Author: Shijun

1. Research Background

The author has recently studied almost all the Perps (perpetual trading platforms) available on the market. The hype market's fivefold growth once again proves that my initial judgment during last year's research overlooked its core value.

Moreover, with recent entries from aster, antex, dydxV4, and even Sun Ge, the sunPerps that have shaken the track are gradually bringing the Perps sector to a period of explosion.

Additionally, major exchanges are competing to launch hype and the perpetual trading capabilities on their platforms. Just yesterday, it was reported that Metamask has become another major wallet platform, following Phantom, planning to integrate Hyper's perpetual trading. Circle has also become a validator, breaking the core concerns of decentralization. Hyperliquid itself is also striving to enhance its openness, especially with the gradual rollout of hyperEVM, hip2/3/4.

1.1 Three Key Elements of the New Track

At this point, Perps can be considered to possess the three key elements of a new track.

In fact, if we look back at any significant wave in history, we can see that it often involves new leading platforms, new wealth opportunities, and new narrative backgrounds. The convergence of trends brings peaks, while subsequent platform airdrop strategies, the gradually developing complexity of platforms, and the decline in user perception of novelty eventually lead to troughs.

This process has already gone through many waves, with typical scenarios as follows. Each module has been analyzed in previous articles on "Shijun," and interested readers can look them up:

The ICO frenzy of 2017 corresponded to CEX platforms. The basic demand was undeniable, and many are still thriving today.

The DeFi summer of 2021 corresponded to platforms like Uniswap, lending, and stablecoins, similar to the above.

The NFT boom of 2022 had protocols that existed long before, but it peaked due to OpenSea, rooted in pricing through trading and spreading based on price. Its decline stemmed from arrogance, leading to a death spiral of price chasing due to airdrop strategies and royalties, which was self-inflicted.

The inscription trend of 2023 corresponded to the Unisat platform, whose decline was due to shortsightedness, focusing solely on asset issuance at the hottest moment without applications, resulting in a very short narrative lifecycle. When other new narratives emerged, RWA and Perps captured attention, making it difficult for recent Alkanes and BRC 2.0 to regain popularity, also self-inflicted.

The meme trend of 2024 and corresponding pump platforms, along with this year's dark horse Axiom, have made this wave unusually persistent. This is due to the inherent advantages of the chain in trading and the continuous influx of new users brought by the wave of compliance.

Finally, in 2025, there will be both RWA (focusing on stocks) and Perps (led by Hyperliquid).

2. Interpretation of Key Development Steps for Hyperliquid

2.1 Current Development Status

Objectively speaking, until now, the system is still in a relatively centralized state, theoretically capable of pulling the plug and changing the status. Moreover, there are hacker funds involved, which is a significant bottleneck for many exchanges in terms of compliance and heat integration. However, its data is quite contradictory.

Hyperliquid currently has about 10,000 to 20,000 active users daily, with a total user count of approximately 600,000. Among them, 20,000 to 30,000 core users contribute nearly $1 billion in revenue, a significant portion of which comes from the United States.

It has accumulated over $30 trillion in trading volume, with an average daily trading volume approaching $7 billion.

Currently, it supports Perps trading for over 100 types of assets.

Looking at its data, one can only say it is exceptionally good, and although the user base may not be large, it consists of the most capital-generating individuals.

2.2 Major Updates and Interpretations

The specific timeline is as follows:

March 25: Opened the connection between HyperCore and HyperEVM, theoretically allowing users to trade core tokens from EVM (limited to trading at that time).

April 30: Launched the read precompiled function, enabling HyperEVM smart contracts to read states from HyperCore.

May 26: Halved the block duration to 1 second, increasing HyperEVM's throughput.

June 26: Updated HyperEVM blocks, removing the previous sorting of only published orders to improve integration with HyperCore.

July 5: HyperEVM updated a new precompiler called CoreWriter, allowing HyperEVM contracts to write directly to HyperCore, including functions like placing orders, transferring spot assets, managing treasury bonds, and staking HYPE.

Recently, there have also been Builder core and Hip4, entering the data prediction market. This step was completely unexpected by the market, indicating that the founder has a unique perspective on industry pain points, which often leads to polarization of the platform.

How should we understand this series of updates?

First, compared to last year, Hyperliquid has now opened core order operation capabilities.

