer 2, users' transactions are first executed off-chain, then submitted to StarkEx to generate proofs, and finally settled on Ethereum. This ensures both the integrity and verifiability of transactions.

If EdgeX fails to process a user's withdrawal request within the grace period (usually 1–2 weeks), users can also initiate a forced withdrawal.

First, users can register their Stark Key to a certain L1 address and then directly submit a withdrawal request to Ethereum. If the request is ignored, users can exit directly through Merkle proof.

It is important to emphasize that EdgeX does not custody user funds. Funds are always held in Ethereum contracts, and only the user's own signature can move them.

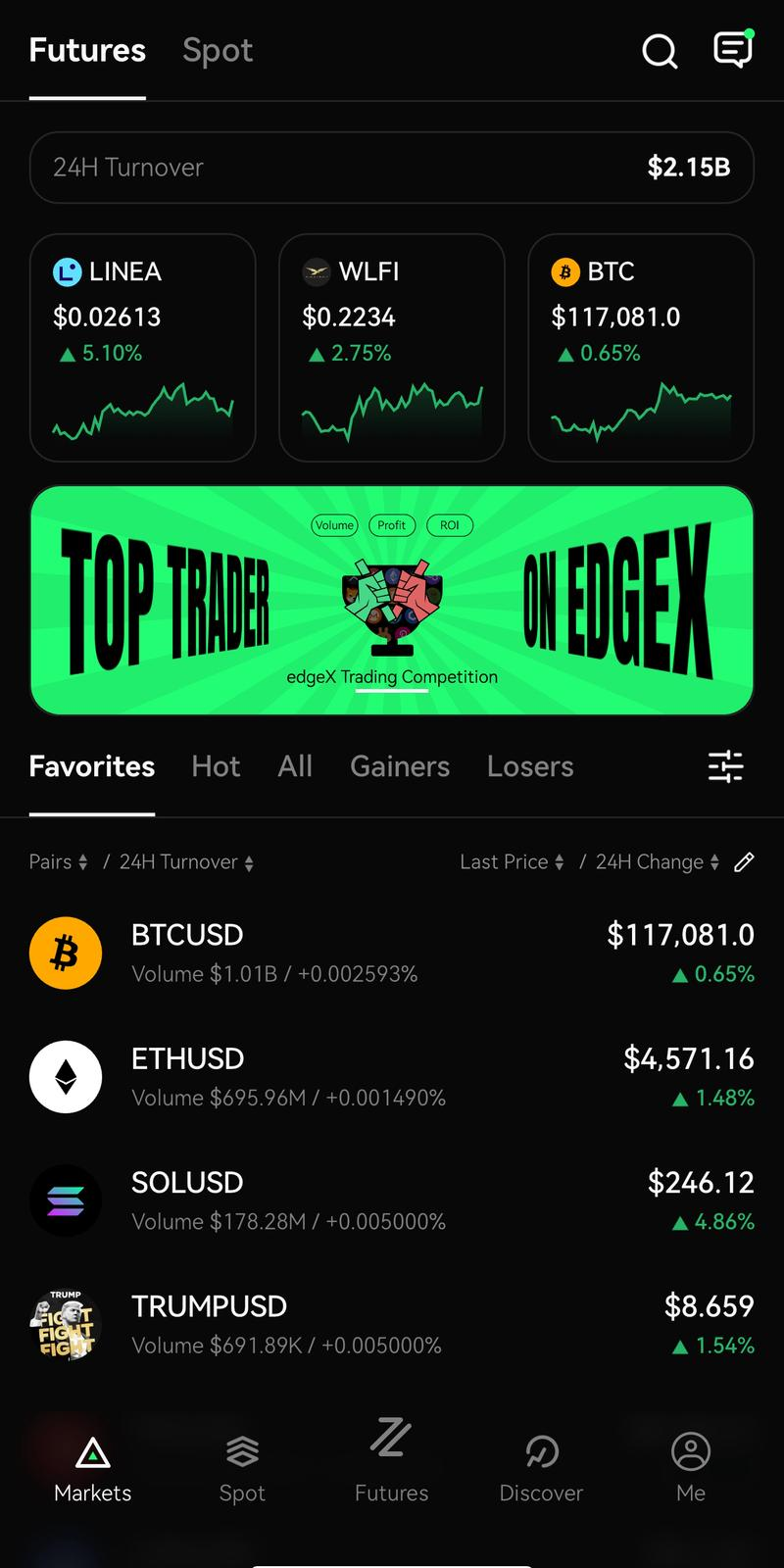

5.4. Mobile-First Experience

In the Asian market, mobile experience is one of the most demanded features.

Currently, most traders access Hyperliquid or Lighter through OKX Wallet or Phantom, while EdgeX simplifies this process by launching a native mobile application (now available on the App Store), allowing users to trade conveniently anytime and anywhere.

Here is the application interface:

5.5. Team Supported by Amber

EdgeX is incubated by Amber Group, a well-known market maker in Asia. Its team members include former professionals from Goldman Sachs and Jump Trading.

According to the official website, core contributors include @EdgeXKF and @EdgeXTraderX, while @ZoomerOracle is also a partner.

Highlights of EdgeX

- High revenue

- Tighter spreads and better depth for trades below $6 million

- Incubated by Amber

- Strong influence in the Asian market

- Based on StarkEx, supporting forced withdrawals

- Native mobile trading experience

- Normal volume/OI ratio (not severely wash traded)

Conclusion

Perpetual contract DEXs have become one of the fastest-growing segments in the crypto market.

As mentioned earlier, Hyperliquid, with its first-mover advantage and continuous innovation, is already two steps ahead of most emerging competitors and is still expanding its moat. HYPE is gradually building a highly integrated system through Buildercode, rapid listing of trading pairs, deep liquidity, an expanding ecosystem, and partnerships with fintech, enabling users to perform almost all operations on the same platform.

For emerging perpetual contract DEXs to truly break through, they must make their products sufficiently attractive to all types of traders. This often means they need to seek new breakthroughs outside of Hyperliquid's "track."

Tighter spreads, zero fees, smoother mobile experiences, additional margin earnings, better accessibility, and even monetization incentives like points programs are all potential reasons to attract users to join and stay long-term.

But like any project, the real test will begin after the TGE. Only then can we see from the performance of OI, trading volume, and protocol revenue whether its stickiness can withstand market scrutiny.

Airdrops are a double-edged sword: poor execution can be a fatal blow, while a successful (often not overly mined) airdrop can bring real user traction at lightning speed and initiate a positive cycle driven only by a truly valuable product.

The market will always leave a place for the "strongest second."

And all of this may happen very soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。