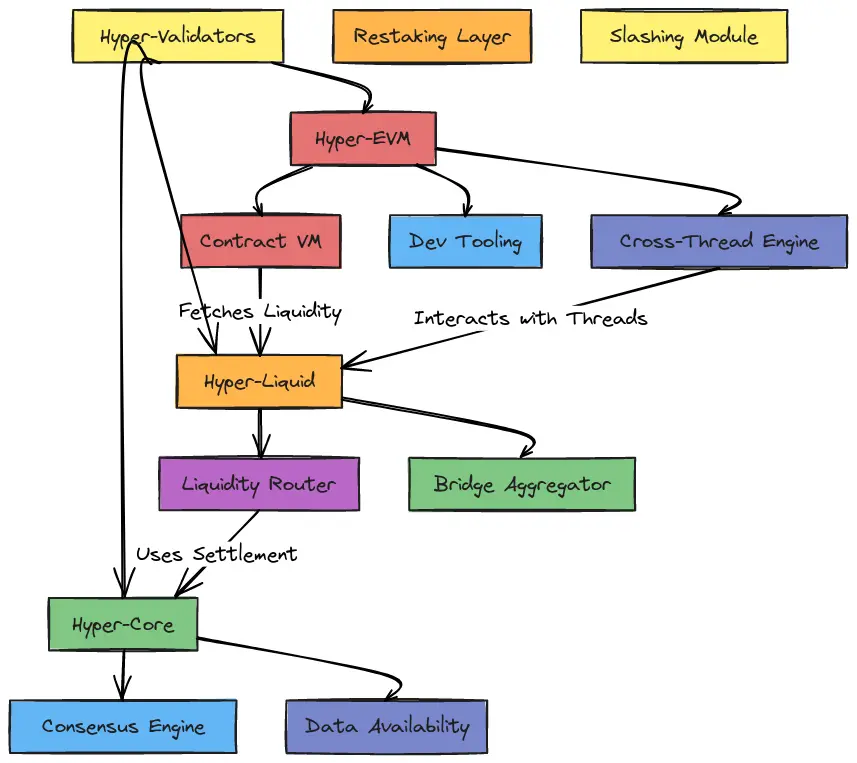

HyperEVM

Especially with the EVM-based dual-chain architecture, the logic is quite outrageous. It adds a large number of precompiled contracts and integrates with HyperCore without opening (or deploying) HyperCore, theoretically providing the foundation for wallet (Phantom, Metamask) and exchange integrations, enabling EVM trading operations to execute Core's order asset buying and selling capabilities.

The official has a diagram that reflects the positioning of HyperEVM in the system.

It can be seen that both writing and reading from HyperCore and HyperEVM are confirmed by HyperBFT, and the specific confirmation mechanism for validators has not been disclosed, with no cross-chain bridges or delayed synchronization.

The dynamics observable through on-chain transactions indicate that HyperEVM can influence HyperCore through system contracts (0x333…3333, CoreWriter.sendAction(...)), allowing for order placement, liquidation, and lending operations.

The state feedback from HyperCore (the previous block's state) is available for HyperEVM's smart contracts to read.

- User Data — Positions, Balances, and Vault Information

- Market Data — Marked Prices and Oracle Prices

- Staking Data — Delegation and Validator Information

- System Data — L1 Block Count and Other Core Metrics

The essence of the information is received by the EVM's system contracts, generating corresponding receipts or events for recording. In the EVM, the precompiled contract (0x000…0800) can call perp positions or oracle price (oraclePx).

Secondly, the implementation of hip2 and hip3 is changing Hyperliquid's platform positioning.

Hyperliquidity

This is an on-chain liquidity mechanism built into Hypercore.

It automatically places buy and sell orders based on the current price of the token without manual intervention, maintaining a narrow price spread of about 0.3%.

This mechanism allows for native-level liquidity insertion operations without AMM or third-party bots, embedded in block logic.

For example, when the PURR/USDC spot market was launched, Hyperliquidity immediately placed initial depth seed trades, enabling real transactions before normal user liquidity arrived.

Builder Core

This is a mechanism with significant future value, allowing DeFi builders (developers, quantitative teams, aggregators) to charge additional fees as service income when placing orders on behalf of users. The application scenarios for this are very clear, representing a move to open profits and welcome ecological co-construction.

Quantitative Strategy Custody: Quantitative teams help users place perp position orders, charging management fees through builder fees, forming a "revenue sharing + builder fee" composite profit model.

Aggregator/Trading Routing: For example, 1inch, Odyssey, etc., integrating perp trading services on Hyperliquid can charge builder fees as a routing income model.

The initial launch has already brought over ten million dollars in dividend income to some projects, demonstrating the effect of hyper capital depth solidifying at the platform level.

In fact, opening depth is not just something Hyper is doing; Uniswap V4 also aimed to do this through hooks, but V4 did not take off, as most users are still accustomed to V2 and V3.

This may be due to the influence of having fewer historical burdens and stronger centralized decision-making.

3. Summary and Comments

3.1 Many Advantages, Let's Go Through Them One by One~

Hyperliquid's primary advantage is its strong early product capability, as it addresses two user pain points:

The trading needs of non-compliant users, which have become even rarer amid this year's wave of compliance.

The needs of advanced trading users for high leverage and high transparency, the former brings exposure from KOLs, while the latter is often overlooked by the market's existing ideologies, thus catching many CEXs off guard.

Next is the team's background. Its greatest advantage is its small size, leading to high communication efficiency, low wear and tear, and high human effectiveness. With a team of just over a dozen, excluding 3-4 product operation BD and front-end and back-end personnel, it essentially relies on just 3-4 people to create a high-performance chain with 20 WTPS.

Compared to many traditional large factory blockchain teams, which can still produce a lot of palace intrigue, it is quite remarkable.

In its background, it started as a market maker in 2020, which brought good initial depth. You can also feel its matching logic in many details, which is not simply settled by time or amount like other order book systems.

However, due to insufficient data, further comparative analysis of multiple Perps will be added later.

Then there is the trend.

Generally, projects need to adapt to the market, but when a platform's popularity peaks, it can make the market adapt to it.

Currently, Hyperliquid enjoys such treatment.

On one hand, the openness in the updates above provides space for various ecosystems to enter. Compared to many past platforms that often think about doing everything themselves and reaping all the benefits, openly criticizing OpenSea while also creating a set of mandatory royalty systems that force the market to follow the leaders, each time incurs fixed high costs, intervening in the flow of goods and affecting the true pricing of the market, ultimately becoming a family heirloom.

In the hype, it has opened up EVM and all kinds of DEX Perps APIs, so we quickly see a bunch of derivatives in the market.

Hyperliquid's generosity is also evident in its airdrops; from the beginning, it was impossible for it to follow a compliant route.

Therefore, it will not attempt to embrace the so-called expectations of going public, naturally allowing profits to be released. By using the Hlp mechanism to stake HYPE back, it can reinvest profits, allowing the official token to be decentralized, gaining the market's rarest decentralized evaluation and reputation.

Its openness has attracted market attention, with Phantom first integrating its Perps capabilities from the perspective of a decentralized wallet. This is not particularly difficult, mainly involving significant adaptation and development costs. Recently, it has also been reported that Metamask is integrating as well.

This also shows that those decentralized wallets that have not updated for over half a year, after missing the inscription opportunity, now understand the importance of capturing annual narratives.

Finally, it has also pushed to introduce giants like Circle as validators, bringing decentralized security and filling its decentralization gap, thus providing a compliant CEX platform with integration opportunities.

3.2 Now, let's talk about the drawbacks

After overcoming the most challenging initial phase, the compliance issue arises. Even pure DEXs like Uniswap are embracing compliance, let alone users who have made their fortunes with Hyperliquid in Europe and the U.S.? If it is deemed non-compliant or labeled with other serious titles, existing CEX/Wallet collaborations will be severed, and former allies will part ways.

Additionally, this system will also face the complexity of development in the future. Most projects become increasingly complex, making it difficult to simplify and return to first principles, ultimately causing novice users to struggle to understand and lose fresh blood.

Finally, there is the risk of single points of failure. Now claiming to have 20 WTPS, if it is integrated by multiple global platforms, there will be many inconsistencies in the information, which will put immense pressure on the core HyperCore module. This high-performance construction is not something that can be achieved overnight. The official background of more market makers may not be able to withstand the traffic, especially if multiple liquidation issues arise due to outages (similar to the short squeeze incident in March).

Thus, the hard-earned reputation is fundamentally very fragile.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。